Alexandria Coari is vice president – capital, innovation, and engagement, at ReFED, a food waste-focused nonprofit based in Chicago, US.

The views expressed in this guest commentary are the author’s own and do not necessarily reflect those of AFN.

In the fight against food waste, capital providers play a critical role in funding waste reduction solutions. ReFED estimates that approximately $14 billion is needed each year to launch and scale solutions. Corporate finance and spending is the most appropriate capital type to cover the majority of the investment needed each year to cut food waste by 50% by 2030 (in accordance with national and international goals), since food businesses can receive direct, measurable, and tangible benefits through lower costs, new revenue potential, and increased consumer goodwill. But there are opportunities for capital providers of all types to drive the adoption of food waste solutions – many of which have a strong potential for investment returns.

In the US, 35% of all food goes uneaten or unsold. While some of that is recycled and some is donated, the majority goes straight to landfill, incineration, down the drain, or is simply left in the fields. That equals $408 billion worth of food each year – roughly 2% of GDP – causing 4% of the country’s annual greenhouse gas emissions. While businesses, entrepreneurs and innovators, funders, government agencies, and others have already started making efforts to address this challenge, a massive acceleration is needed to achieve the 2030 reduction goal.

What’s needed to cut food waste in half by 2030? Investment and innovation

A recent analysis by ReFED shows that an annual investment of $14 billion into food waste reduction solutions over the next ten years can reduce food waste by 45 million tons each year – more than half of what it is today. And that investment would result in $73 billion in annual net financial benefit – a five-to-one return. Plus, every year, it would reduce greenhouse gas emissions by 75 million metric tons, save 4 trillion gallons of water, and recover the equivalent of 4 billion meals for those in need. Over 10 years, it would create more than 51,000 jobs – and achieve the 2030 reduction goal.

Where can and should this vital capital come from?

Bolstered by the insights of an expert panel of capital providers (including foundations, impact investors, venture capitalists, private equity firms, and institutional investors) and food businesses, ReFED’s analysis provides a recommended mix of the $14 billion annual financing needed across nine different capital types:

- Corporate finance and spending: $7.1 billion

- Venture capital: $1.4 billion

- Non-government grants: $1.2 billion

- Private equity: $1.1 billion

- Government grants: $1 billion

- Impact-first investments: $909 million

- Government project finance: $714 million

- Commercial project finance: $617 million

- Tax incentives: $97.2 million

Effective action against food waste will require a smart matching of the correct type of capital with the appropriate opportunity. In many cases, multiple types of capital are required to fund food waste reduction solutions from conception to adoption. While the majority of financing required to scale food waste reduction solutions is expected to come from traditional market sources, there is an equally important and crucial role for catalytic capital – that is, investment capital which is patient, risk-tolerant, concessionary, and flexible in ways that differ from conventional investment.

ReFED estimates that $3 billion per year of catalytic capital, largely in the form of government grants, non-government grants, and impact-first investments such as program-related investments, mission-related investments, and low- to no-interest rate loans, would unlock the additional $11 billion of necessary financing. Since catalytic capital tends to be first money-in, it can have a multiplier effect that stimulates larger amounts of future funding and helps overcome system-level barriers.

Where should these investments be made?

Food waste innovation has historically been categorized more broadly as part of food systems efficiency, supply chain innovation, or even sector-specific innovation (farm, manufacturing, and so on.)

But as $1 billion-plus valuations of food waste-focused companies — such as shelf-life extension startup Apeel, ‘ugly produce’ e-grocer Misfits Market, and cold storage enabler Lineage Logistics, among others — make evident, more and more investors are recognizing food waste as a thriving sector unto itself, given the powerful RoI these solutions provide to major food businesses.

A range of food waste reduction solutions already exists – some are breakthrough innovations, some are basic best practices – and more are being shepherded to market all the time.

