Data Snapshot is a regular AgFunderNews feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research.

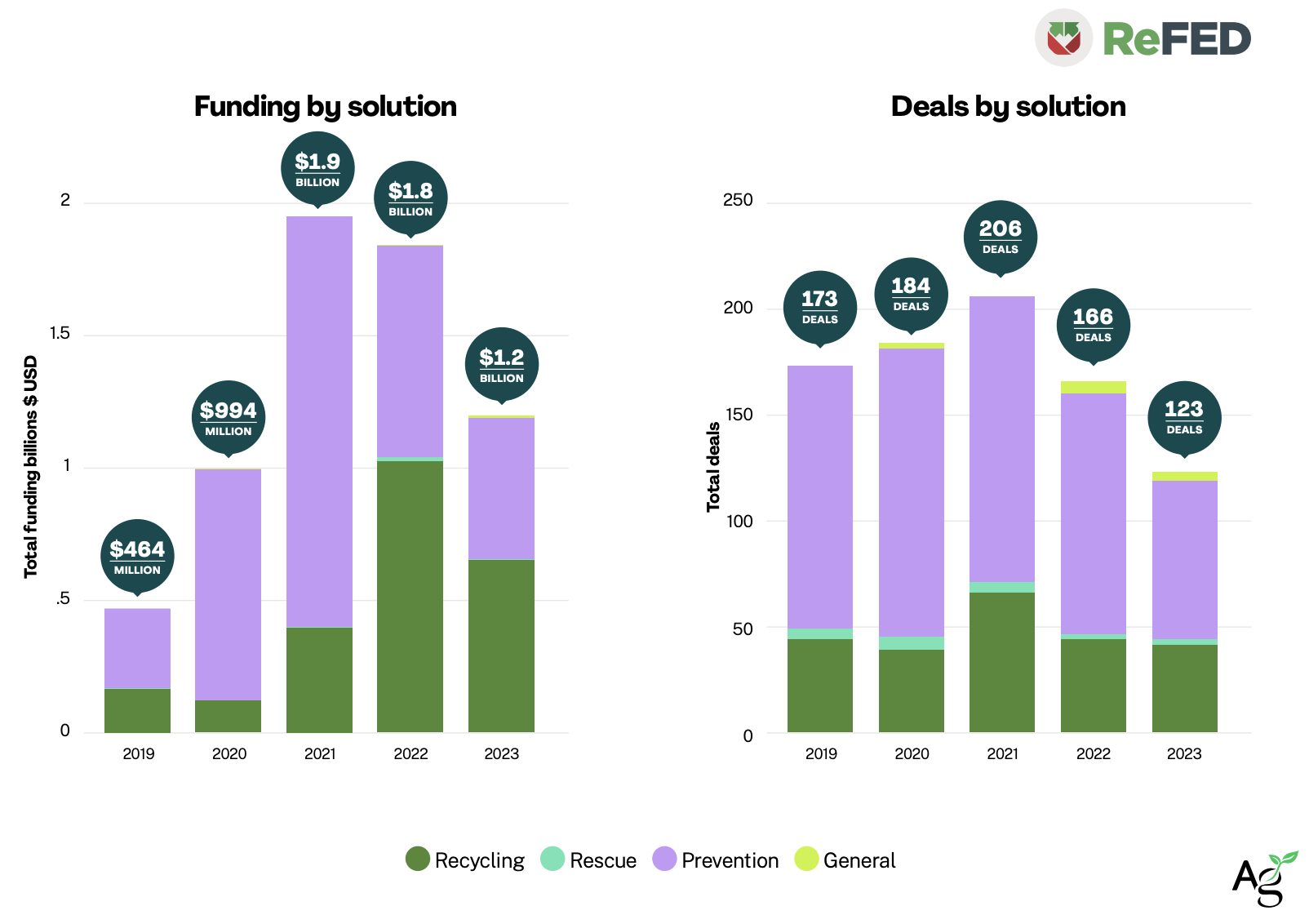

Investment in food waste solutions in the US dropped 33% from 2022 to 2023, according to AgFunder’s latest Global AgriFoodTech Investment report, which includes data and analysis from food waste nonprofit ReFED.

