Terramera has closed a $45m Series B round, led by new investor Ospraie Ag Science and returning investor S2G Ventures. The Vancouver-based startup said the funding will go towards advancing Actigate, its targeted crop protection technology. The round was oversubscribed.

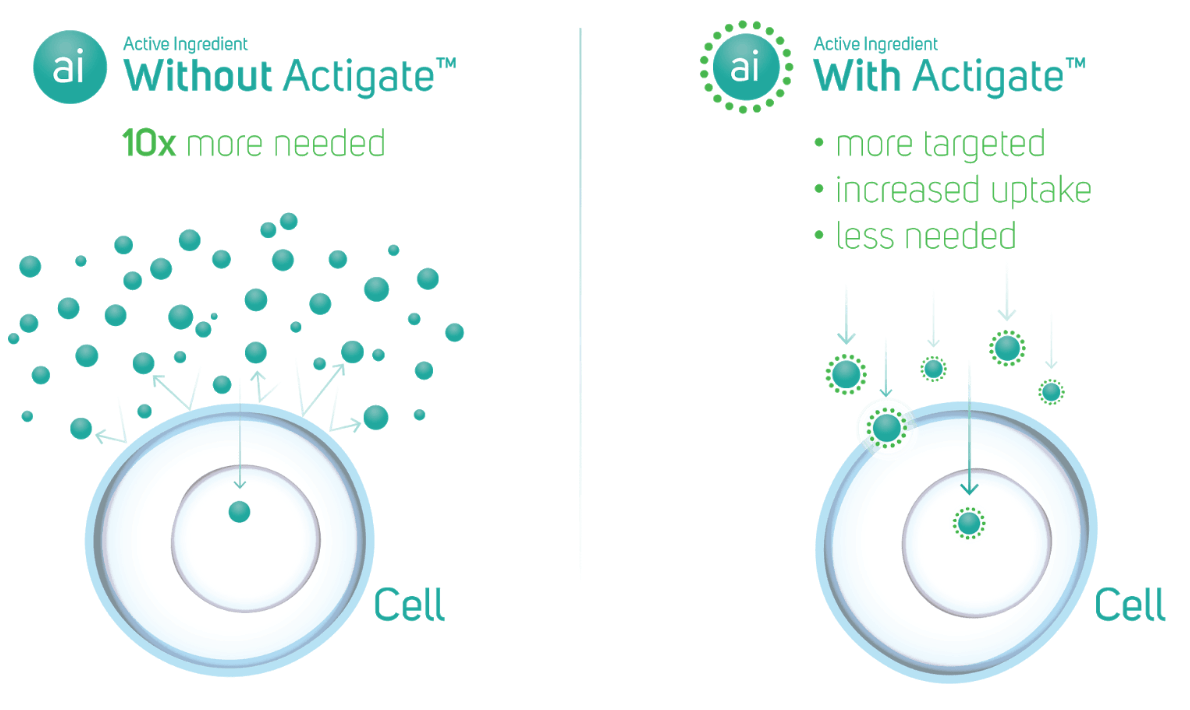

Actigate is a delivery mechanism for biological and “natural” crop input products that have struggled with efficacy over the years making organic crop yields lower than those grown with synthetic, chemical products. Terramera says Actigate can increase the efficacy of the active ingredients in products such as bio-pesticides by up to 10 times, to make them more viable options compared to industrial fertilizers.

And the company has a lofty goal, to ‘reduce global synthetic chemical loads in agriculture by 80% by 2030 with Actigate.’

While Karn Manhas, CEO of Terramera, said the goal was ‘audacious,’ he believes organic input products could soon be as effective if not more effective than their synthetic counterparts. But the industry will need to work together, he added, and much of this funding round will go towards creating more partnerships with input manufacturers to use Actigate with their products. It will also go to expanding the number of active ingredients that can be optimized by Actigate; currently the company focuses on cold-pressed neem oil.

