Henry Gordon-Smith is CEO at Agritecture, an urban farming consultancy based in New York, US. The views expressed in this guest commentary are the author’s own and do not necessarily reflect those of AFN.

It’s October 15th, 2021 and my phone starts blowing up: “Did you see this!?” asks one vertical farming executive in a text. “AeroFarms’ SPAC fell through!” another journalist slides into my DMs, referencing the plan for the New Jersey-based vertical farming business to list on the Nasdaq stock exchange via a Special Purpose Acquisition Company.

An hour later, I get an email from an investor reviewing a strategy proposal we’d sent them about making large investments into the Controlled Environment Agriculture (CEA) sector. “Based on the underperformance of AppHarvest [a SPAC-listed CEA company whose stock has dropped significantly after poor Q1 results] and AeroFarms, we will not be investing into the sector as planned,” it read. “This industry is not ready for public markets.”

It was like time stopped and suddenly everyone was questioning the economics of novel farming systems, including high-tech greenhouses and vertical farms. Is this the end? Where do we go from here?

Granted, the termination of AeroFarms’ SPAC could have as much, if not more, to do with the volatility of the public markets. And public companies often miss their sales projections like AppHarvest did. But the news happened to coincide with a broader concern I’ve had about the progression of the CEA sector in recent months, so I decided to dig a little deeper.

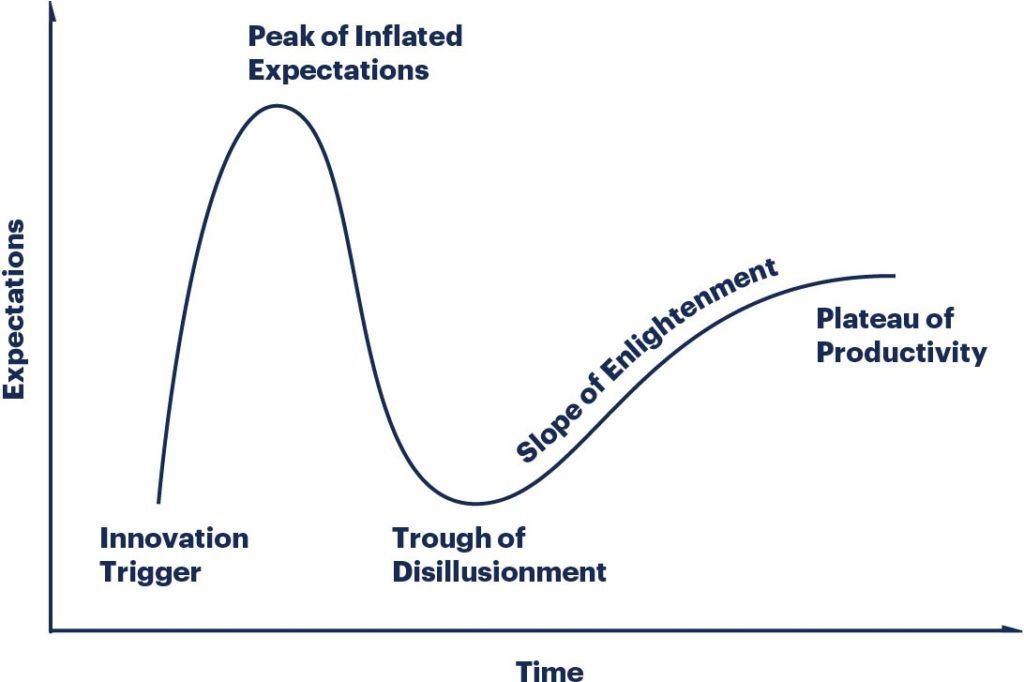

The Gartner Hype Cycle might shed some light on how this will all play out. I hope that placing the CEA sector in the context of this long-established pattern for industry growth cycles, matched with my own 10 years of CEA experience, might help us all be better prepared for what’s coming next.

According to Gartner, “Hype Cycles offer a snapshot of the relative market promotion and perceived value of innovations. They highlight overhyped areas, estimate when innovations and trends will reach maturity, and provide actionable advice to help organizations decide when to adopt.”

