This interview is part of a series on agrifoodtech corporate VC investment strategies and insights. The series is produced in collaboration with the OnRamp Agriculture Conference, which brings together the agriculture and food industries’ leading corporations, investors, and startups to highlight innovations disrupting agriculture and the future of food. Sign up now to receive the forthcoming report on corporate VC strategies in Q1 2021. Previous CVC interviews in the series have featured Syngenta Ventures and Leaps by Bayer.

US agrifood giant Cargill isn’t new to the corporate venture capital game. But its style is unlike most of its peers. The Minnesota-based company leans into the expertise and experience of the teams running its four business lines to make external investment and partnership decisions. That means its Animal Nutrition and Health group has the license to hunt for and back innovations improving animal welfare, boosting the nutritional value of feed, and driving efficiency and transparency on the farm.

The Cargill Protein & Salt, Ag Supply-Chain, and Food Ingredients & Bioindustrials groups all have similar mandates within their respective verticals.

There are several cross-cutting themes that tie the activities together – digitization and sustainability being the most prominent.

“We are collaborating to be thoughtful about how the pieces connect with one another,” SriRaj Kantamneni, managing director of digital insights in Cargill’s Animal Nutrition & Health (ANH) group, told AFN.

Kantamneni spoke with AFN about the shift to digitized farming, and how disruptions from the Covid-19 pandemic are forcing change in a slow-moving industry.

AFN: For starters, you represent one business line within Cargill—the Animal Health and Nutrition (ANH) business—so tell us how is Cargill’s venture financing activity operates?

SriRaj Kantamneni: Cargill has a centralized team that monitors deal flow and provides governance for investments. The flow itself is driven by Cargill’s businesses, not a corporate venture capital group inside of Cargill.

ANH, for example, pays for its investments through the ANH business. That approach yields the best results because each business knows what kind of technology is potentially transforming and disrupting their industry.

Our business has invested in or partnered with five companies. We have another 30-40 companies on our game board.

Talk us through how you think about opportunities in agrifood technology?

We start with identifying the unique jobs to be done or problems to solve, then look at the landscape of companies that are addressing those challenges. Cargill’s mission is to be the global leader in nourishing people, and we want to do that in a safe, responsible, and sustainable way. With that in mind, we ask ourselves: what are the big industry trends that could accelerate this mission?

Digitization is one, and that’s where I spend my time. There’s really two parts to digital: productivity — how do you improve what’s happening on the farm — and tracking and tracing whether you’re getting the outcomes you want from a nutrition and formulation standpoint.

With farm management practices, it’s about how the digital solutions and investments we’re making improve those practices, because ultimately those improvements lead to greater sustainability, efficiency, and efficacy.

On the nutrition side, the extent that we can measure and monitor helps us start to address sustainability and consumer preferences. If consumers want non-GMO products, or all-natural products, those are trends we can impact by tracking and tracing.

Do you only do equity deals?

No, there are occasions where we would just be a commercial partner — paying for licenses or becoming a reseller or distributor. We try to be creative, depending on the needs of the startup. Capital isn’t always what a startup is looking for.

Share a bit about some the startup investments and partnerships the AHN group has pursued.

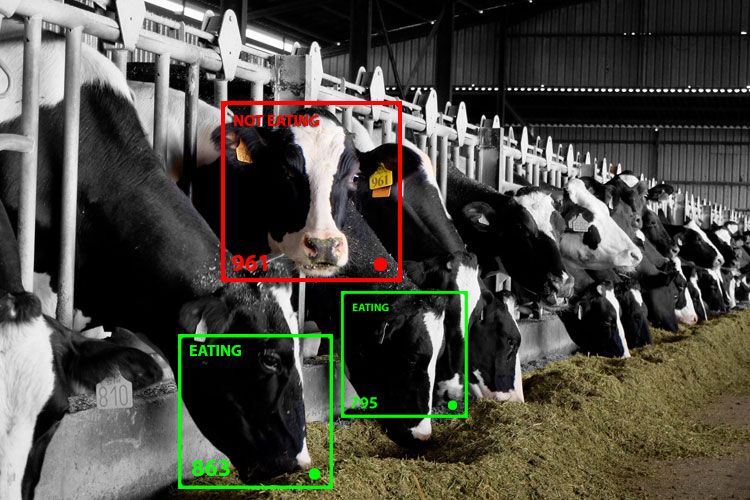

We invested in Cainthus, which is bringing computer vision to the dairy industry. When we invested there were specific challenges in dairies that we wanted to solve. One was expanding the understanding of what’s happening with each individual animal or in each pen to the entire operation. There is obvious research that indicates that the more a cow is ruminating the better milk productivity she has. Knowing when feed is gone in front of a particular pen, for instance, and triggering alerts for the farm manager is beneficial to this process.

