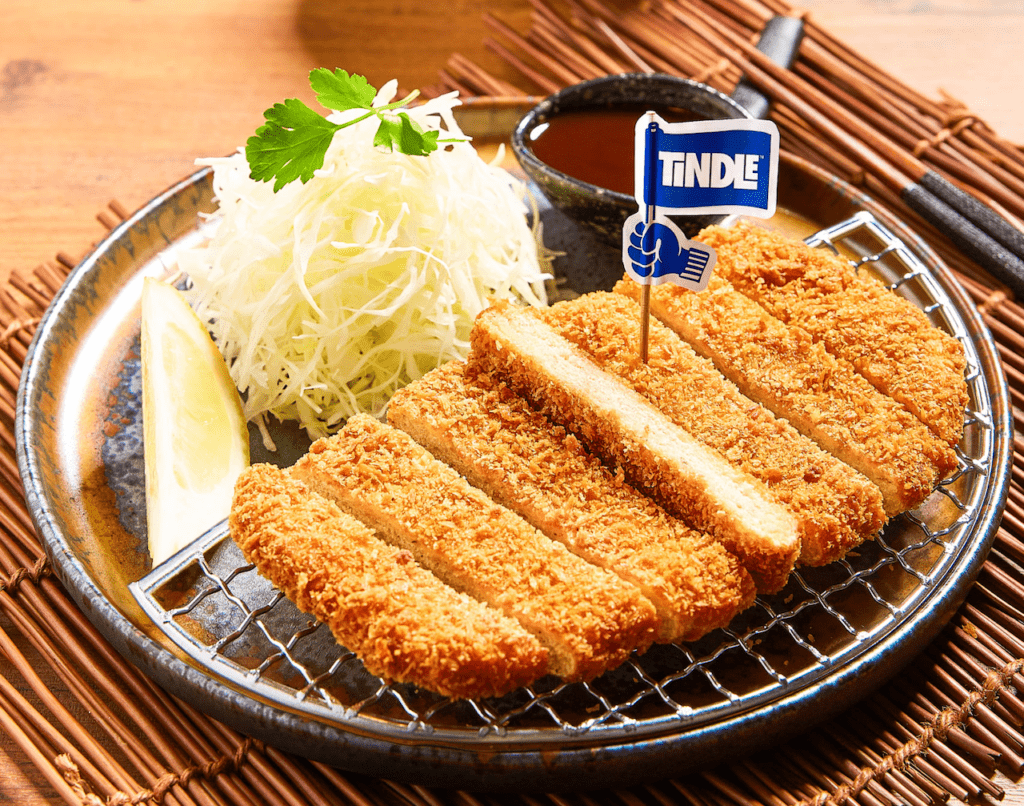

Singapore-based Next Gen Foods is the startup behind Tindle — a chicken analog made from soy, wheat, and coconut, among other things, that it produces using an asset-light model inspired by software development.

Earlier this year, Next Gen raised $100 million in what is the plant-based protein segment’s largest Series A round to date, according to AgFunder data [disclosure: AgFunder is AFN‘s parent company.]

Among the backers of that round was Singapore sovereign fund Temasek, which had first invested in Next Gen’s seed round in early 2021. Temasek director Rohit Bhattacharya joined the startup’s board at that time; within a few months, he’d joined the team full-time as its first chief financial officer (CFO).

In the wake of the round, and as the company gears up to launch in new markets like the UK, AFN spoke to Bhattacharya (RB) about the ins and outs of being a plant-based protein CFO, what Next Gen has planned for Tindle, and what it was about the startup that made him leave his job at Temasek.

AFN: As CFO, you will have had a key role in raising the latest funding round. What can you tell us about it?

RB: We raised about $30 million last year and the trigger for [this year’s Series A] round was, as we grow globally, to bring in other investors that are mission-aligned and help us expand – in particular in the US. Secondly, we’re also using that funding to support our innovation capabilities; later this year we’re launching our R&D hub in partnership with Temasek’s Asia Sustainable Food Platform.

Amongst our existing investors, we’ve been privileged to have long-term, mission-oriented investors like Temasek and K3, who backed us from very early. As we expand our focus [we aimed to further] bring on investors who can help us beyond capital – be it in the form of the experience they have or the network they can bring, say, in US foodservice. Some may not be very large in terms of dollar allocation, but bring disproportionate voice and reach to amplify the role alt-protein plays in planetary sustainability. [The Series A] round was a good mix of new and existing investors, Asia-based and Western.

AFN: Why is the company focusing on expansion in the US and Europe?

RB: The US is our number one focus market; Andre [Menezes, co-founder and CEO] has relocated to the US and we are building rapidly there. [Board member] Rachel Konrad, who’s ex-Tesla and ex-Impossible Foods, is very active shaping our strategy there.

If you look at chicken consumption, the US, Europe, China, and Brazil [together] make up something like 50% of the global total.

[In those markets] we will use a very similar strategy to that we have used in Asia: starting from a handful of restaurants, growing to several hundred, working with chefs.

The product was originally developed with chefs, for chefs. We want consumers to have their first couple experiences of Tindle to be great – so they realize that eating delicious food doesn’t necessarily involve animal farming.

Much like real chicken, Tindle is the most versatile form factor we could think of; when we were 90% done [with formulation] we started working with chefs and asked what features they wanted. They can get it either frozen or chilled, as chunks. They can hand-form it, make it into parmigiana, kiev, satay, stir fry – they can do more with this than with real chicken.

Going forward Tindle will also come in the form of tenders, patties, nuggets, or whatever form factors are needed in any given geography.

