- More investors are backing regenerative agriculture according to natural asset manager Sustainable Land Management (SLM), which just released its fourth-annual impact report and first-ever portfolio-wide carbon accounting report.

- SLM says its assets under management (AUM) has grown 40% year on year across its different funds as well as separately managed accounts.

- Carbon accounting reveals an estimated 100,000 tons of CO2e [carbon dioxide equivalent] sequestered in soil and vegetation in 2023.

- Carbon sequestration estimates outweigh carbon emissions in SLM’s real asset portfolio thanks to regenerative management practices.

Mapping investor interest in regenerative ag

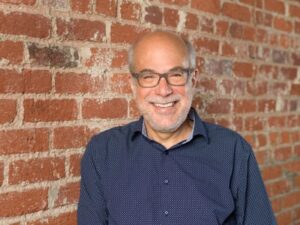

“There are far more investors who want to invest in regenerative agriculture and forestry, and we see that with AUM growing by 40% year on year,” SLM managing partner Paul McMahon tells AgFunderNews. “It’s certainly a feeling of achievement on our side that we’re getting backing for something we’ve been talking about for quite some time.” SLM was founded in 2009.

That AUM growth, says McMahon, has happened across multiple funds and strategies in the US, Europe and Australia.

“Probably the biggest growth is in working with large institutional investors at large pension funds and insurance companies, and also some quite large family offices,” he adds.

SLM currently has $610 million AUM and 306,066 hectares of land under management. Growth has happened across a range of regenerative farming strategies that fall into four main areas:

- Increasing organic annual crops to reduce reliance on pesticides, GMOs, growth hormones and other conventional practices

- Developing regenerative practices for permanent crops such as tree nuts to increase biodiversity and reliance on external inputs

- Continuous cover forestry, which relies on natural regeneration and diversity versus monocultures of prepared and planted trees

- Holistic planned grazing of livestock.

For example, in the US Midwest, SLM partners with local organic farmers on long-term leases and helps them convert the land to organic.

“We set up one large program in the US Midwest, and then we were able to extend that to the West Coast of the US last year with another institutional investor,” says McMahon. “We also did a new investment in the High Plains region, again with organic grains, backed by a family office.”

He notes that total AUM in the US is around $400 million, or roughly two thirds of SLM’s total AUM.

Another big area for growth is SLM’s mixed-farming project in Australia, an initiative McMahon says involves using regenerative farming to both improve productivity and generate carbon credits to sell in the local Australian market.

For this project, SLM created a joint venture with Impact Ag Partners, an established farm operator and natural capital firm.

“Through that we were able to attract a large separate account backed by a family office, and make two quite large acquisitions in New South Wales,” says McMahon.

Carbon: ‘An additional lucrative upside’ to regen ag

One of SLM’s goals as outlined in the report is to turn land into carbon sinks as well as expand regenerative practices through carbon markets that can “provide an additional lucrative upside” for land management.

SLM’s portfolio-wide carbon accounting for 2023 reveals an estimated 100,000 tons of CO2e sequestered in soil and vegetation, which is equivalent to the emissions from 23,000 barrels of oil. Carbon sequestration is outweighing its emissions in the cases concerned, the firm says.

Australia, which has aggressive goals to cut its carbon emissions by 40% by 2050, is an important market for SLM in this area. The firm reports having sold 1.8 million carbon credits in Australia between 2016 and 2023.

“Australia has a very well-developed, regulated carbon market, which is trying to encourage landowners and farmers to participate,” says McMahon, adding that credits are sold as offsets into local regulated markets.

Last year also saw a shift in Australian carbon markets.

“Initially, the Australian government was the buyer of those credits through long-term off-takes,” explains McMahon.

Now, there’s a new demand “where corporates in Australia have a strong demand for credits. A lot of the big emitters now have certain caps and they need to meet certain targets. So we’ve seen a shift away from the government as buyer to corporates, and we’ve seen a strong increase in prices as a result.”

Australia is “much more developed” when it comes to carbon markets compared to other parts of the world, he says. Nonetheless, SLM has projects in other regions, including a pilot project in the US and one in Spain and Portugal where the firm is working with Climate Farmers to measure carbon on orchards. (Results of the pilots are forthcoming.)

Cost still a major challenge for carbon

Measuring, reporting and verification, not to mention the cost of such tasks, is an ongoing challenge for carbon farming anywhere in the world.

Technically speaking, measuring soil carbon is not difficult, says McMahon. Financially speaking, however, soil sampling is difficult to justify in some cases because of the upfront cost of doing it.

“In the US Midwest, the cost of sampling per acre is not prohibitive and we hope we will get that payback for being able to generate and sell credits over a five-to ten-year period,” he says. In contrast, in Australia, “if you’re going to do full, accurate soil carbon measurement across 300,000 hectares of land with a lot of variability of land types and your soil and terrain, it becomes very expensive, and it’s harder to get that payback.”

“The question is, ‘How do you get the cost down?'” he says. “How do you marry soil carbon sampling within modeling approaches and remote sensing to try and get that cost down? Where does the payback come from? How many credits can you generate per hectare? And what price can you expect to get and therefore what’s the breakeven?”

McMahon says these are still questions the industry is trying to work out, and that answers will vary from one geography and land type to the next.

There is potential to achieve carbon-neutral beef

One surprise was the ability to sequester a lot of carbon from livestock production just by adopting regenerative grazing systems, says McMahon.

In Australia, SLM has invested in a system called “holistic planned grazing” that involves dividing land up into smaller fields, investing in fencing and water and moving animals round.

“People think beef cattle emissions are a big problem, and yes there are certainly emissions associated with that category,” he says. “But what we found is that it doesn’t take a lot of carbon sequestration in soils and vegetation to offset those emissions.

“We have a carbon project which only extends to about a quarter of our Australian land portfolio, but they are intensively monitored and measured and producing verified credits. And even just a quarter of those verified credits were more than enough to outweigh the emissions of the full herd across the whole portfolio.”

“That gives us more confidence on those extensive landscapes,” he adds. “If you get your management right, there is the potential to achieve carbon neutral beef, which is quite exciting.”

Farming still ‘a tough business’

Any project concerned with regenerative ag these days has to come with a bit of a disclaimer, suggests McMahon.

“We always have a little note of warning when we talk to investors coming to the space for the first time, based on our experiences. We do see a certain amount of greenwashing — everyone’s rushing to claim that what they are doing is ‘regenerative.’

“You have to really interrogate what is happening on the ground. Is it business as usual or is it actually changing? In our report, we tried to set out very clearly what we’re doing, which is different from conventional agriculture [and we have] very clear theories of change and practice change.”

He also cautions against some of the current hype around regenerative agriculture, “where you get new entrants coming in who almost get seduced by the potential.”

“Farming is still a tough business, and a lot of things have to be right to make good investment returns, no matter how regenerative you are,” he adds. “We’re trying to be realistic in the report about what works and what doesn’t work.”

GUEST ARTICLE Scaling up foodtech, the investor’s take: ‘The real potential of the space has gotten muddled’