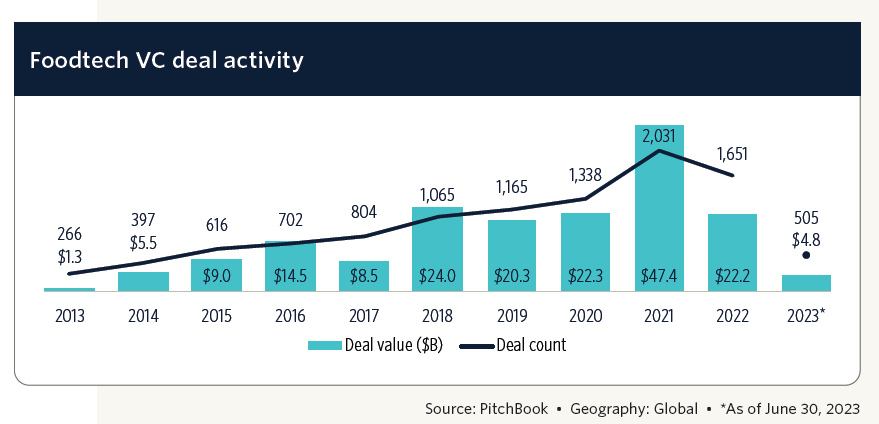

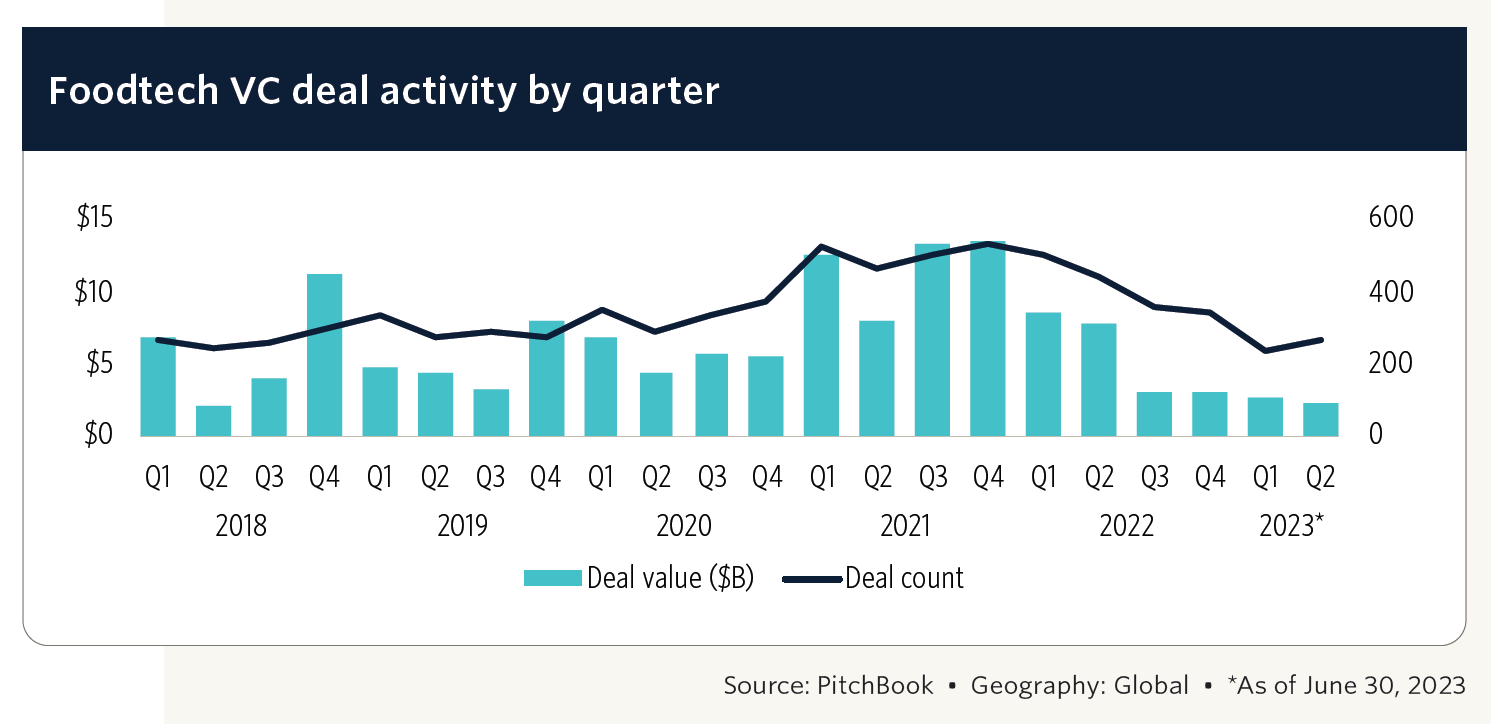

Foodtech VC funding experienced its sixth consecutive quarter of decline in the second quarter of 2023, settling at 268 deals worth $2.2 billion, down 13.9% on the first quarter and down more than 70% year-over-year, according to a new report from PitchBook.

However, deal count was up 13.1% quarter-over-quarter, which “may indicate a return of investment activity after a pause due to caution surrounding the closure of Silicon Valley Bank at the end of Q1,” said report author Alex Frederick senior analyst, emerging technology, at PitchBook.

