Venture capital investment across all industries dropped in 2019 — around 16%, according to the VenturePulse report — against a backdrop of global uncertainty related to the US-China trade war, Brexit, and a weakening Chinese economy. It was the same for agri-foodtech but not to the same extent, with total funding coming in just 4.8% lower than in 2018, according to AgFunder’s sixth annual investment report.

The drop in funding overall was largely a result of a pullback in funding to US and Chinese startups and a 56% decrease in investment to consumer food delivery apps; this segment became less attractive to investors as the mature players like DoorDash extended their dominance in an over-saturated marketplace with ever-larger fundraisings.

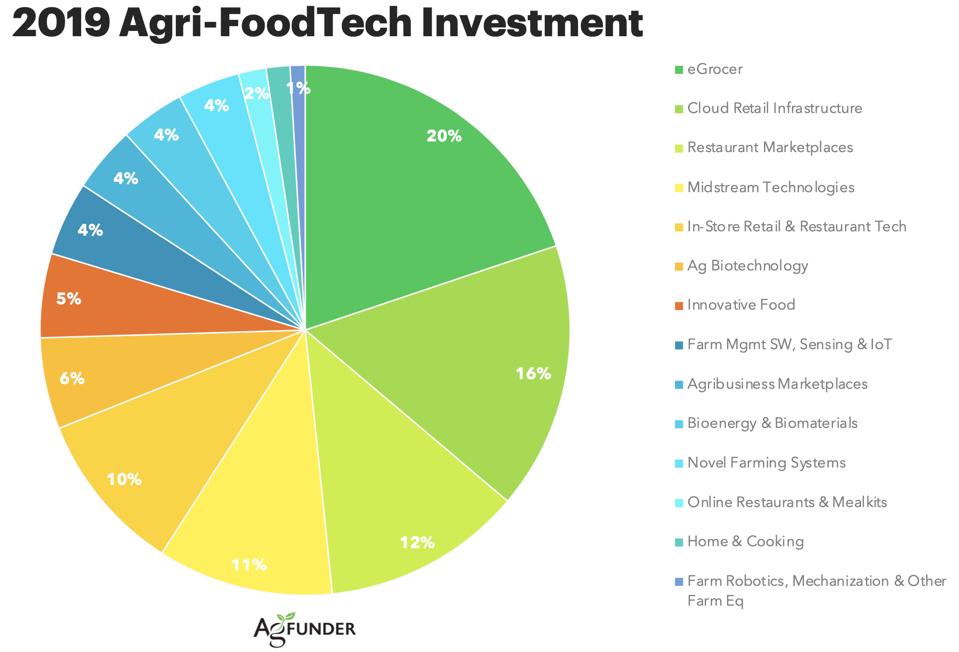

In fact, funding to startups operating upstream, closer to the farmer and in the supply chain, raised $100 million more in 2019, a 1.3% increase to $7.6 billion. The main drivers of that increase? Meat and dairy alternatives and vertical farming.

The Beyond Meat Effect

While those two categories might not come as a surprise to many in the industry, they’ve generally accounted for a small portion of the overall foodtech and agtech ecosystem, eclipsed by investment growth in food delivery but also by other upstream categories such as ag biotech — think seed technology, innovative microbial crop inputs, and gene editing — and midstream technologies, encompassing the messy middle of traceability, food freshness and innovative production.

But by raising over $1 billion in 2019, innovative foods startups beat out the more mature upstream categories of farm management software and bioenergy & biomaterials, doubling the funding they raised in 2018. Novel farming systems also had a big year, raising $745 million, a 38% year-over-year increase, with three insect and vertical farming deals raising $100 million or more each.

Why such growth? No doubt the blockbuster IPO of Beyond Meat midway through the year contributed to investor excitement about the meat and dairy alternatives space. If you were living under a rock, you may have missed Beyond Meat’s public markets debut, which saw the company at one point reach a valuation of $9 billion.

The belief that the $1.4 trillion global meat and dairy industries are on their way out drove much of this excitement, bolstered by moves from the incumbent meat and dairy industry, who are making investments, internally and externally, in plant-based and lab cultivated alternatives. Just this week, global commodities and meat industry group Cargill announced the launch of its own private label plant-based patties and ground products. A report that came out in the fall of 2019 even argued that the traditional meat and dairy industries would be defunct by 2030; I think that’s too aggressive but indicative of where public opinion is moving.

