“We felt like we were doing a lot of things right. Only in retrospect [are there] a lot of lessons that we learned that I’d like to share and hope some of you can learn from the stuff that we experienced.”

Former VP Chris Cerveny was referring to his company — the now-defunct Fifth Season — when he said this onstage at Indoor Ag-Con earlier this year. But he might as well have been talking about the entire indoor agriculture industry.

It would take a sizable book to rehash the last 10 years of indoor agriculture, not to mention the litany of troubles the vertical farming and high-tech greenhouse industries have seen over the past 12 months. While this book has yet to surface, Cerveny’s point about learning from the past needs more attention nowadays as the indoor farming fallout continues against the backdrop of a larger tech downturn.

So-called futurists have historically scoffed at studying the past, with little room for it in the “move fast and break things” era. Thankfully, many don’t subscribe to that mindset.

“Understanding the past is something that will help us prepare for the future,” Agritecture CEO Henry Gordon-Smith wrote in 2021. “Unfortunately most of the newer entrants to CEA [controlled environment agriculture], whether farmers or investors, know little about the history of vertical farming.”

What follows is not an exhaustive survey of the last 10 years of indoor ag (though if anyone wants to team up on creating that, drop me a line.) But consider it a series of snapshots along a 10-year timeline, which we’re releasing in conjunction with AgFunder’s 10th anniversary, aided by AgFunderNews’ 10-year archive of articles and interviews on the industry, providing a glimpse into indoor ag’s last decade. And hopefully a look at what may come next.

A word on definitions: The CEA category typically includes systems outside the scope of this piece, like aquaculture and insect production. For the purposes of this piece, “CEA” and “indoor ag” are used interchangeably and refer to tech-enabled indoor crop production, typically of leafy greens and other produce.

Note on the data: All funding round data comes from AgFunderNews’ parent company, AgFunder.

Want more highlights from the last decade? Download the AgFunder 10-year e-zine here.

2014 – The year of the groundbreakers

Controlled environment indoor farming was very much niche in 2014, more associated with NASA and the cannabis industry than the future of the food system. Greenhouses, of course, had existed for decades, but tech-enabled operations were rare, and vertical farming as we know it today was only a couple of decades old.

AeroFarms was at the time planning its Newark, New Jersey facility, which the company said would grow 1.5 million pounds of lettuce a year — “enough to supply about 60,000 people without digging any earth or shoveling any manure.”

Another company fundraising that year was Atlanta, Georgia-based PodPonics, which was one of the earlier startups to talk about powering indoor farms with something other than electricity from the grid. While PodPonics itself didn’t last (the company went to bankruptcy court in 2016), the idea of powering indoor ag with renewable energy has lived on. It remains to a large degree an elusive goal for many today.

Top VC deals: 2014

| Company | Amount | Stage | |

| 🇬🇧 | Sundrop Farms | $100m | Late |

| 🇺🇸 | AeroFarms | $36m | B |

| 🇺🇸 | Gotham Greens | $8m | A |

| 🇺🇸 | BrightFarms | $4.9m | B |

| 🇺🇸 | PodPonics | $4.5m | A |

| 🇺🇸 | Freight Farms | $3.7m | B |

| 🇺🇸 | BrightFarms | $2.7m | B |

| 🇺🇸 | Grove | $2m | Seed |

| 🇬🇧 | GrowUp Farms | $1.8m | A |

| 🇨🇭 | CleanGreens Solutions SA | $1.4m | Seed |

2015 – Global ambitions — and challenges — take root

“The nature of the business means that we are always in capital raising mode,” Aerofarms then-CEO David Rosenberg told AgFunderNews at the time.

This was the year dialogue around the purported benefits of vertical farming — grow more in less space, 95% less water used, etc. — grew louder. AeroFarms itself said its facilities — for which it then had global ambitions — were 75 times more productive per square foot than a field farm, and 10 times more productive than hydroponic greenhouses.

But as AeroFarms and other industry players were discovering, all that equipment and technology needed energy to run, and required more and more capital.

Later in 2015, Indoor Ag-Con attendees also discussed the looming challenges the industry faced. Availability of funding was one. Others named finding talent as a major hurdle, and Viraj Puri of Gotham Greens warned that a lot of technologies being used lacked a commercially proven track record.

