A new breed of agtech fund is born. Pontifax Food and Agriculture Technology Fund (Pontifax AgTech), which just held a first close on a private equity vehicle which is targeting $200 million, differs from many of its peers in its approach to the sector.

It invests in later stage deals; its founders made the first four investments before the fund was even formed; it’s committed to engaging strategic players in its investments; it has a unique footprint in both the US and Israel; and it’s attracted a new set of high profile investors to the sector.

The fund’s founding investors, revealed for the first time to AgFunderNews, include David Bonderman, founder of private equity giant TPG Capital, Tony Ressler, founder of Ares Management, the global alternative investment manager, media mogul Haim Saban, and Stewart Resnick, founder of The Wonderful Company, the largest vertically integrated permanent crop company in North America.

The motivation for each of these investors ranged from interest from their family offices in the fund itself, as direct co-investment partners, later stage project financing deal flow for infrastructure funds, technology scouting, and industry intelligence, according to Ben Belldegrun, co-founder of Pontifax AgTech.

“Because we realized there was a lot of investor education needed, especially among our investor base of new and larger sources of capital in the space, we wanted to go out and make a handful of compelling and tangible investments before putting a fund together,” said Belldegrun. “We didn’t want to offer a blind pool fund, but felt that a tangible portfolio would be the most effective way to illustrate to investors ‘here are our insights into the sector, here’s how we think, and here’s our investment strategy’.”

The first four investments — enhanced efficiency fertilizer company Anuvia Plant Nutrients, AgBiome, a biological crop protection startup, robotics company Blue River Technology, and ag software business Conservis — were made with capital from Belldegrun, Erlanger, and the founding Investors. This is an unusual route to market for any private equity fund, and the investments have now been rolled into the fund at cost.

“We think these companies, which address some of our key focus areas, are industry-leading and disruptive,” said Philip Erlanger, co-founder of Pontifax AgTech.

Anuvia was the first investment Belldegrun and Erlanger made together, and it built on their strategy.

“We’re very thematically focused in our investment strategy. We try to identify key problems that broadly confront the agriculture supply chain and then work on solving them through the companies we invest in,” said Erlanger. “Anuvia’s slow release fertilizer provides increased nutritional efficacy for crops while at the same time reducing groundwater leaching.”

Anuvia is also solving another big problem: municipal waste management. It uses bio solids – read human waste — as feedstock for its fertilizer.

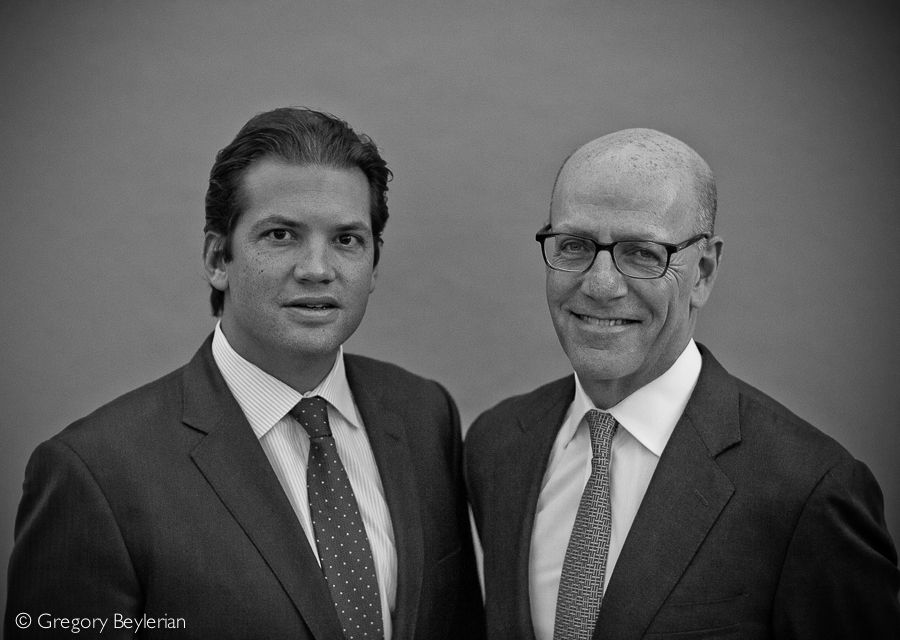

Erlanger and Belldegrun have known each other for years as family friends, but came to agtech through different routes.

