Editor’s Note: Remus Brett is partner at UK venture capital firm LocalGlobe, previously the cofounder of a specialist benchmarking and advisory Finalta, which was acquired by McKinsey. Today, LocalGlobe announced its lead role in the £2 million ($2.7 million) seed round for Breedr, a UK digital ag startup for the animal agriculture sector. Breedr joins Wefarm and Infarm in LocalGlobe’s agtech portfolio. Here Brett tells us more and why they invested.

As far as industries go, are any older than livestock farming? Emerging somewhere between the Neolithic and Bronze ages, if you excuse the lack of historical precision, this puts it around 10,000 years old.

How much has it really changed? It’s certainly a lot bigger, worth around $500bn. And, despite the move away from meat in some countries, is still undergoing significant growth. From 2005 to 2050 global demand for beef is forecast to increase from 64m tonnes p/a to 106m. A growing global population, a swelling middle class and Chinese consumption are key drivers.

However, much has hardly changed. Farmers still tend to tend to operate in rural isolation, decisions on when to sell cattle are often based on eye and physical auctions dominate trade. Of course, technology has started to play its part from electronic identification (EID) tagging, farm management software and nascent farm to farm trading platforms, but the fundamentals of a multi-layered and manual supply chain prevail.

It is also an industry facing huge challenges and the UK is bearing the brunt of these:

- Low productivity. UK livestock “total factor productivity”, a Defra measure to assess the industry, grew by just 0.8% over 10 years. This is three times lower than the US, France and Germany. With beef becoming an increasingly global market and China expected to account for more than 50% of beef consumption by 2050, the UK has a huge productivity gap to close.

- Decreasing subsidies. UK farms received €3.1bn in subsidies from the European Union in 2018. This accounts for 90% of livestock farmer profits, propping up the very survival of the industry. Few others are more exposed to Brexit risks than livestock farmers.

- Consumers demand provenance… The UK has not recovered from the horse meat scandal in 2013. Consumers and in turn, the leading retailers, now demand high quality ‘paddock to plate’ traceability. For an opaque industry, this is not a straightforward challenge.

- …and a transformation in environmental impact and animal welfare. Awareness of the environmental impact of the beef industry is supported by a growing stream of research. For example, compared to staple diets like potatoes and rice, per calorie, a recent study argued beef requires 160 times more land and produces 11 times more greenhouse gases. Further, wastage is huge — up to 49% of the meat sold by farmers is classified by processors for being “out of spec”.

So, as a VC firm, you can probably predict the outcome of our story. Is this another case of “software to the rescue”? Well actually no, our story is one of “farmers to the rescue” albeit, with a technology twist.

Meet Ian Wheal and Claire Lewis, co-founders of Breedr. Ian comes from pedigree farming stock, growing up on a 2,000-hectare farm in South Australia. His father was a Nuffield Farming Scholar and an early pioneer in using data and insights to improve farm productivity. Ian also happens to be a computer scientist and entrepreneur.

Claire, who recently joined as co-founder, is also a born and bred farmer. With a childhood based on a family farm in Cheshire, a degree in agri-food and 10 years working in the agri-supply and food retail sector, Claire shares Ian’s passion for the industry and his deep expertise.

This is their take on the industry:

“At the heart of the meat and livestock supply chain is farmers who in our eyes are not just farmers, they are environmentalists, entrepreneurs, mechanics, inventors, traders, marketers, fathers and mothers. They are passionate about the produce and animals they care for and place of agricultural is the millions of rural communities around the world.

“Breedr believes that bringing these amazing minds together with technology that can enable them to be the best they possibly can, and through better collaboration, smarter use of data and connecting the supply chain, can create benefit for the entire industry so that it can meet the challenges of the future.”