The Gartner Hype Cycle

A short history of CEA

So let’s begin with a short history of how we got here. The best way to investigate is to focus on vertical farming because it represents the most “extreme” form of CEA. Understanding the past is also something that will help us prepare for the future and unfortunately most of the newer entrants to CEA, whether farmers or investors know little about the history of vertical farming.

Vertical Farming is the practice of growing food and/or medicine in vertically-stacked layers, vertically inclined surfaces, and/or integrated into other structures. It uses technology to control all environmental factors that contribute to crop yield, quality, and consistency, such as lighting, climate control, and fertigation. This high level of technology means it carries significant transformative potential, but also increases the risk of being over-hyped as a panacea to humanity’s food system woes.

The first vertical farms were more visionary than they were practical. The sector was carried forward by research, with players like NASA in the game. Profitability wasn’t the objective, which was a good thing as costs were astronomical. The economics of lighting and providing energy for a farm system meant this was something for the future. But, thanks to rapid advancements in technology, by 2021, many aspects of vertical farming have improved.

For one, the underlying technologies of vertical farming, including lighting, automation, climate control, and processing, have advanced significantly, reducing the very high capital costs of these novel farming methods.

Secondly, consumer and retailer interest in local and pesticide-free leafy greens has continued to grow, driving demand and sales, as well as premium price points. Companies like Little Leaf Farms and Bowery Farming are leading sales in North America with their greens in thousands of stores already. Vertical farms are popping up all over the world, but nothing has matched the amount of money and interest pouring into the US market where companies such as Plenty, AeroFarms, and Bowery have raised hundreds of millions of dollars each from investors including Google, Jeff Bezos, and SoftBank.

Finally, the macro-level drivers for CEA, which include the impact of supply chain disruptions, climate change, and food safety concerns, are leading impact-driven investors and climate-sensible policymakers to back the sector.

That’s the good news.

The bad news is that these farms are still incredibly expensive to build and, while demand is rising, the sector is still immature in its capacity to build large farms on time and deliver on projected unit economics. This brings into question how fast vertical farming can responsibly grow, by the number of farms and by farm size.

Recent AgFunder data point to a decrease in the number of deals closing in the Novel Farming Systems category. Jack Ellis reports that this could be down to waning interest in early stage startups in indoor agriculture. Read more here.

Going big makes a lot of sense for these businesses: they get the best economies of scale, they can form unique partnerships with equipment/technology suppliers, and they can unlock generous economic development incentive packages from local governments through their job growth narratives. Venture capital backers want them to go big, always targeting outsized returns for their funds, otherwise they’re less interested.

The operational challenge

But as every vertical farm or greenhouse operator will tell you over a beer and outside of the board room, operations are a real challenge, and learning to manage them effectively takes time, justifying a responsible, incremental scaling approach over a “move fast and break things” hyper-growth, Silicon Valley mentality. Where investors see these farms as factories filled with exponential technologies, operators have to deal with complex and varied business operations covering production, food safety, hiring & training, sales, and distribution.

It is important to remember that vertical farms and local greenhouses often handle every part of the business from training entirely new teams of employees to developing fleets of trucks to distribute locally. The logistics are more complicated than meets the eye and are in stark contrast to traditional farming models, which rely on cheap labor, subsidies on land and water, and outsourced marketing and sales.

The outside world sees shiny brands, cool tech, and delicious, fresh products; on the inside, these farms experience chaotic days and often much more wasted product than meets the eye in the first years of operation.

The bottom line is that these big farms are struggling to pay back their investors simply because they are running incredibly complicated operations that take time and precision to scale.

Another challenge is that as big CEA businesses get more money and pressure to outperform one another, they become less collaborative and even secretive. Data sharing is actually relatively common in the CEA sector until the farms raise any significant amount of money, and then they become closed off. On the one hand, this serves to protect IP and investors’ interests, but on the other hand, it stifles innovation and learnings at an industry level. Even companies that hire dozens of ex-Tesla engineers to re-invent agriculture will face a rude awakening: despite all our efforts, agriculture simply takes time. During that development time, benchmarking your performance relative to others and gaining new insights to help you leapfrog is critical but is largely missing from the well-funded companies of the CEA sector.

