Data Snapshot is a regular AFN feature analyzing agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Food and ag tech startups in Europe raised close to $9 billion last year, according to the upcoming AgFunder Europe Agrifoodtech Investment Report, in collaboration with F&A Next, an AgFunder Network Partner.

While it was a record haul for the continent, it has fallen increasingly far behind the Americas — which are driven almost entirely by the world-leading US market — on around $24 billion, and Asia, where China and India dominate, on approximately $17 billion, according to AgFunder’s flagship AgriFoodTech Investment Report released in March.

That’s despite Europe almost matching Asia in terms of deal numbers – pointing to a market with plenty of dealmaking activity, but smaller ticket sizes on the whole.

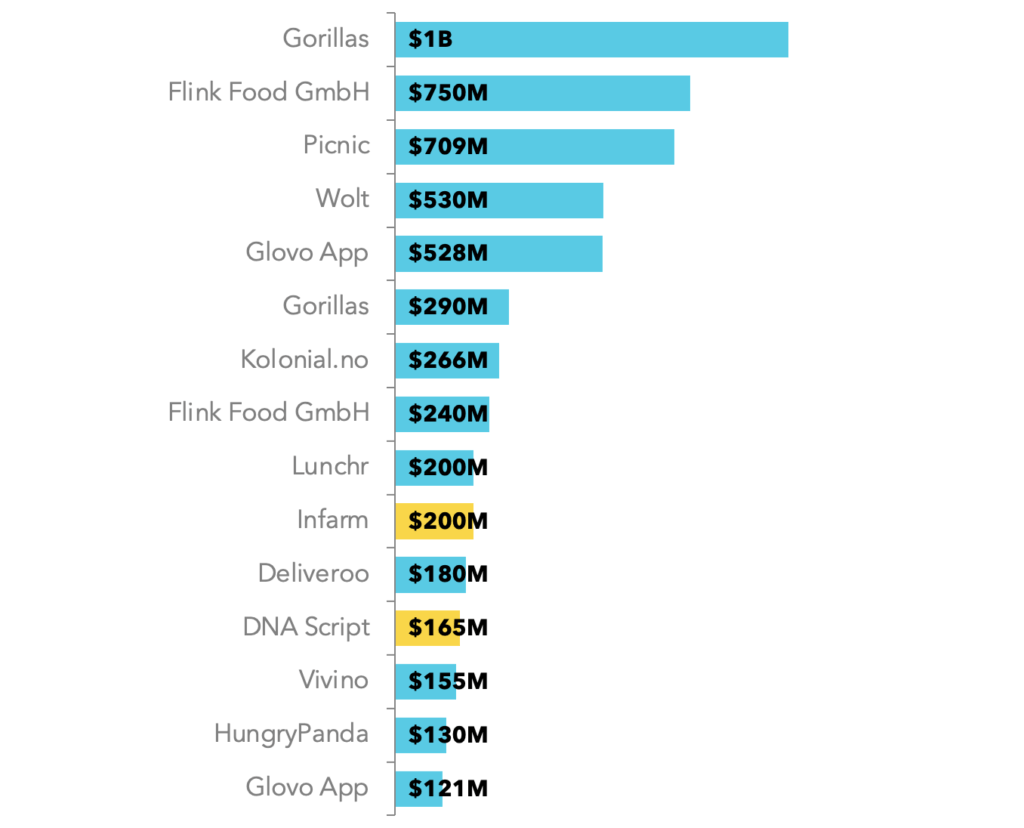

Top 15 agrifoodtech venture deals 2021, Europe

A much deeper dive on these trends will be exclusively revealed at the F&A Next 2022 summit, which is being held on May 18-19 next week in Wageningen, the Netherlands (you can grab yourself a last-minute pass here), before we release our full Europe 2022 report to the public in the following weeks.

In the meantime, I spoke to Kevin Camphuis (KC), co-founder at our Europe data partner ShakeUpFactory, for more insight.

What do the top 15 deals in Europe in 2021 tell us about the broader agrifood venture funding landscape?

KC: 2021 was the year of eGrocers and Restaurant Marketplaces; with most of the top 15 deals involving ‘quick commerce’ actors like Gorillas, Flink, or Picnic mobilizing over $3.5 billion and unicorns emerging almost from stealth. Beyond this delivery maze, Europe has experienced the fastest growth of every geography in 2021, with $9 billion raised in total. This vitality of entrepreneurship makes Europe weight for a quarter of all deals, but with an average deal size still much lower than US or China.

What were the key trends and developments in agrifood venture funding in your region in 2021?

KC: Europe is showing strong dynamics in all categories, with every country gradually consolidating its own diverse ecosystem of specialization. Year after year we see Europe consolidating its excellence in Novel Farming Systems, Innovative Food, and Ag Biotech – as well as some more niche areas like fintech for restaurants, or robotics for farmers or warehouses.

2021 has also confirmed the emergence of a solid ecosystem of European investors and stronger interest from international VC funds towards European startups – some of these funds having even setup dedicated teams in Europe.

What are your expectations for 2022?

KC: We’ll probably not experience the the same frantic investment activity around ‘quick commerce’ that we had in 2021. However, the necessary transformation of the whole food system and of its numerous local actors across Europe will sustain the emergence of more local startups – as well as the growth of its most prominent players.

2022 will also be the year of deployment of the new six-year European Common Agricultural Policy, adding more pressure on upstream actors to adopt new practices and technologies.