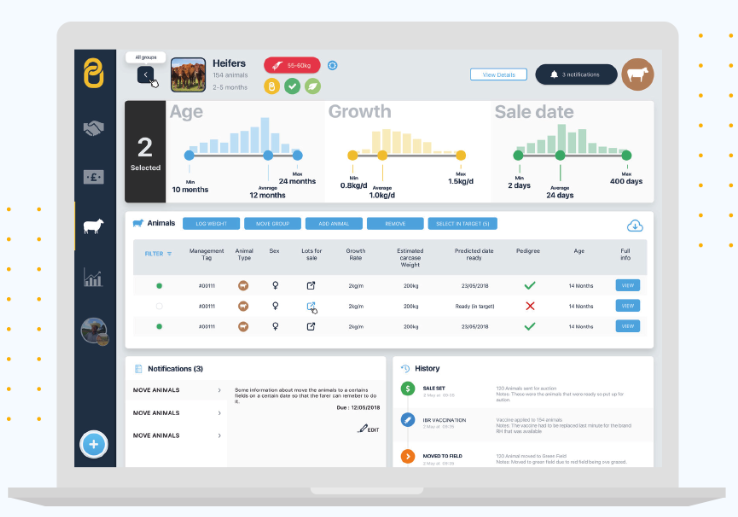

This is the foundation on which they are building Breedr, a technology platform to enable precision farming. The core of the proposition is the farmer’s app. It pulls in all critical animal data from breeding history, medicines, health and weight data. These data transfer with the animal when it leaves the farm and integrates with regulatory systems to provide traceability.

Powering the app are a set of performance tools to help farmers make better decisions. As the number of farmers on the platform grows, aggregate data will become increasingly powerful to benchmark growth in offspring, keep animals healthy and calculate their peak selling time. Computer vision capabilities will complement advances in weighing technologies to say goodbye to hugely flawed “eye” based decisions.

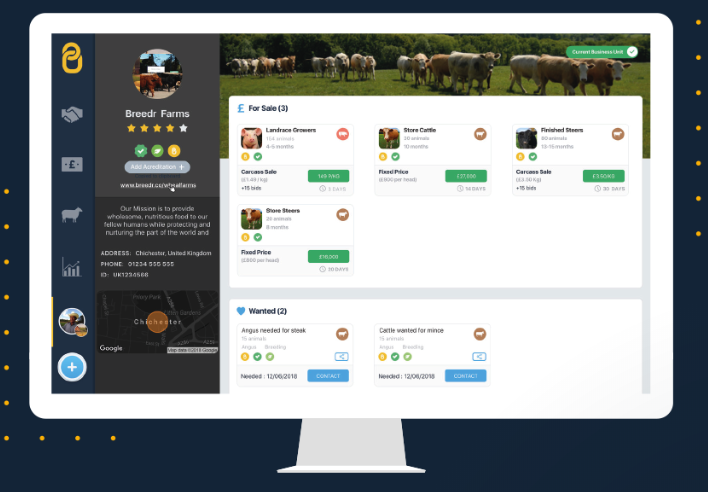

Supply chain transformation comes from disintermediation as the platform will allow farmers to market and trade directly with the major processors and retailers rather than today’s brokers and auction houses.

Farmers create their own marketing page, providing full records of each animal and accreditations of welfare and environmental standards. Using animal growth and trading data, farmers can also use forward contracts to finance their business and optimise cash flows. Smart contracts will underpin the process.

And UK livestock is just the start. Breedr’s ambitions are global and the technology can be applied to most other farmed animals.

The big question is why now? If the supply chain has survived for 10,000 years, is it really ready to be disrupted? Whilst farming credentials are not a skill set the LocalGlobe team possess in abundance, an understanding of the forces and timing of industry disruption is in our DNA. Sure, not all 200,000 UK farm holdings will use Breedr to start with, but there are a growing generation of young, digitally savvy farmers who are already embracing Breedr.

Also, there’s no better proxy bet than the judgement of ambitious, deep industry experts as founders. This investment also continues our interest in enterprise blockchain deployment (see Gospel).

We are very excited to lead the seed round in Breedr. Thanks (again) to Michael Pennington for the introduction and to Forward Partners who led the pre-seed and continue to participate. We’re also delighted to welcome an A-team cast of value-adding angels.

Ian and the team have chosen Cambridge as their base and are actively hiring across a number of roles. Visit their careers page if you’d like to know more.