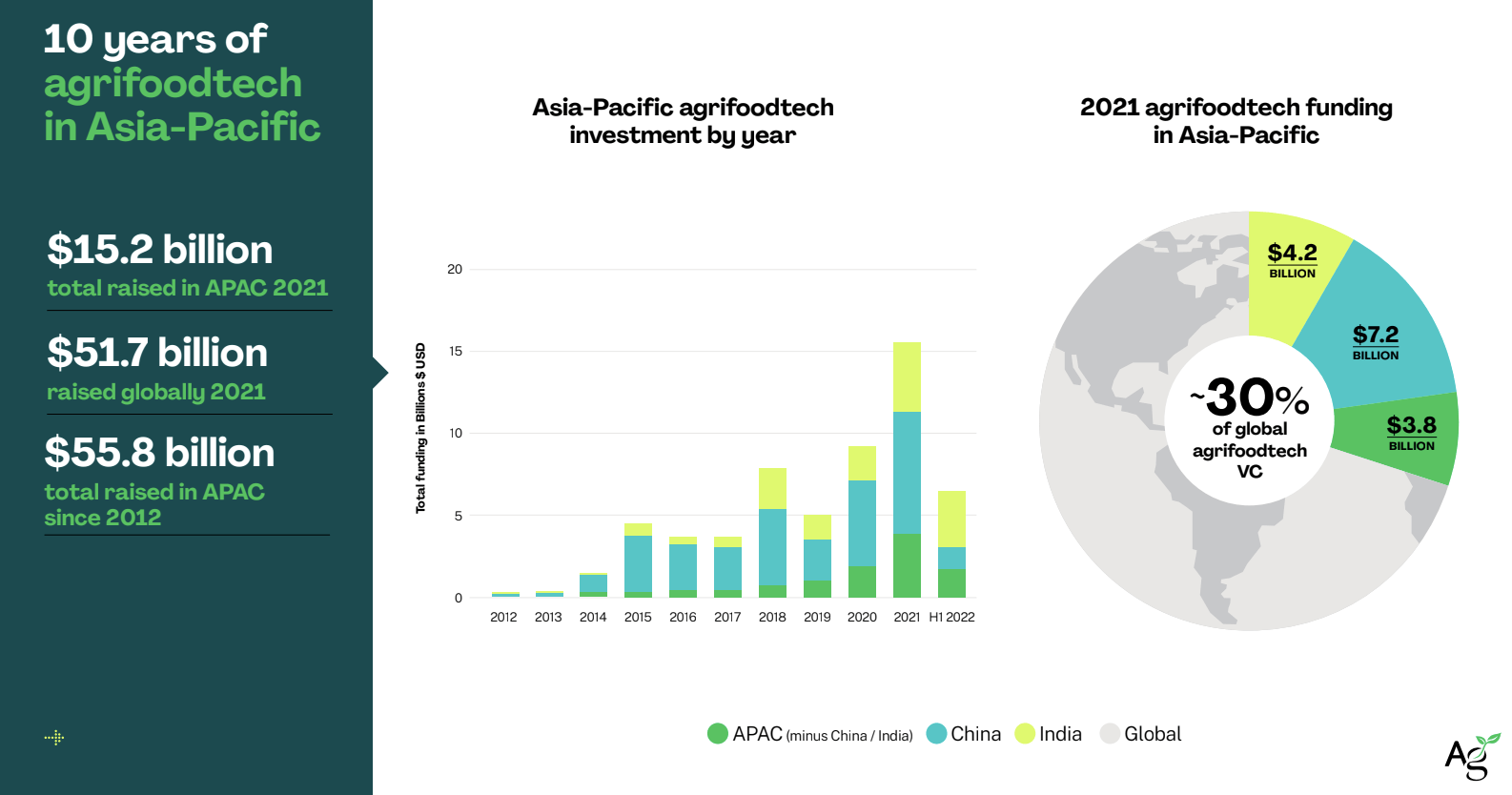

It’s widely accepted that 2022 is a difficult year for the global financial markets. Asia-Pacific’s venture capital and agrifoodtech industries are by no means immune; investment flows to the region’s foodtech and agtech startups reached just $5.3 billion in the first half of 2022, a 47% year-on-year (YoY) drop, according to a new report from AFN‘s parent company, AgFunder.

But when you factor out China, funding for the rest of the region increased 15% year-on-year, reaching $3.9 billion in the first six months of 2022, according to the report released in partnership with Thai Wah, Omnivore and AgriFutures Australia.

Chinese agrifoodtech investment skewed 2021’s record-breaking year $15.2 billion in agrifoodtech investment, contributing nearly half of that total. Chinese eGrocery startups were the bulk within that raising a whopping $5.5 billion. But in the first half of 2022, Chinese agrifoodtech startups have raised less than $1 billion as investors have pulled back from the increasingly regulated and unsuccessful food delivery segment that’s seen significant downsizing and even closures this year.

Furthermore, the world faces significantly more political and economic upheaval right now than it did in 2021. Downstream technologies that were popular with investors during the good times may be less relevant now as food security, climate change and other external crises come front and center. Future investment dollars will undoubtedly reflect that.

Where did the money go?

Asia-Pacific agrifoodtech investment is very much a downstream game right now. Even excluding China, investors in 2021 poured more than $5 billion into downstream categories like Cloud Retail Infrastructure, Restaurant Marketplaces, and eGrocery.

Retail and Restaurant Tech was another popular category, raised nearly $1 billion across the rest of Asia-Pacific outside China. For example, Australia’s top three deals were restaurant technologies and one plant-based meat company.

Further upstream, farm tech funding in Asia-Pacific doubled from 2020 levels, reaching $2.2 billion in 2021. Large, late-stage deals drove much of this growth, suggesting that the farm tech market is maturing. The category also saw a 17.5% uptick in the number of deals YoY.

Top countries for investment

As noted above, investment for H1 2022 dropped considerably. This is mostly due to a decline in funding to Chinese startups that in 2021 accounted for nearly half of all Asia-Pacific agrifoodtech investments. Online grocery platform Xingsheng Youxuan alone raised $3 billion in 2021, for example.

But the high cash-burn, growth-at-any-costs model for eGrocery has butted up against government regulations as well as downsizing and closures. Chinese agrifoodtech startups have raised less than $1 billion, compared to over $5 billion during the same period in 2021.

Farm tech was still a big category for China; the country closed some $605 million in farmtech deals in 2021, a 60% YoY jump.

Indian agrifoodtech could break records in 2022, with $2.7 billion in funding already recorded for H1-2022.

Singapore and Indonesia followed China and India as best funded countries in 2021. Singapore startups raised $1.1 billion and Indonesia $816 million. The latter may beat its 2021 total this year. By contrast, funding for Singapore agrifoodtech has cooled.

The climate tech opportunity

Investing in downstream technologies is often a no-brainer in good times. Generally speaking, it takes less time and money to get food and grocery delivery apps, ghost kitchen operations and even many food robots to market. On the flip side, a gene-edited crop variety that can withstand heatwaves might take years to reach customers thanks to complex science, expensive technologies and a rigorous regulatory process.

But grocery apps can’t save the planet. As investors get more careful with their capital thanks to the downturn, and as droughts, floods and other disasters underscore the urgency of climate change, VC attention and funds are both swimming upstream.

The Asia-Pacific region is home to many important climate technologies, from novel farming systems to a huge variety of alternative proteins and a healthy biotechnology industry. With median deal sizes in the region starting to catch up to the West, the region has a major opportunity to help lead the charge when it comes to climate tech. These next few years will be telling.