Editor’s note: A version of this article previously appeared in Forbes.

We’ve been watching the surge of investor interest in upstream, close-to-the-farm technologies since the Covid-19 pandemic started. We now have numbers that show just how significant that farm tech investor interest is.

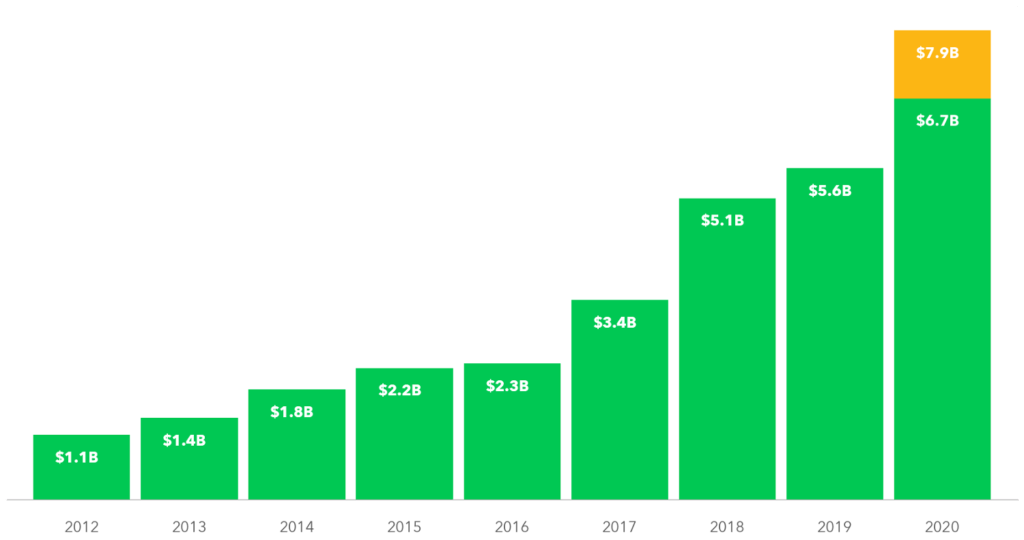

‘Farm tech’ investing soared to $7.9 billion in 2020, topping 2019 investments by $2.3 billion, or 41%, according to AgFunder’s latest Farm Tech Investment Report. [Disclosure: AgFunder is AFN‘s parent company.]

To put this in perspective, farm tech’s acceleration was about six percentage points greater than agrifoodtech overall — that’s foodtech and farm tech combined — and 37 percentage points higher than global VC’s year-over-year increase in 2020 (which Crunchbase pegged at just 4%.)

Much of the investment activity was led by two sectors: Ag Biotechnology and Novel Farming Systems (mostly the indoor farming of crops and insects). Investors pumped more than $1.5 billion into each category. Ag Biotech companies attracted particular interest from investors: 173 deals closed, representing 58% growth from 2019. Novel Farming Systems deal activity grew by 47% year-over-year.

As difficult as 2020 was globally (2021 hasn’t been pretty in many parts of the world), the pandemic seems to have buoyed farm tech because it “exposed cracks in the industrial agricultural system,” particularly the vulnerability of the food supply chain, Infarm’s CEO Erez Galonza told AFN in an interview featured in the report. The German hyper-local vertical farming venture, whose modular units can be found in grocery stores across Europe, secured $170 million from investors last year.

“[The pandemic] highlighted the need for resilient, localized solutions,” he added.

Farm tech funding 2012-2020

SPACs for best-funded farm tech categories

Perhaps the biggest winner, in that sense, was US-based high-tech greenhouse operator, AppHarvest. The company announced plans to go public last September via a special purpose acquisition company, or SPAC. It officially listed on the Nasdaq stock exchange in January, just weeks after shipping its first harvest.

AppHarvest recently purchased robotics leader and AgFunder portfolio company Root AI, making founder Josh Lessing the publicly listed company’s new CTO. Read more here.

AppHarvest kicked off a SPAC trend for Farm Tech companies, and Novel Farming ventures specifically. We’ve since seen four other agrifoodtech companies announce plans to go public through SPACs: agbiotech companies Benson Hill and Gingko Bioworks and novel farming ventures AeroFarms and Local Bounti. (Keep up to date with agrifoodtech SPAC news here.)

