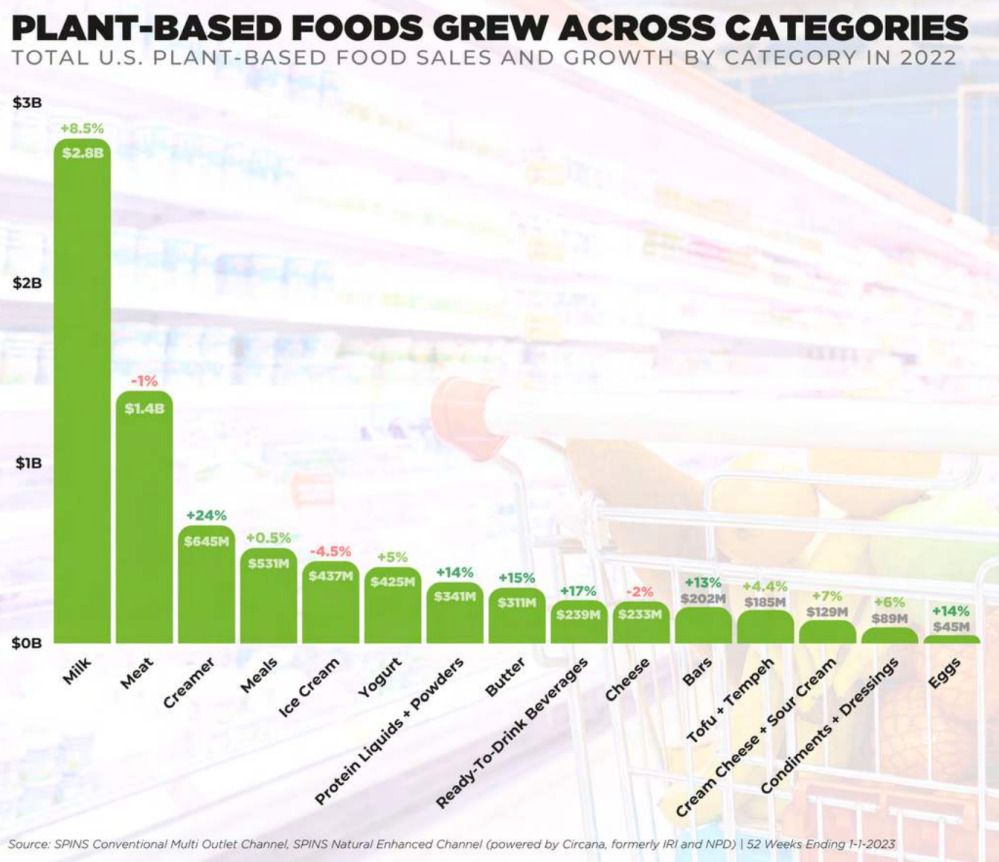

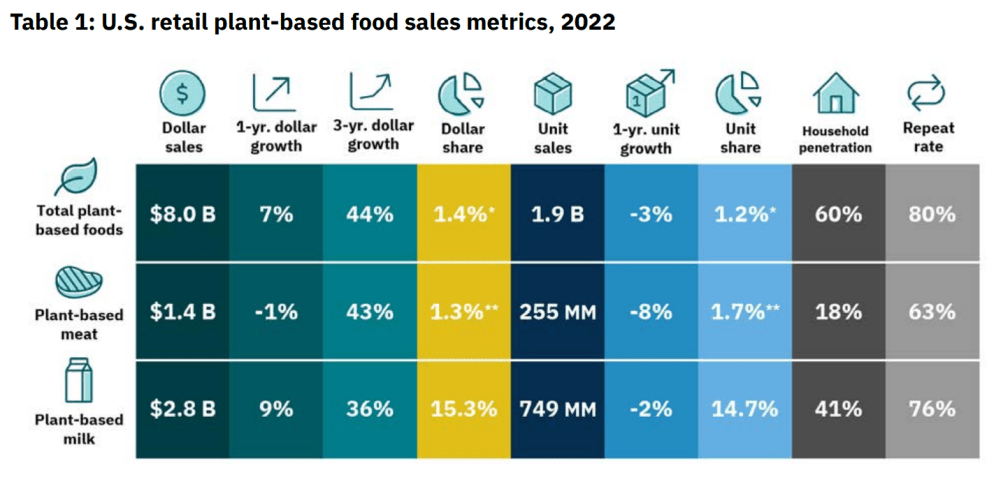

US retail sales of plant-based foods rose 6.6% to $8 billion in 2022, with growth in creamers, eggs, and butter partially offset by declines in meat, ice cream, and cheese, according to new reports from the Plant Based Foods Association (PBFA) and the Good Food Institute (GFI). Unit sales fell 3%.

While sales of animal-based food rose 11% over the same period, with unit sales also down 3%, the average retail price of animal-based foods increased by 15%, claimed the PBFA in its 2022 summary report, Plant-based foods: State of the marketplace.

“Plant-based foods, however, maintained 6.6% sales growth… with only a 10% increase in average retail price.”

Dollar sales in the biggest category within plant-based at US retail — plant-based milk — rose 8.5% to $2.8 billion, while units declined 2%, noted the PBFA. “In comparison, animal-based milk was also down 2% in units, but saw a 12% increase in dollar sales, illustrating the outsized role of inflated pricing in growing sales figures for animal-based milk.

“Plant-based creamers, the third largest plant-based category after milk and meat, grew by 24% in dollars to $645 million and 12% in units, while animal-based creamer units declined by 1.4%.

“Plant-based eggs grew 14% in dollars and 21% in units. Comparatively, animal-based eggs grew 47% in dollars, yet declined by 1% in units.”

US retail sales, plant-based foods & beverages, 2022

- Plant-based milk: +8.5% to $2.8bn (units -2%)

- Plant-based meat: -1% to $1.4bn (units -8%)

- Plant-based creamers: +24% to $645m (units +12%)

- Plant-based meals: +0.5% to $531m (units -7%)

- Plant-based ice cream: -4.5% to $437m (units -9%)

- Plant-based yogurt: +5% to $425m (units -5%)

- Plant-based protein (liquids and powders): +14% to $341m (units +13%)

- Plant-based butter: +15% to $311m (units -11%)

- Plant-based RTD beverages: +17% to $239m (units +11%)

- Plant-based cheese: -2% to $233m (units -5%)

- Plant-based bars: +13% to $202m (units -8%)

- Plant-based tofu and tempeh: +4.4% to $185m (units flat)

- Plant-based cream cheese and sour cream: +7% to $129m (units +2%)

- Plant-based condiments and dressings: +6% to $89m (units -3%)

- Plant-based eggs: +14% to $45m (units +21%)

- Plant-based baked goods +13% to $35m (units +3%)

Source: SPINS natural enhanced and MULO, 2022

US household penetration of plant-based foods and beverages

According to the GFI’s 2022 State of the industry report on plant-based meat, seafood, eggs, and dairy, also released this morning, dollar sales per buyer for households that purchase plant-based and animal-based meat are higher than for the average household, highlighting the value of plant-based shoppers to retailers.

“These households spent 19% more than the average household, and 21% more than an average household that purchases animal-based meat but not plant-based meat.”

US household penetration:

- Plant-based milk 41%

- Plant-based meat 18%

- Plant-based ice cream and frozen novelties 12%

- Plant-based yogurt 9%

- Tofu, tempeh, seitan 7%

- Plant-based cheese 5%

- Plant-based eggs 2%

& NPD), 52 weeks ended January 1, 2023. Household data: NCP, All Outlets, 52 weeks ended January 1, 2023.

Closing the price gap

GFI analysis indicates that, in 2022, weight for weight, plant-based meat commanded a 67% price premium versus animal-based meat, while plant-based eggs commanded a 122% premium, and plant-based milk attracted an 87% premium.

However, the gap narrowed over the year in the egg department as an Avian flu outbreak pushed conventional egg prices up to record highs and increased scale and efficiency helped bring the price of plant-based products down, said the GFI.

“Overall, the premium prices of plant-based foods present a barrier to reaching more consumers and with more frequency, particularly given that consumers are likely to be increasingly mindful of prices in the current economic environment. Closing this price gap represents an opportunity to appeal to more consumers and position products as more feasible swap-outs for conventional products.”

Consumer barriers to purchase

As for other barriers to purchase, consumer survey data from FMI: The Food Industry Association suggests taste is the primary barrier both to trial and to repeat purchases for plant-based meat, said the GFI.

“Mintel’s 2022 report further validates taste and flavor concerns as primary barriers. Additional consumer perceptions and concerns include the idea that ‘meat is a better source of nutrients’ and that plant-based proteins are too expensive.”

When it comes to purchase drivers, health remains the primary motivation for buying plant-based options, said the GFI, although FMI research suggests consumer perceptions about the healthfulness of plant-based foods may be changing.

“In 2020, 50% of consumers stated ‘I think they are healthy’ as a top motivator for preparing plant-based meat alternatives compared to 38% in FMI’s 2022 survey.”

