By many accounts, 2017 was a good year for agtech exits. That was not only because exciting exits in agtech have been few and far between for the last few years, but also because a couple of the major ag players — Deere & Company and Dow DuPont — made acquisitions.

No longer distracted by consolidation and the ensuing M&A transactions, this could be a signal that the large strategic players will have more time, and money, to pursue more exits in 2018, according to some industry insiders.

“We’re starting to come out of the winter storm of all the consolidation,” said Armand Lavoie, managing director of investment banking firm Kirchner Group. “You’re seeing Bayer and DuPont, and even Syngenta, coming out of the woodwork and starting to look at acquisitions.”

Acquiring innovation is a typical strategy for companies across industries and the large ag companies have been relatively quiet compared to other industries such as healthcare, agreed Matt Crisp, CEO of ag biotech startup Benson Hill Biosystems and an ex-venture capitalist.

“I anticipate we see a lot more activity next year all over the place — small and large deals and more exits throughout the value chain. We know organizations will want to buy additional innovation. It’s not uncommon in other industries and our space is no different,” he told AgFunderNews.

Lavoie added: “I think the supply of transactions will increase as companies and investors mature. Since the consolidations, you’re seeing a hollowing out of their internal R&D and moving more to a pharma model,” where acquiring innovation is the norm, he added.

The strategic wakeup will be important in shaping the perception of agtech and attracting more new investors to the sector, according to Gideon Soesman, cofounder and managing partner at Greensoil Investments, the Israeli agtech VC that’s been investing in the sector since 2011.

“It’s been a good year but if you look at overall activity over the last two years, we were all hoping and expecting for a bit more bullish growth than what we’ve seen,” he told AgFunderNews. “Yes, we’ve got more investors in the space and more exits, but it’s not been the hockey stick growth we would have liked.”

While more, general investors are investing in agtech, many have a policy of doing one or two deals to test out the market and wait and see, added Gideon.

“Even though we are growing steadily as a sector, agtech is not seen as a sector with a fantastic track record — for that you need to see five to 10 big exits a year and VCs clearly making good returns. Then we will see more general investors doing deals in agtech the same way they do in other sectors; at a higher frequency.”

Deal by Deal

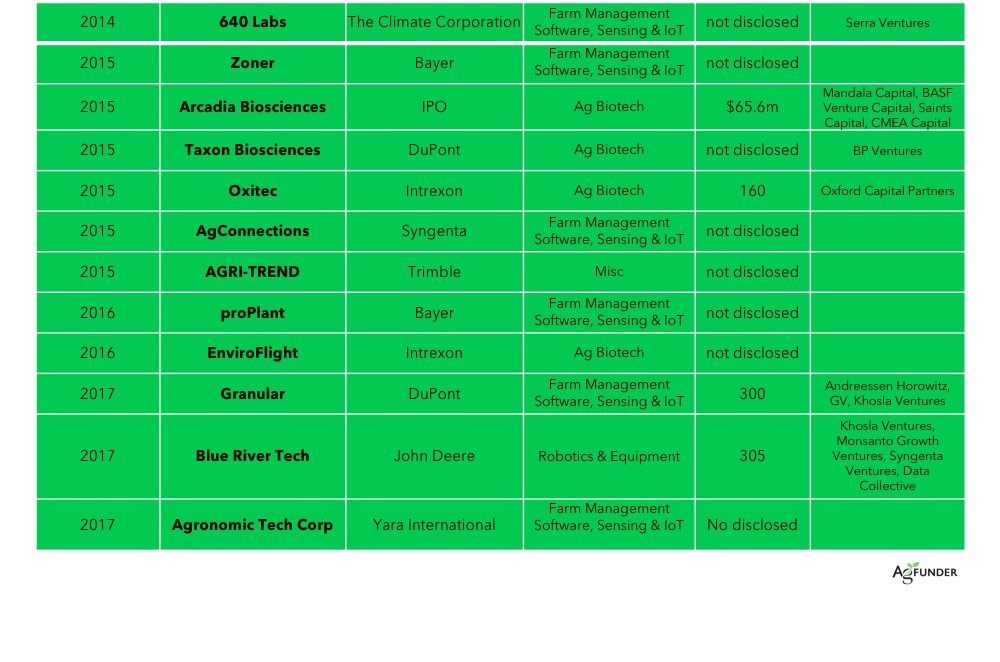

The first high profile deal of the year — Dow DuPont’s acquisition of farm management software startup Granular for $300 million in August — was certainly a step in the right direction; it ticked many of the boxes including a good investor return and participation from an ag strategic.

According to various insiders, the acquisition valued Granular at 100 times revenue, a far cry from the typical three to four times revenue many software companies might expect.

Having raised just $24.9 million in two venture capital rounds, Granular produced a great exit for its investors that included VC heavyweights Andreessen Horowitz, Khosla Ventures, and GV (Google Ventures) as well as Californian family office Tao Capital Partners and agriculture investor Fall Line Capital.

“It’s great that we’re starting to see exits. Granular has built a great system that was clearly attractive to the majors. It’ll be interesting to see how the rest of the industry responds because there’s not a lot of companies like Granular in the market,” said AgFunder’s Rob LeClerc upon the acquisition announcement.

The next high profile deal of the year was John Deere’s acquisition of ag robotics startup Blue River Technology for $305 million. An obvious match and route for Deere to build out its artificial intelligence capabilities, the deal also provided a good return for investors. AgFunder Research can reveal that the acquisition price was a roughly four times increase on the $87 million post-money valuation the company fetched at its last round of funding.

Blue River was founded in 2011 and had some big investors behind it, including Khosla Ventures, and Innovation Endeavors, which is the VC fund of Eric Schmidt, Google’s chairman, as well as ag industry giants Monsanto and Syngenta. The company raised just over $30 million in total since its founding.

There were a handful of other relatively high profile acquisitions such as multinational chemical company Yara International acquisition of Adapt-N’s parent company Agronomic Technology Corp (ATC).

Alternative Routes

Strategic acquisitions are not the only route to exit, however, and there are a small but growing number of startups hoping to build stand-alone businesses that could list on a public exchange or take in private equity funding in due course. Digital ag startup Farmers Business Network and ag biotech company Indigo Agriculture are two examples of startups that have expressed such plans.

“In some segments of agtech, we may see more public offerings as companies look to finance their growth, and I do think some may become acquirers themselves, while some segments may see more private equity activity,” said Lavoie.

Lavoie is skeptical that many startups will succeed under this strategy, particularly the risk in rolling out marketing and distribution platforms for ag products. Some startups will need to “spend a lot of money” to build out a salesforce for their products to compete with the large retailers and this may require building out a platform of several different products to support that salesforce.

“Data analytics startups may be able to build out to profitability and become a target for private equity, although PE firms will pay much lower multiples than the strategics would,” he added.

Lavoie also warned that companies with diversified investor bases could struggle to make decisions on how and when to exit. “They will have different investors with different abilities to write more checks and with different timeframes on their cap tables meaning they have different motivations. So the sector should be prepared for some reality too.”