Top VC deals: 2015

| Company | Amount | Stage | |

| 🇺🇸 | AeroFarms | $20m | B |

| 🇺🇸 | BrightFarms | $16m | B |

| 🇺🇸 | Soli Organic | $8m | Late |

| 🇺🇸 | Crop One | $5.5m | A |

| 🇺🇸 | PodPonics | $3m | A |

| 🇨🇭 | Urban Farmers | $3m | B |

| 🇨🇦 | Harvest Urban Farms | $3m | Seed |

| 🇨🇭 | Urban Farmers | $2m | A |

| 🇺🇸 | PodPonics | $2m | A |

| 🇺🇸 | Grove | $1.7m | Seed |

2016 – The greenhouse vs. vertical farm debate begins

“We are not convinced that the energy and labor costs are low enough for indoor, vertical farming at this time,” Greg Oberholtzer, senior managing director at WP Global Partners, told AgFunderNews that year.

“You are paying for light that you can get for free. The rationale to go indoors is the lack of strategically-located arable land…but a high-tech greenhouse can also be located near the city, or even on a rooftop.”

Oberholtzer’s comments came shortly after BrightFarms, then the largest CEA operation in the US, had just bagged a Series C round. WP Global had been an investor in the company since 2014.

In other words, Oberholtzer had skin in the game, but his commentary highlighted a lot of inefficiencies in the straight vertical farming model and helped kick off the greenhouses versus vertical farms debate still alive and well today.

Top VC deals: 2016

| Company | Amount | Stage | |

| 🇺🇸 | BrightFarms | $32m | C |

| 🇺🇸 | Plenty | $24.5m | A |

| 🇺🇸 | Soli Organic | $20.5m | Late |

| 🇺🇸 | Solaris Farm | $11m | A |

| 🇺🇸 | 80 Acres Farms | $10m | Seed |

| 🇨🇦 | TruLeaf | $8.5m | B |

| 🇫🇷 | Agricool | $4m | Seed |

| 🇦🇪 | Badia Farms | $4m | Seed |

| 🇺🇸 | Iron Ox | $2m | Seed |

| 🇫🇷 | Prêt à Pousser | $2m | A |

2017 – ‘You will see us around the globe’

“I think people at the end of the day, as they look back three, five, 10 years from now, they’re going to be stunned at the rate that which more and more people around the world have access to fresh fruits and vegetables and a nutrient-rich diet in a way that they do not in 2017,” Matt Barnard, who co-founded Plenty, said in an interview on AgFunderNews’ podcast.

He was speaking of the promise of large-scale vertical farming operations like Plenty and their ability to provide “local” produce to consumers, who relied mainly on truckloads of greens shipped from California.

At the time, Plenty had “literally dozens of farms in different stages of development in different parts of the world,” according to Barnard. The company was also fresh off a $200 million funding round led by Softbank.

In response to a question about Plenty’s plans for the next year, Barnard said, “You will see us around the globe.”

He wasn’t the only one making global claims. AeroFarms said much the same thing that year at the time of its fundraise, though relatively new kids on the block, like Bowery, appeared to be more cautious.

“A rush to scale without being thoughtful can ultimately do more harm to a company than spending more time to make sure you’re ready to effectively and efficiently scale,” said Bowery CEO Irving Fain told us at the time.

Top VC deals: 2017

| Company | Amount | Stage | |

| 🇺🇸 | Plenty | $200m | B |

| 🇺🇸 | AeroFarms | $40m | D |

| 🇺🇸 | AeroFarms | $35m | C |

| 🇺🇸 | Bowery Farming | $20m | A |

| 🇺🇸 | Crop One | $13m | A |

| 🇺🇸 | Soli Organic | $10m | Late |

| 🇫🇷 | Agricool | $9m | A |

| 🇺🇸 | Bowery Farming | $7.5m | Seed |

| 🇺🇸 | Freight Farms | $6.5m | B |

| 🇨🇭 | CleanGreens Solutions SA | $6m | A |

2018 – Grower or tech company?

As happens with most technologies, the early years of the last decade were filled with companies spending millions on R&D just to build vertical farms. One might say a whole lot of reinventing the wheel happened by necessity.

Mid-way through the decade, that started to change. No longer required to build everything themselves, indoor ag companies began to face a choice: grower or technology provider?

“In a gradually maturing industry, companies will necessarily need to focus on the primary scope of their business if they want to be successful. That means growers will grow and sell produce while their suppliers will develop and provide the required technology,” Urban Crop Solutions’ Pieter De Smedt wrote on AgFunderNews at the time.

As if on cue, Intelligent Growth Solutions (IGS)* launched a first demonstration that year of the vertical farming technology it would provide to growers, rather than trying to be both grower and technologist. At the time, IGS had invested a mere £7 million in R&D.

