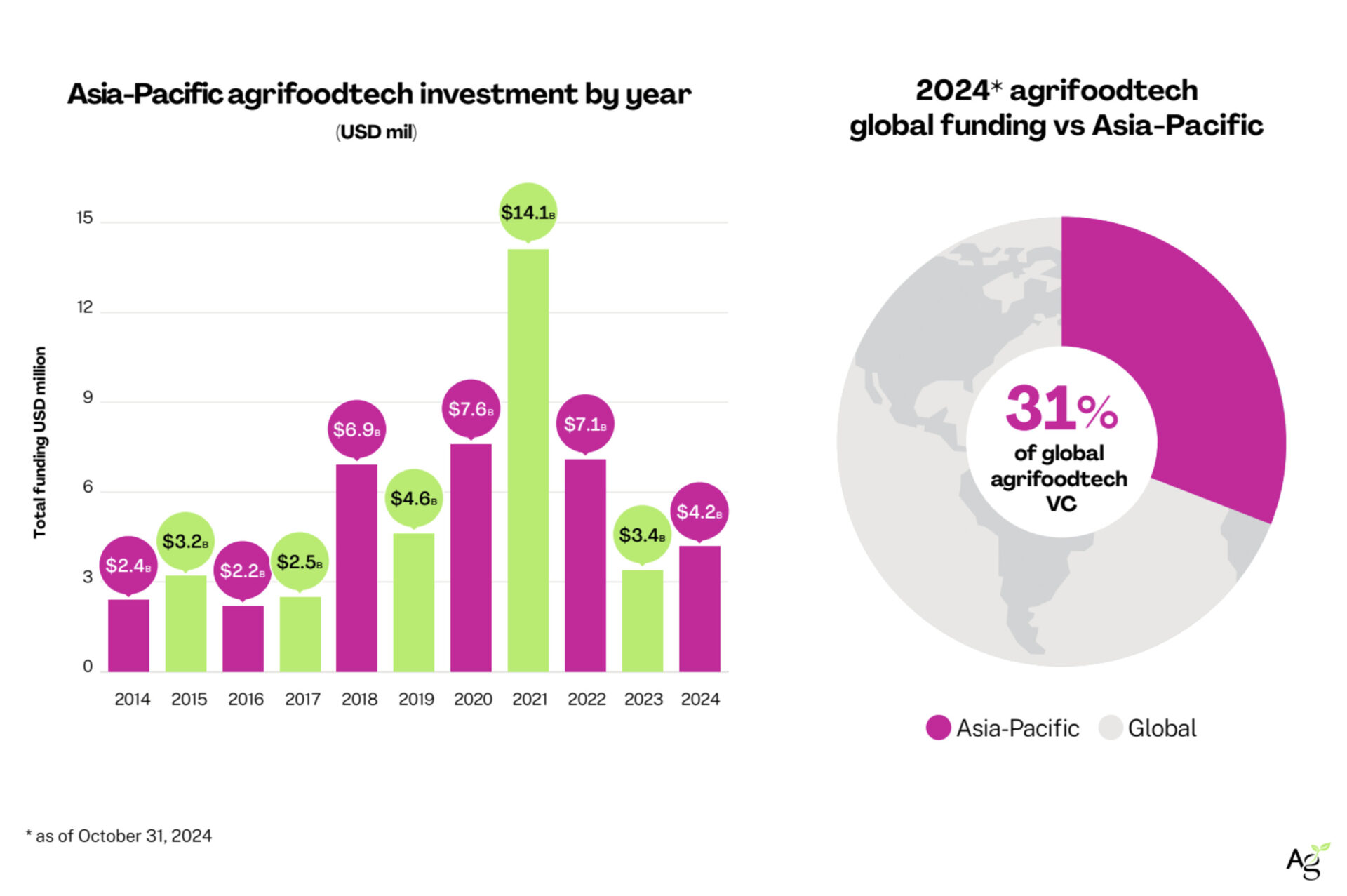

The Asia-Pacific (APAC) agrifoodtech ecosystem has recorded an impressive recovery so far in 2024 with startups in the region raising some $4.2 billion, a 38% year-over-year increase, in the face of global market headwinds that have plagued the venture capital industry writ large.

That represents some 31% of the global agrifoodtech investment landscape, up from a 26% average over the past 10 years, according to a new report from agrifoodtech investment and intelligence firm AgFunder. [Disclosure: AgFunder is AgFunderNews‘ parent company.]

