San Leandro-based cultivated meat startup SCiFi Foods has closed shop, AgFunderNews has learned.

“Given challenges in the fundraising market, we’ve appointed an advisory firm to run a sale process,” said cofounder and CEO Joshua March.

“Given the nature of the process, I can’t really say much more beyond this,” added March, who has raised about $40 million to date from investors including British rock bank Coldplay, Andreesseen Horowitz, Valor Siren Ventures, BoxGroup, Entree Capital, and Prelude Ventures.

Founded as Artemys Foods in 2019 by March and Dr. Jessica Krieger (who left the following year), with Dr Kasia Gora joining in 2020 as cofounder and CTO, the startup rebranded to SCiFi Foods in 2022. The firm opened a pilot plant late last year growing beef cell lines in serum-free media in single cell suspension in a 500-liter bioreactor, in what it claimed was an industry first.

A pragmatic approach?

While cranking out 100% cell-cultured filet mignon steaks is not going to be commercially viable any time soon, March has argued that using cultivated cell biomass as an ingredient in plant-based burgers and sausages at an inclusion rates of 10% is commercially viable with existing technology.

Speaking to AgFunderNews last year, he said: “You can make a blended product commercially viable at an affordable price at relative scale using existing technology without needing crazy-scale bioreactors. I think you need genetic engineering and synthetic biology to get to that point, but still, it’s viable.”

He added: “We’re taking satellite cells from cow muscle and we’re using the power of synthetic biology [CRISPR gene editing techniques] to immortalize those cells and to get those cells grow in single cell suspension, and to make sure they have all the performance characteristics necessary so we can scale them. The cells are “partially differentiated,” and should be “seen as an ingredient,” he said. “We’re not trying to create tissue.”

Crunch time for cultivated meat

The last 18 months have been challenging to say the least for cultivated meat and seafood companies: Finless Foods made big cutbacks to conserve cash, New Age Eats shut up shop after running out of funds, GOOD Meat was sued by its bioreactor supplier over allegedly unpaid bills, and Omeat is now operating with a skeleton crew following a turbulent few months during which the founder stepped down as CEO.

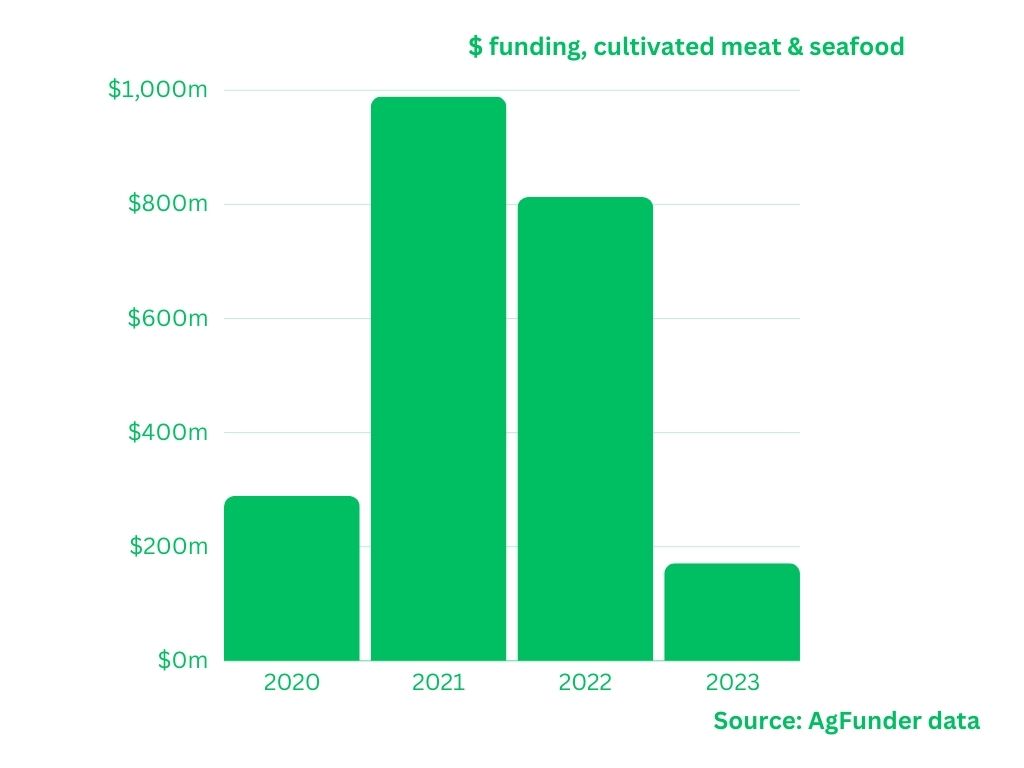

Meanwhile, AgFunder data show a dramatic decline in funding to the segment in 2023, with funding for cultivated meat startups peaking at $989 million in 2021, dipping slightly to $807 million in 2022 (bolstered by a $400 million round into UPSIDE Foods) and then dropping sharply in 2023 (-78%) to $177 million, against a backdrop of a -50% drop in agrifoodtech investing overall last year.

While the funding rounds were far smaller in 2023 vs 2022, investors placed a sizeable bet on Uncommon, a UK-based startup (formerly Higher Steaks) which netted a $30 million series A round led by Balderton Capital and Lowercarbon Capital to scale production of cultivated pork using patent-pending technology it claims gives it a competitive edge by speeding up the cell differentiation process.

Meatable, a Dutch startup that raised $47m in its series A in the heady days of 2021, raised a more modest $35 million in its series B round last year, while cultivated seafood startup BlueNalu netted $33.5 million to scale up production at its pilot facility in San Diego.

Investing in cultivated meat: ‘There’s just a general risk aversion’

In a panel session on investing in cultivated meat at the cell ag innovation day at Tufts University in January, Harris Komishane, general partner at agrifoodtech investor Meach Cove Capital noted that the current funding environment for cellular ag is not favorable.

“The IPO market has been locked up and there’s just a general risk aversion amongst companies, among VCs, to invest money. The good news is that these are largely cyclical issues. But at the sector level, there are other issues. There is a proliferation of companies doing the same or similar things, and many of these companies probably would not have gotten funded if funding wasn’t so available when interest rates were near zero. So there’s clearly going to be a shakeout from that, although that is also a cyclical thing that will pass.”

He added: “There are also a lot of challenges about scalability and getting to cost parity, which seems to be taking a lot longer than the VC world was hoping and expecting. There’s also an underdeveloped ecosystem, so a lot of the earliest startups in this space had to basically do everything soup to nuts because there was nobody to outsource things to.”

Further reading:

Crunch time for cultivated meat: ‘Probably 70-90% of players will fail in the next year’

Sponsored

Farmers ‘ready and willing to try’ biological crop solutions. Only ‘strong business models’ need apply