“During the second quarter, the number of deals increased across all stages except for angel and seed, where it declined 6.1%. The early stage experienced the largest increase in value, climbing 65.5% quarter-over-quarter.”

That said, the median VC deal size declined for the first time in seven years, dropping to $3 million in Q2 2023, which “may reflect a new, more careful paradigm,” Frederick told AgFunderNews. “In the past 12 months, the number of deals and their value have decreased by 39.3% and 75.1%, respectively.”

Dry powder and down rounds

He added: “There are still high levels of dry powder available to deploy, as with all the market volatility over the past 18 months, we’ve seen investors sit by the sidelines as everything has been in flux from a valuation standpoint. So perhaps there’s sentiment now that things are stabilizing and valuations are somewhat normalizing.

“But it’s very early to tell as the number of deals which report valuations has been very low, so while median deal valuations have continued to increase, I think we’re seeing down rounds [where the value of the company is lower than it was in a previous round] being omitted in many cases.”

Notable companies to exit in Q2 include Meatless Farm (sold to VFC after running out of cash), Noblegen (sold to Solar Biotech), and Ordermark (sold to Urban Piper), in each case, for an undisclosed sum, said Frederick.

Could Instacart IPO signal an improved outlook for the foodtech vertical?

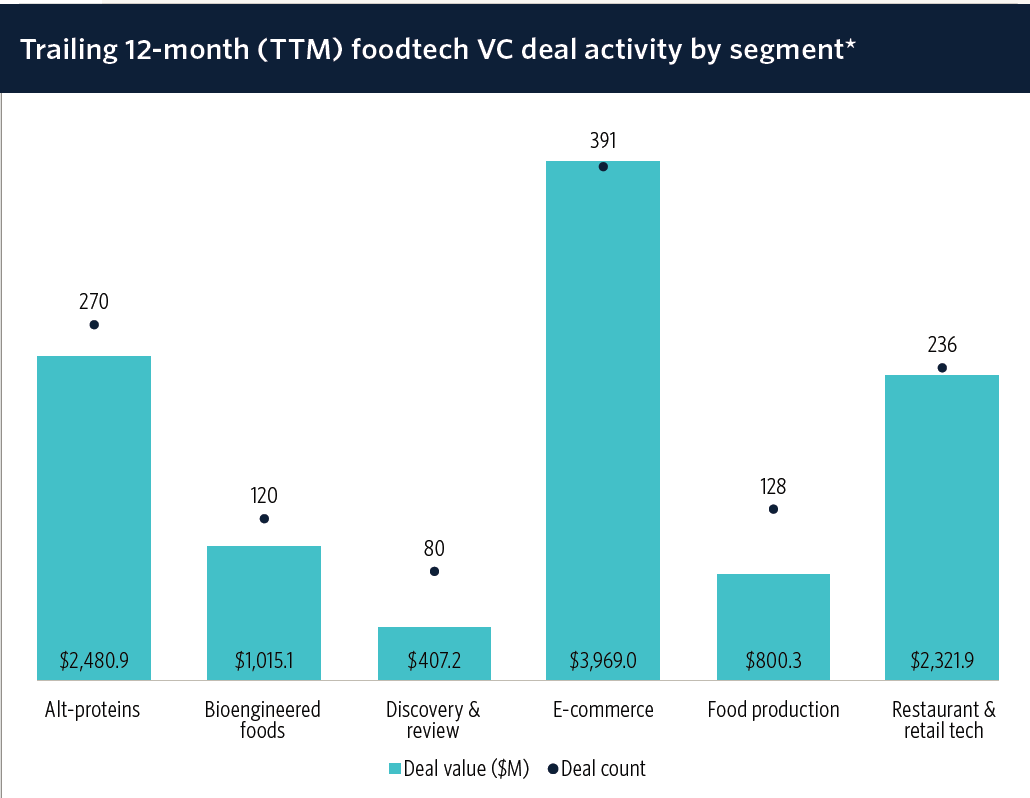

E-commerce continues to generate the largest overall deal activity in foodtech, with a deal value of just over $1 billion across 91 VC-backed transactions during the second quarter, according to PitchBook, which breaks down the segment into six subsegments: e-commerce, bioengineered food, alternative proteins, discovery and review (spanning personalized nutrition, food & beverage discovery, and kitchen enablement software), restaurants and retail tech, and food production.

According to Frederick, grocery-delivery app Instacart’s plan to go public suggests the “outlook for the foodtech vertical may be improving after a decline that started in Q1 2022.”

However, he acknowledged that the largest deal of the quarter—a $475 million round raised by rapid grocery provider Getir in April—was a “significant down round,” with Getir’s pre-money valuation dropping to $6.2 billion from $11.8 billion a year earlier. The company, which acquired German grocery delivery platform Gorillas for $1.2 billion in December 2022, has also been progressively shedding staff, most recently axing 2,500 positions in August.

In April, Egyptian grocery provider Kazyon completed a late-stage VC round for $165 million, while Berlin-based food e-commerce co KoRo raised the third-largest deal in Q2, closing a €70 million ($75 million) series B round led by HV Capital.

What to expect in the second half of 2023

According to Frederick: “We expect that in the second half of 2023, investors will continue to invest in restaurant and grocery e-commerce, but primarily into companies with a more profit-minded, conservative approach and less focus on high-growth, high-cash-burn strategies.”