Data snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

With Finless Foods rumored to be making big cutbacks to conserve cash, New Age Eats shutting up shop after running out of funds, and GOOD Meat sued by its bioreactor supplier over allegedly unpaid bills, the last 12 months have been challenging to say the least for cultivated meat and seafood companies trying to raise capital.

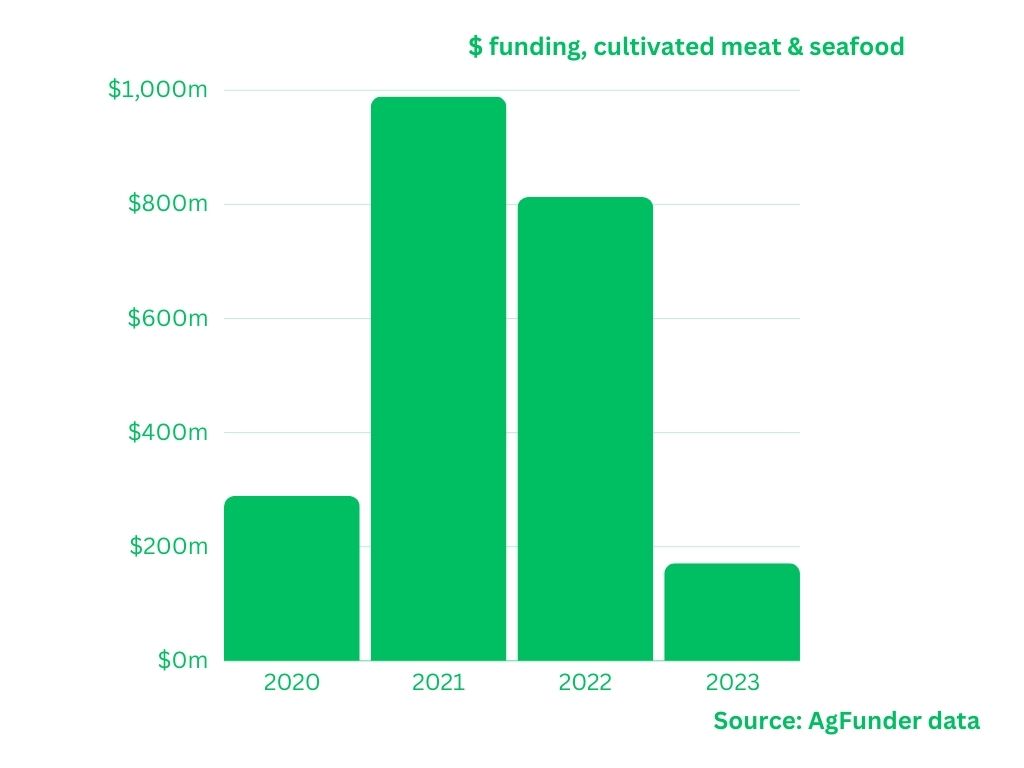

As AgFunder crunches the numbers for its forthcoming annual global agrifoodtech investment report, preliminary data shows that funding for cultivated meat startups peaked at $989 million in 2021, dipped slightly to $807 million in 2022 (bolstered by a $400 million round into UPSIDE Foods) and then dropped off sharply in 2023 (-78%) to $177 million, against a backdrop of a -50% drop in agrifoodtech investing overall in 2023.

While the funding rounds were far smaller in 2023 vs 2022, investors placed a sizeable bet on Uncommon, a UK-based startup (formerly Higher Steaks) which netted a $30 million series A round led by Balderton Capital and Lowercarbon Capital to scale production of cultivated pork using patent-pending technology it claims gives it a competitive edge by speeding up the cell differentiation process.

Meatable, a Dutch startup that raised $47m in its series A in the heady days of 2021, raised a more modest $35 million in its series B round last year, while cultivated seafood startup BlueNalu netted $33.5 million to scale up production at its pilot facility in San Diego.

