“Wood Milk started with a simple idea,” says actress Aubrey Plaza in a recent spoof ad from MilkPEP, the dairy industry-backed body behind the iconic ‘Got Milk’ ads. “I saw a tree and I asked myself: Can I drink this?”

The answer is yes, says Plaza, posing as the cofounder of Wood Milk, a fictitious plant-based milk startup peddling “wood squished into a slime that’s legal.”

Is Wood Milk real? “Absolutely not,” she assures us after downing a glass of grainy tree-gloop. “Only real milk is real.”

Gen Z-fueled backlash?

With some notable exceptions—Miyoko’s founder Miyoko Schinner says “the vegan echo chamber could learn a thing or two” from MilkPEP’s “brilliant” ad—its campaign has not gone down well with plant-based enthusiasts.

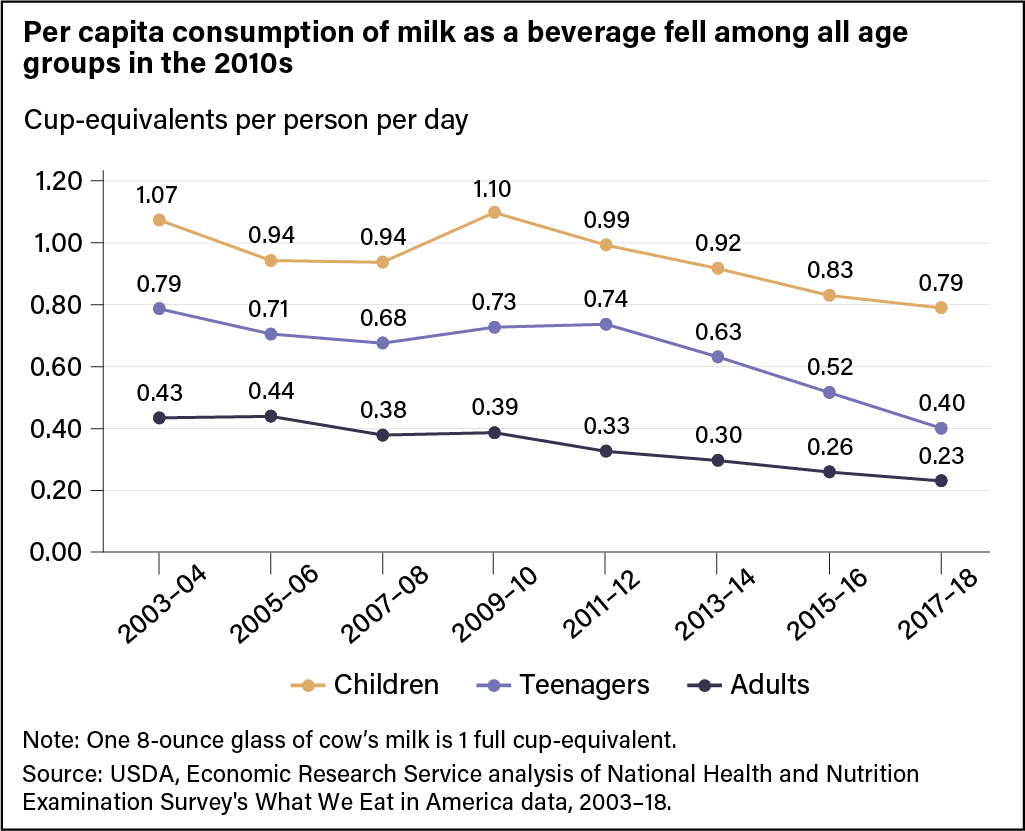

In a Linkedin post and Tik Tok video, Vegan Women Summit founder Jennifer Stojkovic blasted the ad as poorly-timed (it launched as 18,000 dairy cows died in an explosion in Texas), and ill-judged, as Plaza’s “main fans are Gen Z and Millennials,” who have “the lowest [dairy] milk consumption of any generation.”

Had Plaza, who is apparently an avid almond milk drinker, unwittingly taken part in “the biggest marketing FAIL of the year?” speculated Stojkovic. Vox later weighed in with a lengthy article highlighting “the very real harms of dairy production: air and water pollution, greenhouse gas emissions, inhumane treatment of cows, and dangerous conditions for a low-paid and vulnerable workforce.”

With MilkPEP and Plaza disabling comments on social media posts following a flood of “angry comments,” noted Bon Appetit magazine, their plan to persuade the nation’s youth to return to “real” milk had spectacularly backfired, “making Big Dairy look stupid.”

