Wherever you are in the world, you no doubt experienced extreme weather events in recent months. In fact, nearly half the global population – some 3.6 billion people – is highly vulnerable to the impacts of climate change, from droughts, floods and storms to heat stress and food insecurity.

Climate hazards are only expected to worsen and the agriculture industry is particularly at risk of the increasingly inhospitable growing conditions presented by climate change. As early as 2030, corn and wheat yields could drop by as much as 24% and 17% respectively as a result of climate change.

Investment in climate adaptation reached an all-time high of $63 billion in 2021/2022, a 28% year-over-year increase, yet it declined as a portion of overall climate finance – to 5% from 7% – as climate mitigation finance grew at a faster rate, according to nonprofit climate researcher Climate Policy Initiative. What investment there has been remains just a fraction of what’s needed; low and middle-income countries alone need some $212 billion a year by 2030.

Developing nations are particularly vulnerable and are home to the majority of the world’s 2.5 billion smallholder farmers, fishers, herders, and forest-dependent communities.

In Sub-Saharan Africa, land providing 70% of crop value will be prone to extreme heat stress by 2050. Some $15 billion of annual adaptation investment in agriculture is needed on the continent, according to the Global Center on Adaptation.

Given that smallholder farmers produce one-third of the world’s food, their ability to adapt to climate change impacts us all.

The good news is that there is a range of ways private investors can invest in climate adaptation for smallholders, according to a new report from AgFunder and ISF Advisors which focuses on smallholder farmers. [Disclosure: AgFunder is AFN’s parent company.]

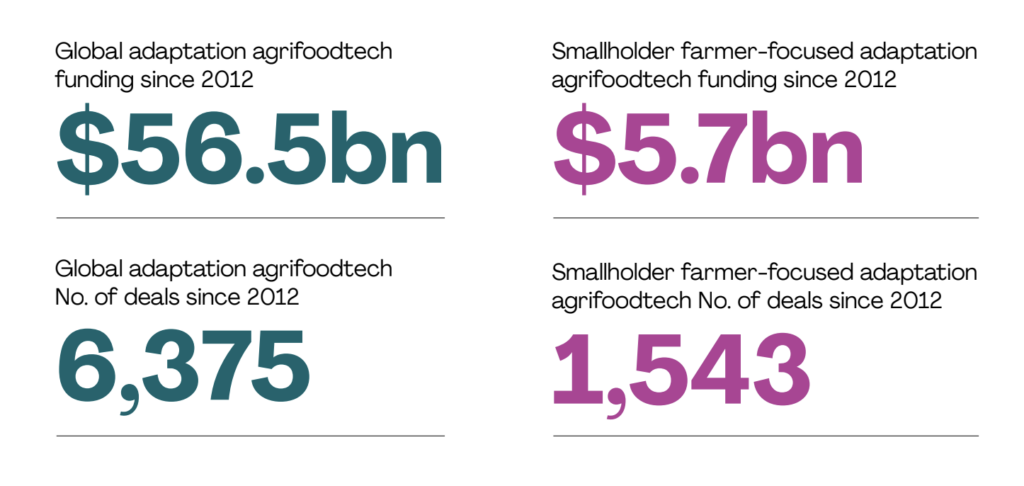

For example, some $5.7 billion has been invested in climate adaptation technologies and innovations focused on smallholders since 2012, according to the research. Some 1,724 investors, including venture capital, private equity, impact funds, development finance institutions, international and local banks, and angel investors backed these businesses across 1,543 deals.