By monitoring what’s happening with milk output, combined with Cainthus-like technologies, you can start to close the loop in impacting feed from the standpoint of both nutrition and output. There are technologies in the industry like SomaDetect or Labby that are monitoring in-line milk production, fat and protein content.

There are now so many productivity tools out there. How do you help the entrepreneurs you are supporting think about scaling their tools and integrating them with others?

One of the areas we are acutely aware of is the role that Cargill plays in helping bring technology capabilities together. If you think about an ecosystem, many of these startups won’t be able to do that on a standalone basis. But we can help facilitate that. We’ve got industry knowledge and we have a massive distribution channel and network to help startups scale.

Two or three years ago, we didn’t necessarily have a keen sense of whether we should be a seed stage investor or Series A or bigger. We’re learning in this area. Now, for most technologies, we find that it’s better to get involved once the technology itself is somewhat proven and then helping the startup refine what it does to scale in the key markets where that technology could have an impact.

For example, Brazil’s poultry and pork markets are huge, and we have a large animal nutrition business in Brazil. We could easily help get a startup working on technologies for poultry or swine into the Brazilian market.

On the other end, we could get involved from a R&D perspective, but we tend to do that less frequently now. With a company our size, getting involved too early is not always beneficial. For really early-stage innovation, we believe it’s better that a startup be nimble and can pivot. Our core skillset is helping businesses scale.

Has this strategy grown as the agrifood startup ecosystem has grown in recent years?

Cargill is a 155-year-old company. To be relevant, you evolve with what’s happening in the market. Cargill was at one time in shipbuilding — most people wouldn’t know that.

We really started doing early-stage agricultural technology investments in earnest, four or five years ago. Before that, we were a company that waited for something to scale and then we acquired it.

For early-stage investments, we’re finding that it’s working. It’s bringing some interesting things into the house of ANH. Covid-19 has only accelerated that. If you look at history, every large economic disruption germinates innovation.

OK, you mentioned Covid-19. Can you share some of the innovation you’ve seen emerge from the pandemic’s impacts?

Our Cargill Protein & Salt and Food Ingredients & Bio-industrial colleagues cover food service, retail and e-commerce. Retail has transformed dramatically over the last eight months, with the emergence of click and collect; food service though, has been decimated, and we are working with our customers to support them through this difficult time. Those realities have forced us to think about things differently.

Take the concept of ghost kitchens. They were probably not even in Cargill’s vocabulary 12 months ago. The Uber-ization of chefs and restaurants is going to happen. Covid is accelerating this and it’s a market that we’re going to have to serve. We either figure it out ourselves internally, or we watch what startups do and partner with them.

Food security is another example. The resilience of food supply-chains is pretty remarkable. While there were some scares early on [in the pandemic], there weren’t any major disruptions that created panic. That’s because companies like ours and our competitors have invested time and money making sure supply chains are robust. But labor challenges on the farm or in processing facilities are heightened. Leveraging technology to alleviate labor challenges has only accelerated in the last six months.

With Cainthus, the biggest opportunity is to help farm operators get information at their fingertips and use human labor more effectively.

Food is the one thing everybody in the world needs. Why, in such an essential industry, is the uptake of tools that improve the efficiency and resilience of supply chains so slow?

The essential aspect of food makes the industry less volatile than other industries. For that reason, I think both producers and the industry are slow to disrupt too many things.

I do think we’re going to see some tremendous change over the next three to five years.

Technology concepts that are applied in other industries are coming to agriculture. For example, “Food-as-a-Service”: getting everything shipped to your house, recipe and all, so that you’re able to have a restaurant-like experience in your home.

We’re cognizant that in a big company like Cargill, there are startups out there that we don’t know about that are waking up every day thinking about this. Sometimes having disruption forced upon the industry is a good thing.