Deeper collaboration between the public and private sectors across Southeast Asia is critical if the region is to overcome its near and long-term food supply chain challenges, say the authors of a new research report.

The study by PricewaterhouseCoopers (PwC) — and commissioned by Food Industry Asia (FIA) — found that Southeast Asia’s food supply chain was already at risk of serious disruption, even before Covid-19 hit earlier this year. What the pandemic has done is underscore frailties that already existed and brought them to the fore, says Steven Bartholomeusz, policy director and head of advocacy and communications at FIA.

“Food security is already a long-term challenge in Southeast Asia and a lot of work has been done to look at the impact of things like climate change, the availability of arable land, and so on,” he tells AFN.

“What’s really critical is the contention that this report puts forward: that Covid-19 will compound these challenges in the short term.”

The report states that rapid urbanization and accelerating consumption across Southeast Asia are straining food supply chains – as are regional trends such as an aging agricultural workforce, large-scale food waste, decreasing availability of arable land, and stagnating crop yields. This is in spite of the fact that most ASEAN member states are net exporters of agrifood products, running a trade surplus of $48 billion per year, according to PwC.

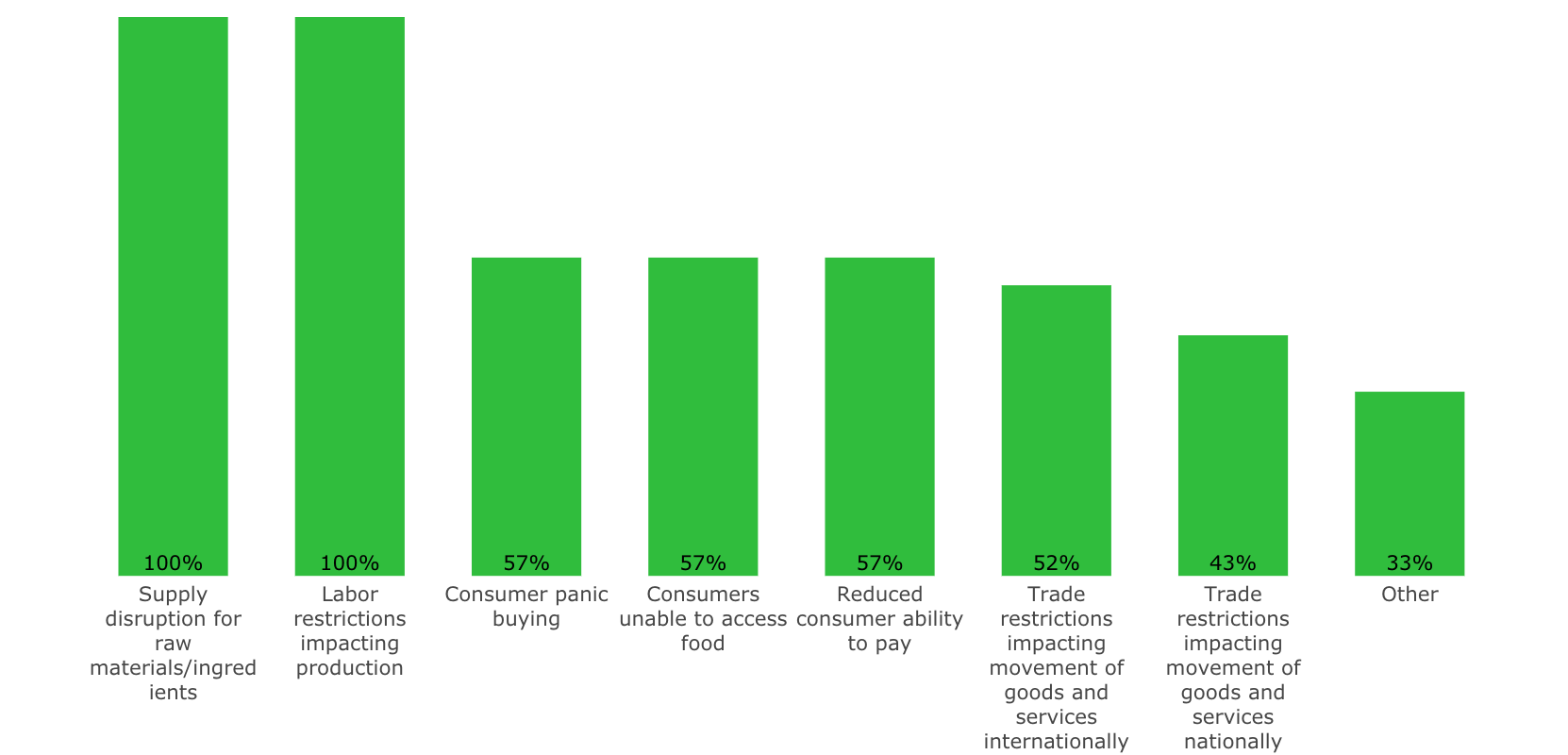

The onset of Covid-19 — and the lockdown measures taken by most countries in an attempt to lessen the virus’ impact — have exacerbated these issues. At the same time, a host of new problems brought on by the pandemic has stunted both in-country and cross-border supply.

“On the supply side, [there are] labor shortages, [with labor] required at all these different locations,” Bartholomeusz says, referring to how farming and food production are being affected by restrictions on the movement of people.

“We also need to be cognisant that much of the manufacturing that takes place can’t be done remotely. Packing, for example, needs someone physically there doing it, or at least monitoring it.”