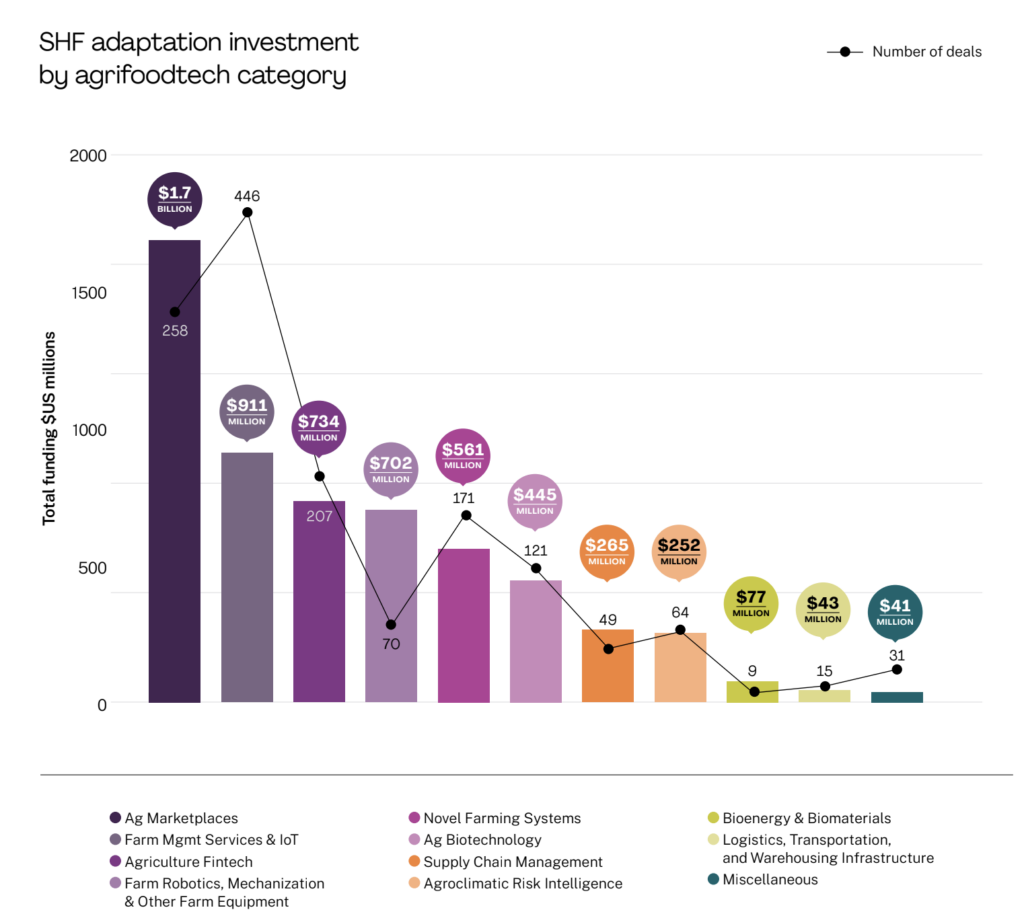

Digital tools are the most popular tech categories to invest in climate adaptation for smallholder farmers. This includes digital ag marketplaces, the most invested category, as early-stage investors back the scalable aggregation of farmers to which they can supply inputs and markets typically unreachable to them. Farm management services & IoT, which enable the adoption of precision agriculture practices and a better understanding of crop yields, are the second most popular followed by fintech tools, which also enable SHF financial resilience through access to credit and insurance.

No or low-tech investment opportunities for smallholder climate adaptation

But not all private investment in smallholder adaptation is in high-tech innovation, reveals the report. In many cases, low-tech adaptation initiatives are also gaining investment, including local and international efforts to transition farmers to climate-smart and regenerative farming practices, particularly from local and international banks and corporations.

The new report suggests that climate-smart supply chain players can be an interesting investment opportunity for a range of investors; it is one of six key themes or “pathways” it offers investor readers to explore.

“Farmers across the world often have meaningful interactions with their suppliers and offtakers; the relationship between an ag inputs retailer or consultant typically has a direct influence on the type of seed a farmer grows or herbicide he deploys. Increasingly crop offtakers – from large multinational food companies to local processors – are also influencing how farmers operate based on the demands of their consumers.

“While this pathway is a bit less direct than others, there are several instances of midstream actors in the global south who are directly engaging with smallholder farmers to encourage and provide them with the necessary training and inputs to help them adapt to climate-smart practices.”