MilkPEP: ‘We wanted to start a conversation’

MilkPEP, however, says we should all chill out. Wood Milk, explains CEO Yin Woon Rani, was merely a “comedic reaction to a culture that is making milk out of seemingly everything.”

She told AFN: “We anticipated that Wood Milk wouldn’t be for everyone, but we wanted to start a conversation. We want consumers to make informed choices when it comes to their beverage options and be aware that not all milks are created equal when it comes to their nutritional profile.”

Referencing recent draft guidance from the FDA recommending that plant-based milk labels include text spelling out how they differ nutritionally from cow’s milk, Rani said “many people do not know the nutritional value of their beverages, or lack thereof.”

“In creating our fictitious Wood Milk, a made-up brand with zero nutritional value, we hope to bring the power and goodness of real milk into the spotlight.”

Will attacking plant-based milk help revive flagging dairy milk sales?

So was this a cynical PR stunt presenting plant-based milks as both gross and ridiculous in order to get our attention? Yes!

Did it work? Yes, if you believe all publicity is good publicity. After all, we’re still talking about it.

The key question, however, is whether attacking plant-based milks will help boost sales of dairy milk, which have been spiraling downwards since the end of the Second World War.

And if this is the aim, I’m not convinced it’s a winning strategy. Not because it’s tone deaf (it is a bit, although I confess it also made me smile), but because it seems to be predicated on the assumption that ‘fake’ milk is to blame for ‘real’ milk’s flagging fortunes, which isn’t really supported by the data.

To what extent are plant-based milks cannibalizing sales of dairy milk?

Plant-based milks have undoubtedly taken some market share from dairy milk in recent years, gaining traction on coffee chain menus and garnering 15% of the US retail market.

But their growth does not account for the dramatic loss in volume experienced by fluid milk in recent years, something MilkPEP itself routinely points out in its topline data reports on fluid milk sales.

According to a 2020 report from USDA’s economic research service, the increase in US sales volumes of plant-based milks between 2013 and 2017 was about one-fifth the size of the decrease in cow’s milk. This suggests that while plant-based milks have cannibalized some dairy milk sales, most of the slack appears to have been taken up by other beverages such as bottled water and energy drinks.

Changing consumer habits are also to blame. USDA data shows the share of preadolescent children who did not drink fluid milk on a given day rose from 12% in 1977-78 to 24% in 2007-08. Meanwhile, sales of cereal, a key driver of milk consumption, have been on a steadily declining trajectory, despite a brief resurgence during the pandemic as people ate breakfast at home.

And these trends, you could argue, are just as likely to impact plant-based milk as dairy milk. If you’re not eating cereal for breakfast anymore, it doesn’t matter whether you prefer it with almond or dairy milk.

Indeed, new SPINS data shared with AFN shows unit sales of refrigerated plant-based milk (-4.9%) declined more than dairy milk (-2.2%) in the year to March 26 2023 in US retail, hardly compelling evidence that Big Almond is eating Big Dairy for breakfast.

‘Real’ milk

But assuming plant-based milks are eating into at least some of Big Dairy’s pie, are ads such as Got Wood Milk likely to convince shoppers to think again about reaching for almond or oat over cow’s milk?

First, let’s explore the ad’s focus on ‘real’ milk.

We can argue until the cows come home whether our bovine friends should have a permanent monopoly over the term ‘milk.’ But spending millions trying to stop companies from using the term ‘milk’ on plant-based products may not be the best use of dairy’s dollars. If Gen Zers want Oatly in their lattes, calling it an ‘oat drink’ (as it’s currently labeled in Europe) won’t stop them.

Similarly, the assumption built into the ad—that ‘real’ milk tastes better—is by no means obvious to consumers, many of whom buy almond milk precisely because it doesn’t taste like dairy milk, according to the makers of Almond Breeze.

The nutritional argument for ‘real’ milk—which is implied, although not directly articulated in the ad—is potentially more compelling (at least if you’re comparing it with wood milk). But again, it’s by no means clear that nutrition is the primary purchase driver in the fluid milk category. If that were true, soy—the only non-dairy milk recommended in the Dietary Guidelines for Americans—would still be the category leader within plant-based.

Put another way, while survey data suggests many shoppers buy plant-based milk because they think it’s healthier, that doesn’t mean they assume it has a superior nutritional profile to ‘real’ dairy milk. They may just have a different definition of ‘healthier,’ choosing almond milk over dairy because it has fewer calories and no lactose, for example.

Indeed, dairy brands such as Fairlife have arguably been so successful because they have addressed such consumer concerns head-on by offering lactose-free cow’s milk with more protein and less sugar, rather than wasting energy attacking ‘fake’ plant-based milks.