Hype is the enemy

“This is what sustainable agriculture looks like,” one large-scale vertical farm operator’s newest TikTok video says while a fresh-faced staff member speaks in front of a green screen of their mega vertical farm filled with lights and microgreens. On another operator’s website, they claim to reduce the carbon footprint of food by growing food closer to the customer; this is ‘greenwashing’ as it sidesteps the fact that the transportation footprint of sending greens from California to New York pales in comparison to the carbon footprint of a vertical farm on the outskirts of NYC powered by non-renewable energy sources. No mention of that on their website, of course, just more hyperbole about saving water and being the future of farming mostly.

It is no wonder why, according to our 2021 Global CEA Census, 70% of farming operators agreed that CEA is “susceptible to excessive greenwashing.”

And what about growth plans? So many farms have announced major expansion plans around the world that have never materialized. It’s difficult to scale companies and teams that can’t make the underlying economics of large-scale CEA work. It’s not that it won’t work; it’s often that they need more time than venture capital timelines allow for.

Most of the entrepreneurs I work with who are starting CEA facilities have no past experience in agriculture. Our 2020 Global CEA Census showed just that: 49% of operators had zero years of prior farming experience, and 73% of them would opt to change the equipment, technology, or crops they selected if they could go back in time. But they can’t go back in time; their farms are some of the most expensive per acre on Earth, and so the only path is continuing to charge forward rather than correct a mistake with more investment.

I have really tried in my CEA career to be a voice of reason to balance the hype. I strive to be honest with my clients at events and through our blog. I wish I could say it has done more but it’s been relatively futile. Investors are driven by FOMO (fear of missing out) and operators know that, which is why so few discuss the weaknesses of the sector and instead continue hyping it up. It becomes a herd mentality — everyone rushing to get a piece of the pie rather than focusing on solving underlying issues. Presenting vertical farming as a panacea — “vertical farming will feed the world” — is an easier sell to journalists and investors than admitting that it’s a small but important part of the future of agriculture.

If big and fast investment dries up, there is no future for the sector after all, right?

Wrong.

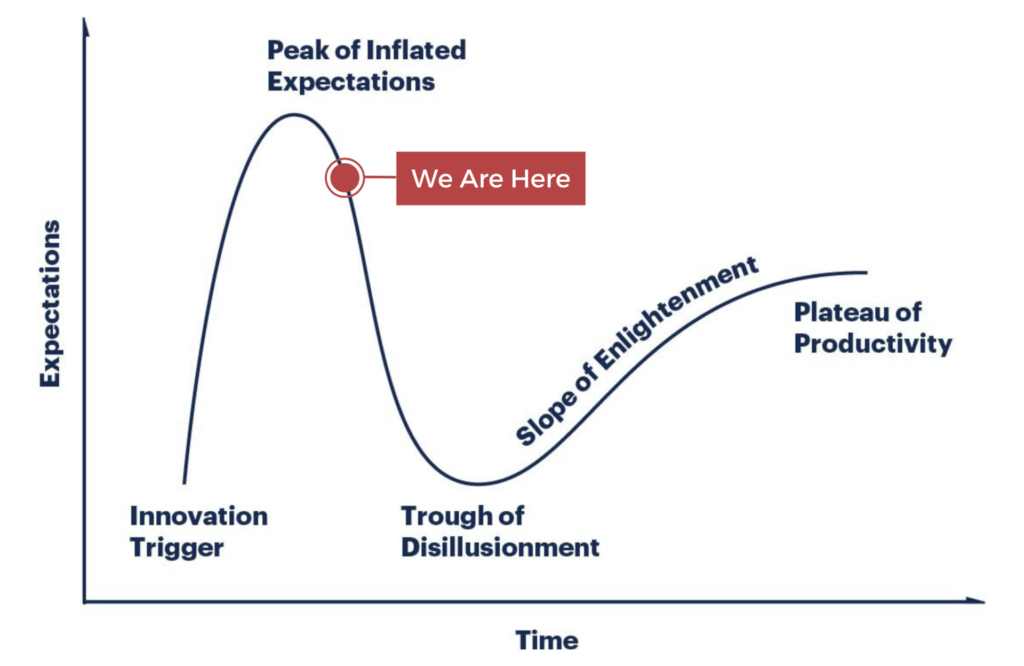

There is a different way to look at anti-hype thinking, which brings us back to the Gartner Hype Cycle.

