- Climate action levels remain “half baked” for 44% of the 83 companies examined in a new analysis by climate intelligence platform CarbonCloud.

- The “first-of-its-kind analysis” includes the largest companies at four stages of the food supply chain: ingredients companies; food and bev producers; wholesales/distributors; and retailers/grocers.

- Sweden-based CarbonCloud declined to disclose specific companies’ results with AgFunderNews, but said “the analysis includes the likes of Nestlé, Cargill, Danone, and Walmart.”

- Despite mixed levels of progress, CarbonCloud predicts a “projected positive trajectory of climate action in the next few years.”

Palatable climate narratives fall short

The analysis comes just days before the start of COP28, which has placed food systems at the center of its agenda. It’s also a time when major agrifood companies are under pressure to clean up their supply chains, and under fire for failing to live up to climate goals, such as those set with the Science Based Targets initiative.

Food and agriculture represent more than one third of global greenhouse gas emissions. They’re also linked to methane emissions, biodiversity loss, deforestation and numerous other planetary threats.

One (though certainly not the only) reason for the lag in progress from agrifood companies is what CarbonCloud calls the “narrative-driven strategy.”

“To this date, too many companies build their climate strategy on palatable narratives,” CarbonCloud’s Caroline Mizael tells AgFunderNews. “Narrative-driven strategies are ineffective towards the objective of climate mitigation and emission reduction.”

In other words, broad climate goals sound great on investor calls but too often never materialize or land on this list that tracks corporate greenwashing accusations.

According to the CarbonCloud analysis, “external communication of climate performance is still narrative-driven, convoluted with other sustainability categories, or quantified but unverified (67%).”

“The single biggest change the food industry can employ to reduce emissions is to base their climate roadmap on data representative to their operations and supply chains,” notes Mizael.