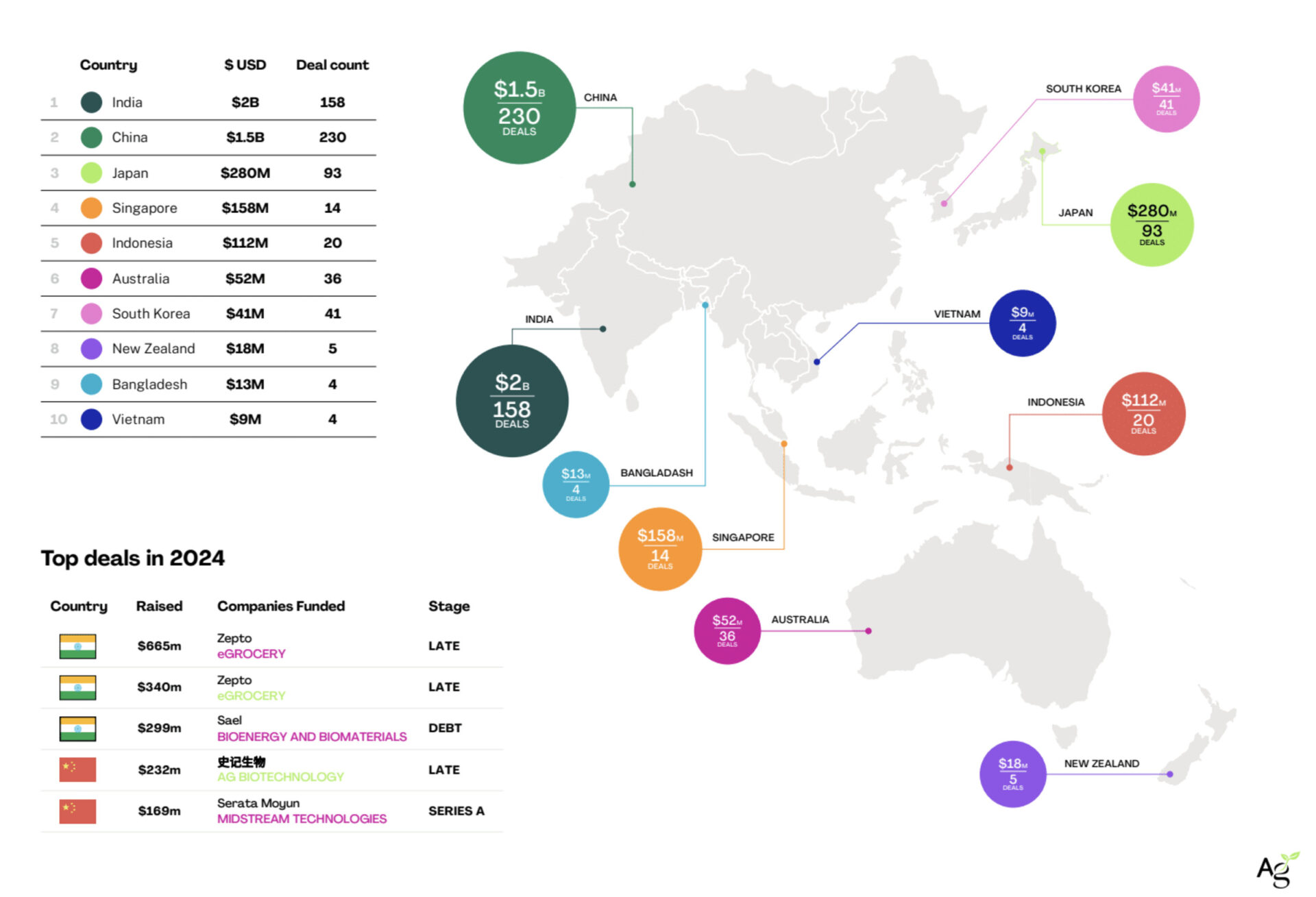

India has reclaimed its position as the best-funded APAC country for agrifoodtech, reeling in $2 billion so far in 2024, almost half of the region’s total. eGrocer Zepto contributed significantly to India’s total raising some $1 billion across two late-stage deals so far this year.

Despite dropping to second place, Chinese agrifoodtech startups raised 18% more than in the same period in 2023 across 230 deals.

Japan posted an impressive increase in funding, climbing three spots to third place with some 58% more funding year-over-year.

Agrifoodtech investment in APAC by country in 2024 so far*

With $1.5 billion across 101 deals, eGrocery was the top-performing AgFunder category of the year, clearly pushed by Zepto in India but also by renewed enthusiasm for the sector in China, where startups raised over $300 million.

Upstream of the supply chain, Bioenergy & Biomaterials attracted the most investor interest, despite a 46% year-over-year decrease in funding to $475 million.

Pronounced Chinese activity boosted the Ag Biotech category, which so far this year has attracted over $390 million in funding, posting a 30% year-over-year gain across 86% more deals.

Midstream Technologies also raised 88% more year-over-year.

Agrifoodtech investment in APAC by category in 2024 so far*

*as of October 31, 2024

In terms of maturity, seed stage deals have raised 13% more funding year-over-year but across fewer deals. While Series A rounds raised almost 52% more capital across 90% more deals year-over-year. Late-stage rounds raised 133% more with a count of 44 deals, more than double the 17 recorded last year over the same period.

The report was completed thanks to support from AgriFutures (Australia) and Omnivore (India), as well as data partnerships with Beyond Next Ventures in Japan, Bits x Bites in China, and Sopoong Ventures in Korea.

Download the report in full – and for free – here.

APAC agrifoodtech funding by the numbers

$4.2 million: total funding raised so far in 2024 (to the end of October) in Asia Pacific, a 38% increase on the same period in 2023

31%: Asia Pacific’s share of global agrifoodtech funding in 2024 so far, up from the 10-year average of 26%

$2 billion: India’s funding in the year so far; the sub-region of South Asia (including India, Pakistan and Bangladesh) is already up over 100% from FY 2023

$1.5 billion: raised by eGrocery, again the largest category by total funding so far in 2024, due in large part to some $1 billion of funding for India’s Zepto alone

over $1 billion: raised by India-based eGrocery Zepto raised across two late-stage rounds in 2024

$578 million: funding in Midstream Technologies startups raised so far in 2024, a 88% year-over-year increase

$475 million: total funding in Bioenergy and Biomaterials, the biggest upstream category in 2024, despite a 46% year-over-year decrease

$459 million: raised by Ag Biotech startups, posting a 30% YoY gain, across 86% more deals (67)

265: deal count for seed stage investment in 2024 so far. That accounted for 43% of the total APAC deal count