This interview is part of a series on agrifoodtech corporate VC investment strategies and insights. The series is produced in collaboration with the OnRamp Agriculture Conference, which brings together the agriculture and food industries’ leading corporations, investors, and startups to highlight innovations disrupting agriculture and the future of food. Sign up now to receive the forthcoming report on corporate VC strategies in Q1 2021. Previous CVC interviews in the series have featured Syngenta Ventures, Leaps by Bayer, Cargill, BASF Venture Capital and ADM Ventures.

Philadelphia-based FMC Corporation has been in the agri-chemicals game for nearly 140 years. It has been in the venture investing business for less than one.

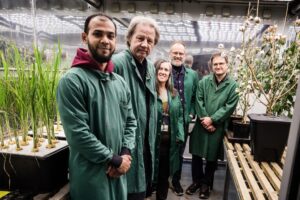

Last year, FMC recruited a team of three, including venture professional Amar Singh, to build out an investment strategy in an agrifoodtech venture ecosystem that includes most of FMC’s peers and competitors. Singh spoke with AFN about the advantages and challenges of being the newcomer in agrifood corporate venture investing, and how FMC’s laser-focus on crop protection technologies gives the company an edge in a still under-invested space.

AFN: FMC Ventures is pretty new! You all only began investing last year. Give us the high-level overview of the team, fund and what you’re looking for.

Amar Singh: Our mission is to opportunistically back emerging technologies that can create strategic advantages for FMC. FMC today is very different than it was four years ago. Leadership has tasked the ventures group with focusing on emerging technologies that could radically augment or alter how agri-science products are developed, sold, and applied.

We prefer to invest at the early stage, but for the right opportunity, we would make an exception. We can either lead a round or be part of a syndicate—it just depends on having the right partners that bring complementary skills to help the company grow.

I joined in April 2020. We are a team of three and growing, spread out in the Bay Area, Philadelphia, and Boston. We also leverage resources within FMC to evaluate opportunities and bring capabilities to companies we back.

AFN: What has changed at FMC in the past four years that is shaping the mission of the ventures group?

Previously, the company had a diverse portfolio of businesses. Today, we are a pure-play, global, agriculture sciences company, and in this part of the value chain, technology-based advantages are paramount.

Leadership recognizes the role of external innovation and has the conviction that technology can drive the adoption of sustainable practices.

AFN: You have an agtech venture background already. What trends have you seen from your prior experience that you’re bringing to FMC as you help shape the venture group?

Our key role internally is to help FMC think creatively about the problems and surface and pursue opportunities that may not be obvious at first blush. It’s less about what’s trending and more about ‘jobs to be done’ and working backwards from there.

For example, it takes a long time to bring a product to the market. How can we use deep learning techniques to reduce the time and cost it takes to launch?

Similarly, we are inquiring about different and sustainable ways to nourish and protect crops and evaluating technologies with a very open mind.

We are also closely evaluating emerging business models that could alter how products are purchased and applied, and by extension, how and where value is captured in the value chain.

It takes a multidisciplinary approach to attack these problems. The best opportunities today are at the intersection of several different domains, such as molecular biology, computational chemistry, machine learning, and robotics.

One thing I’ve learned from previous experiences in funding early-stage technologies is that a healthy and spirited debate is necessary. If we have a consensus at the first blush, we are probably late to the party. To paraphrase a fellow investor, I want at least half of my friends to say this is a crazy idea that’ll never work.

AFN: A lot of new startups are trying to reduce the use of synthetic chemicals in agriculture. Do you see the use of chemicals coming to an end soon?

I may be a minority opinion among my investing friends, but I think ‘coming to an end’ is unrealistic for the foreseeable future. Almost everyone raising crops today could tell you that, so I wouldn’t paint with a broad brush. There are excellent synthetic products with unmatched control and sustainable environmental profiles. But what gets attention – and rightfully so – are the ones with severe negative consequences.

