[Disclosure: AgFunderNews’ parent company is AgFunder.]

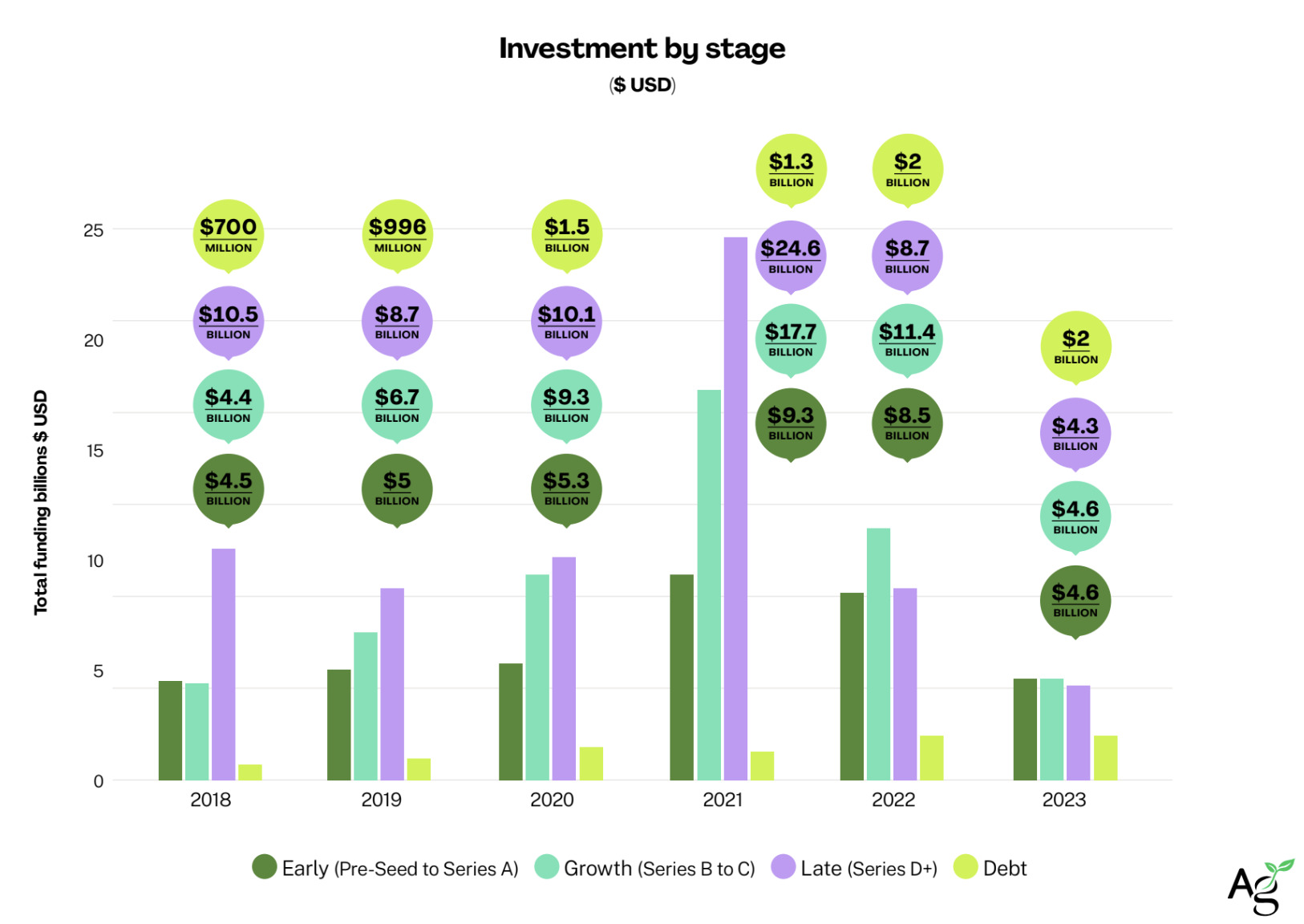

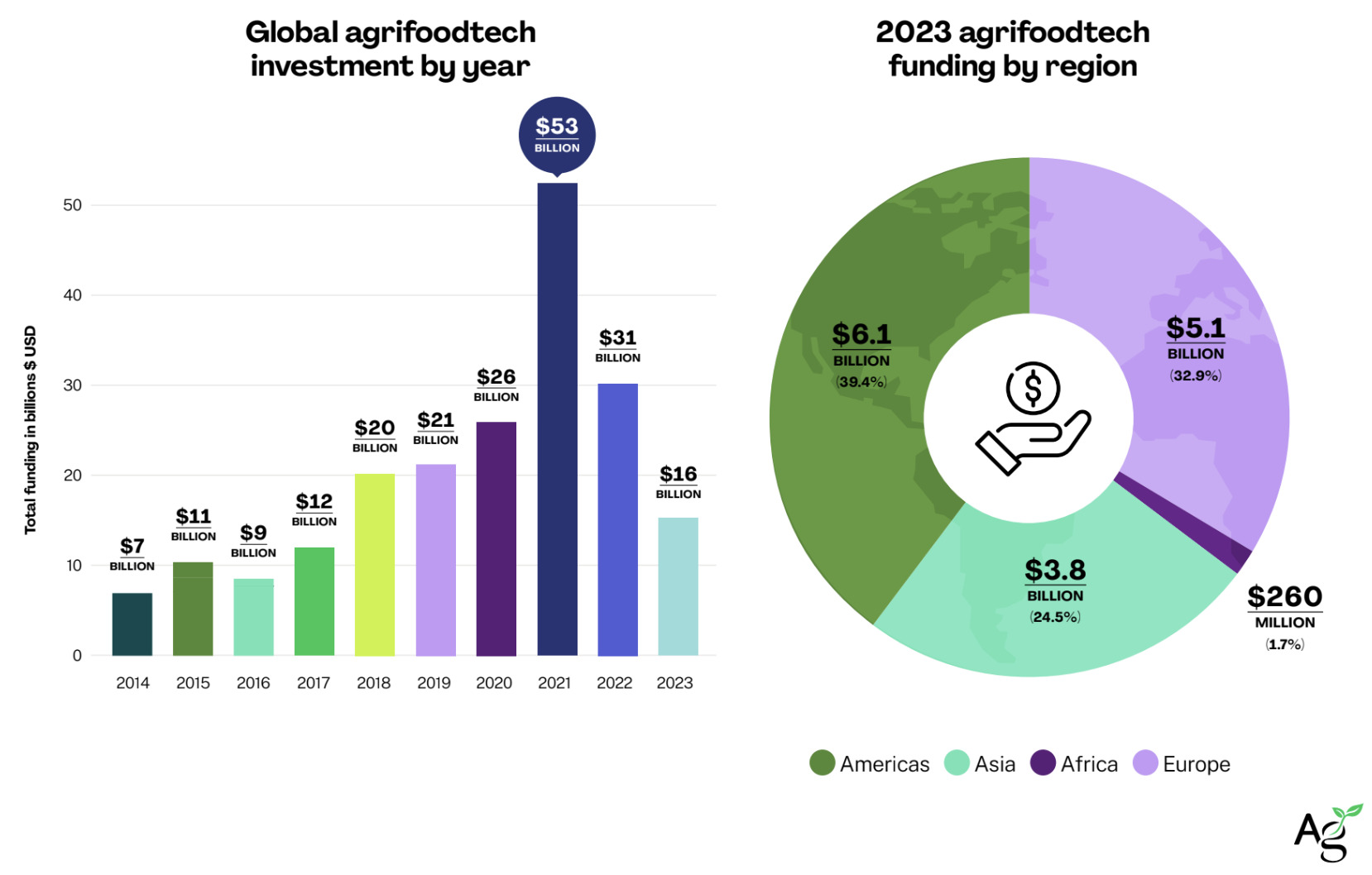

Investment in agrifoodtech startups has hit its lowest point in six years, declining nearly 50% from 2022 to 2023 as a result of fewer and smaller deals, according to AgFunder’s just-released Global AgriFoodTech Investment 2024 report. That’s lower than the 35% year-over-year drop experienced across venture capital markets, according to AgFunder’s main data partner Crunchbase.