How CarbonCloud’s analysis works

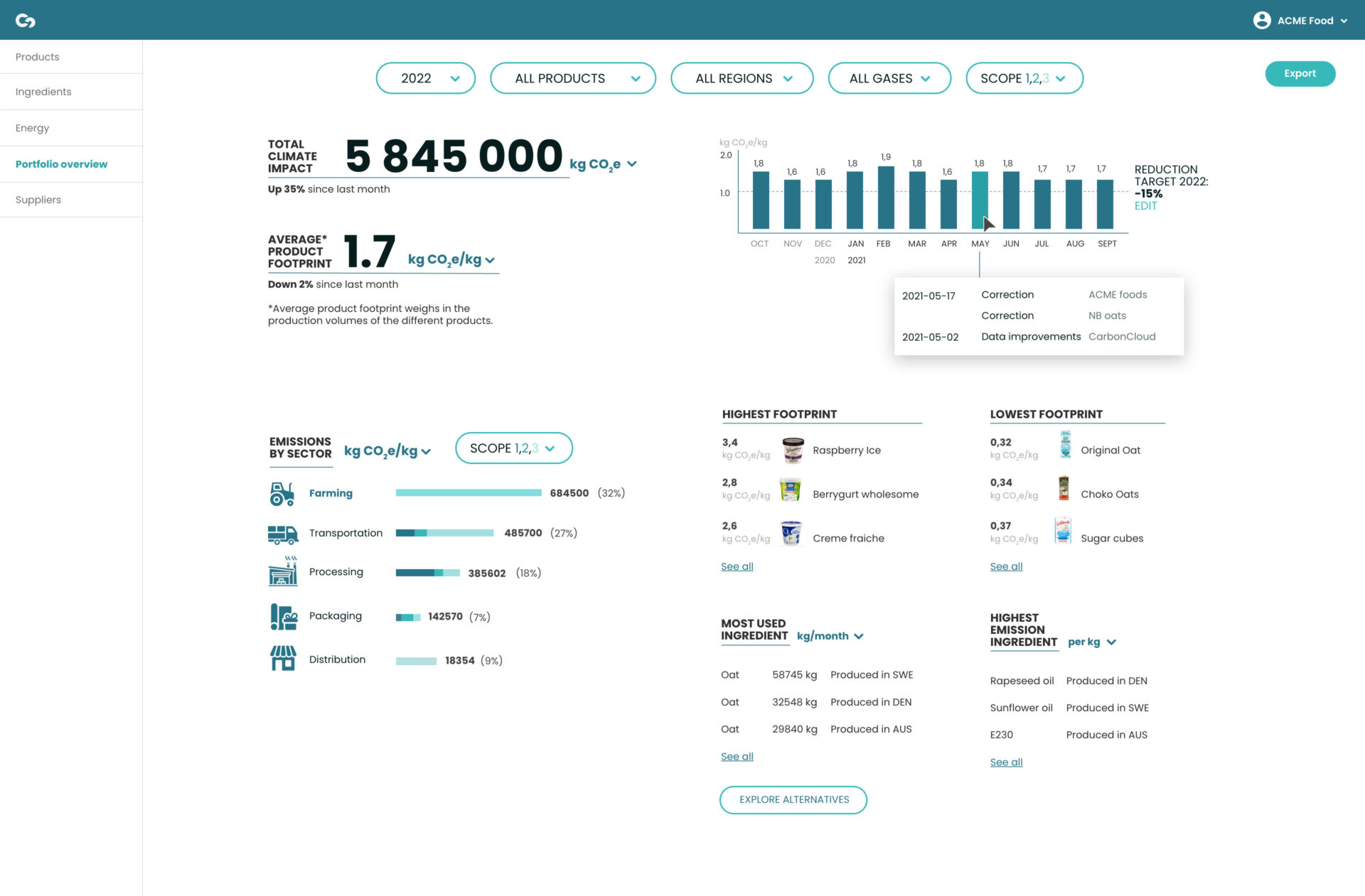

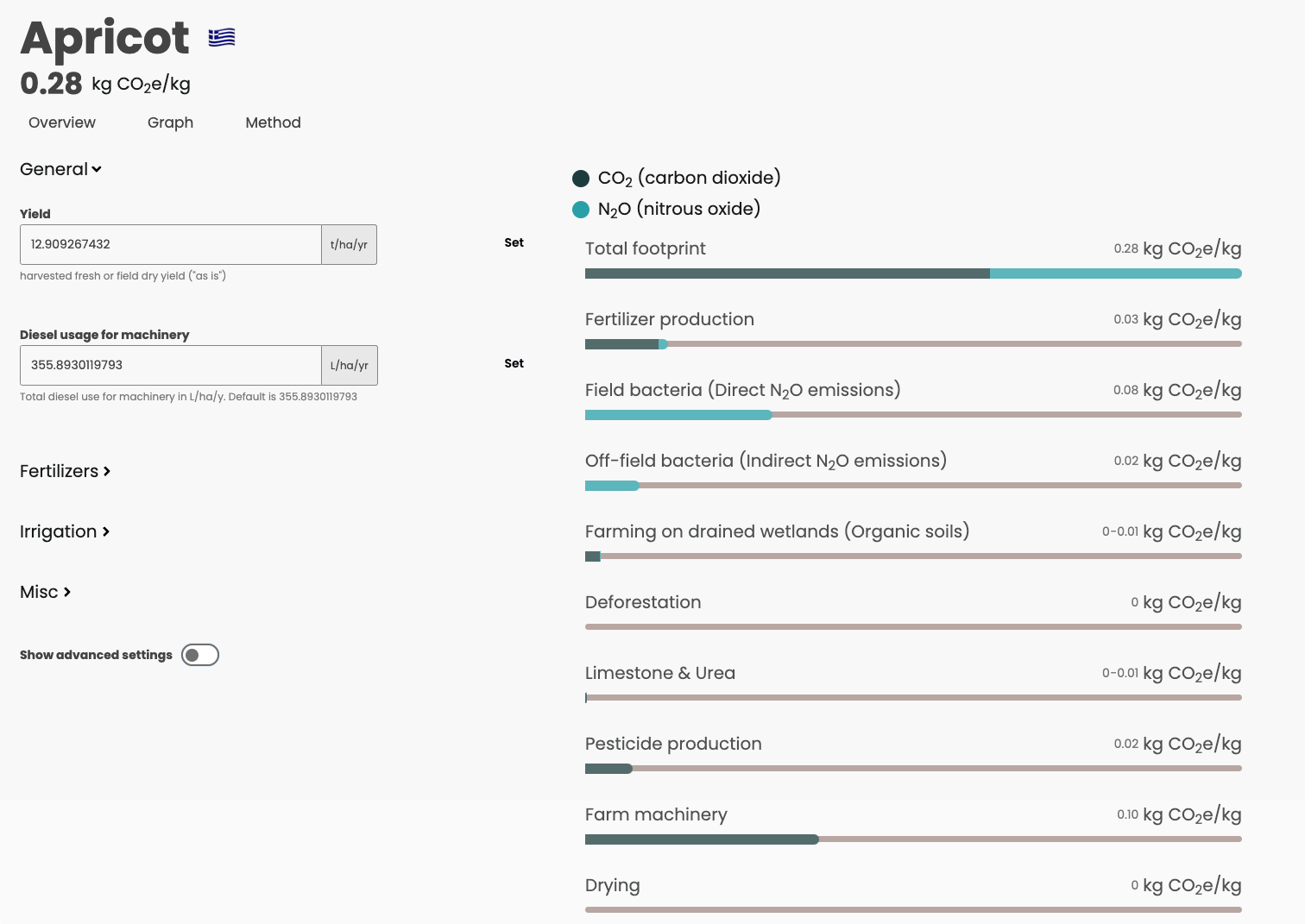

The analysis uses CarbonCloud’s “climate performance maturity model,” which the company says “has years of climate research and interaction with the food industry distilled into it,” according to Mizael.

The model features four levels of maturity: “problem aware,” “solution aware,” “mobilizer,” and optimizer.” Two additional dimensions, “flee” and “NA,” represent levels where company data is opaque or nonexistent.

CarbonCloud assigned levels to “companies actively engaging the risk of climate change” in: corporate strategy, supply chain strategy, data management, communication, climate compensation/offsetting; and organizational empowerment.

Nearly half of companies “problem aware”

Nearly half (44%) of the 83 companies analyzed are “problem aware,” which is the first maturity level in CarbonCloud’s model. As the name suggests, companies here have acknowledged the need for climate strategies in their organizations.

Less than a quarter, 23%, are “solution aware,” the next level of maturity. The number drops to 10% at the third stage, “mobilizer,” and no companies in the analysis have reached the highest level of maturity, “optimizer.”

Within individual areas, 41% of food companies have reached the “solution aware” level with regard to their supply chain strategy. CarbonCloud says this acknowledges the significance of the value chain for emission reductions.

“The peak of the maturity curve in supply chain strategies is further along than any other dimension,” notes the analysis.

However, “a large portion (46%) of the companies analyzed still calculate supply chain emissions based on screenings or manually consolidated data.”

Also worth noting is the drift away from carbon offsets in climate performance. Thus far, 39% of companies analyzed do not mention carbon offsets as part of their sustainability reports or in their climate communications with the outside world.

For example, Nestlé recently announced it was transitioning from carbon offsets to focus on reducing actual emissions in its supply chain.

Negative press and lawsuits around carbon neutral claims are the likely driver of this shift away from offsets for agrifood corporates.