Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

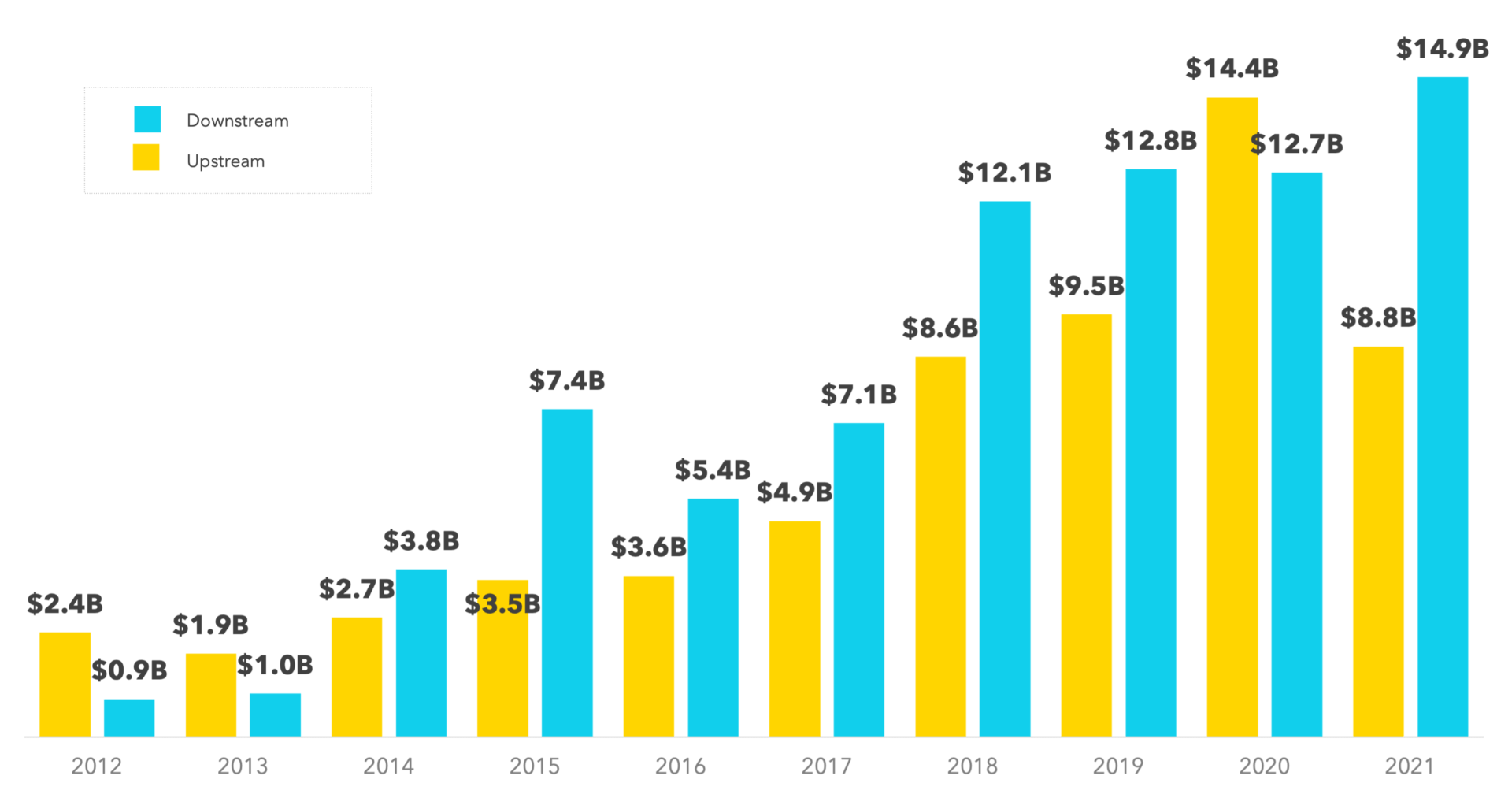

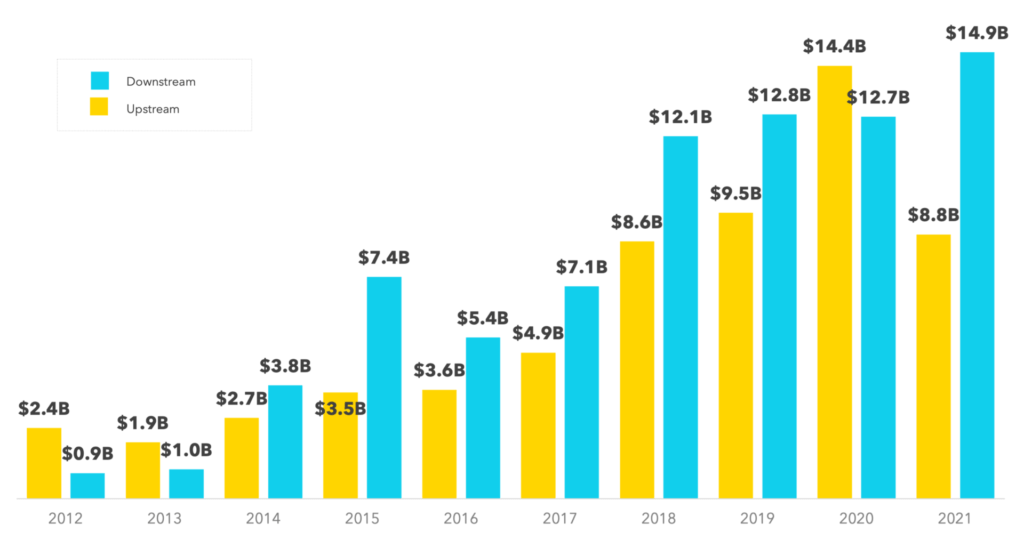

Investment in foodtech startups operating consumer-facing businesses is rebounding with $14.9 billion invested in the first half of this year, according to AgFunder data.

The rebound comes after investment in downstream startups slipped behind upstream startups (those operating on the farm, in the midstream, and in the lab) for the first time in almost a decade. In 2020, investment in upstream technologies and business models outpaced downstream for the first time since AgFunder published its first global investment report in 2014.

While upstream investment still looks set to outpace the total from last year, it’s far behind downstream investment; the staggering amount of investment raised in downstream startups in the first half of 2021 is higher than any full-year total on record.

Agrifoodtech startup investment – upstream vs downstream

‘Downstream’ defined

Downstream categories are those areas of agrifoodtech that are closer to the consumer. AgFunder uses a number of self-defined categories in its research reports, grouped into upstream and downstream (i.e, consumer-facing) categories. AgFunder’s downstream categories include:

- In-Store Retail & Restaurant Tech (shelf-stacking robots, 3D food printers, POS systems, food waste monitoring IoT

- Restaurant Marketplaces (online tech platforms delivering food)

- eGrocery (Online stores and marketplaces for sale and delivery of processed and unprocessed ag products to consumer)

- Home and Cooking Tech (smart kitchen appliances, nutrition technologies, food testing devices)

- Online Restaurants & Mealkits (startups offering culinary meals and sending pre-portioned ingredients to cook at home)

- Cloud Retail Infrastructure (on-demand enabling tech, ghost kitchens, last-mile delivery robots and services)