The report highlights and unpacks in some detail six opportunities to invest in climate adaptation:

On-Farm and Post-Farm Infrastructure

Changing temperatures and natural disasters will require innovative on-farm and post-farm solutions for smallholders, including solar irrigation, climate-controlled environments, drying equipment, cold storage solutions, and feasible transportation channels.

Enabling Data and Intelligence

Emerging sets of software providers – including precision agriculture, traceability, MRV, and agroclimatic risk providers – are key to collecting, interpreting, and delivering data and information to players across the value chain, thereby allowing for improved forecasting and risk assessments before, during, and after production.

Adapted Inputs

Various applications of adapted inputs can assist smallholder farmers in adapting to climate change through adapted crops that offer more stable yields, enhanced pest and disease resistance, improved water efficiency, and improved soil health. Both high-quality inputs and the right distribution channels are instrumental in promoting adaptation.

Financial Services

Climate change will pose additional challenges in the agriculture sector, therefore making working capital even more constrained and necessitating increased and alternative finance sources for smallholder farmers, including the need for increased insurance.

Climate Adaptive Value Chain Actors

Many adopters directly engage with farmers, which will be crucial in encouraging and providing the necessary training/inputs to help them adapt to climate-smart practices.

Ag Marketplaces

Innovative solutions will be instrumental in promoting supply chain connectivity and access to better markets and inputs for smallholder farmers across crop systems, livestock, and aquaculture.

India is the top country for investment in agrifoodtech climate adaptation for smallholders, bringing in $1.9 billion of investment across 434 deals and 171 companies since 2012. As a leading agrifoodtech ecosystem globally – and one of the first to have an agtech industry – this is unsurprising, write the report’s authors.

“Faced with numerous climate hazards, the focus of the country’s entrepreneurs on adaptation innovations is equally unsurprising. Israel [which came second] is another hotbed of agtech innovation with particular strength in irrigation technologies.”

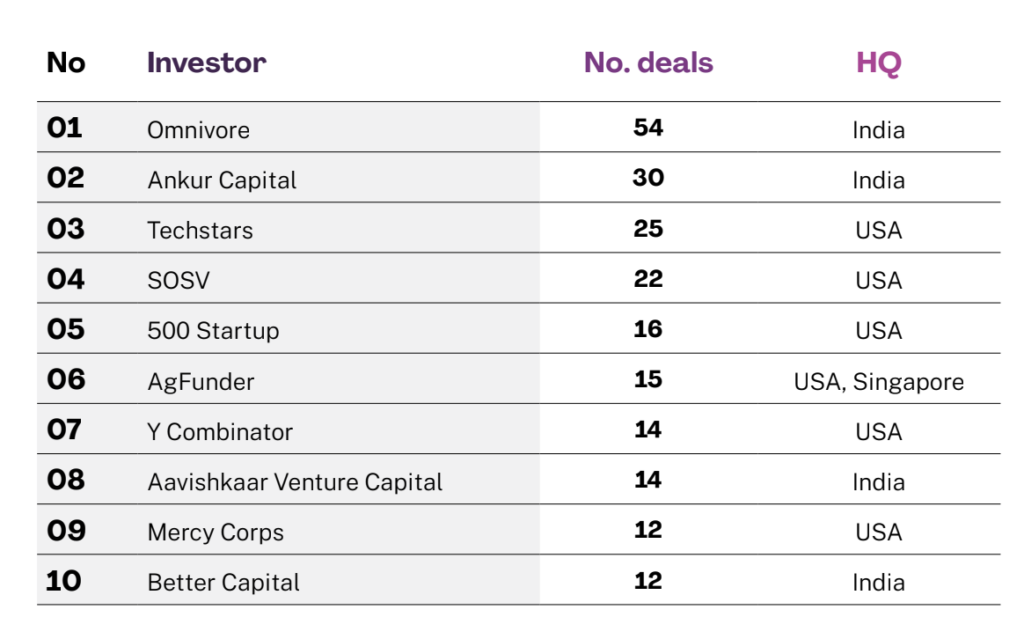

India’s leading agrifoodtech investor Omnivore tops the investor league, followed by another Indian firm: Ankur Capital. But the majority of the top 10 investors in climate adaptation for smallholder farmers are actually US firms with a global footprint, including accelerator programs Techstars, SOSV, 500 Startups and Y Combinator. AgFunder, which runs the Singapore-based GROW accelerator, is also in the top 10. [Disclosure: AgFunder is AgFunderNews’ parent company.]