Agrifoodtech funding declined as an overall portion of global venture capital as generalist investors — many of whom fueled billion-dollar-plus valuations in categories like alternative protein and vertical farming just a few years ago — are now fleeing the sector. In 2023, agrifoodtech represented just 5.5% of VC dollars across all sectors in 2023 compared to 6.7% in 2022 and 7.6% in 2021.

Elsewhere, some of the first specialist agrifoodtech VC firms have failed to raise follow-on funds and will likely soon close their doors.

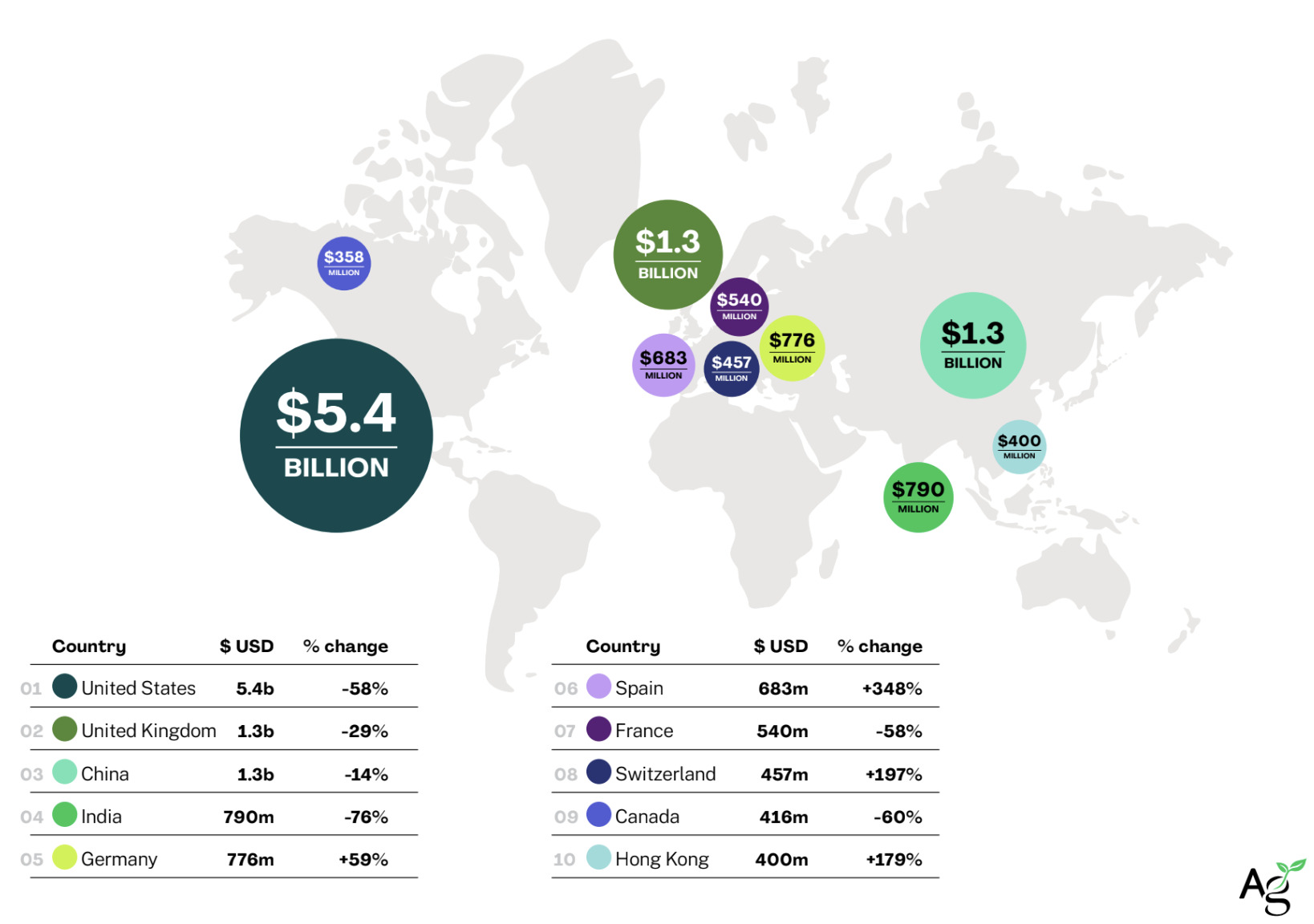

The decline is global, particularly for Asia, which did not recover its pre-Covid totals and raised only $3.8 billion, and the US, which saw its share of agrifoodtech funding drop to just 30% of global funding when it usually accounts for at least 40%.