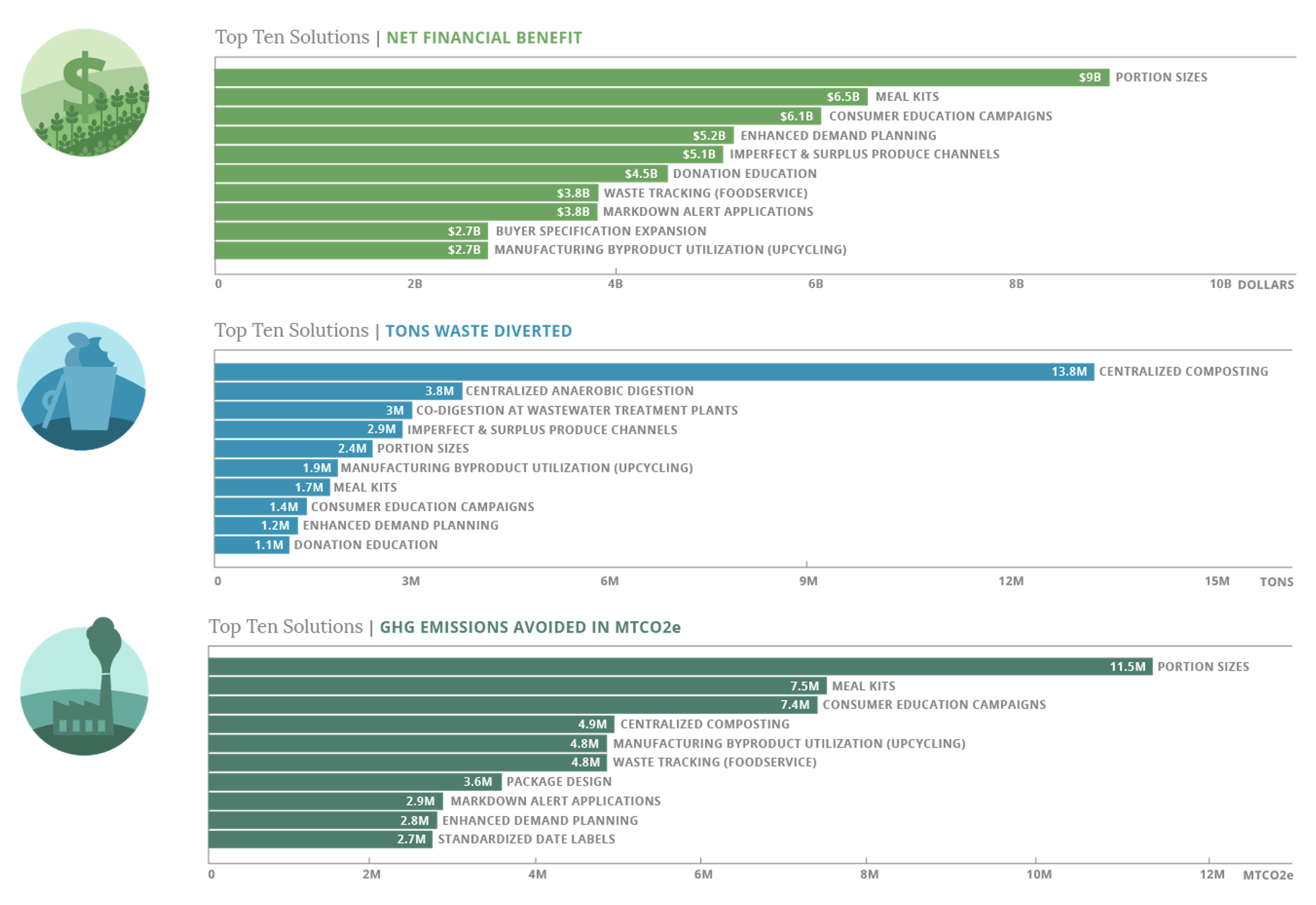

According to an analysis carried out using ReFED’s Insights Engine — an online knowledge hub for food waste data designed for use by food businesses, funders, solution providers — these are the top solutions for investors across the impact metrics of net financial benefit, tons of food waste diverted, and greenhouse gas emissions avoided:

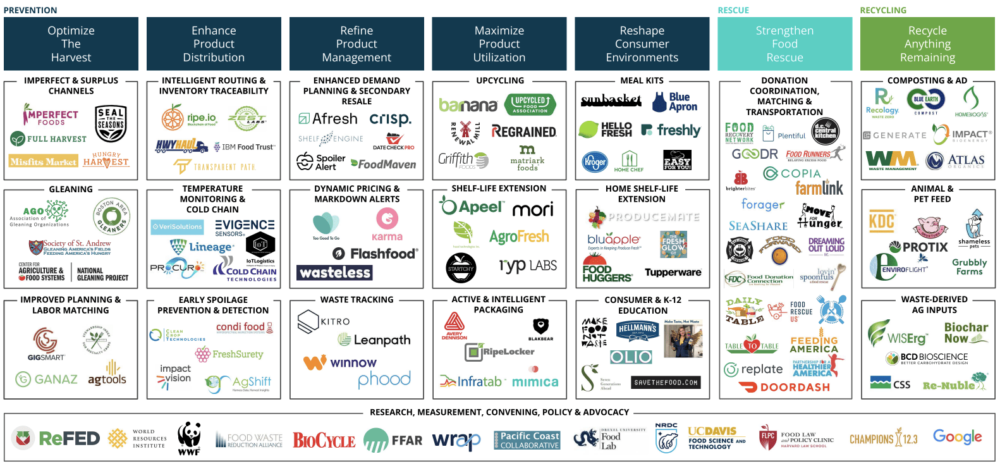

ReFED’s Food Waste Landscape Market Map [PDF here] provides a small snapshot of some of the solution providers working in the food waste space right now, many of which are actively seeking funding.

The Food Waste Landscape Market Map is organized based on seven key action areas from ReFED’s ‘Roadmap to 2030: Reducing US food waste by 50%‘ report, which spans the entire food supply chain and provides a framework to help guide the food system with solution implementation.

Food waste is an investment opportunity that can result in both social benefits and financial returns. The growing level of interest and funding activity in the space is exciting, as is the increasing number of funders recognizing the enormous opportunity they have to support the launching and scaling of solutions that could transform the food system.