Ospraie, which operates with the slogan ‘Do More With Less,’ called its investment “a huge opportunity to transform the industry.” Carl Casale, senior partner at Ospraie — a Syngenta board member and former CTO of Monsanto to boot — said Terramera’s platform could “create value and reinvent conventional inputs to have greater impact, while reducing cost, waste, and effects on the environment.” This is Ospraie’s second investment in as many weeks focused on improving the efficacy of crop protection; it invested in AgroSpheres’ Series A last week.

Targeted delivery

Currently, farmers apply vast amounts of crop protection products to their crops in the hope they get absorbed in the right place, according to Manhas.

“[Actigate] carries bioactive products into the target pest where they can kill it. This increases the efficacy of natural products, improves efficiency of inputs, and generates effective products that take full advantage of nature’s evolutionary success,” said Steve Slater, Terramera’s VP of Strategic Initiatives, in an article he posted on LinkedIn after the company released Actigate or the first time in September 2018.

This translates to farmers using up to 90% less product, while cutting down on waste and also helping them save on costs. Terramera’s field trials have also shown up to a 70% increase in crop quality and marketable yield. Due to the organic nature of the input products used, they decompose into safe, naturally-occurring compounds and hopefully eliminate any negative impact on the surrounding environment.

“Our goal is to generate highly effective products that are also biodegradable once they’ve completed their mission. We want to improve environmental, technical, and economic performance on both organic and conventional farms,” added Slater.

Terramera has come a long way. Check out our coverage of its $10 million venture round in 2016, here.

Changing the Paradigm on Biological Ag Inputs

|

Snapshot: Recent lawsuits against pesticides 13 May 2019: A California jury ordered Monsanto to pay more than $2 billion to a couple that got cancer after using its weedkiller, Roundup 7 Aug 2019: Six states sue the Environmental Protection Agency (EPA) over Chlorpyrifos, a pesticide tied to brain damage 20 Aug 2019: Center for Biological Diversity and Center for Food Safety filed a petition over the EPA’s decision to re-register sulfoxaflor |

The usage of synthetic crop products has come under increasing fire in recent times. In the US, several groups have sued the Environmental Protection Agency for allowing the use of a pesticide that is harmful to bees, and another associated with reduced IQ in children. In May, a California jury ordered Monsanto to compensate a couple over $2 billion, after they developed non-Hodgkin lymphoma from the use of a RoundUp weedkiller for several years, and the list of legal actions against Monsanto’s new owner Bayer continues to pile up.

So this begs the question: why haven’t less harmful, natural inputs taken off in mainstream use?

Manhas told AFN that what’s clipping the wings of the organic industry is the sector’s reputation for inconsistent crop protection and the limited availability of high-performance herbicide. In fact, Terramera was created for this sole purpose – to change the paradigm on organic, natural, biological ag inputs.

Terramera said it would be taking on all these challenges in its rollout of Actigate. It is also selling two agriculture products of its own based on cold-pressed neem as the active ingredient– Rango and TerraNeem, both broad-spectrum insecticides, fungicides, and miticides. TerraNeem is also a nematicide. And the company has bed bug products that use the same technology. But it’s likely the company will focus more on its partnership model where it licenses its tech to companies, including manufacturers of natural inputs.

Check out my fellow reporter Lauren Manning’s in-depth piece on what it takes for biologics to succeed, here.

|

Challenges facing organics, according to Karn Manhas, founder & CEO, Terramera 1. The performance and consistency of organic crop protection 2. The availability of good, high-performance organic herbicide 3. The performance and uptake of organic nitrogen |

“We are working on the application and rollout of Actigate to meet these challenges in that order,” said Manhas, “right now to proprietary crop protection active ingredients for disease, insect and nematode control, then to organic herbicides and in coming years to crop health and crop nutrition inputs.”

One thing’s for sure: more cash is being pumped into products based on biology, instead of harsh chemicals. $1.5 billion in funding was pumped into ag biotech startups, including many biological alternatives, according to AgFunder’s 2018 AgriFood Tech Investment Report. Indigo, a microbial agriculture seed products-cum-ag products retailer, booked a $250 million Series E in September 2018, while Precision BioSciences secured a $110 million Series B to further product development efforts for its genome editing platform.

Know a startup that could shake up the sector? Drop me an email at [email protected].

Additional reporting by Louisa Burwood-Taylor