Border closures, panic buying

Shortages are also felt farther down the food supply chain, he adds — noting that similar trends are playing out across the wider region, beyond Southeast Asia.

“F&B relies upon so many other input industries – packaging, chemicals, oil,” he says. “[There are] also border challenges. We’ve heard of instances in India where a truck goes from state A to state B with some goods but is not allowed to come back from state B to state A.”

On the demand side, restrictions on foodservice are hurting enterprise — though measures such as those in place in Singapore, where establishments can stay open to offer takeaway and delivery, could soften the blow.

“We also need to be mindful [of], across Asia as a whole, workers who don’t have a salary but work for daily pay,” Bartholomeusz adds. Many of these individuals have found themselves unable to work due to lockdowns. As a result, they aren’t earning money – and that means they are struggling to feed themselves and their families, he says. “Tuk tuk drivers, laborers – how are these consumers able to afford food?”

And then there’s the global phenomenon of panic buying, which hasn’t spared Southeast Asia. “All this has led to short-term spikes in demand, with a major impact on inventories, with more stuff going off the shelves than usually does,” he says.

Public-private collaboration key

According to FIA, addressing these issues – not just in light of Covid-19, but with a longer-term view – is going to require extensive collaboration between public and private sector players in Southeast Asia.

“Governments by themselves cannot resolve supply chain issues. Industry working by themselves can’t either,” Bartholomeusz says.

The response needed from both sides is similar to what is expected in the healthcare sector during the pandemic, he suggests. “We have to make sure whole food value chain is seen as essential, to keep that functioning.”

Singapore’s announcement last week of a $21 million grant for entrepreneurs who can ramp up domestic supply of eggs, fish, and leafy vegetables is another welcome development.

