Editor’s note: Aaron Magenheim is CEO at AgTech Insight, an agriculture technology consultancy based in Salinas, California, US.

As my focus turned from our family irrigation business to founding AgTech Insight in 2014, I soon found myself spending much of my time visiting and advising agriculture, tech, and business leaders from around the globe.

Among the most promising opportunities I have seen in this time are in South American countries. In particular, Argentina, Brazil, Colombia, and Peru are all relatively large markets and focus on growing many of the same key crops we have in the US – though on opposite growing cycles, given they are in the Southern Hemisphere.

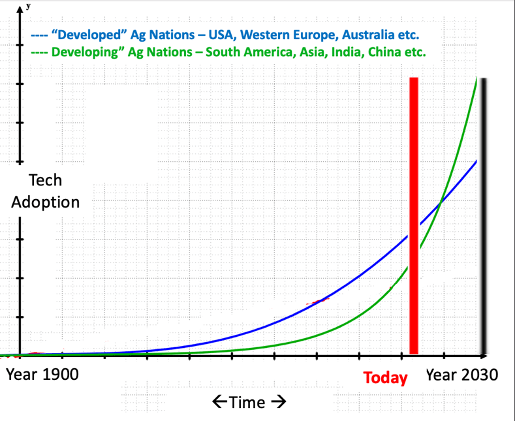

So why South America? There, farmers and agritech entrepreneurs have seen the value of agricultural technology as it became mainstream elsewhere, and rapidly embraced it.

They have leapfrogged the decades-long technology learning curve we had to endure in the US, and fully leverage digital communication tools like WhatsApp, Facebook, TikTok, and other social media – both for their businesses, and in their everyday lives in general.

This simple graph highlights current growth and adoption curve projections:

So what does this mean for US agritech entrepreneurs more broadly?

- In South America, they are starting with a clean slate, and working with prospective customers who already embrace technology. When talking to a South American farmer about the advantages of using more technology, they are already more open to integrating such solutions into their operations.

- With an opposite growing season to the Northern Hemisphere, a US agtech provider can not only create year-round income, but also has two chances every year to get feedback and make improvements to their solution.

- Farmers and agribusinesses in South America typically work closer together and share ideas amongst themselves with an attitude of ‘a rising tide lifts all boats.’ With South American exports growing, they work together to compete in these markets, instead of looking at their neighbor as the main competition. These open relationships allow an agtech provider to scale quicker by word of mouth and digital or social media.

- There’s less competition than back home. While entrepreneurship is growing at an incredible pace, the amount of companies working in agtech throughout South America is a fraction of that in the US. This means that US providers can concentrate on selling their idea and solution itself, instead of trying to make the case that their company is ‘better than the other 20 companies which do the same thing.’

- Lower cost of doing business. While the pricing structure for agtech in South America is often lower than for average sales in the US, almost all of business, customer acquisition, and support costs are typically 50% to 70% less than similar activities back home.

The result is for US entrepreneurs is increased farmer interaction driving usability, much quicker adoption, finding their ‘dollars and cents’ value proposition, lower cash burn rate, and improved EBITDA.

Let’s dive into some of the more specific reasons I believe these four countries present excellent opportunities for US agtech providers:

Argentina

Despite massive annual inflation year-on-year and several economic, trade, and political challenges, I have met more farmers and agribusiness professionals who travel to learn how to improve their operations from Argentina than anywhere else in the world. In agricultural terms, much of Argentina looks like a carbon copy of the US Midwest, growing corn, soy, wheat, and — of course — beef.

Most well-known, broad-acre row crop tech companies like Climate Corp, Granular, Conservis, FBN, and Farmers Edge have not made any big moves to South America, so farmers don’t have access to the tools farmers farther north are starting to utilize.

Argentina also has a thriving specialty crop industry, trailing the US by only 8% in wine grape acreage. They also have lots of citrus, nuts, and other permanent crops.

We have also seen the rise of many accelerators, investors, and events in the region like Glocal, Nesters, NXTP Labs, The Yield Lab LatAm. Club AgTech is a strategic partner of AgTech Insight and it works at the forefront of the agritech movement in Argentina, building and connecting the national ecosystem to the world.

Peru

When I first visited the Lima region in August 2018, I was instantly reminded of California’s central coast. That’s reflected in its agricultural output.

Peru has become the world’s largest exporter of asparagus. Blueberries are a more recent success story, and in the past five years the country has become the second largest exporter of the fruit globally. It’s also a top producer and exporter of avocados, coffee, mango, table grapes, quinoa, and many more specialty crops.

The agritech support system in Peru is less established than other South American countries, so along with our Peruvian partners we have started an agrifoodtech incubator and accelerator, ACM Ventures, to help with building out the country’s ecosystem.

Colombia

This country has a deep-rooted food culture, a wide diversity of crops, and a thriving agtech sector.

There’s lots of help on hand from organizations like AgroLink to support startups’ growth throughout the region and beyond.

After three years of participating in Colombia’s AgroFuturo, one of the largest ag events in the Americas, I’ve learned attendance is a must if you want to build business in South America.

Colombia has large palm oil, coconut, and sugarcane plantations, a growing hemp and cannabis export industry, and many other specialty crops like coffee, cocoa, bananas, pineapples, mango, and avocado.

Colombians embrace technology in all aspects of their lives and with large infrastructure projects being undertaken constantly, the country offers an incredible opportunity for agtech.

Brazil

I look at Brazil through a similar lens to China or the US. There are many regions, crop types, social differences, and altogether a lot more to navigate than smaller countries.

Brazil has similar opportunities as the three countries discussed above – but on a much bigger scale and in Portuguese rather than Spanish, so you need to make your moves wisely. But there are lots of organizations and people who can help, as the Brazilian agtech ecosystem is strong and growing fast with accelerators, investors, multinationals, and local companies scrambling to get a piece of the pie.