Data snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Kenya, Egypt, and Nigeria have long been the leading nations when it comes to agrifoodtech investment in Africa. And despite elevated levels of economic upheaval in those countries of late, they still lead the region in terms of food and agriculture startup funding, according to AgFunder’s Africa AgriFoodTech Investment Report produced in collaboration with the Bill & Melinda Gates Foundation, FMO Ventures Program, and Mercy Corps Ventures.

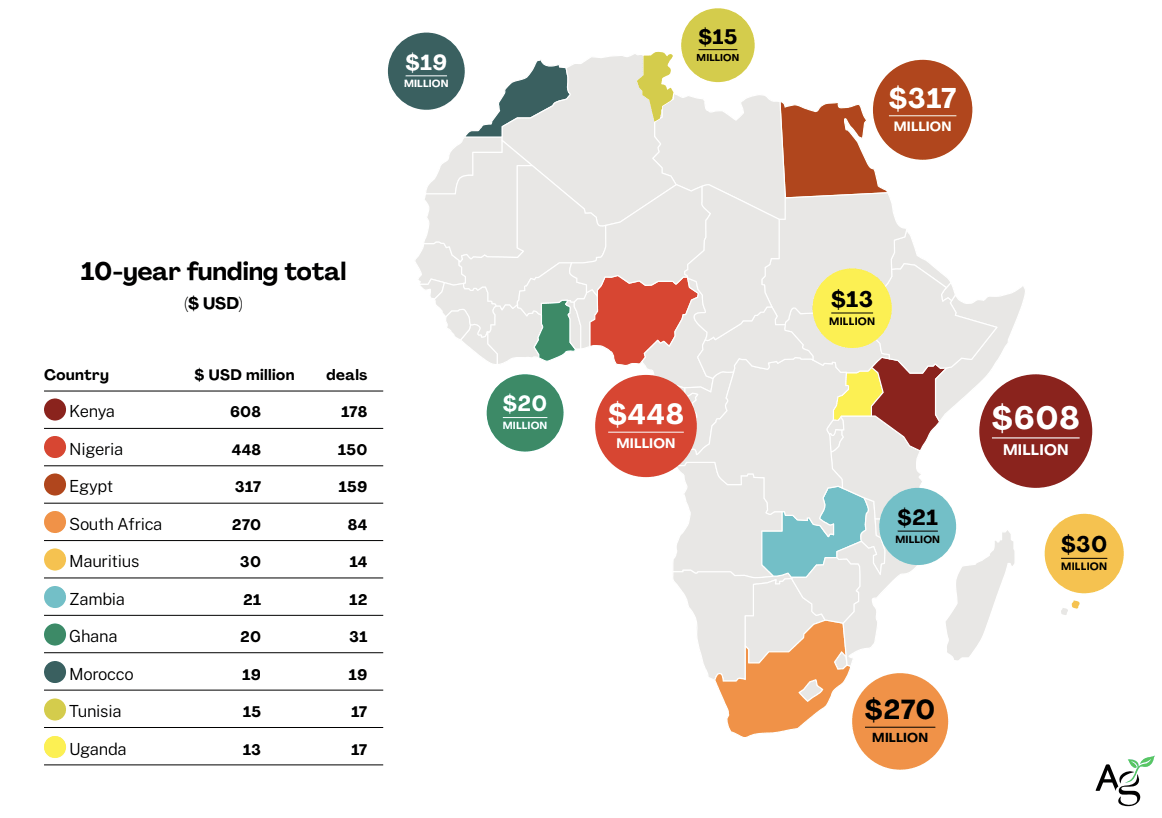

Over the past 10 years, these three nations have cumulatively raised 76% of total funding to the region’s agrifoodtech sector, bringing in over $1.3 billion. In 2022, this increased to 86% ($546.8 million) of the $636 million of total funding.

Kenya and Nigeria competition

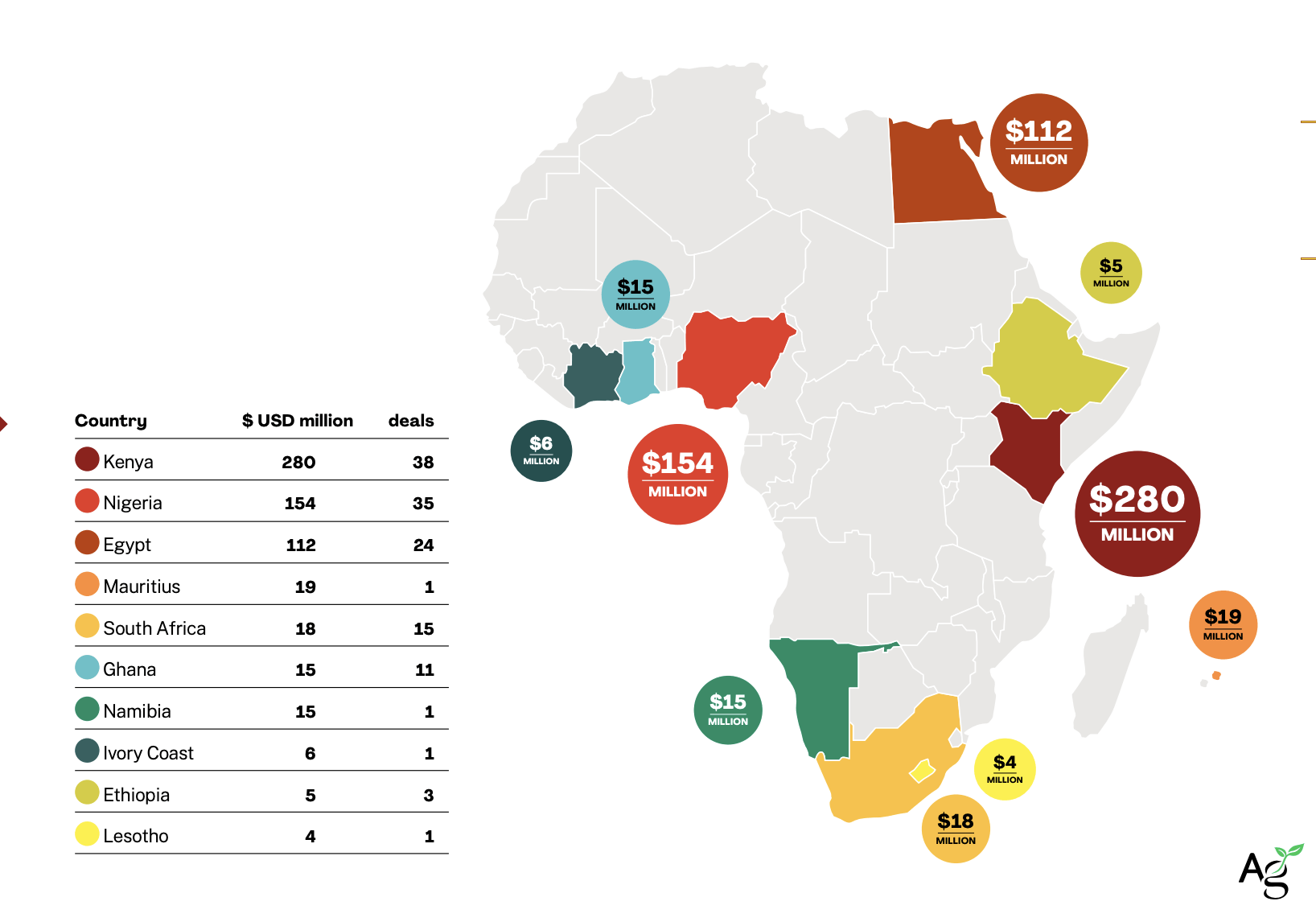

Kenya and Nigeria are in particularly close competition and in 2022 Kenya overtook Nigeria as the most active country for dollar totals as well as the number of deals, closing $280 million across 38 rounds. Much of this was thanks to a few large deals, including Wasoko‘s $125 million Series B from Tiger Global and Avenir. Wasoko’s technology connects small shops selling essential goods to the digital economy; the company’s raise accounted for 67% of all In-Store Retail & Restaurant Tech fundraising in Africa in 2022.

Nigerian agrifoodtech deals were similar in number to Kenya; 35 deals amounted to $154 million in 2022. Agribusiness marketplace ThriveAgric‘s $55 million round was a notable round for Nigeria, and also the largest for the Agribusiness Marketplaces category.

In H12023, Kenya and Nigeria startups raised almost the same amount of funding, with $41 million and $45 million, respectively.

Kenyan agrifoodtech startups have raised the most in the past 10 years at $608 million. That’s one-third of the $1.8 billion of total funding to African agrifoodtech since 2013.

Fundraising around Africa

Egypt raised $112 million in 2022 across 24 deals. However, funding in Egypt — a country where agriculture and food account for 12% of GDP — has decelerated significantly, according to the report. In H1 2023, agrifoodtech startups in the country raised just $700k compared to over $15 million in H1 2022.

Funding deal sizes in other African nations were significantly smaller than those in Kenya, Nigeria and Egypt in 2022; Mauritius recorded the next-biggest deal at $19 million.

South Africa, often a key market for Africa, is feeling the negative impacts of a prolonged economic crisis. The country recorded just $18 million across 15 deals, a near-flat increase in deals and an 18.5% percent nosedive in funding amounts compared to 2021. Ethiopia, where agriculture is 40% of GDP, barely features.