Belldegrun’s most recent role before partnering with Erlanger was as an agriculture equity manager at hedge fund Brevan Howard. This capital markets experience led him to the conclusion that agriculture companies had better risk-adjusted returns at the pre-IPO stage. He also fostered relationships with leading global ag companies and now puts potential investments in front of them to get their feedback as part of the fund’s diligence. In return, the aim is that these companies will routinely co-invest alongside Pontifax AgTech; explore joint ventures or consider other business development opportunities, according to Belldegrun. “They tell us what they want to see,” said Belldegrun. “We encourage them to invest in our portfolio companies alongside us. We think there are great synergies to be found collaborating with strategics that we know well.”

Erlanger, meanwhile, spent 24 years as a senior investment banker at Lehman Brothers and later Barclays Capital, focusing on M&A, capital raising, and corporate restructurings, covering large global financial institutions and private equity firms across a wide range of industries. After the global financial crisis, he left investment banking and started looking for his next project.

“I started to gravitate to food and agriculture, as I felt the fundamentals were compelling. I started to become more transactionally active in the sector, including some personal investments. Then, as Ben and I started to collaborate and we developed a shared vision and passion for investing in the sector, we formed Pontifax AgTech.”

Erlanger and Belldegrun decided early on to partner with Pontifax, a global life sciences venture capital investor based in Israel. Belldegrun is Israel-born with deep roots in the country, and Israel has been a consistent source of agtech innovation throughout its history; Israeli agtech startups raised $550 million in 2015, according to AgFunder’s investing report.

Pontifax was founded by Eli Hurvitz, the founder of Teva Pharmaceuticals, Tomer Kariv, and Ran Nussbaum in 2003 and the firm recently closed its fourth biotech fund, which was oversubscribed, on $150 million. Pontifax AgTech is the first dedicated agtech fund for the firm and its fifth life sciences fund.

“There was a real opportunity to take advantage of Pontifax’s expertise in life science investing and apply it to the growing convergence between agriculture and science,” said Belldegrun. “They bring a group of unmatched relationships, expertise, and infrastructure and are extremely well placed in traditional life sciences, biopharma and medical technology.”

Erlanger and Belldegrun have decided to invest growth capital in more mature agtech companies with established revenues and distribution, and proven technologies. They want to focus on execution, scaling and commercialization, and not technology risk.

The team’s backgrounds, combined with the complexity and diversity of agriculture as a sector, also contributed to the decision to focus on helping later stage companies scale, according to Belldegrun and Erlanger.

“Agtech is an incredibly broad and complicated swath of the global economy,” said Belldegrun. “We are focused on adding value to our investments through our expertise. We collaborate with our ecosystem of technical and corporate partners to confirm the efficacy of a technology, its value proposition to farmers and its commercial potential.”

“Being a Ph.D. in plant biology or robotics or whatever it might be is a very small piece of the pie,” added Erlanger. “The breadth of what you’re investing in makes it valuable to invest at a later stage, where there’s lower risk but a significant amount of valuation upside in the lifecycle of these companies.”

Other subsectors of focus for Pontifax AgTech include precision agriculture, water treatment, irrigation, aquaculture, genomics, microbials, food safety, and traceability.

While very excited about the prospects for agtech as an investment asset class, Erlanger closes with a word of warning. “The complexity of agtech must not be underestimated,” he said. “The broad population thinks about a farmer as a guy sitting on a tractor, but in fact, it’s an extremely sophisticated and risky business, and now it’s becoming more complicated, with more regulation and more focus on food traceability. A farmer needs to manage a huge amount of data, crop pricing volatility, import/export dynamics, and environmental concerns, in addition to the fundamentals of growing crops in a world of exploding demand and decreasing natural resources. These pressures make innovation and technology critical.”

The fund expects to hold a second close within three months.

Have news or tips? Email [email protected]