Cultivated meat and seafood funding 2020: $278 million

Top 10 rounds:

- Memphis Meats: $161m

- Mosa Meat: $55m

- Mosa Meat $20m

- Shiok Meats $12.6m

- IntegriCulture $7.4m

- SciFi Foods $6.1m

- Avant Meats $3.1m

- Shiok Meats $3m

- New Age Meats $2.7m

- Mosa Meat: $2.2m

Cultivated meat and seafood funding 2021: $989 million

Top 10 rounds:

- Believer Meats: $347m

- GOOD Meat: $170m

- Aleph Farms $105m

- GOOD Meat $97m

- BlueNalu: $60m

- Meatable$47m

- Believer Meats $26.8m

- New Age Meats $25m

- Mission Barns $24m

- Shiok Meats: $10m

Cultivated meat and seafood funding 2022: $807 million

Top 10 rounds:

- UPSIDE Foods (formerly Memphis Meats): $400m

- Wildtype: $100m

- Vow $49.2m

- Gourmey: $47.6m

- Finless Foods: $34m

- Ivy Farm Technologies: $22.6m

- Hoxton Farms: $22.2m

- SciFi Foods: $22m

- Avant Meats: $10.8m

- CellX: $10.6m

Cultivated meat and seafood funding 2023: $177 million

Top 10 rounds:

- Meatable: $35m

- BlueNalu: $33.5m

- Uncommon (formerly Higher Steaks): $30m

- Bluu Seafood: $17.5m

- CellMEAT: $13.2m

- Future Fields (growth factors): $11.1m

- WandaFish: $7m

- Clever Carnivore: $7m

- CellX $6.5m

- Meatafora: $5m

A shakeout to come

In a panel session on investing in cultivated meat at the recent cell ag innovation day at Tufts University, Harris Komishane, general partner at agrifoodtech investor Meach Cove Capital noted that the current funding environment for cellular ag is not favorable. “It is pretty bad although in the last month or so we have started to see some positive signs. There are issues at the macro level affecting all industries with the exception of AI, which is particularly hot right now. The high-interest rates are really a challenge.

“The IPO market has also been locked up and there’s just a general risk aversion amongst companies, among VCs, to invest money. The good news is that these are largely cyclical issues. But at the sector level, there are other issues. There is a proliferation of companies doing the same or similar things, and many of these companies probably would not have gotten funded if funding wasn’t so available when interest rates were near zero.

“So there’s clearly going to be a shakeout from that, although that is also a cyclical thing that will pass.”

He added: “There are also a lot of challenges about scalability and getting to cost parity, which seems to be taking a lot longer than the VC world was hoping and expecting. There’s also an underdeveloped ecosystem, so a lot of the earliest startups in this space had to basically do everything soup to nuts because there was nobody to outsource things to.”

Private investor Davide Dukcevich added: “I think that the cycle being at a low in this industry right now is actually a positive thing. Some startups will go bankrupt so that there can be consolidation. It’s the natural progression of any industry.”

In a fireside chat opening the event, Good Food Institute founder Bruce Friedrich said government support was essential to kickstart the cultivated meat industry.

“If the government gets the industry started then the private sector can take over, just like electric vehicles,” he claimed. “The economic opportunity here, which is also a national security issue, is such that the US government should be prioritizing support for alternative proteins in the same way it prioritizes support for clean energy transition, the biopharma industry, and advanced chips for artificial intelligence.

“Elon Musk says they would have failed twice, if not for long term low interest government loans. There is no solar industry, there is no EV [electric vehicle] industry, there is no biopharma industry, if not for governments helping the companies that can’t qualify for standard bank loans, giving them long term low interest loans.”

Exit scenarios

Speaking to AgFunderNews after unveiling plans to build a cultivated meat facility in the Kulim Hi-Tech Park in Malaysia with Cell AgriTech, UMAMI Bioworks cofounder Mihir Pershad said: “I think a few years ago investors got caught up in the idea of a thing that seemed like it should exist, without necessarily building a philosophy about how it might come to exist in the world in a real way.

“It led to a lot of investments before they started picking up on things that were probably obvious from the start around capex issues and exit scenarios,” added Pershad.

He added: “If I raise $150 million pre-revenue and I have to raise another $100 million to build factories after that, how does this capital structure get to an exit that makes sense? Even if you’ve financed it with debt, you’re still carrying $200 million in debt on your books, which makes it really hard for someone to acquire you.

“Our view is that startups cannot be in the capex business. Instead, we need to figure out where we can tap into expertise, capital and muscle from existing industry and use that to help us scale however we can.”

Further reading:

Crunch time for cultivated meat: ‘Probably 70-90% of players will fail in the next year’