Got cheese?

So where does this leave us?

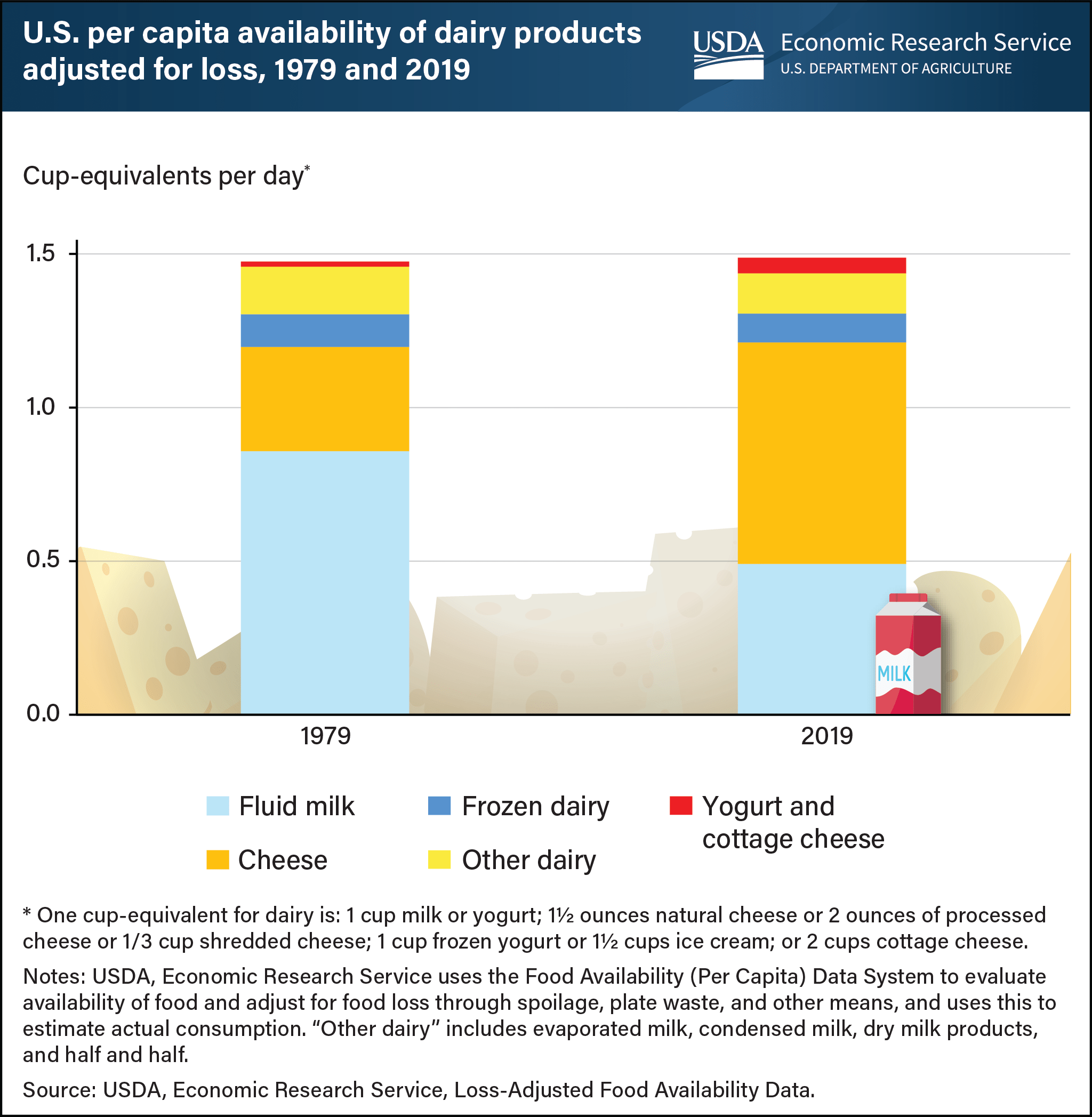

If ‘Big Dairy’ has misjudged Gen Z and Millennials with a ‘tone deaf’ ad, the chart below suggests plant-based advocates may also be engaging in some magical thinking if they think consumers are spurning cow’s milk primarily because of ethical and environmental concerns. If this is true, why haven’t sales of all dairy products followed the same declining sales trajectory?

As the chart below spells out pretty vividly, overall dairy consumption in the US was actually flat between 1979 and 2019, with declines in fluid milk offset by corresponding increases in consumption of other dairy products such as yogurt and cheese.

Put another way, if Americans haven’t ‘got milk,’ they’ve definitely got cheese.

Watch the ad here: