Funding for Asia-Pacific startups working on plant-based proteins, cultivated meat, and protein fermentation increased by 92% last year, according to figures released today by GFI APAC – the Good Food Institute‘s regional chapter.

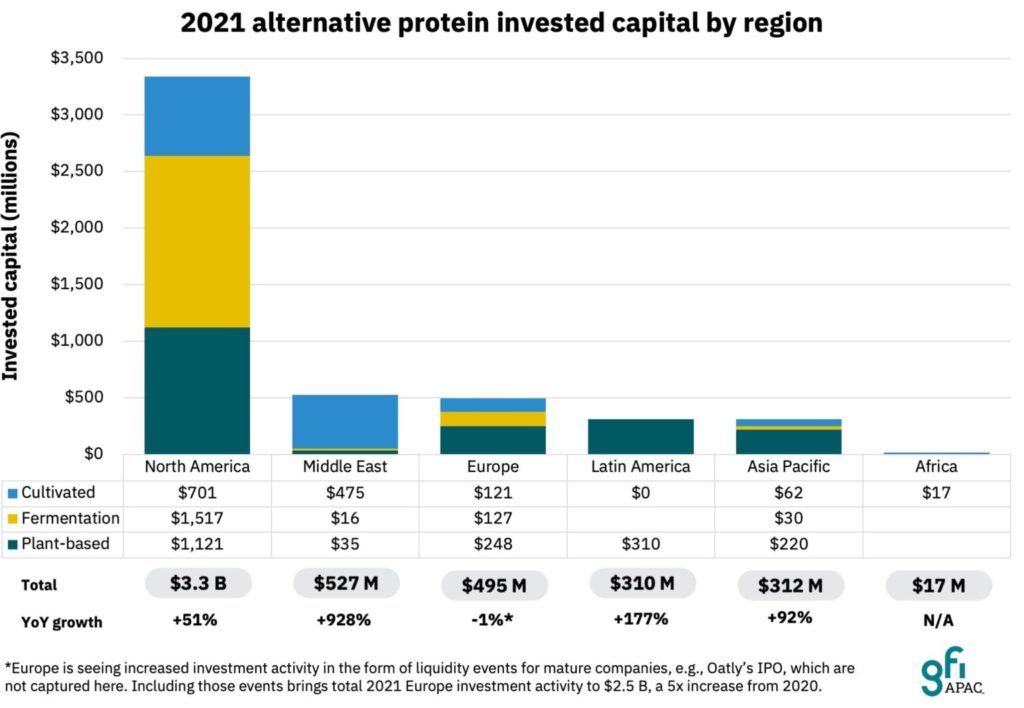

Total funding across all three subsectors in Asia Pacific hit $312 million in 2021 – almost double 2020’s $165 million total.

That’s compared to 60% growth in alt-protein funding worldwide, from a global total of $3.2 billion in 2020 to $5 billion last year – showing that Asia Pacific has one of the fastest-growing meat-replacement startup scenes.

But the region is falling behind when it comes to mission-critical fermentation technologies, said GFI APAC acting managing director Mirte Gosker.

Less than 10% of the region’s total alt-protein funding last year went to this subsector, compared to 26% in Europe and a whopping 46% in North America.

This is important because fermentation has the potential “to almost single-handedly resolve the global protein deficit,” the nonprofit states.

“Put simply, Asia has a lot of catching up to do,” Gosker told AFN. “Even within [Asia Pacific’s] $30 million of fermentation-enabled protein investments, Australia-based companies constitute the bulk of that – inn particular, All G Foods raised $16 million, Nourish Ingredients raised $11 million, and Eden Brew raised another $3 million.”

Could North America become ‘minority player’?

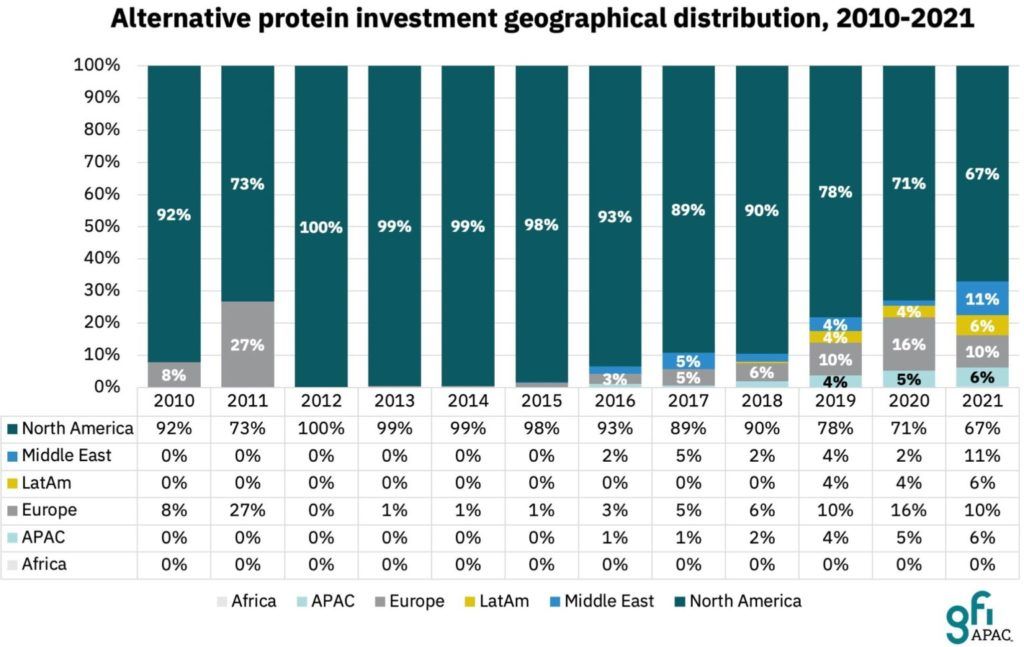

GFI’s analysis — which is based on data from PitchBook — indicates that, counting all three subsectors, Asia Pacific now lays claim to a larger share of global alt-protein funding than ever before.

North America continues to dominate, with two-thirds of total funding going to its startups. Asia Pacific secured 6% of global funding, up from 5% in 2020 and just 1% back in 2015.

But it still falls behind Europe — which took 10% — the Middle East, which was thrust into second place on 11% thanks to a couple of cultivated meat mega-rounds in Israel.

Aleph Farms‘ $105 million Series B round in July — which saw participation from investors including L Catterton, Cargill, BRF, and Thai Union — and Future Meat‘s $347 million Series B in December, which was co-led by ADM, ensured that Europe dropped to third place; marking the first time since GFI began its analyses in 2010 that it has not placed second behind North America.

However, GFI APAC makes the point that Europe saw an increase in liquidity events for “mature companies” last year, such as the $13 billion IPO of plant-based milk brand Oatly. When such events are included in the calculus, Europe’s alt-protein funding total for 2021 hits $2.5 billion, putting it firmly in second place.

Nevertheless, Asia Pacific alt-protein funding is on a rapid upward trend, according to GFI APAC’s analysis – which notes that the region has already witnessed a handful of substantial deals in the first two months on 2022, including $100 million rounds for plant-based protein producers Next Gen Foods and Starfield, which are based in Singapore and China, respectively.

In a statement, GFI APAC suggests that there’s a “distinct possibility” that, by as soon as next year, North America could become a “minority player” in alt-protein funding; as Asia Pacific, the Middle East, and Latin America — which matched Asia’s 11% share in 2021, driven mainly by multiple rounds involving plant-based brands NotCo and Fazenda Futuro — take a majority of investment dollars between them.

But this can happen only if investors “dramatically ramp up support for plant-based, fermentation, and cultivated meat manufacturing infrastructure, which is critical for nurturing sector growth,” the statement said.