ESG’s time to shine

But it was the high demand for ESG-related companies in the public markets that drove demand for Beyond Meat stock; 2019 was a breakout year for ESG (environment, social and governance), a term that’s been around for years but has only now become a mainstream concept for the investing world with a reported $12 trillion of assets now being allocated to a sustainable investment strategy. And that’s because consumers and retail investors are demanding it. Investing for positive impact beyond financial gains is increasingly a must-have as opposed to a nice to have and 2019 saw a surge in rhetoric and strategy around ESG from the world’s largest financial institutions. Beyond Meat’s goal of replacing animal agriculture is a fairly straight forward ESG investment with its potential impact well documented in multiple research reports in recent years. That’s not the case across the sector, according to Bloomberg.

The ESG investing trend will only gather pace in 2020 and agri-foodtech stands to gain from that as a key industry in the fight against climate change essential to human health and nutrition, and employs over 28% of the world’s workforce, including a large number of women in developing nations. Alternative proteins are just one example of an ESG or “impact” investment from agri-foodtech.

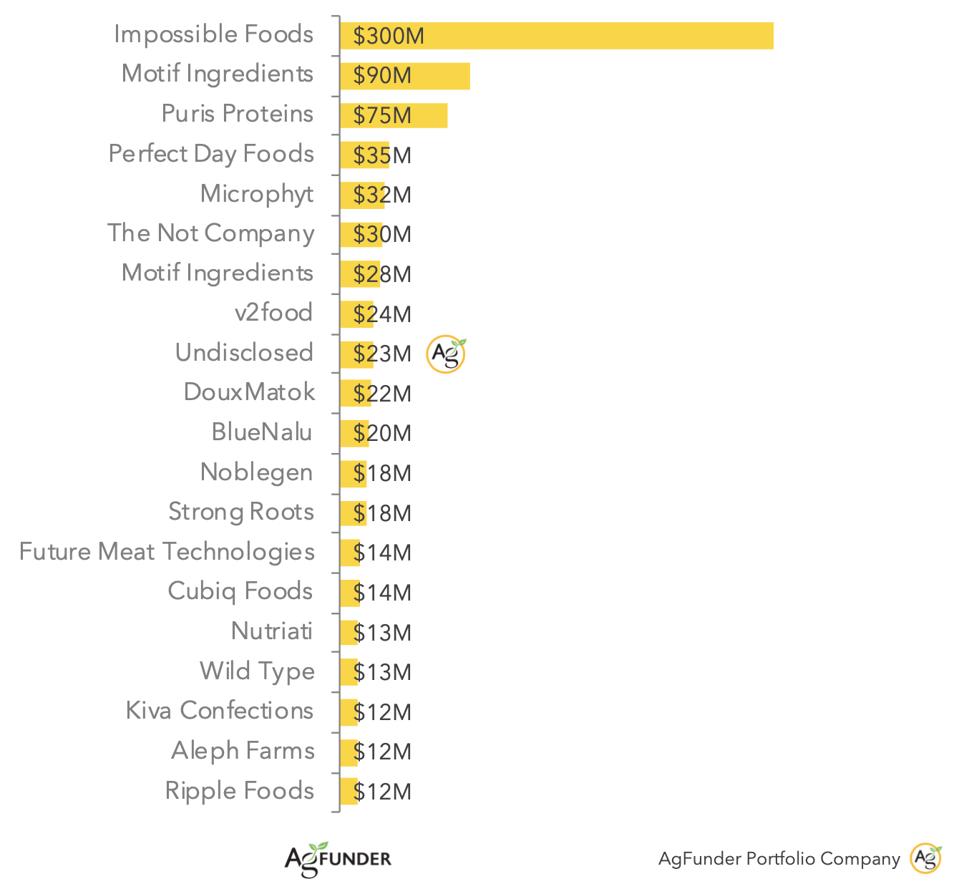

Major investments in the meat alternative category during 2019 included Impossible Foods’ celebrity-studded $300 million bridge round, microbe-based alt protein ingredient supplier Motif FoodWorks’ $90 million Series A, and a $75 million late-stage round for Puris Proteins, the pea protein supplier backed by Cargill.

The top 20 Innovative Food startup fundings in 2019

AGFUNDER AGRI-FOODTECH INVESTING REPORT 2019

Indoor Ag is Back In

Novel farming systems, largely insect and vertical farms, fit into similar ESG trends, with goals to provide food access to inner cities, grow food more efficiently and sustainably (data on water usage is particularly impressive as are efforts to eliminate the use of damaging chemicals in the growing process) and job creation. This category experienced renewed interest and excitement from investors and consumers generally in 2019 — our readership statistics on AFN indicate the topic is now very much back in favor after a few years’ hiatus — as startups appear to have worked around many of the biggest challenges that were holding back its scaling.

