Data Snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

The story of global agrifoodtech investment has varied little from one region to the next over the last 12 months: eGrocery startups raised the most money in 2022; eGrocery startups fell out of favor in early 2023; VC dollars bolted back upstream as 2023 progressed.

So it was in the Nordics, the Northern European region comprising Norway, Denmark, Sweden, Finland and Iceland.

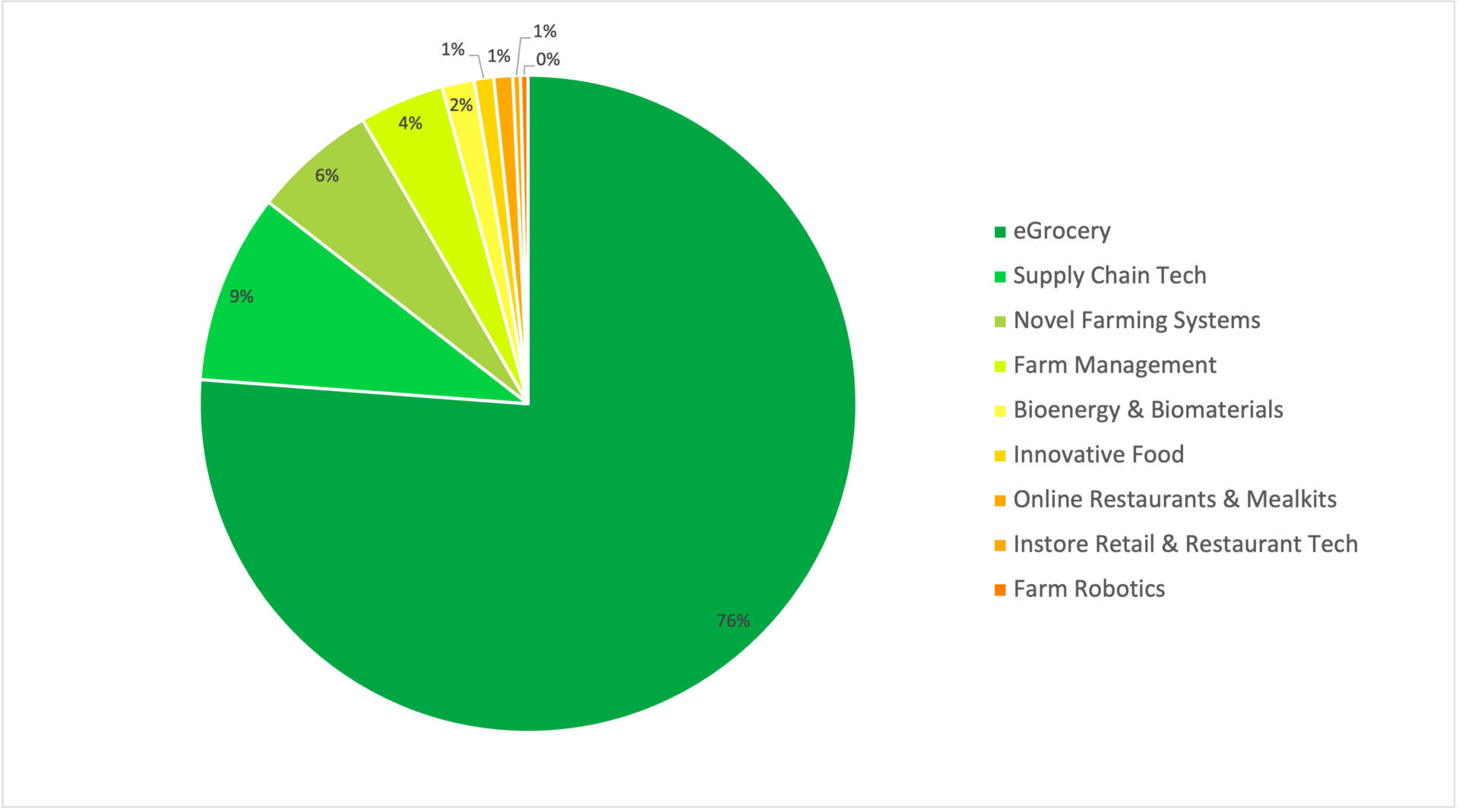

Nordic agrifoodtech startups raised nearly $500 million across 39 deals from mid-July 2022 to mid-July 2023, according to AgFunder data. As illustrated by the following chart, eGrocery took a massive portion of that funding:

