Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder. Click here for more research from AgFunder and sign up to our newsletter to receive alerts about new research reports. Disclosure: This article contains numerous references to AgFunder portfolio companies, which are clearly signposted.

Farm robotics ventures raked in a total of $491 million in investment during H1 2021, a 40% increase on the same period in 2020, and a similar jump on the second half of 2020 too, according to AgFunder data.

Many of the noteworthy deals during the period went to startups using robotics to automate everyday on-farm tasks usually performed by individuals, rather than complex agricultural operations.

“Autonomous equipment will be as transformative as mechanized agriculture. It’ll be the platform that will fulfill the promise of digital farming, which has struggled to drive value from insights alone,” AgFunder founding partner Rob Leclerc wrote recently following John Deere’s $250 million acquisition of his firm’s portfolio company Blue Flag Robotics.

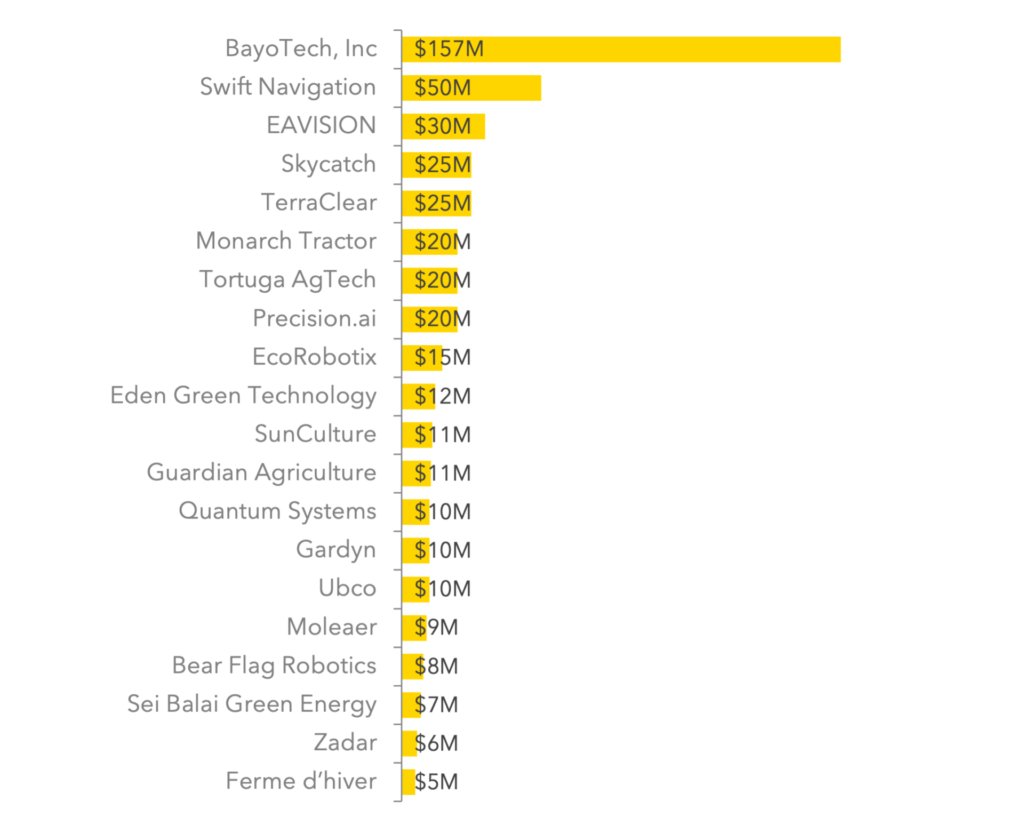

Farm Robotics, Mechanization & Equipment is an AgFunder-defined category which covers on-farm machinery, automation, drone manufacturers, and grow equipment, among other areas. Here are the top 20 deals in the category in H1 2021:

Top H1 deals for Farm Robotics, Mechanization & Equipment

The largest deal in the category, by far, was US-based energy solutions company BayoTech’s $157 million equity investment for its green hydrogen production systems.

Swift Navigation, which develops global navigation satellite system and positioning technology for autonomous vehicles, raised the next highest amount with its $50 million Series C raise. Another substantial Series C haul went to China’s EAVision, which specializes in building drones for challenging agricultural areas like hillsides.

Automating the basics

Again, many of the major deals of H1 2021 were for companies bringing more autonomy to mundane, dirty, and dangerous tasks tasks around the farm.

TerraClear, which closed a $25 million Series A round in H1, is a case in point with its Rock Picker machine that automates the process of removing unwanted stones from the soil. Tortuga AgTech makes harvesting robots and raised a $20 million Series A round in H1; while autonomous weeding startup Ecorobotix scored $15 million.

Separate from VC deals, AgFunder portfolio company Root AI, which makes harvesting robots, was acquired by controlled environment agriculture company AppHarvest earlier this year.

Not to be forgotten are tractors. Both Monarch Tractor and Bear Flag Robotics raised significant rounds in H1, at $20 million and $8 million, respectively.

Both have also achieved additional milestones since the close of H1. Monarch raised a $61 million Series B round this month. Bear Flag Robotics was acquired by John Deere for $250 million in August, making it the second robotics acquisition for an AgFunder portfolio company in 2021 after Root AI.