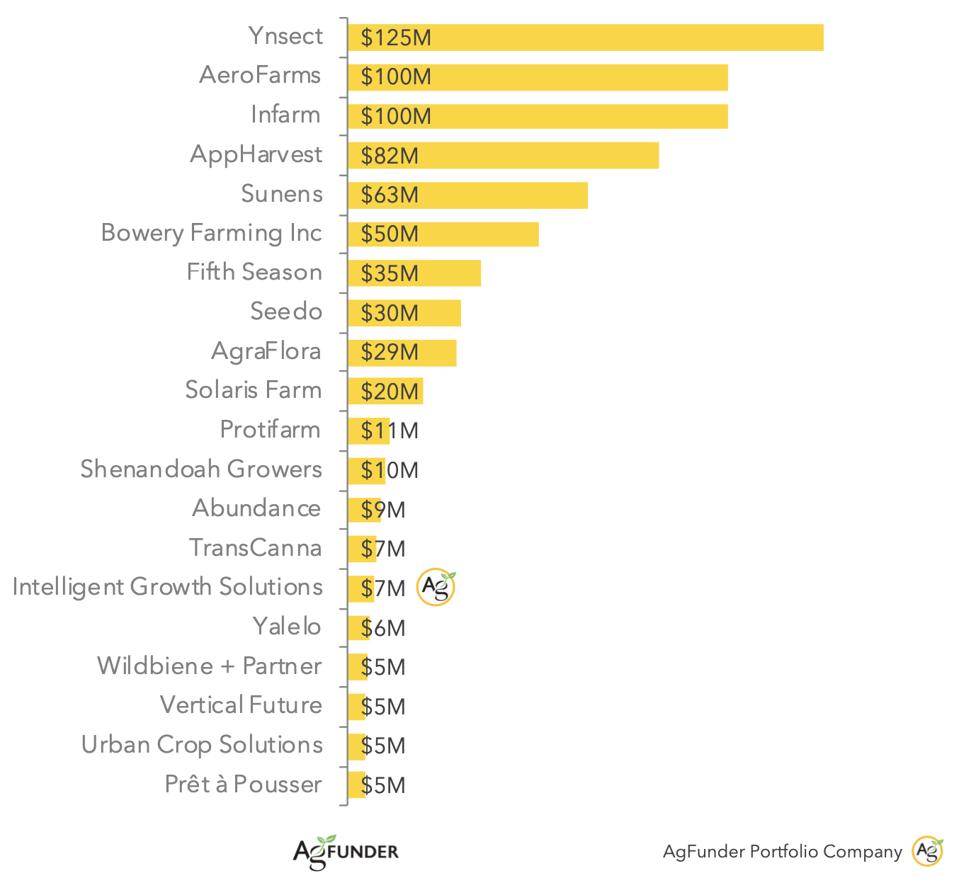

The introduction of effective robotics and automation, and a growing number of enabling technologies, have brought the costs of growing indoors down significantly and this trend will no doubt continue into 2020 and beyond. Ynsect, the mealworm farming startup out of France, raised a mega $125 million in Series C funding at the start of the year, breaking European agtech records to build what it said at the time would be the world’s biggest insect farm, combining sensor technology, automation, data analysis and predictive modeling to measure and respond to temperature, insects’ growth curve, and weight, and Co2 emissions.

Where many once believed massive plant factories were the only way to do indoor farming at scale, other indoor ag business models gathered pace during 2019. Infarm, a German startup, raised $100 million to scale its distributed model where it deploys small growing units within grocery stores, all of which are technologically connected in what the CEO described to me as one large farm. A more recent example is Freight Farms, which recently signed a deal with major foodservice group Sodexo to bring its shipping container farms to universities.

The top 20 Novel Farming Systems funding rounds in 2019

AGFUNDER AGRI-FOODTECH FUNDING REPORT 2019

Food Delivery Matures

While deal activity in the restaurant marketplaces category declined 53% on top of the 56% drop in funding dollars, the category is certainly here to stay and 2019 witnessed increasing investment in enabling tools and services for on-demand food delivery. Uber founder Travis Kalanick revealed his latest business CloudKitchens, for online only restaurants to rent kitchen space. The company raised a massive $400 million in funding including Saudi Arabia’s sovereign wealth fund. Others in the cloud retail infrastructure category include Nuro, a delivery robot company; Fabric, an order fulfillment robot; Rappi, Colombia’s deliver-anything behemoth; as well as Spain’s similar service Glovo. These offerings also serve the e-grocery segment, which continued to gather pace in markets like China where arguably the ongoing coronavirus will make them more relevant than ever for providing Chinese consumers with access to fresh food. Major retailers were also increasingly working on their own delivery offerings, no doubt buoyed by the potential to use white labeled technologies from startups. Kroger, for example, partnered with Nuro.

The split of deals to different categories across the supply chain

AGFUNDER AGRI-FOODTECH INVESTING REPORT 2019

We’ll be digging into more trends from the report in the coming weeks but feel free to download a free copy of the full report here.

This article was originally posted on Forbes.