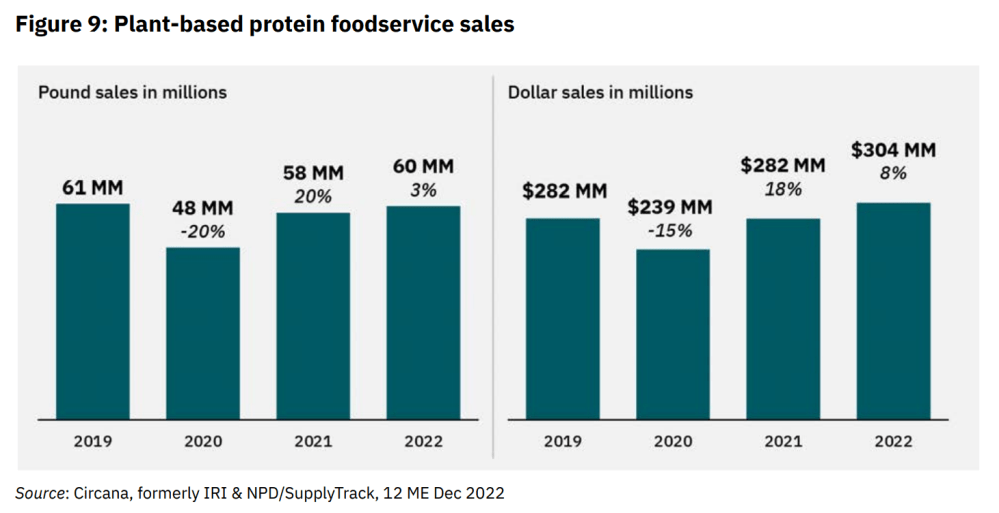

US foodservice: Plant-based protein dollar sales +8%, volume sales +3%

Dollar sales of plant-based protein in the US foodservice market rebounded in 2022, growing 8% in dollars to $304m and 3% in volume according to data from Circana (formerly IRI & NPD/SupplyTrack) shared by the GFI.

“In the last year, per-pound prices for plant-based proteins in broadline distribution increased by 21 cents per pound, or 4%. Notably, this is significantly less than price increases for conventional meat in foodservice, which increased by 29 cents per pound, or 8%.”

The GFI added: “After an unprecedented contraction in 2020, foodservice has returned as an attractive go-to-market strategy for plant-based companies. Launching into foodservice allows companies greater control over how their product is prepared, and it also plays an important role in ensuring plant-based products continue to become more accessible and familiar to consumers across regions.”

The GFI estimates that combined US retail, foodservice, and e-commerce dollar sales of plant-based meat rose 2% while estimated pound sales decreased by 4%.

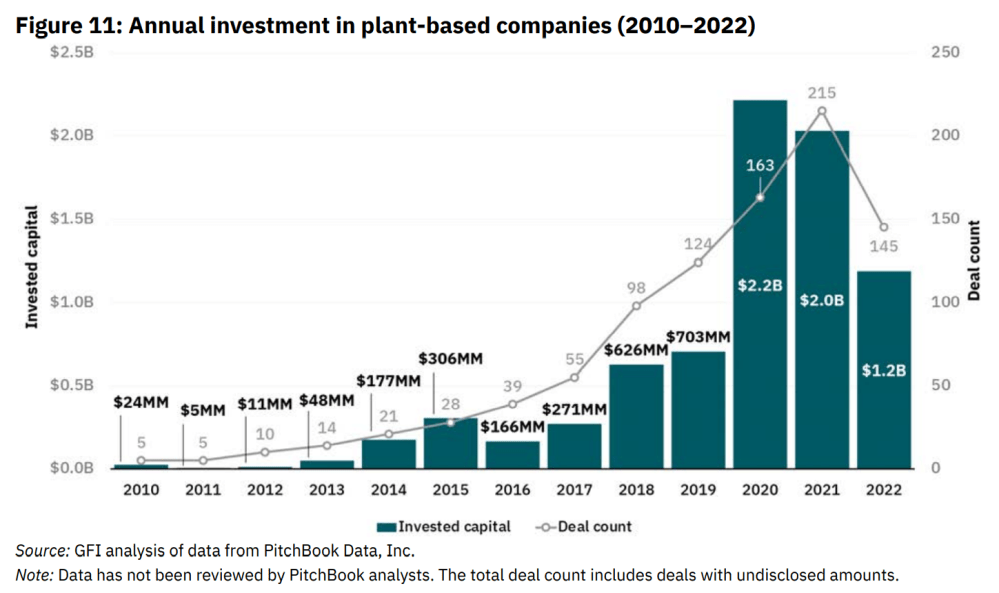

Global funding for plant-based meat, seafood, eggs, and dairy down 41% in 2022

Plant-based meat, seafood, eggs, and dairy companies raised $1.2 billion in 2022, down 41% year-on-year, said the GFI. “This modestly underperformed the overall global venture funding decline of 35% year-on-year. However, funding in certain regions accelerated, rising in APAC (by 30%), Europe (15%), and the Middle East & Africa (223%).

“We expect to see an increased number of mergers and acquisitions in the coming year as companies with stronger financial footing—incumbents and startups alike—acquire firms with valuable technologies, manufacturing processes, and talent that are struggling to maintain a financial runway.”

The global picture

Citing data from Euromonitor International, the GFI said:

- Global retail sales of plant-based meat and seafood rose 8% to $6.1 billion in 2022, with volumes up 5%.

- Global retail sales of plant-based milk grew 6% to $19.1 billion, with volumes up 3%.

- Global retail sales of plant-based yogurt were up 11% to $1.7 billion, with volumes up 6%.

- Global retail sales of plant-based cheese were up 22% to $869 million with volumes up 11%.