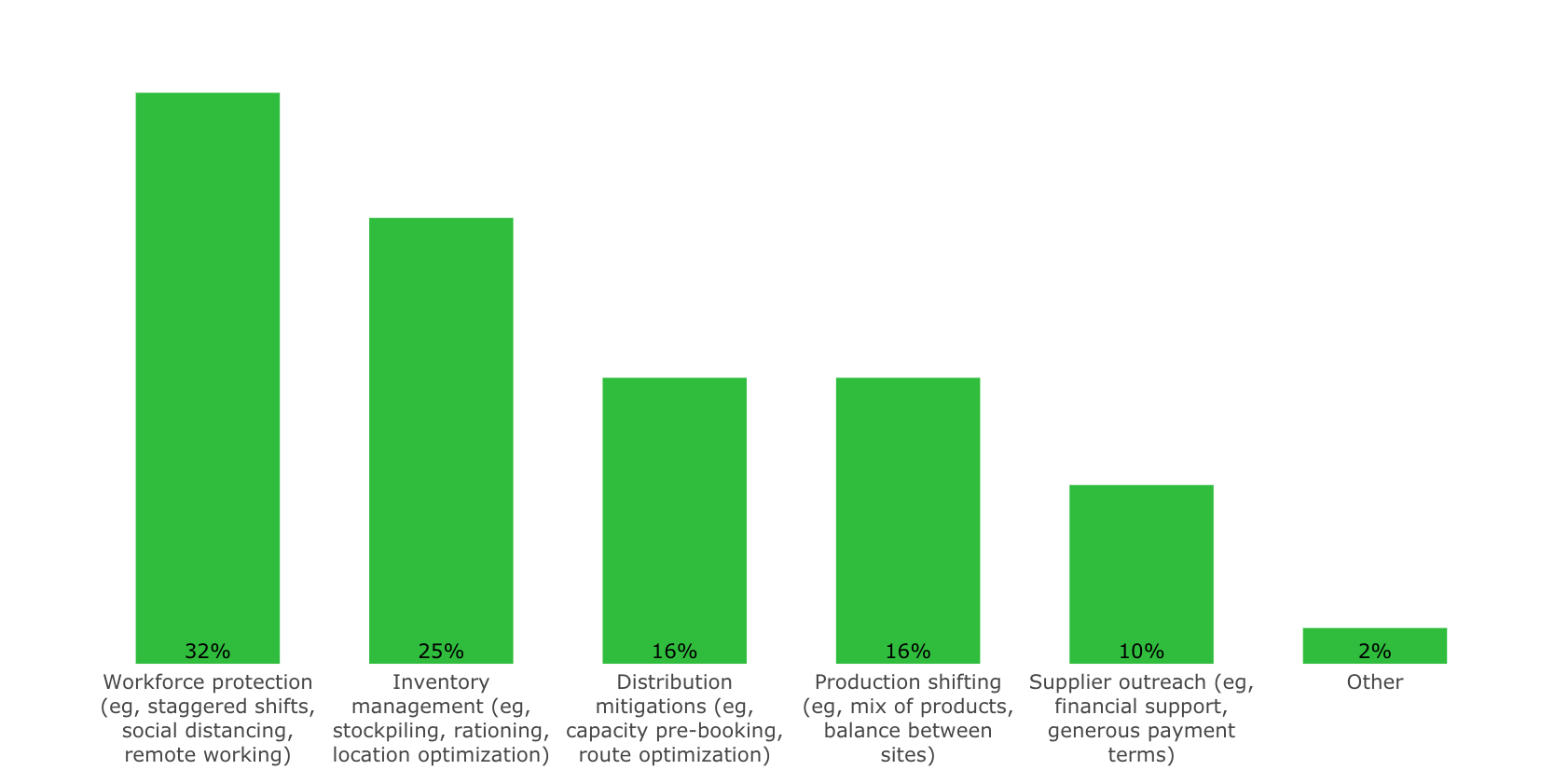

In addition, the authorities should be considering what kinds of social support they can provide to consumers. In the private sector, employers need to think about what mitigation measures they can take, and what kinds of protection they’re able to provide for their workers.

