This article features insights from one of AgFunder’s international data partners, who provide data for AgFunder’s agrifoodtech investment reports. AgFunder is AFN’s parent company.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

Latin America registered no fewer than six nine-figure funding deals for agrifoodtech startups in 2021 – indicative of investors’ growing enthusiasm for the region, AgFunder’s 2022 Agrifoodtech Investment Report suggests.

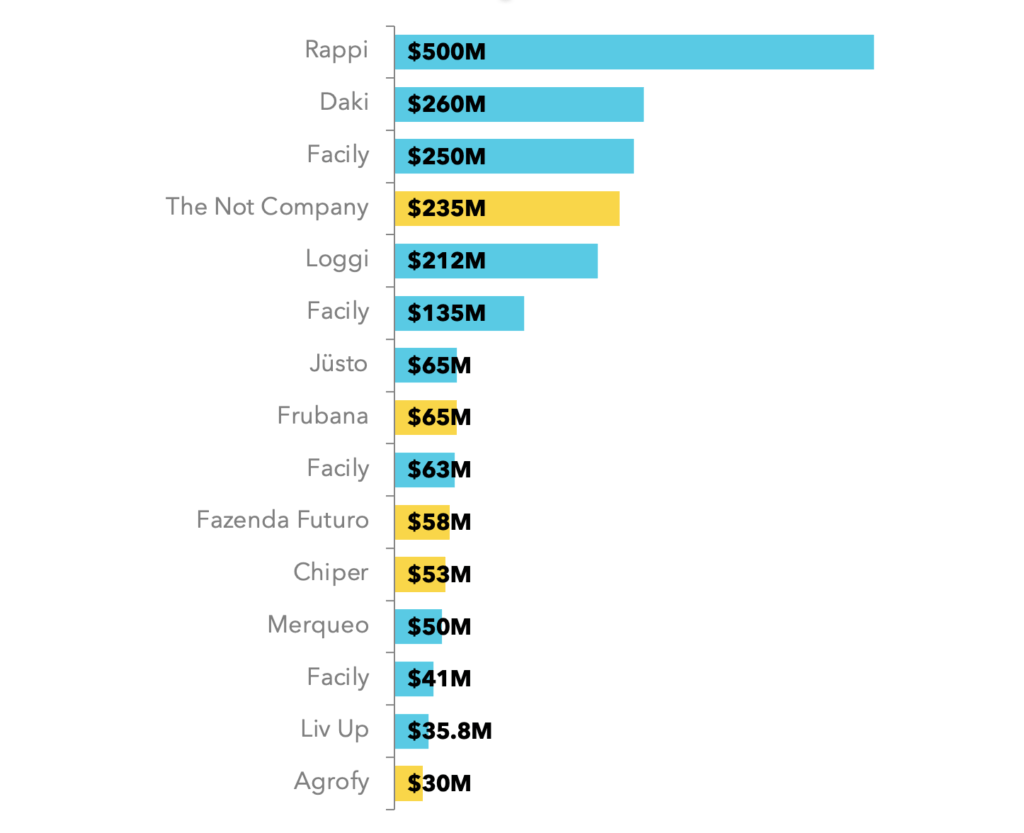

Many of the top 15 Latin American rounds involved startups offering food e-commerce and related services. Among these were the likes of on-demand delivery apps Rappi, Daki, and Loggi; eGrocer Jüsto; and group-buying platform Facily, which closed four of the region’s top 15 deals in 2021 [disclosure: AgFunder is an investor in Jüsto.]

However, upstream companies also made their mark; including alt-protein players The Not Company and Fazenda Futuro, and online farmer marketplace Agrofy.

Latin America’s top 15 agrifoodtech venture deals 2021

We caught up with Hernan Castro (HC) and Bernardo Milesy (BM) — chief financial officer and managing director, respectively — at AgFunder’s Latin America data partner Glocal to find out more.

What do Latin America’s top 15 deals in 2021 tell us about the broader agrifood venture funding landscape?

HC: The top deal list shows that this region has a lot to say in terms of providing solutions for global problems. Fortunately, more and more funds are viewing this as a region where the seeds of the next unicorns are emerging.

On the one hand, it is important for entrepreneurs to pay attention and pick the right partners according to their culture, vision, and plans as more money comes into the region. On the other hand, the valuation for early-stage startups is getting more difficult to determine – and could become a tricky situation for the entrepreneurs.

Overall, what were the key trends and developments in agrifood venture funding in Latin America last year?

BM: Downstream solutions continued to get VCs’ attention. While the effects of Covid-19 are fading away, some of the social behaviors it created have become deeply rooted. So food delivery, dark kitchens, and online grocery are very hot right now. Those solutions that mix comfort, ease, and affordability are getting more and more traction not only from users, but also from investors.

HC: As regards upstream technologies, 2021 was a year of momentum for ag biotech and alternative proteins. Globally, social and environmental consciousness is bolstering investments in these sectors.

BM: As we were expecting, ag fintech solutions started a new wave of entrepreneurship. Traceability has also appeared on the scene, as startups and companies come to understand the importance of tracking what happens along the whole supply chain.

What are your expectations for 2022?

HC: Latin America has the opportunity to further strengthen its agrifoodtech ecosystem this year, with new successes for established startups – but even more so with many seed companies emerging which are rapidly being backed by regional VCs in partnership with global leaders.

BM: In terms of trends, we see that consumers are becoming more aware of sustainability – which is evident in the purchase decisions they make – and that our society is changing its mindset because of this. This is going to foster investments in solutions focused on traceability, water management, and carbon neutrality. We also predict that we are going to have a second wave of ag fintech – including not only lending and risk management platforms, but also blockchain-based solutions.