The decline is in keeping with most other agrifoodtech categories for 2023, a year that included severe corrections to company valuations, tough fundraising conditions and a mass exodus of the sector by generalist investors.

However, investment in the US food waste sector remains higher than it was in 2019 and 2020, suggesting continued momentum.

Despite the downturn, food waste tech is “well positioned to outperform overall trends,” ReFED executive director Dana Gunders tells AgFunderNews.

“Because of the increased [food] prices, there’s more motivation for businesses to be adopting some of the [food waste] technologies.”

Consumers, too, are changing some behaviors around food waste “because of the pressure that high food prices are putting on households,” though Gunders notes that household food waste is still much more difficult to track than waste elsewhere in the value chain.

Food retail has always seen the most progress, she adds. For example, the Pacific Coast Food Waste Commitment (PCFWC), a public-private partnership between food businesses and West Coast jurisdictions to cut food waste in the region, reported a 25% reduction in grocery retail food waste from 2019 to 2022.

“We’ve never had that before,” says Gunders, adding that this data is the best example of progress the US has to point to right now in terms of food waste.

Food waste solutions: category growth over time

ReFED tracked funding and deal numbers for four different food waste solutions between 2019 and 2023.

These solutions fall into three main categories, as laid out by the ReFED Insights Engine, a comprehensive hub of food waste data and information for the US.

Recycling: Food recycling is in essence about turning surplus food, scraps and other non-edible food parts into valuable materials for industry. Composting, whether at home or in community-scale settings, is a major solution in this category along with anaerobic digestion and turning would-be waste into livestock feed, as many insect-based systems are doing.

Rescue: Food rescue involves diverting healthy food such as produce from the landfill and donating it to food relief agencies. In foodservice and some grocery environments, food rescue also includes selling surplus items or those nearing expiration to consumers at heavily discounted prices.

Prevention: Prevention is concerned with earlier stages of the agrifood supply chain, from optimizing harvests in the field to improving distribution and product management and reshaping consumer environments like food retail stores. Specific solutions, or “action areas” include “active and intelligent” packaging, standardized date labels, waste-tracking systems, more efficient transit, and consumer education.

Zoom in on food waste recycling

Over the last half-decade, much investment has gone into the Recycling category, which is often seen as scalable and able to handle large volumes of waste, according to AgFunder’s report.

Data collected from the ReFED Insights Engine shows that, in 2023, the Recycling category raised $681 million across 44 deals.

Gunders says this category includes, “everything from turning things into animal feed [via] insect farming or other processing techniques to composting or anaerobic digestion and even turning food scraps into non-food products like textiles or bioplastics.”

In keeping with global agrifoodtech investment trends, the amount of funding to recycling solutions is down substantially (from $1 billion in 2022) but only marginally lower in terms of deal count (46 in 2022).

Bucking global trends, investment to food recycling solutions in 2023 was over 40% higher than in 2021, a banner year for most agrifoodtech investment (though deal count dropped 36%). This is largely thanks to a couple of mega deals.

