French insect farming startup Ÿnsect has raised an additional $224 million in Series C funding, bringing the round to $372 million in total. It had announced a first Series C close of $148 million in February last year.

According to Ÿnsect, the round is the largest ever raised by a non-US agrifoodtech startup. The new funding brings its total capital raised to date to $425 million, which it claims is more than the total amount raised by rest of the insect protein sector globally.

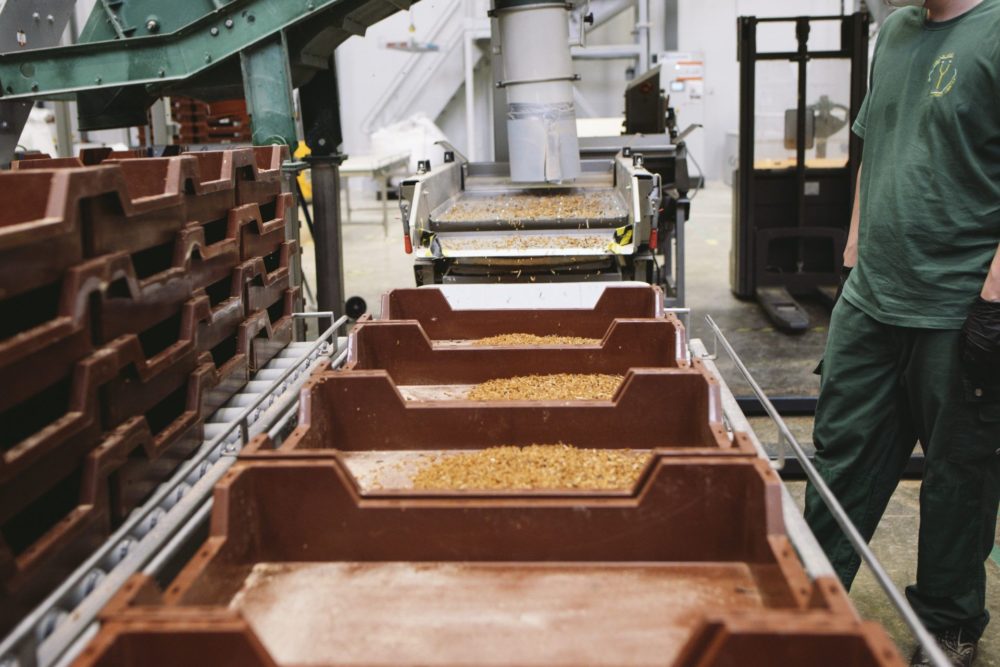

The startup farms mealworms to produce ingredients for fish feed, pet food, and crop fertilizers in an effort to capture some of the $500 billion animal feed market. Aquaculture still relies mostly on feed containing fishmeal — which is made of wild-caught fish — which accounts for over 25% of global fishing and contributes to declining wild fish stocks globally, according to the startup.

The new capital will be used to help the company build what it describes as the largest insect farm in the world, which is currently under construction north of Paris.

Ÿnsect is also expanding its business in the pet food ingredient market, which is worth roughly $40 billion worldwide. Consumer spending on pet food is also seeing a noticeable increase. In 2019, consumers spent the most money ever on pet food and treats at $36.9 billion. That figure is projected to climb 4% this year alone.

“Hypoallergenic, healthy, sustainable pet food is growing,” Ÿnsect CEO Antoine Hubert told AFN. “We have our first customers and we hope to close new deals in the future with this. We have very positive traction there at the moment.”

Insect protein for human food remains an area of interest but faces serious challenges around consumer acceptance. Some people may never be able to embrace bugs as part of their diets.

“We have such stringent demands in pet food today in terms of toxicological studies, mutagenesis to these allergens, allergenicity studies, which are actually the same as human food,” Hubert said. “So, we have the data that human food companies could ask for. The question is just the time and resources we need in terms of marketing. We would like to invest more [in this] in the coming years.”

Ÿnsect is aiming for its new factory to be carbon-negative. For Hubert, this is the most important part of the company’s funding announcement. It has completed life cycle assessments for the facility with sustainability consulting firm Quantis. The assessments included all the upstream and downstream aspects of its operations as well as the indirect and direct consequences of having the new farm in the supply chain.

An initial report has been completed, Hubert said. An independent party has also done a review as part of the ISO standards, and has validated the carbon-negative status of Ÿnsect’s operations. This is achieved in part from using the manure — called frass — that’s a byproduct of rearing the insects as a soil amendment.

“Basically, we are emitting 45,000 tonnes of carbon per year with the farm. But then we are sequestering carbon back into the soil, about 3,000 tonnes,” he said.

“We are avoiding a lot of emissions thanks to the positive performance and health benefits we have on fish and plants. It’s really due to the products we have, their performance, which [is] unique in the tech sector, and the volume we are able to generate because of this vertical farming platform we have designed.”

Lead investor Astanor Ventures participated in the Series C extension along with Upfront Ventures, actor Robert Downey Jr’s FootPrint Coalition, and existing investors Happiness Capital, Supernova Invest, and Armat Group. The financing was also supported by a bank consortium including French government-linked investor Caisse des Dépôts, Crédit Agricole Brie Picardie, and Caisse d’Epargne Hauts-de-France.

“Uniquely, Ÿnsect offers its customers significant nutritional advantage that helps them improve yields,” Eric Archambeau, co-founder and managing director of Astanor Ventures, said in a statement.

“Its offer, combined with its proven ability to scale and a carbon-negative supply chain, means Ÿnsect is bringing a highly disruptive, scalable new technology that is capable of revolutionizing an important segment of our most vital sector, agrifood, guided by a deep understanding of, and respect for, nature.”

The Series C extension was in the works during 2019 but the startup held off on making the announcement during the earlier part of the Covid-19 pandemic. The first goal with the follow-on funding was to secure investors who can assist with its global expansion plans, Hubert explained.

“Our investor bases were only European and Asian. We knew that one of our key markets would be North America [and] developing our business there is much better if we have local investors,” he said.

“The second [goal] was to intensify a hyperlocal network around the facility we are building now. The third goal was to be fully funded. So, now we don’t need any more funding to be profitable. We have enough cash to build the plants, generate cash, and to be profitable forever.”

Earlier this year, NextProtein, a French-Tunisian startup working on new ways to produce insect-based animal feed and fertilizer, raised €10.2 million ($11.2 million) in Series A funding. Insects for animal feed startup Beta Hatch raised a $3m Series A1 round around, as well.