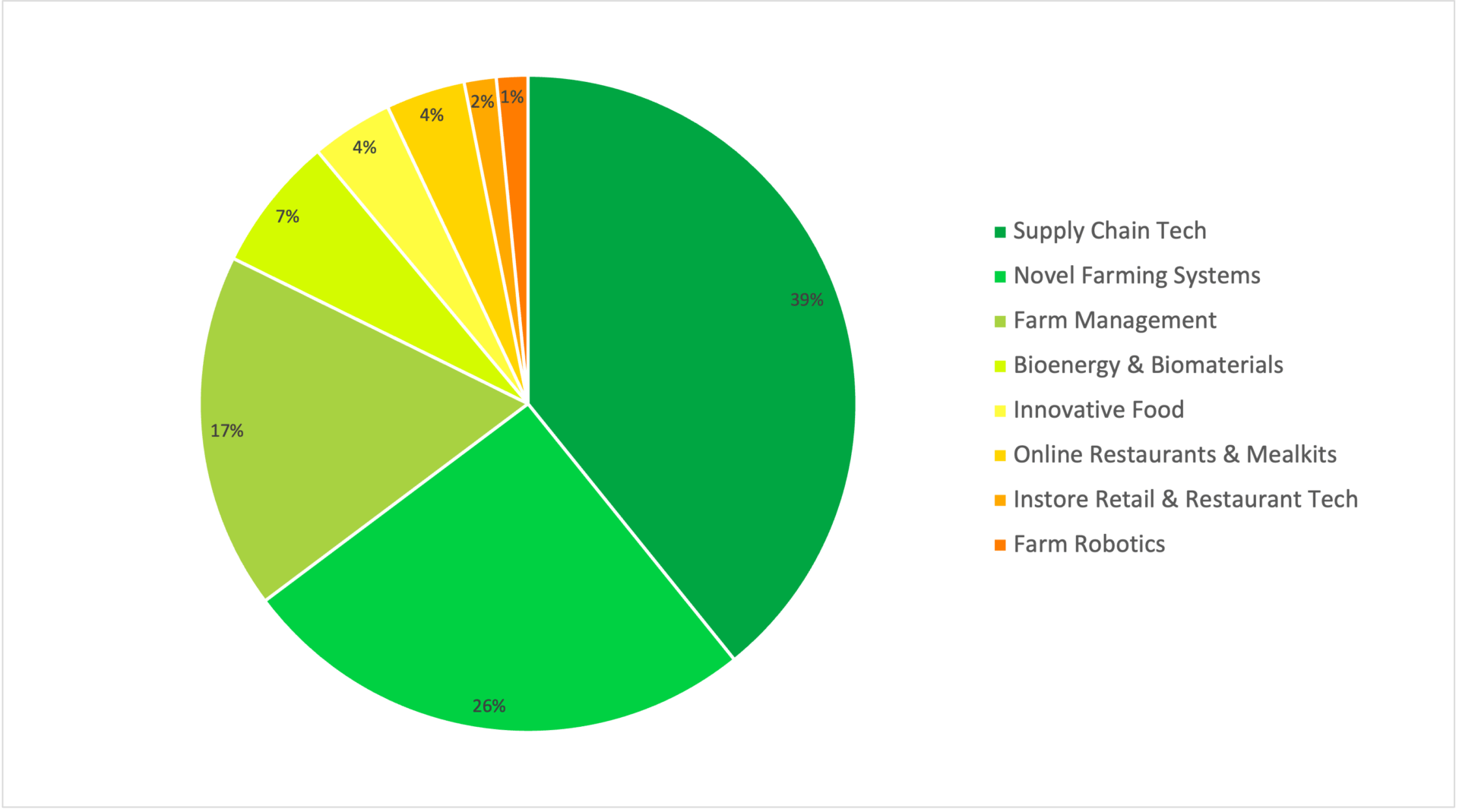

Remove eGrocery from the pie, and the remaining categories even out somewhat. Ex-eGrocery, supply chain technologies raised the most funding: $43 million across five deals:

Top deals in Nordic agrifootech investment

Online grocery retailer Oda (formerly Kolonial) raked in the most funding of any Nordic startup, with its various 2022 deals taking the top four spots for deal size.

Those rounds included a €150 million ($166 million) fundraise in December 2022 at a post-money valuation of €350 million ($387 million). At the time, Sifted reported that this was less than half of what Oda was valued at in 2021.

Oda slowed its expansion plans as a result, saying it would prioritize reaching profitability over new geographies. The company currently operates in its home country of Norway, and in Finland.

Another eGrocery startup, discount retailer Motatos, had the fifth-largest deal in terms of dollar amounts with its €38 million ($42 million) Series D raise in September 2022.

From there, agrifoodtech funding swam back upstream and out into the sea.

Novel Farming Systems, an AgFunder-defined category that includes insect farming, vertical and greenhouse systems, and aquaculture, had the largest number of deals: eight for the 12-month period starting on 15 July 2022.

The top deals in this category all went to startups working in or near the ocean. Sustainable salmon production company Gaia Salmon raised $16 million. Seaweed Energy Solutions, which specializes in seaweed farming, raised nearly $5 million, while aquaculture startup Villa Seafood raised $2.5 million.

Collectively, Novel Farming startups in the Nordics raised $28 million in total over the timeframe. The focus on fish and ocean life here isn’t surprising, given the region’s long coastlines and the prevalence of seafood in the population’s diet.