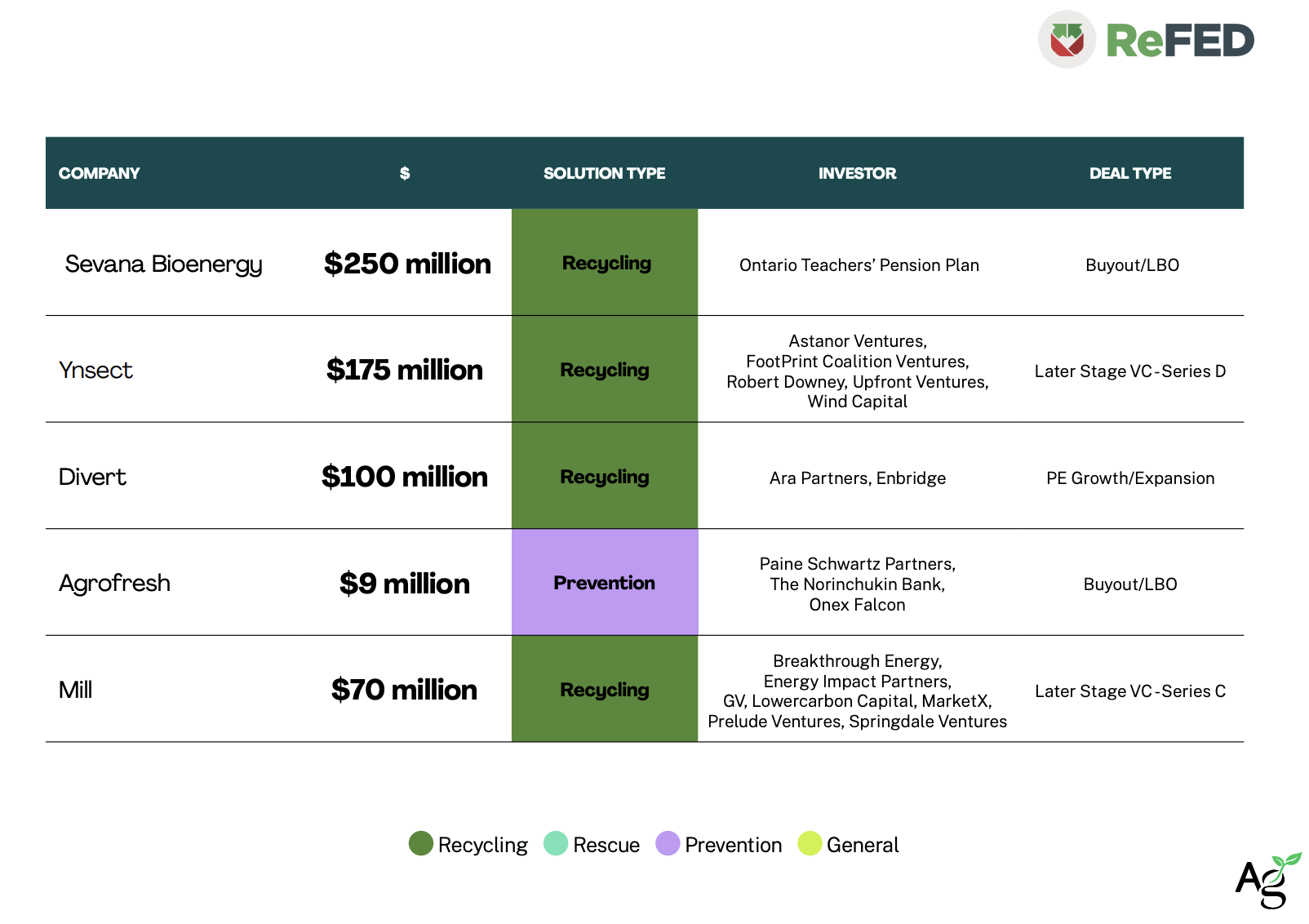

Sevana Bioenergy, which turns agricultural byproducts into biogas via anaerobic digestion, was acquired by Ontario Teachers Pension Plan through a $250 million leveraged buyout. France’s Ynsect raised $175 million from venture capitalists for its waste-to-protein insect farming model.

Recycling solutions took four of the top five funding rounds for food waste in 2023:

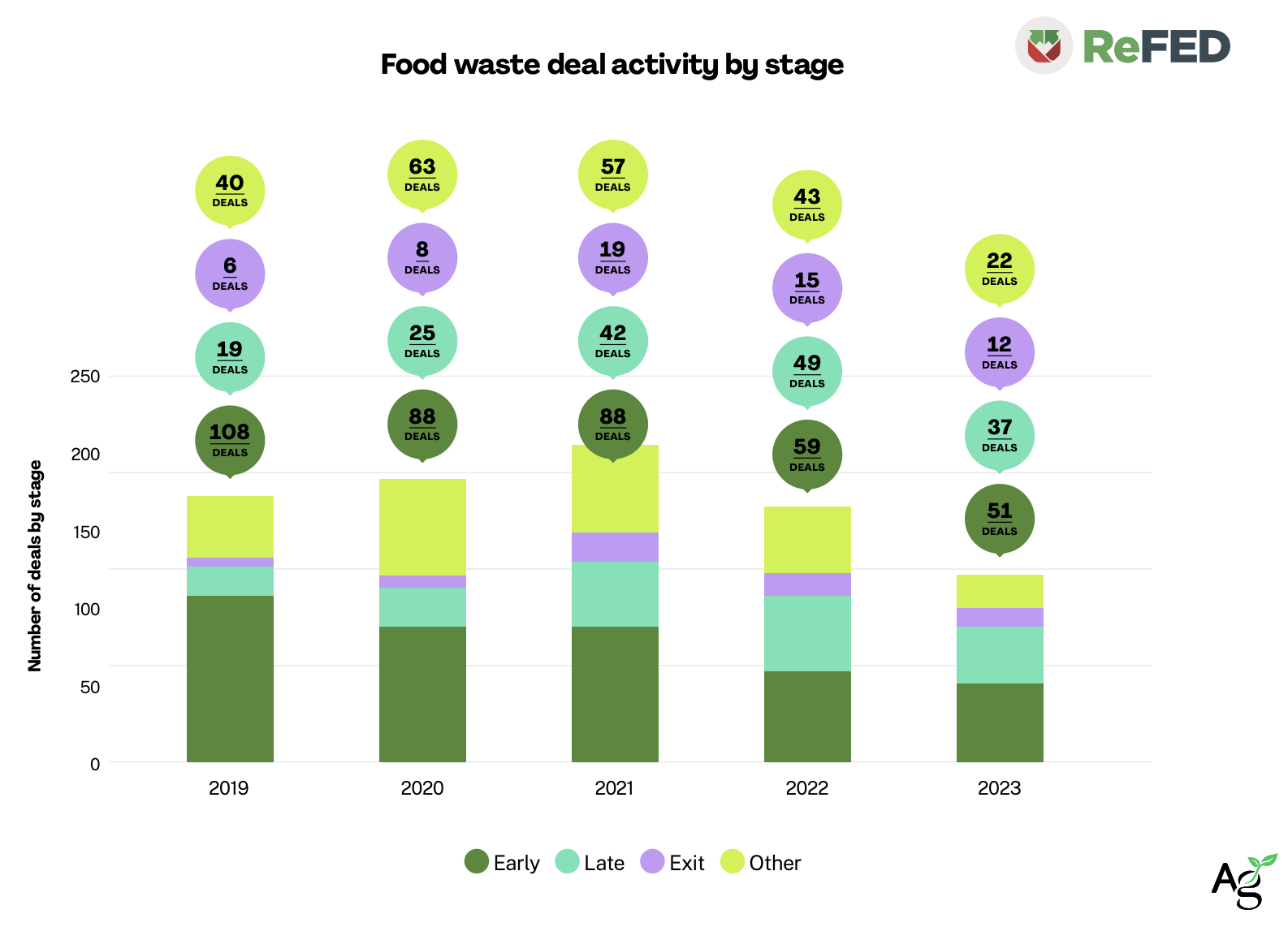

Later-stage deals on the rise

Although food waste as a sector still is in the early stages of development, ReFED says we are now seeing solutions companies enter the later stage and beginning to scale with the help of corporates.

Gunders says there’s “no question” that this is a sign of maturity. “There’s a regular drumbeat now of at least double-digit, million-dollar investments in companies [and] we have a few that have gotten acquired.”

Insect farming, where insects turn waste and agricultural byproduct into high-value ingredients (mostly for animal feed), illustrates this maturity well. Ynsect, Protix, and Grubbly Farms all raised later-stage rounds in 2023 (read our recent deep dive into this segment HERE).