We’re building out our operational pipeline to be able to serve the US market. Tindle will be available nationwide across the US; that requires us to build partnerships with distributors.

The other thing we need is to produce locally; right now, we produce outside the US and import in, but this is a significant market for us and we are looking at ways to localize manufacturing capabilities in the US.

AFN: Will Tindle remain an Asian brand even as it focuses on expansion in other parts of the world?

Ultimately chicken consumption is extremely global, across multiple cuisines and cultures. So to make an impact at scale, Tindle needs to be just as global, just as ubiquitous as chicken.

Since March 2021 when we started in Singapore, we have built foundations and have a very strong team in APAC, and we continue to deepen relationships with chefs and restaurants and accelerate growth in all those countries. All of our priority geographies we will go in to at the right point, but we’re not pulling back on Asia; there’s lots of growth still to be done here!

The future and past of Next Gen has always been global: we’re headquartered in Singapore, fighting a global crisis. We want to avoid being too focused on one particular region. And in many ways, being Singapore-based based has allowed us to be global from day one.

AFN: You mentioned other form factors in the pipeline; what new products – including, perhaps, meat analogs other than chicken – are in store and when might we see them?

Our commercialization priority for now is to extend the Tindle portfolio to consumers around the world, with different muscle cuts [and] innovation around chicken. So I don’t see us launching any new category in the next two years. Having said that, we are also laying the foundations for new categories – red meat, seafood, dairy – but the goal is to really make Tindle a global brand and ubiquitous.

Within chicken, right now we’ve gone through the channel of foodservice. [But with] Tindle patties, nuggets, we can do certain things; they make it more accessible to quick service restaurants and home cooks and so on. Ultimately, the maximum impact will only come with omni-channel. Once consumers have experienced Tindle with chefs, have tried it in their favorite restaurants, and know how good it can be and have ideas on what to do with it, the natural extension is to make it available for people to take home and make their own recipes.

AFN: You’ve used the term ‘impact’ a few times. Is the company doing anything to quantify its environmental and social impact potential? And how much responsibility for that falls to you as CFO?

We are still in the early stages [of measuring our impact], but from the start, we built this product with sustainability in mind: right from the choice of ingredients through to the manufacturing process, which is distributed. Over time we would essentially produce Tindle locally for each geography.

Tindle contains just nine ingredients – all of them can be easily pronounced! These are fairly ubiquitous and easily sourced. That’s one of the reasons we decided to go for these ingredients – because we think they give the best taste and texture that consumers want, and secondly, they’re available at scale around the world. We wanted to avoid niche ingredients that would hold us back from getting to scale.

We will build a supply chain which is inherently more efficient than animal agriculture is right now; plant-based is inherently more efficient than feeding soy as animal feed to birds and harvesting them.

AFN: How did you end up joining Next Gen?

I spent the last decade at Temasek, and over the last few years was focused purely on foodtech and agtech [during which time] I’ve had the fortune to get to know the leading players in the space and taste-tested many of the products. While I am technically new to Next Gen, I’m the one who first connected [founders] Timo [Recker] and Andre back in 2019. That serendipitously led to launch of Next Gen Foods, and I led the seed round investments for Temasek and was on the board. While briefing me one day, they cheekily asked me to join as CFO!

In terms of why I chose to take up that offer: having seen a number of products in the category, I found this team to be exceptionally strong, and a lot of thought went into shaping the business, into product R&D, operational scale up, [and the] brand.

While many investors have their interest piqued by one or other of those aspects, this team saw that all need to work in tandem to reach impact scale. We are running against the clock to fight climate change, and the fact they chose to avoid GMO or novel ingredients, and had the foresight to find an operating model partnering with co-manufacturers to scale fast rather than buying steel and building their own factory – that they were working backwards from the fact we need to work really fast, is what excited me about this.

AFN: What does an average day look like for you – and what tips can you pass on to other plant-based protein CFOs?

As senior management in an early-stage startup, you’re [working] at a pace where everyday you have to accept: ‘I haven’t seen this before!’

When the first seed tranche closed in February 2021, Next Gen had no brand or commercial presence; then in March, we launched in Singapore, then Macau and Hong Kong, then the Middle East, by November it was Amsterdam – and now, the US! So the pace keeps going. It’s an incredible learning experience. Produce the technology, apply it, and keep tailoring it to apply to more complex markets.

On a day-to-day basis, being CFO is really a juggling act between prioritizing what’s urgent versus what’s important – so really, no different to what any one does! For me, that’s balancing operational priorities – like making sure people are getting paid – to setting up governance for our different markets, setting up hiring practices, and having those systems in place. And at the same time, building relationships with value-add partners and investors. I also need to ensure the business is well funded, such that we can deliver on our ambitions.

If I were to pick one thing [that’s most important as an alt-protein CFO] it’s building a team that can actually support the ambition you have versus what you have right now, and building a culture where we’re all working really well together.

AFN: Looking ahead, what are the key objectives for the business from your perspective as CFO?

Our ambition is to build scale in those key markets – the US being the largest one of the lot. We’re really focused on delivering revenue in the US and our existing markets in Asia, and over time other key markets will come into play: the EU, China, and Brazil. And then two to three years out, new categories will kick in.

Our immediate objective is to build revenue in the US. We’ve built a business that is gross margin positive from day one. Many startups in this space haven’t done that; many established [alt-protein companies] took 10 years to get margins to decent level. We wanted to be sustainable financially from day one, so we could focus on how to build access, get into key markets, and change preferences, so that without having to make a compromise on taste, people can switch from animal to plant-based protein.