There are a few bright spots in the report.

Funding to upstream startups – those operating on the farm or in food production – accounted for 62% of overall dollar investment in 2023, up from 51% in 2022 and 30% in 2021. This matters because upstream tends to include the sectors innovating in the fights against climate change, metabolic illness, food insecurity, and agrifood system inequalities.

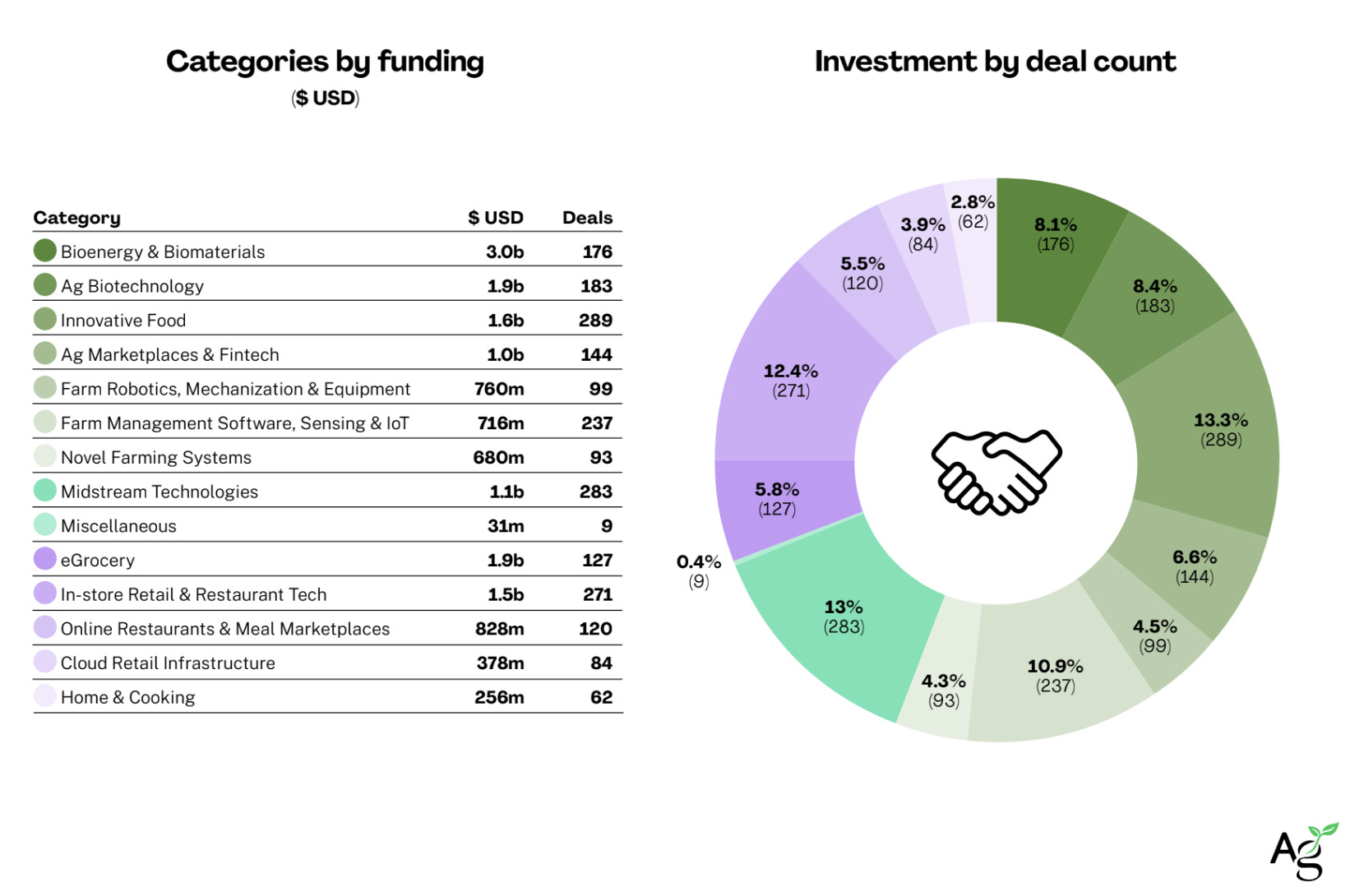

Another encouraging point in the report is the growth in investment in the Bioenergy & Biomaterials category, which has never been a huge slice of the agrifoodtech investment pie. In 2023, investment in this sector increased 20% to $3 billion across 177 deals.

While both Bioenergy (a type of renewable energy derived from biomass) and Biomaterials (materials like packaging or fabric made from organic matter) have existed for decades, investors appear to be more attuned to their value as climate change forces the planet to find new sources for energy, food packaging, fashion, and more.