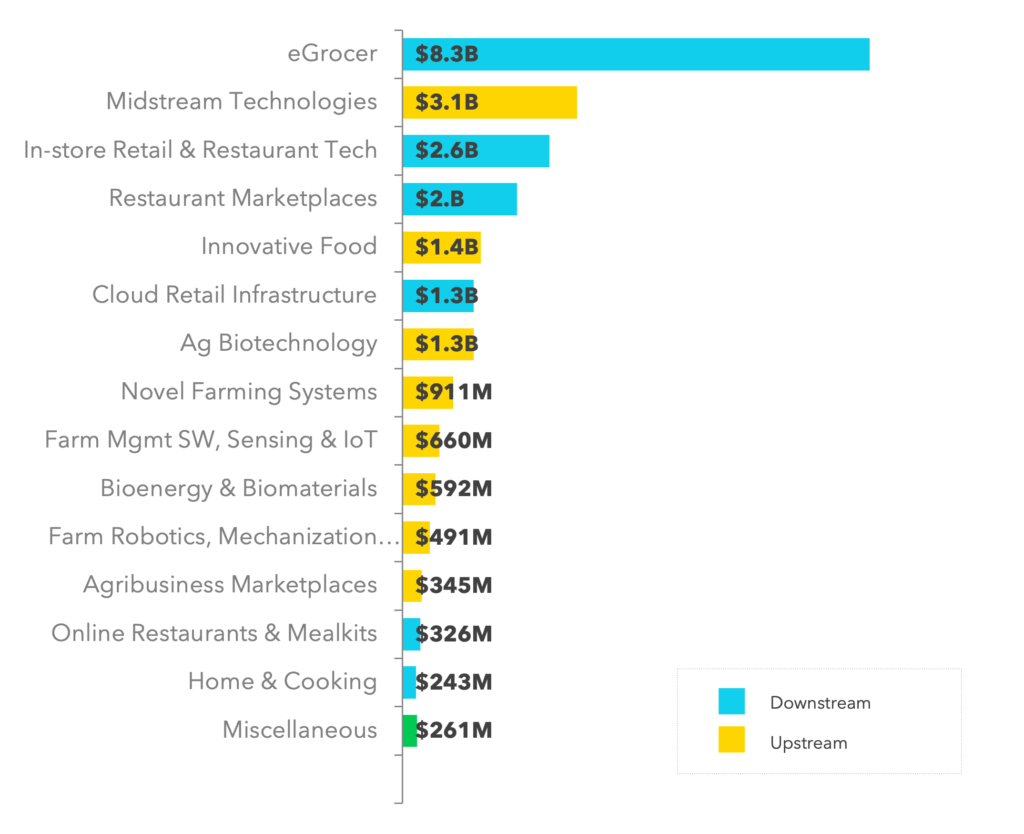

eGrocery outliers

The pandemic buoyed investment in eGrocery startups for obvious reasons, and that’s not going anywhere as consumers get increasingly comfortable and reliant on at-home food delivery, and investment in the category in the first half of 2021 reached a whopping $8.3 billion. It’s important to highlight that Chinese eGrocery startups contributed nearly half of that total with just three startups raising $3.8 billion, including Furong Xingsheng’s $2 billion late-stage round. But even when we strip out Chinese deals, eGrocery is still the most active category with $4.5 billion in investment, lead by rounds from rapid delivery startups like Weee!, Gorillas and Getir.

Interestingly, after eGrocery startups, In-store Restaurant and Retail solutions raked in the most investment dollars downstream, with $2.6 billion in investment, more than double what was raised in the first half of 2020.

Agrifoodtech investment in H1 2021 by category

What’s behind the resurgence?

The rebound for downstream investments coincides with economies around the world opening back up and more foot traffic headed to brick-and-mortar businesses, now that more people around the world are vaccinated for Covid-19. Echoing that, online grocery store numbers have fallen in recent months and foot traffic at restaurant brick-and-mortar locations is on the rise again.

Another reason for more front-of-house investment right now could also be the ongoing labor shortages many businesses still face. Restaurants and retailers alike have had to adjust their operating hours to accommodate the fact that they can’t fill staff rosters. Technologies that can automate certain tasks when there aren’t enough humans on hand could in certain cases be a boost to business. That might include ‘cashierless’ checkout technology at the grocery store or letting restaurant drive-thru cashiers take orders without ever leaving their homes.

Funding rounds from the last several months also underscore this trend back towards downstream investment. To name just a few, in June, Slice grabbed $40 million for its pizzeria-specific ordering tech, Cava raised $190 million for its in-store personalization tech, and cashierless tech startup Zippin raised $30 million.