Now, looking forward, we think there will be a good mix of both synthetic and non-synthetic products. Technologies that help us do more with less, whether that’s on the formulation side to reduce the amount of active ingredient or using robotics for precision application. We will see more judicious use of certain products.

For bio-pesticides, there are different modalities, and the question is: can they be scaled? Can they provide similar, if not identical, levels of control? Those are the things we’re looking for because, at the end of the day, that’s what growers are looking for.

AFN: What is driving the shift though—to replace or reduce the use of synthetic chemicals? Is it about synthetics’ environmental impacts, consumer consciousness, or just the natural evolution of technology?

One of the key drivers is that consumers are voting with their dollars and it is causing a ripple effect throughout the value chain. Grocers, aggregators, processors, mid-stream actors, producers, and crop-input companies are reacting to seize the opportunities emerging from these changing preferences.

There’s the natural evolution of technology as well, as you say it. For example, by adopting a superior formulation technology or robotic spraying, if I can use fewer inputs, lower my cost of goods sold, and have a lower environmental impact, and still have a similar outcome, that’s a no-brainer.

AFN: Tell us about the companies you’ve invested in and how they’re supporting FMC Ventures’ mission.

We have made four investments so far; two have been publicly announced. We also have seven or eight in the pipeline under review.

The two unannounced ones are in pheromone space and pathogen detection space.

Our first investment, in June, was Trace Genomics. Trace is a soil bio-informatics company that uses shotgun sequencing and machine learning to decode the microbial diversity of soil.

We think soil biology as a category is under-studied. This is largely because the tools required to analyze and understand soil’s complex biology were until now unavailable or very expensive. What Trace did, by marrying sequencing with advanced computing, is make it possible to explain the complexity and diversity of all these microorganisms living in soil. Technologies like Trace Genomics can accelerate the adoption of biological products by overcoming objections at the point-of-sale.

Further, Trace Genomics’ core technology is ideally suited to measure carbon sequestration.

AFN: And the second company?

The second is Kiwi Technologies, which is building an unmanned aerial sprayer here in the US. It’s a seed stage bet on an incredible team with favorable tailwinds, building in an enormous market.

Today, aerial spraying in the US is an unscalable and highly fragmented business fraught with tactical and safety issues. Kiwi’s breakthrough is that they redesigned the spraying vehicle from the ground up, to drive down material costs and to regulate the quantum of spray. We think of Kiwi as a crop protection technology that uses robotics to do more with less and do it safely and sustainably.

AFN: How does their technology fit alongside traditional aerial spraying techniques and emerging ones, like drones?

There is a lot of activity in aerial application. But much of what I have seen in the US is someone attaching a plastic tank to a drone and calling it an unmanned sprayer. It’s a nice short-cut but unscalable and differentiation is unclear.

What is different with Kiwi is that they fundamentally redesigned the machine to do aerial crop application. They’re a deeply technical team with a bias for action and solving lots of engineering problems. They can offer relatively superior targeting than status-quo at same or lower prices.

AFN: The agtech venture capital space has evolved a lot in the past few years. What are the advantages and challenges to launching a corporate venture investing group today, versus several years ago, when many of FMC’s peers launched similar groups?

Today, we can focus exclusively on agriculture. FMC has a full-stack R&D organization from discovery to development, with an award-winning pipeline, so we can focus externally from a position of strength.

With respect to launching earlier, I think the jury is still out on many of the early bets, especially in certain sub-sectors. We do get the benefit of learning from others, i.e. what worked and what didn’t – sort of like the old saying, pioneers get arrows, settlers get the land, so I think there are advantages in being patient.

With respect to challenges, established companies are relatively slower than a startup, it’s like maneuvering a ship versus a speed boat. We are less than a year in and have a game-plan, the leadership team is energized, and we’ve placed a few strategic bets and more to come.

Lastly, if we look at the breakthroughs in molecular biology, robotics, computational chemistry, and novel ways of linking demand to supply, I think the best opportunities are ahead of us.