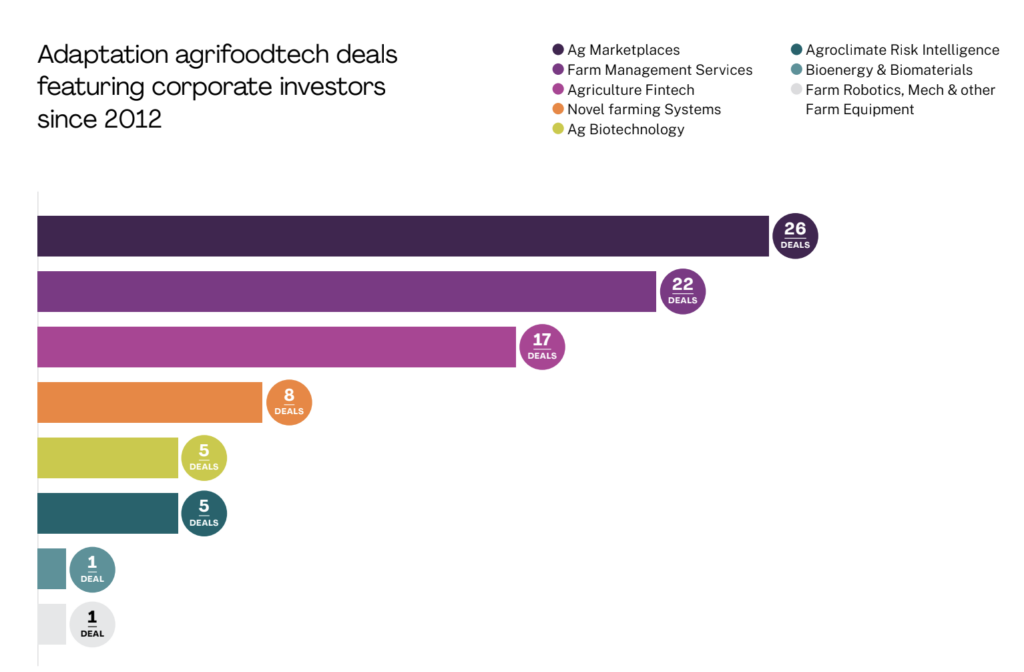

It’s not just financial investors placing bets in agrifood adaptation tech deals; some 47 corporations have made adaptation investments, predominantly from their venturing arms, contributing to $1.1 billion in funding – nearly 20% of the total $5.7 billion in adaptation agrifoodtech funding – across 85 deals. MDI Ventures, the venturing arm of Indonesia’s telecommunications giant Telekom, has been the most active corporate venture investor to date, making nine investments, followed by Telefonica’s Wayra, Indonesia’s Bank Rakyat Indonesia, Malaysian multinational Genting and Norwegian chemicals giant Yara.

What we don’t know

The report emphasizes the role of local and international banks in climate adaptation for smallholder farmers offering a few interesting examples such as the Green Climate Fund and CRDB Bank in Tanzania’s partnership to establish a lending and de-risking facility designed to make climate-adaptive technologies affordable to local farmers and SMEs. That project is valued at $200 million in total and there are other examples in the report, but the report’s authors were unable to size total banking investment in smallholder adaptation; the data are just not available.

The importance of debt, and therefore banks, in the agriculture sector, cannot be understated. And although comprehensive data on bank lending for agriculture adaptation is not specifically tracked, it is well known that banks, lenders and insurers have not been servicing smallholder farmers – and SMEs more broadly – well enough.

Download the FREE 93-page report entitled Climate Capital: Financing Adaptation Pathways for Smallholder Farmers here.

The executive summary on ly is available here.