*Disclosure: AgFunderNews’ parent company AgFunder is an investor in IGS.

Top VC deals: 2018

| Company | Amount | Stage | |

| 🇺🇸 | Bowery Farming | $90m | B |

| 🇺🇸 | BrightFarms | $55m | D |

| 🇳🇱 | Future Crops | $30m | Seed |

| 🇨🇦 | GrowForce | $29m | A |

| 🇺🇸 | Gotham Greens | $29m | C |

| 🇫🇷 | Agricool | $28m | B |

| 🇩🇪 | Infarm | $25m | A |

| 🇺🇸 | Living Greens Farm | $12m | A |

| 🇺🇸 | Edenworks | $4m | Seed |

| 🇨🇦 | Inno-3B | $4m | Seed |

2019 – Year of the mega-round

By 2019, the days of struggling to find capital were long gone for indoor ag — a point solidified by the multi-million rounds leading VC funding.

Size was everything, it seemed, from Kalera breaking ground on the Southeast’s ‘largest’ indoor vertical farm to AppHarvest’s 60-acre greenhouse in the works.

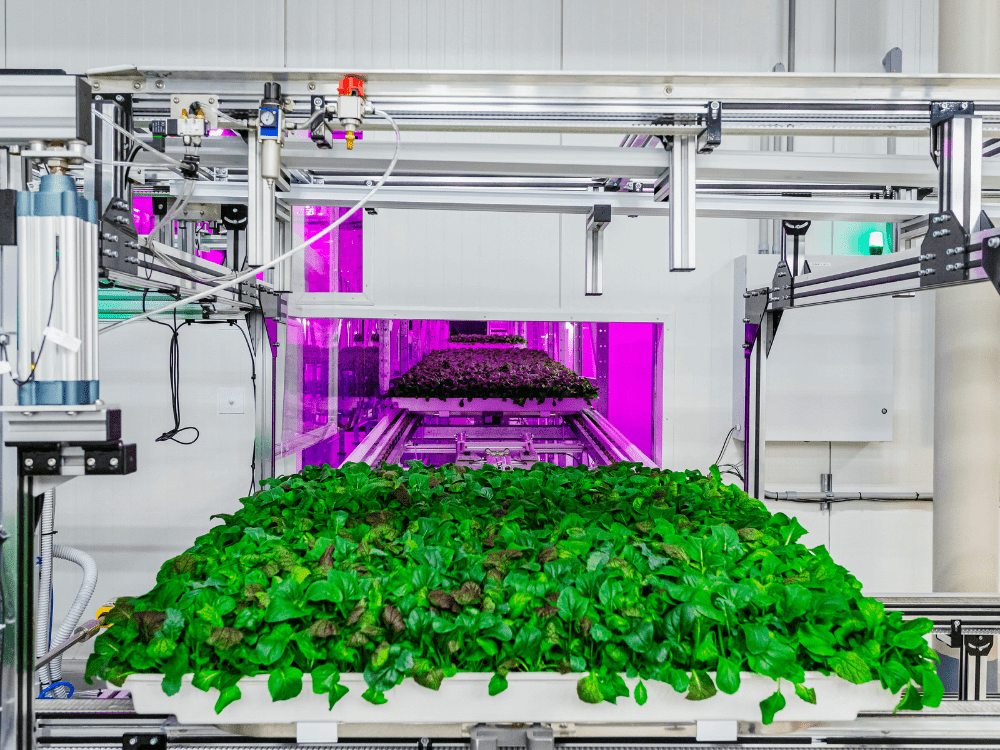

Perhaps a more interesting development at that time, however, was the rise of automation in CEA. Fifth Season emerged from stealth with its robotic vertical farm, promising to reduce labor costs via automation.

“Traditional vertical farms have anywhere between 40% to 60% in labor costs,” co-founder and CEO Austin Webb told AgFunderNews. “At the full-scale vertical farm we are about to launch in Braddock we are down to 20%. With traditional vertical farming, labor by itself has been more expensive than the total, fully-delivered cost of field-grown produce.”

That year, 80 Acres debuted its own automated vertical farm, and Iron Ox was gaining attention for a robotics-based indoor farming setup, too.