Where do we go from here?

With one of the oldest and biggest vertical farming companies failing to go public and an already-public greenhouse behemoth missing its revenue projections, it’s safe to say we have passed the Peak of Inflated Expectations.

Just look how Gartner itself defines this stage: “A wave of ‘buzz’ builds and the expectations for this innovation rise above the current reality of its capabilities.” Sound familiar?

What comes next is a period of depression and correction.

That sounds awful but depending on how you look at it, this could be a good thing. Only the smart will survive and, at this stage, “impatience for results begins to replace the original excitement about potential value. Problems with performance, slower-than-expected adoption or a failure to deliver financial returns in the time anticipated, all lead to missed expectations, and disillusionment sets in.”

For investors who have held out or spread their risk across the sector, they will see a new industry chapter where mergers and acquisitions occur and a more honest and mature discussion on the present-day realities of CEA emerge. They will see more honest valuations, healthier economics, better-planned facilities, and responsible growth plans. There will be big opportunities for investors to get in with startups that have benefited from how the underlying technologies have advanced, have access to more available talent seeking a stable employer, and have observed the mistakes of the industry’s pioneers.

Now some of you might claim that this stage has already passed. Tens of millions of dollars have been lost already and countless CEA operations closed. But I disagree: the wider, more honest discussion about CEA has still not happened yet.

Most still claim to be sustainable, profitable or feeding the world when it’s unlikely that they are any of those things.

The trough of disillusionment has not fully begun.

We will need to see how investors react to the range of SPACs coming in the next 12 months and how incumbent operators weather the storm ahead.

CEA is here to stay

I, for one, remain very excited and optimistic about the future of vertical farming and high-tech greenhouses given the underlying fundamental drivers of climate change and consumer demand for quality are accelerating. There is also a part of the sector focused on collaboration. The CEA Food Safety Coalition has found common ground between large greenhouses and vertical farming operators to work together and contrast their clean greens to consumers and policymakers. The NYC Agriculture Collective has teamed up with big, small, and non-profit operators to guide the passing of NYC’s first urban agriculture bill. In the UK, Urban AgriTech (UKUAT) has brought together groups of novel farmers to fund special projects.

Some companies are already set up to adapt and thrive through the hype. Farm One, with more of a distributed small farm model, is mighty in its margins and deep commitment to transparency and sustainability. Smallhold just raised $25 million for its unconventional approach to vertical farming mushrooms, which have impressive yields and lower operating costs. Dream Harvest is 100% renewable-powered and pioneering carbon-negative vertical farming. Heron Farms grows novel crops too and offsets the energy demands of its farm by restoring wetlands where it operates. Vertical Harvest is scaling up its social-entrepreneurial model of commercial vertical farming with a focus on community impact. Intelligent Growth Solutions, which just raised $58 million, is rapidly scaling up its technology-as-a-service model, deploying vertical grow systems for some of the largest vertical farming companies globally.

All around the world, I meet entrepreneurs, corporations, and policy-makers passionate about making CEA work for a world filled with supply chain and climate change threats. The future is bright for CEA but making that future a reality starts by moving beyond the hype towards an honest discussion about what is and isn’t working in CEA.

Editor’s note: Henry Gordon-Smith is a sustainability strategist focused on urban agriculture, water issues, and emerging technologies. Henry earned his BA in Political Science from the University of British Columbia, Vancouver, coursework in Food Security and Urban Agriculture from Ryerson University in Toronto, and an MSc in Sustainability Management from Columbia University. In 2014, Henry responded to a global need for technology-agnostic guidance on urban agriculture by launching the advisory firm Agritecture Consulting, which has now consulted on over 150 urban agriculture projects in more than 35 countries. The views expressed in this article are Henry’s and do not necessarily represent those of the AFN editorial team or AgFunder at large.

You can read more about how Agritecture is trying to accelerate a more honest sustainability discussion in CEA here: www.agritecture.com/sustainability

Disclosure: Henry is an advisor to Smallhold and was a co-founder of the NYC Agriculture Collective. Farm One, Dream Harvest, and Bowery Farming have been previous clients of Agritecture.

Disclosure: AgFunder, AFN’s parent company, is an investor in Intelligent Growth Solutions. Read more about the company here.