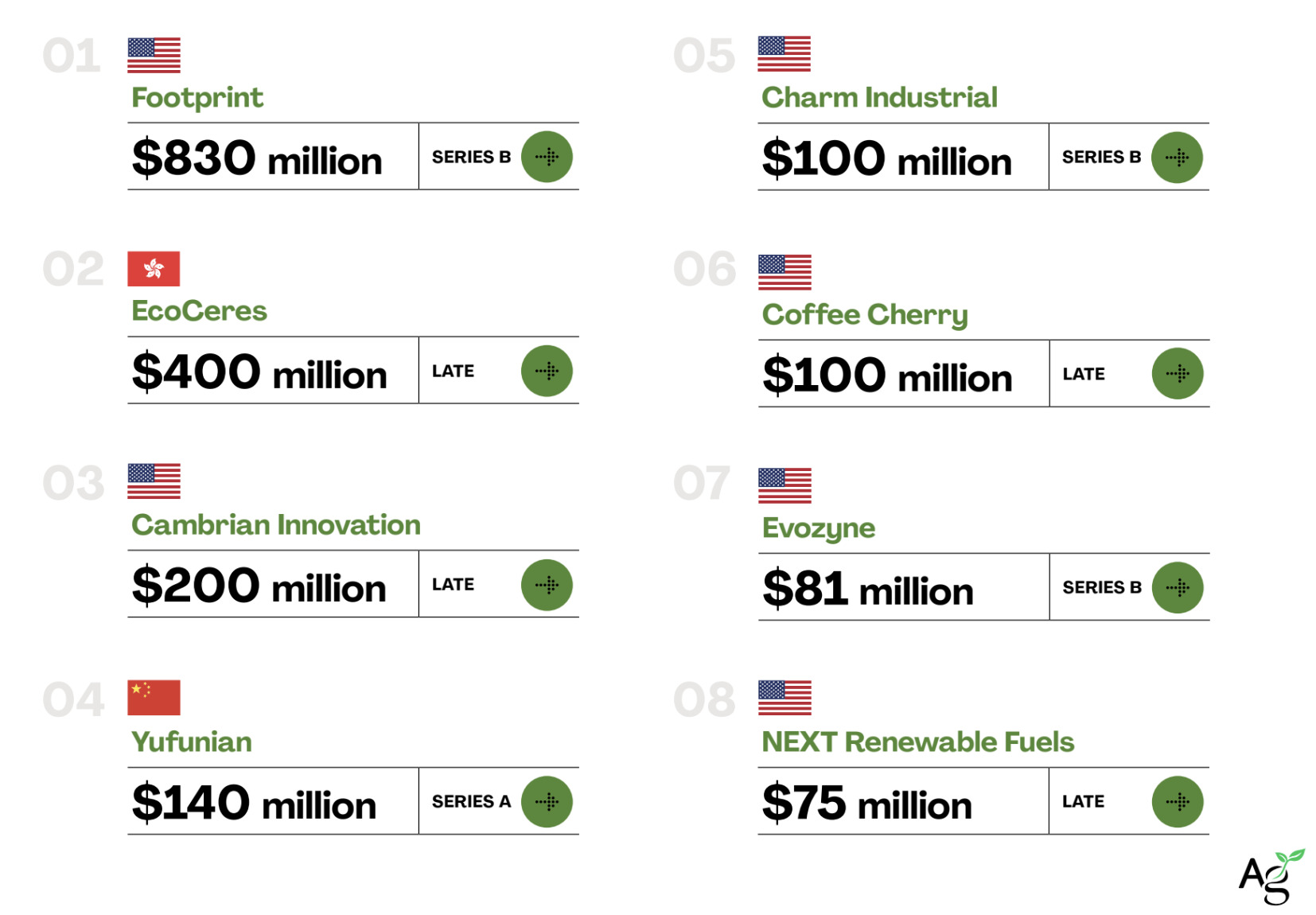

Biomaterials in particular bolstered the sector thanks to a $830 million mega-round for US-based Footprint, which makes molded fiber products that mimic many of the properties of plastic.

The Farm Robotics, Mechanization & Equipment category, which includes much more than weeding ‘bots and autonomous tractors, also grew in 2023, albeit more incrementally. The category continued the steady upward trajectory it’s been climbing for some time now, increasing 9% year-over-year to $769 million.

Asia led investment in the category thanks in large part to Indonesia’s eFishery, which raised a mega $200 million Series D in 2023 taking it to unicorn status. The Americas, which garnered the most investment dollars in 2022, saw less funding but slightly more deals than Asia: 37 and 31, respectively.

It would of course be unwise to ignore the reality of the data and the fact that 2024 is going to be another tough slog for agrifoodtech. More startups will close their doors, more layoffs will happen, and the town criers of LinkedIn will continue proclaiming the death of certain sectors they once said would save the food system.

“Investments made during 2024 will provide solid investment returns given [that] the quality of businesses still standing will be higher on average (than in 2021, for example), and given that valuations will have further corrected from their highs of the past years,” said Costa Yiannoulis, co-founder and managing partner at Synthesis Capital in AFN’s VC survey at the end of last year.

Key insights from the AgFunder Global AgriFoodTech Investment Report 2024:

Agrifoodtech startups raised $15.6 billion globally in 2023, down 49.2% percent from $30.5 billion in 2022.

Funding to all categories declined with the exception of two: Bioenergy & Biomaterials and Farm Robotics, Mechanization & Equipment.