Top VC deals: 2019

| Company | Amount | Stage | |

| 🇺🇸 | Plenty | $175m | C |

| 🇩🇪 | Infarm | $100m | B |

| 🇺🇸 | AeroFarms | $100m | Late |

| 🇺🇸 | AppHarvest | $97m | A |

| 🇨🇦 | Sunens | $63m | Debt |

| 🇺🇸 | Bowery Farming | $50m | B |

| 🇺🇸 | 80 Acres Farms | $40m | Late |

| 🇺🇸 | Fifth Season | $35m | B |

| 🇺🇸 | Iron Ox | $20m | A |

| 🇺🇸 | Solaris Farm | $20m | B |

| 🇺🇸 | Edenworks | $15m | Seed |

2020 – Vertical farming for the lock-down era

At the very end of 2019, appliance maker Miele acquired vertical farming company Agrilution, calling the concept an “elegant solution for kitchens.” Consumer electronics giant LG said it would show off a vertical farming kitchen appliance at CES 2020.

While Miele and LG could hardly have predicted the Covid-19 lockdowns that followed shortly thereafter, there’s nothing coincidental about the rush of “at-home vertical farming” startups that cropped up soon after.

From Aspara’s countertop farm selling in Home Depot to Natufia’s $13,000 “kitchen garden,” these startups promised year-round produce grown pesticide-free and from the convenience (or safety) of one’s own kitchen. Supply chain delays and food security/sovereignty concerns no doubt fueled enthusiasm here.

Outside the home, 2020 was a busy year for other indoor farming startups. Notably, AppHarvest emerged on the scene, boosted by support from the likes of Martha Stewart and J.D. Vance of Hillbilly Elegy fame.

“We believe there needs to be a new standard for agriculture,” said AppHarvest founder Jonathan Webb. “It’s heart-wrenching to see what is happening on farms across our country right now. We are willing to take a lower profit margin in order to pay a living wage, provide paid time off, access to healthcare, and give every employee a path to ownership in the company.”

Top VC deals: 2020

| Company | Amount | Stage | |

| 🇩🇪 | Infarm | 170m | C |

| 🇺🇸 | Plenty | 140m | D |

| 🇺🇸 | BrightFarms | 100m | Late |

| 🇺🇸 | Revol Greens | 68m | Late |

| 🇺🇸 | Soli Organic | 55m | C |

| 🇺🇸 | Gotham Greens | 45m | Debt |

| 🇺🇸 | Gotham Greens | 42m | D |

| 🇺🇸 | 80 Acres Farms | 40m | A |

| 🇺🇸 | Soli Organic | 39m | Late |

| 🇺🇸 | Unfold | 30m | A |

2021 – Year of the SPAC

In the first half of the year, Bowery landed what was then the biggest funding round to-date for an indoor farming company.

“I think it’s becoming very clear that the demand for what we’re doing at Bowery is strong and the technology and the progress that we’ve made is really evidence [of that] to the team and the broader community,” founder and CEO Irving Fain said at the time.

Optimism ran high that year, propelled by several more mega-rounds and a few players announcing plans to go public via special-purpose acquisition companies (SPACs), including AeroFarms and Local Bounti.

AppHarvest had arguably the highest-profile deal of the year, completing its SPAC merger with Novus Capital early in the year. AppHarvest at the time said it would have 12 indoor farms running by 2025. To boost its technology, the company acquired robotic harvesting startup Root AI that year, too.*

But what goes up must come down, as the old saying goes, and 2021 ended lower than it started when AeroFarms announced it was terminating its SPAC deal. Shortly after, Agritecture’s Henry Gordon-Smith wrote that vertical farming was headed for a trough of disillusionment:

“The bottom line is that these big farms are struggling to pay back their investors simply because they are running incredibly complicated operations that take time and precision to scale,” he noted in a guest article on AgFunderNews that went viral.

*Disclosure: AgFunderNews’ parent company, AgFunder, was an investor in Root AI.

Top VC deals: 2021

| Company | Amount | Stage | |

| 🇺🇸 | Bowery Farming | $320m | C |

| 🇺🇸 | Local Bounti | $200m | Debt |

| 🇩🇪 | Infarm | $200m | D |

| 🇺🇸 | 80 Acres Farms | $160m | B |

| 🇺🇸 | Edenworks | $122m | B |

| 🇺🇸 | Soli Organic | $120m | Late |

| 🇩🇪 | Infarm | $100m | C |

| 🇺🇸 | Little Leaf Farms | $90m | A |

| 🇦🇪 | Pure Harvest Smart Farms | $64.5m | B |

| 🇬🇧 | Intelligent Growth Solutions | $57m | B |

2022 – The Trough of Disillusionment

Looking at 2022’s top deals, one would be forgiven for thinking the industry wasn’t in the middle of a massive correction. In reality, the mega-raises a la Plenty, Bowery and others happened mostly at the start of 2022, as did developments like Kalera’s proposed SPAC merger.

