Tarfin, an Istanbul-based provider of agricultural inputs to farmers with extended payment terms, has completed a $5 million Series A investment round.

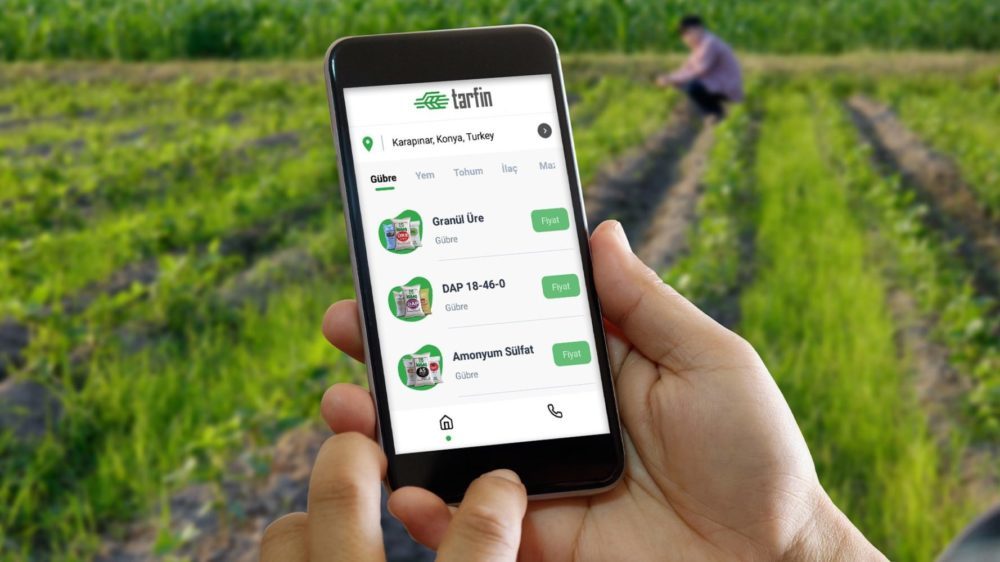

Led by Quona Capital, a venture firm focused on fintech in emerging markets, the round also saw participation from Elevator Ventures (the VC arm of Raiffeisen Bank International), Syngenta Ventures, and Tarfin’s seed investors Collective Spark Fund and Wamda. Tarfin says it will use the new funds to further enhance its data analytics tech and mobile app with the aim of reaching more farmers in Turkey and nearby geographies.

Every season, farms have to fork out serious cash for huge stacks of inputs, whether that’s feedstuffs, fertilizers, or pesticides. For large-scale farmers in developed economies, it is more advantageous to extend those payments to fit with a farm’s yearly cash flows. But access to these sorts of formal credit systems – and on reasonable terms – is lacking for smallholder farmers in emerging markets like Turkey.

Here, established lenders tend to be more risk-averse when it comes to farmers, with at best patchy data to assess creditworthiness. Consequently, interest rates on these schemes are high, if existent.

Otherwise, lending is left up to local retailers or other middlemen to provide informal credit at their own discretion. These come with high premiums and – in emerging markets in particular – cost is compounded by a high risk of inflation, said Tarfin’s founder and CEO Mehmet Memecan.

Memecan told AFN that his company starts with algorithmic risk modelling, focusing “less on collateral-based repayments” and more on “real-time ability to pay.” That way, it can offer credit with lower rates.

Offsetting lending risks

There will always be defaults in the lending business, Memecan said, but his firm’s models seek a “portfolio effect” across diverse geographies and crop varieties to offset risks like natural disasters, poor harvests, or political instability.

Sourcing the finance is different, too. Rather than going down the commonplace intermediary route of stumping up cash to input vendors while they await repayment from farmers, Tarfin is creating pools of receivables – comprising of farmer input sales on credit – and offering them to institutional investors as asset-backed securities.

That said, there’s still a role for retail middlemen in Tarfin’s ecosystem.

“It’s not about cutting out the retailer at all,” Memecan said, highlighting how intermediaries continue to serve as “the point of contact” for Tarfin. They also use the startup to help decide whether or not they should offer delayed payment terms to farmers, either through Tarfin or from their own working capital.

Since launching in early 2017, the startup has financed over 18,000 transactions for fertilizers, seeds, feedstuffs, and chemicals through its 240 partner retail locations. The team says it has facilitated farming on over 440,000 acres.

In deciding to invest, Quona Capital partner Johan Bosini said his firm liked the focus on Turkish smallholders. “Turkey is the seventh-largest agricultural producer globally, and the impact of supporting independent farmers [there] is significant.”

Syngenta’s Shubhang Shankar said his group invested because of Tarfin’s dedication to portfolio effects and the way it has been able to offer low interest rates compared to local informal lenders. “That’s actually the holy grail of agricultural financing,” he added.

His team’s due diligence involved a trip to Turkey just before Covid-19 arrived in the country, and he said they had observed “real and positive” impacts among farmers and retailers on the ground. Shankar anticipates that Tarfin will expand into other countries in eastern and southern Europe where smallholders face similar challenges. Equally, he looks forward to the company layering on additional financial or insurance services.

Ag marketplaces worldwide; E-agronom funding

Elsewhere in the world, other similarly minded startups are hard at work building dynamic, digital-first agribusiness marketplaces. AFN recently reported on the $23 million Series B round of Argentina’s Agrofy – at the time, the largest fundraising effort for a South American agtech startup on record. Agrofy is an online marketplace matching buyers and sellers of a wide range of agricultural products ranging from machinery and crop inputs to farmland and financial services, often through existing retail relationships. The company has already expressed plans to enter the European market.

In France there’s Agriconomie, which works with incumbents to offer an agribusiness marketplace for farmers and their suppliers with advanced logistics capabilities and a streamlined value chain that removes some of the mark-up for growers. In the US, there are offerings like Farmers Business Network – a farm data startup that has pivoted to selling inputs with uniform, transparent pricing – and HarvestPort, which did a pivot of its own from machinery lending to inputs sales last year. India has myriad startups cropping up in this space; one among them is DeHaat, which raised $12 million in a Sequoia Capital-led round in April. [Disclosure: DeHaat is a portfolio company of AgFunder, which is AFN‘s parent company.]

Even in the tiny but tech-savvy Baltic nation of Estonia there’s room for an ag marketplace. E-agronom just raised €1.2 million ($1.4 million) to expand its digital consultancy services and launch operations in Australia. That round included SuperAngel VC, IronWolf Capital, Cats.VC, Martin Villig – founder the mobility unicorn Bolt – along with Salv founder Taavi Tamkivi and other angel investors.