It is interesting to see public listing activity happening in the two agrifoodtech sectors that surged the most in terms of deal activity last year; it signals that there could be more to come if the process proves successful for these early case studies. For now, it’s certainly providing an exit opportunity to early agtech ventures that bet on deep technologies requiring significant amounts of time (and certainly hefty commitments of resources) to become revenue-generating, much less profitable.

That in and of itself is a significant milestone for a maturing agtech industry.

Pandemic pivots

It isn’t all about Ag Biotech and Novel Farming Systems; the biggest deals of 2020 were in the Agribusiness Marketplace sector. Boston-based Indigo Ag raised two investment rounds, totaling $535 million last year, and San Carlos, Calif.-based Farmers Business Network raised $250 million.

Indigo Ag’s executive team told AFN that because it deals directly with the food supply chain, the company confronted an immediate shock from the pandemic.

“The global pandemic was an external challenge that required our team, like many others, to quickly adapt to ensure that our customers and employees were supported,” they said in a special interview featured in the report. “While we were fortunate that our operations were not significantly impeded by the pandemic, we did have to quickly expand our support services and tap our creativity to enable our farmers, buyers and partners to manage their business with confidence during the early stages of Covid-19.”

The company launched a transport support hotline for grain growers, carriers and shippers to ensure the supply of grain could continue to move as efficiently as possible. It also focused on developing pricing tools, access to grain marketing advisors, and even a podcast to help growers grapple with pandemic-related market volatility.

Indigo Ag isn’t a stranger to unchartered business terrain. The company has put itself in the middle of the evolving but murky carbon markets. “With new players entering the carbon space nearly weekly – many taking less rigorous approaches to verification and measurement – Indigo has remained steadily focused on enabling farmers to make informed decisions about how, when and why to participate in the carbon market,” the Indigo Ag team told AFN.

They added: “By leveraging our scientific insight, technological capabilities, and use of industry-leading carbon accounting protocols, Indigo ensures farmers are supported with the right tools and information to take advantage of the opportunity to raise a new and increasingly valuable crop: carbon.”

Food’s sustainable future

Verification of carbon-capture accounting is indeed getting increased attention and scrutiny. It’s likely to be a key theme in the agriculture industry going forward, and it’s one of AgFunder’s key trends to watch in 2021, alongside overall food system sustainability.

“We can invent a new, sustainable food industry, feeding the planet all the while protecting its biodiversity, and combatting climate change,” the executive team behind French insect farming venture Ynsect told AFN. The company sees insects as a crucial component of food’s sustainable future.

“Insects can aid food security and be a part of the solution to food shortages, given their high nutritional value, low requirements for land and water, low emissions of greenhouse gases, and the high efficiency at which they can convert feed into food,” the Ynsect team argued in an interview featured in the report.

Investors seem to agree: Ynsect scored the largest amount of funding in the novel farming sector in 2020, raising $222 million in 2020, taking its Series C total to $372 million, to build an industrial-sized farm for its Molitor mealworms near the city of Amiens. Ynsect went on to acquire Dutch insect farming company Protifarm in April of this year.

Many of the world’s consumers may as yet be skeptical of insects as a protein source. But consumer consciousness and demand for high-quality, low-environmental impact foods is certainly a trend influencing the evolution of Farm Tech, as evidenced by the range of startups that attracted funding in 2020.

Ag Biotech ventures like Benson Hill, GreenLight Biosciences, and Pivot Bio secured investor backing for helping to diversify crop input technology away from environmentally-harmful synthetic chemicals.

Novel Farming ventures are developing highly efficient and resource-conservative approaches to growing fresh foods.

Farm Management Software, Sensing & IoT companies like ICEYE, Aclima and Cervest are illuminating climate change impacts and helping companies anticipate and forecast climate-related disruptions.

Food preservation technologies like Apeel Sciences’s are helping reduce food waste, as are e-grocery services like Misfits Market and Imperfect Foods, which sell “ugly produce” that would otherwise be wasted among their fresh foods and grocery offerings.

Companies like Celtic Renewables are turning farm waste into a resource through the production of biofuels.

“As companies increasingly make commitments to improve their environmental impact – and governments at all levels enact policies to encourage climate-smart agriculture,” said the Indigo Ag team, “the opportunity for agriculture to act as a climate solution will only become more apparent.”