- Insetting solutions provider Klim has raised a $22 million Series A round led by BNP Paribas, one of Europe’s largest banks.

- Earthshot Ventures, Rabobank, AgFunder*, Norinchukin Bank, Achmea Innovation Fund, Ananda Impact Ventures and Elevator Ventures also participated. [Disclosure: AgFunderNews’ parent company is AgFunder.]

- Series A funding will enable Klim to expand internationally as well as introduce a new financial services layer to its platform to help in the transition to regenerative agriculture.

Decarbonizing supply chains through insetting

Klim helps food companies decarbonize their agricultural supply chains through insetting projects, where companies work to reduce emissions in their own value chain rather than relying on offsets.

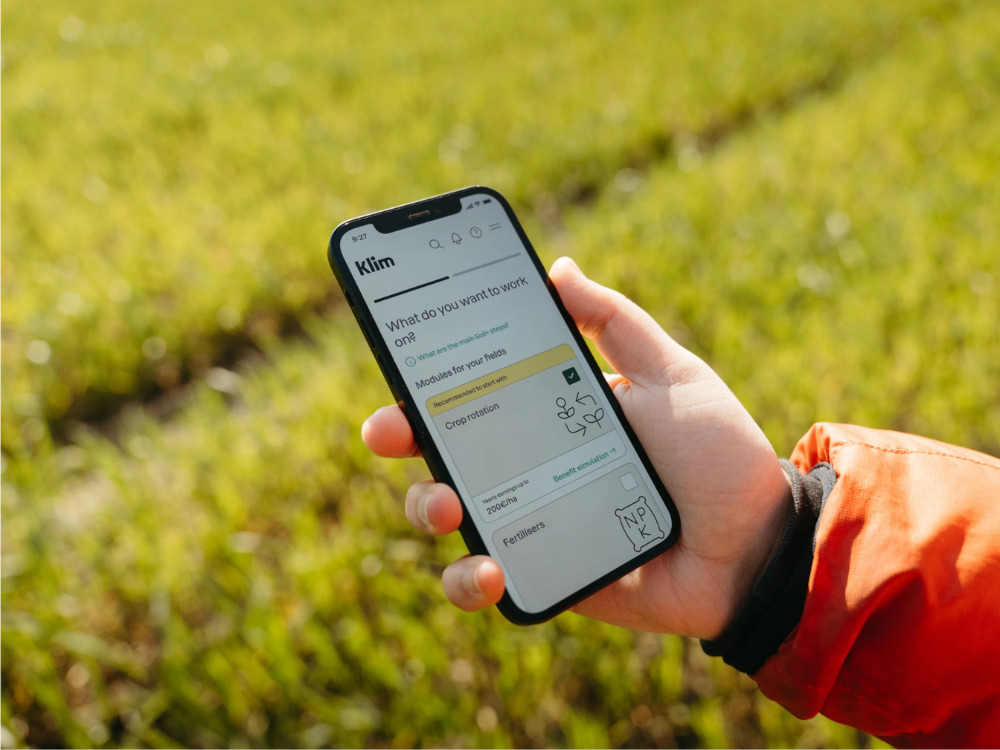

To enable this, its digital platform provides tools like agronomic support and transition capital that can help farmers shift to regenerative agriculture practices, which are vital to insetting projects and reducing scope 3 emissions. Farmers can use the Klim platform to plan, execute, and finance their transition to regenerative practices.

Scope 3 emissions account for nearly 90% of food and beverage companies’ carbon footprint. However, corporates don’t have direct control over these emissions, making them difficult to track, let alone reduce. Simultaneously, farmers are up against financial and operational risks any time they switch practices in the field, as is required of them by the transition to regen ag.

Klim is one of many trying to make the transition to regenerative agriculture a smoother ride for farmers and help agrifood corporates in the process.

Founded in 2020, the company says it already has more than 3,500 farmers using its platform across 700,000-plus hectares, or about 5% of all farmland in Germany. Among its corporate clients are Nestlé, Kaufland, and Aryzta.

‘Economic health depends on soil health’

Part of the new funding will enable Klim to introduce a new financial services layer to its platform — hence the interest from banks in this round.

“At the highest meta level, banks are interested in evaluating and appreciating important assets,” Klim CEO and cofounder Robert Gerlach tells AgFunderNews. “Soil is the most important asset on the globe. Banks, clients (such as farmers) and food companies’ economic health depends on their soil health.”

Soil degradation is no secret, nor are the risks it poses to biodiversity and food production. Problems with soil health lead to volatile harvests, a diminished ability to respond to climate change, and less profitability overall, says Gerlach.

Banks, he adds, are concerned about their clients, be they farmers or food companies, becoming less financially stable.

The financial services offering will enable farmers using Klim to access capital that can help in the transition to regenerative agriculture. Historically, financing this shift has been a major barrier to transitioning more land globally. Partnering with BNP Paribas and other banks allows Klim to address this issue.

“Klim’s innovative platform and approach to scaling regenerative agriculture are perfectly aligned with our commitment to financing solutions that mitigate climate change, make the ecosystems more resilient and improve people’s livelihoods,” Maha Keramane, head of BNP Paribas’ Positive Impact Business Accelerator, noted in a statement. “We believe Klim will play a transformative role in reshaping food supply chains globally.”

International expansion

“Our round was massively oversubscribed and we had much more interest than there was size in the round,” Klim CEO and cofounder Robert Gerlach tells AgFunderNews. “The round was successful because we have achieved great results in terms of insetting traction with Nestlé and others.”

While the new capital will introduce additional features to the Klim platform, Gerlach stresses that “the core” remains this insetting offering.

The new funding will also go towards expanding access to the Klim platform, which is currently available in Germany and Poland.

Gerlach says for now this expansion will include other parts of Europe.

Further reading:

Brief: Nestlé aims to transition 100,000 acres of its wheat supply chain to regen ag

Targeting $50m, Mad Capital unveils new fund aiming to de-risk regenerative-organic farming

Is there enough funding going to regen ag and carbon solutions? Klim says no