Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

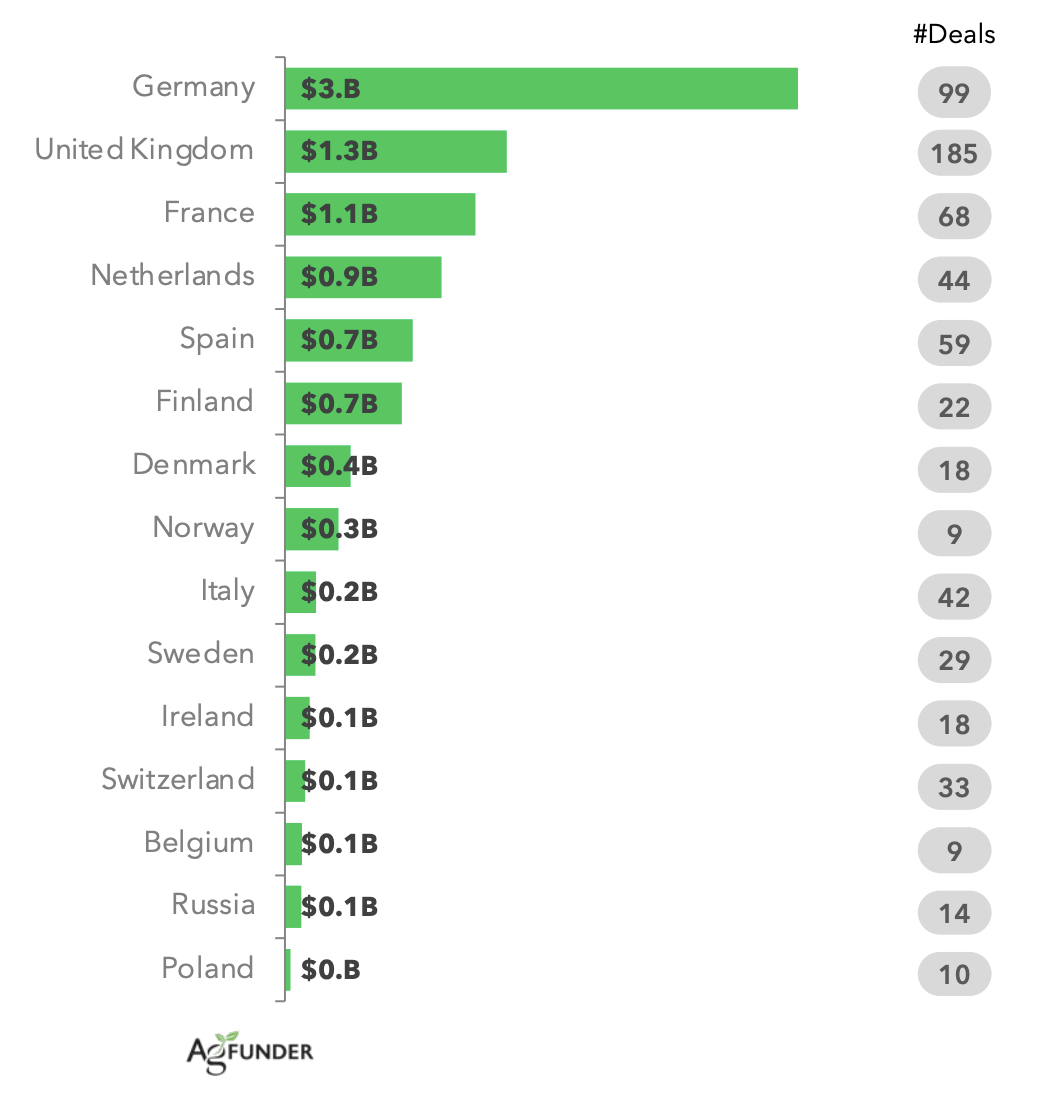

Germany claimed the top agrifood investment market spot in Europe in 2021, doing $3.3 billion in deals according to AgFunder’s European AgriFoodTech Investment report from AgFunder in collaboration with F&A Next.

It’s a sizable jump from 2020, when Germany took the third-highest spot on the list, after the UK and France, and raked in a little under $310 million. However, Germany’s multi-billion-dollar figure in 2021 is largely due to a couple of mega-deals from startups in the now-beleaguered eGrocery sector.

Despite dropping behind Germany, the UK was the most active country in Europe by deal count, closing 186 deals versus Germany’s 99.

The eGrocery slowdown

Roughly 70% of German agrifoodtech’s $3.3 billion in funding in 2021 went to just two companies, both part of the instant-delivery sector: Flink and Gorillas.

A quick comparison between the two brings up many similarities. Both were founded pretty recently, in 2020. Both are based in Berlin, and both raised multiple funding rounds last year.

Gorillas raised a $290 million Series B and a $1 billion Series C. Flink raked in a $52 million seed round early in 2021 and followed that up with a $240 million Series A and a $750 million Series B.

It’s a different VC landscape midway through 2022, though. Instant grocery startups in particular are struggling to stay relevant as inflation drags on and while supply chains remain tenuous amid threats from war and climate change.

Gorillas and many others have already laid off employees, though Flink has yet to make any such announcements.

Elsewhere in Europe

Over in the UK, the top investment also went to a downstream company: delivery service Deliveroo, which raised $180 million at the start of 2021.

Overall, the UK claimed just 25% of all agrifoodtech investment capital in 2021, many of them early-stage deals. Just 13 of the market’s 186 deals were Series B or later. The UK also had the most diverse set of investments, with a presence in multiple categories including Novel Farming Systems, Innovative Food, and In-Store Retail & Restaurant tech.

Notable deals from other European countries include Spanish delivery startup Glovo‘s $528 million Series F, France’s DNA Script, with $165 million, and Norway food and meal kit company Kolonial (now Oda).

The Netherlands in particular is a small-but-interesting market to watch, as it funded several upstream- and climate-focused companies last year. These are areas that, with just a few exceptions, have historically garnered less investment than downstream startups, often because upstream technologies are harder to prove and require more longer-term, patient capital.

As the whole of European agrifoodtech investment in 2021 illustrated, we need a lot more of that patient capital moving forward, which makes the Netherlands one to watch for the remainder of 2022.

Sponsored

International Fresh Produce Association launches year 3 of its produce accelerator