Even casual observers of agtech know what happened next: a tech industry-wide downturn commenced, popping inflated valuations in the wake of war, inflation, lingering supply chain issues and myriad other factors. Under tough macro conditions, investor sentiment for vertical farming waned as the industry sank into Gordon-Smith’s predicted trough.

Agricool went into receivership. Infarm laid off half its staff and exited markets. Fifth Season closed up shop. These are just a few among many setbacks that characterized the industry in the latter part of the year.

“I think it’s fair to say that investors bear some of the responsibility for where the sector is because investors came in at valuations which I think were extremely high and may not have been representative of where these companies were,” Adam Bergman, global head of agtech investment banking at Citi, said in a recent conversation with AgFunderNews.

“A lot of where we are today is because companies in many regards raised too much money focusing on scale, rather than focusing on how they were going to achieve profitability.”

Top VC deals 2022

| Company | Amount | Stage | |

| 🇺🇸 | Plenty | $400m | Late |

| 🇺🇸 | Gotham Greens | $310m | Late |

| 🇺🇸 | Little Leaf Farms | $300m | B |

| 🇺🇸 | Bowery Farming | $150m | Debt |

| 🇨🇦 | Goodleaf Farms | $150m | Late |

| 🇬🇧 | GrowUp Farms | $136m | Late |

| 🇺🇸 | Soli Organic | $125m | D |

| 🇰🇷 | ioCrops | $70m | A |

| 🇳🇱 | PlantLab | $57m | Late |

| 🇺🇸 | Soli Organic | $50m | Debt |

2023 – One man’s Trough is another’s S-curve

“To me, it was very clear that a lot of these companies weren’t going to make it or recoup that investment,” Gordon-Smith tells AgFunderNews. “I think the belief was betting on the technology — that diversification of crops and talking about the uniqueness of the technology — was a big part of the appeal. It was all very muddy to me, rushing, herd mentality.”

Or to use the vernacular, there was a whole lot of FOMO among investors that didn’t wind up paying off.

“When one takes a step back, one of the things they need to realize is most of these companies are not what we would call tech companies,” adds Citibank’s Bergman. “They’re much more [like] industrial companies. And from that perspective, it’s really important to understand the type of profitability that they can achieve.”

The market correction for indoor ag has been the central storyline of 2023. AppHarvest, AeroFarms and Kalera have all filed for Chapter 11 bankruptcy protection. Most recently, news of layoffs at Bowery surfaced.

But there are also those who believe we’re in something more complex than a run-of-the-mill trough on the Hype Cycle.

“This is a bit of a bump on the S curve, not a trough of disillusionment, and we’ll get past it,” EY food & agribusiness leader Rob Dongoski says. (AeroFarms certainly thinks so as it recently emerged from Chapter 11 with a new CEO and grand plans for the future.)

He suggests a focus shift is now needed: “A lot of the folks [in indoor ag] are enamored with the uniqueness of how they produce, but consumers don’t really care if it was grown in a greenhouse or a vertical farm. They care about fresh, local, pesticide-free. That starts with taste and affordability.”

Oishii, which has made a name for itself growing ultra-premium strawberries indoors, says it hasn’t spent a dime on leafy greens. Having already taken a page from the history books, founder Hiroko Koga claims the fallout now happening was completely predictable.

“I saw this whole cycle in Japan 10 years ago. In the early 2000s, Japan had a few hundred vertical farms across the country — probably more than the number of vertical farms that exist today in the US. Almost all of them closed. People thought it was a fascinating technology, but they realized that the unit economics didn’t work.”

Top VC deals 2023

| Company | Amount | Stage | |

| 🇺🇸 | Local Bounti | $145m | Debt |

| 🇨🇦 | Goodleaf Farms | $78m | M&A |

| 🇺🇸 | AeroFarms | $71m | Grant |

| 🇺🇸 | AppHarvest | $40m | C |

| 🇦🇺 | Stacked Farm | $27m | |

| 🇮🇹 | Planet Farms | $19m | Debt |

| 🇬🇧 | Intelligent Growth Solutions | $15m | B |

| 🇫🇷 | Futura gaia | $12m | A |

| 🇮🇩 | Beleaf | $6.8m | A |

| 🇺🇸 | Greenswell Growers | $ 6.3m |

Now what?