Bioenergy & Biomaterials was the biggest category, raking in $3 billion in 2023, up 20% from 2022.

Investment in Farm Robotics, Mechanization & Equipment continued its steady upward trajectory of the past five years, increasing 9% year-over-year to $760 million.

Funding to upstream startups – those operating on the farm or in food production – accounted for 62% of overall dollar investment in 2023, compared with 51% in 2022 and 30% in 2021.

No global region was immune to the downturn. Europe felt it less acutely with a 14% year-over-year decline in dollar funding. African investment levels remained higher than 2021 at $260 million whereas Asia did not recover its pre-Covid totals with $3.8 billion.

The US was particularly badly hit with its share of agrifoodtech funding ($5.4bn) dropping to just over 30% of global funding; the country usually counts for at least 40% of global totals.

Deal count in 2023 was down 26%, reflecting smaller rounds with one or two exceptions.

The median deal size decreased 9% year-over-year whereas the average was down 30% on 2022 and 50% on 2021.

In emerging markets, China and India lost market share to other nations taking a combined 40% of funding, down from 55% in 2021. Startups in Indonesia, Saudi Arabia, Israel, Brazil and Singapore all contributed to the top 20 emerging market deals.

Funding to Ag Biotech — the leading upstream investment category in 2022 — dropped 34% to $1.9 billion in 2023.

The decline was more pronounced in other categories: Novel farming systems -79%, Cloud retail -75%, eGrocery -60%, Farm Management SW, Sensing & IoT -58%, Online Restaurants & Meal Marketplaces -58%, In-store Retail and Restaurant Tech -57%, Midstream Tech -55%, Home & Cooking Tech -53%, and Innovative Food -51%.