Tech opportunity

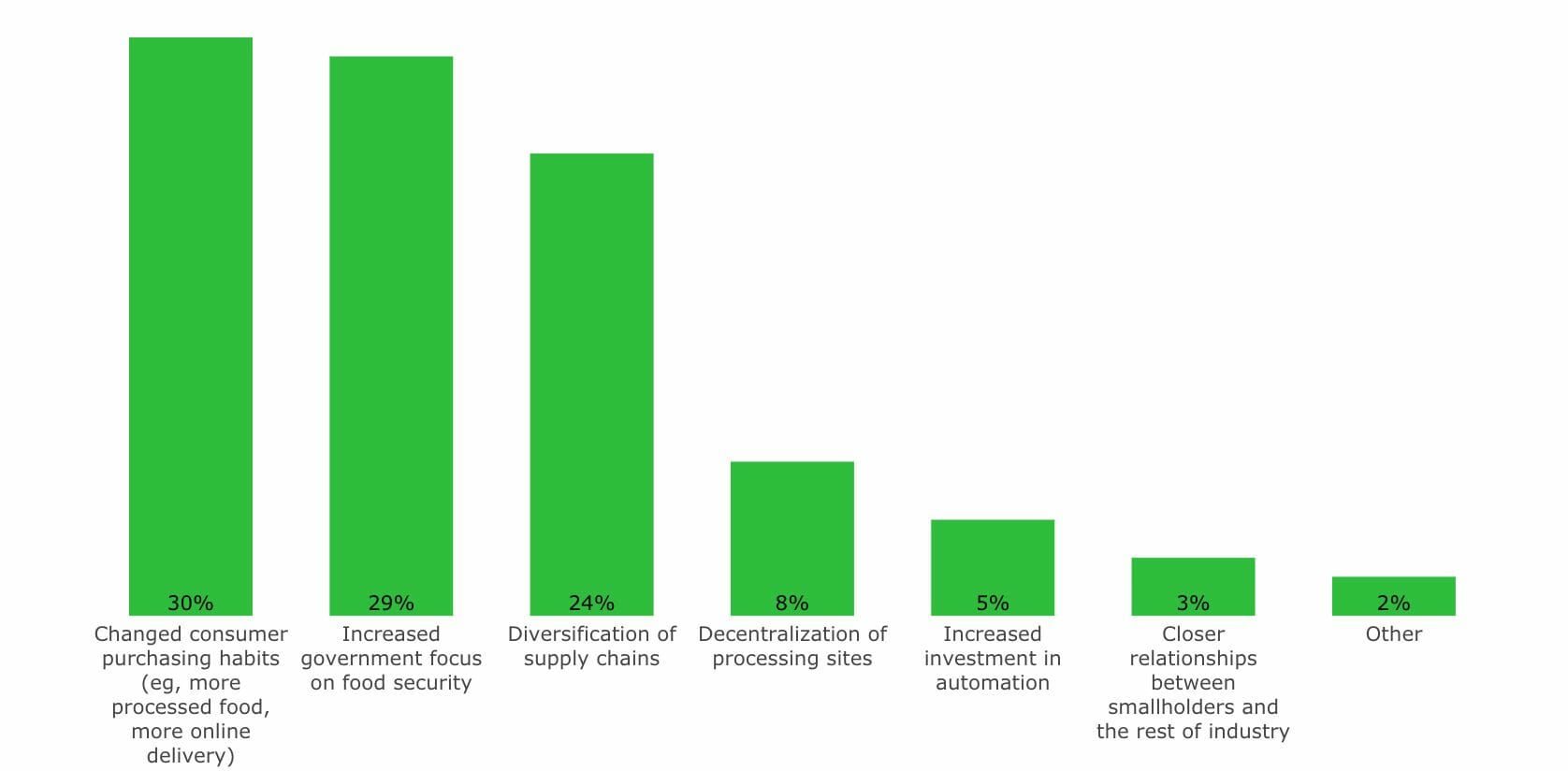

The report further suggests that public and private sectors alike should be looking at diversifying their sources of supplies.

“[Review] inventory management to ensure where supplies are resilient. Then look at things like production flexibility, and how [to] mitigate challenges related to distribution,” Bartholomeusz says.

“Not only food, but industry in general, has learned one thing from this whole pandemic: The importance of having a diversified supply chain, and not depending on one supplier, one country, one market, for all supplies.”

“If there’s an impact it needs to be highlighted, brought to the attention of policymakers. This is certainly an opportunity for agritech [and] for startups in this sector to plug some of the supply chain holes,” Bartholomeusz says.

The PwC and FIA report was based on a survey of global food businesses and existing third-party research.

What are your biggest concerns relating to the impact of Covid-19 in Asia? Get in touch [email protected]

Guest article: The real impact of tariffs on US produce prices