It bears remembering that the so-called failures of the industry are one piece of a much bigger narrative about indoor ag and the food system in general.

Consider food security. Pandemic-era supply chain disruptions left us in no doubt about modern food production’s vulnerability in the face of global crises. The Ukraine war and interest rate hikes affirmed this vulnerability.

Meanwhile, climate change advances, with extreme weather events, declining soil health, and increasingly inhospitable environments, threatening the planet’s future ability to grow crops. Projections from the United Nations expect a “significant decline” in global yield trends for both maize and wheat because of climate change. And depending on the location, various crops other are under threat, including coffee, cacao, potatoes, rice, and strawberries.

Indoor ag is emphatically not the so-called “magic bullet” to these concerns particularly in commodities like wheat. But it may make sense in some locations or provide a venue where researchers can find new ways to cultivate staple crops.

Case in point: UAE-based consortium ReFarm’s deal with Food Tech Valley to build a circular, closed-loop “GigaFarm” to boost the country’s food security and decarbonize its food industry. IGS’ vertical farming technology is one of the technologies powering that project.

“I think we have switched from ‘what kind of crops can be grown indoors’ to ‘how can we make efficient systems to grow any crops indoors,'” explains Paul P.G. Gauthier, a professor of protected cropping at Queensland Alliance for Agriculture and Food Innovation.

“Vertical farming research has been misguided for years by thinking they needed to focus on genetic improvements. While this is part of the solution, research should have focussed on energy efficiency. Because they missed the point; many companies went to excess automation, leading them to higher energy costs and less profitability. We are now seeing more simple systems coming up and they are usually the most profitable ones.”

Gauthier suggests a future focus should be on plant responses to indoor farming systems, where he says research is “still in its infancy.”

“Plant science research has been focusing on the impact of drought, temperature or CO2 on plants as part of climate change,” he says. “Now we need to look at the impact of stable, optimized environments on plant productivity. Light, temperature, CO2 or water used to be a limitation for plants; now we can maximize [them], but we have never experienced how plants respond to constant light intensity, temperature, very high CO2 etc.”

Another use of indoor ag is raising seedlings. IGS, for example, has grown seedlings for potatoes, broccoli, strawberries, and trees in the past, providing them with optimal growing environments when they are are at their most vulnerable stage.

Our colleagues on the investment team at AgFunder are certainly excited about developments at IGS, which expects to make some big announcements at COP28 in Dubai next week.

‘There are plenty of reasons to be optimistic’

“The fundamentals behind CEA are still there,” says Gordon-Smith. “Using water smarter, using less arable land, the mass of consumers that care about this subject and are willing to pay a little bit more — these drivers still exist.”

“This is going to be difficult; what comes afterward is that we’ve got smarter investors, more watchful eyes from journalists, more interest from stakeholders,” he adds.

“When people often get overexcited, the highs are never as high and the lows are never as low,” says Bergman. “The reality [for vertical farming] is, it was never as high as the high and it’s definitely not as low as the low.”

Success in the sector, he says, will be predicated on two components: companies producing with positive unit economics and retailers believing indoor-grown produce is “a valuable component of the product mix.”

And 2023 has included a fair share of positive milestones despite the ongoing turbulence.

Cibus, which backed AeroFarms in the past, recently acquired Duijvestijn Tomaten BV, a Dutch greenhouse company that grows tomatoes in glasshouses powered by green energy, including geothermal. Freight Farms, which operates a network of container farms around the US, announced its plans to go public via SPAC. Oishii CEO Rita Hudetz says she’s “never been more confident about the future of vertical farming.”

“The CEA space is interesting and challenging, but absolutely the direction the industry needs to go in,” adds Local Bounti CEO Anna Fabrega.

In a kind of hat-tip to the early moves of the last decade, she highlights the importance of “the desire to innovate on behalf of the customer.”

“There’s being willing to be the first, which is really hard to do and you see it in the market now. You’re frequently misunderstood and constantly having to explain what it is that you’re doing, why it’s different, why it’s better for customers and better for the planet.”

“There are plenty of reasons to be skeptical of CEA’s future but there are many more to be optimistic,” notes Gordon-Smith. “The abundance of experienced talent, the rise of incentives and policies, and the underlying drivers that demand we grow smarter. I predict that all of these drivers will push novel CEA out of the trough of disillusionment and into the plateau of enlightenment in late 2024. So, now is the best time to plan your next move.”