The Covid-19 pandemic rapidly accelerated technology development and adoption in Brazil’s agriculture sector, according to a new market map of the Brazilian agtech ecosystem.

The Radar Agtech Brasil map details 1,574 agtech companies in 33 categories and three field segments and its creators added a new company each day of the past 15 months; that’s 449 new companies in just over a year.

“Brazil currently has the most robust and decentralized movement of agtechs on the planet. The resiliency of the ecosystem was tested during the pandemic and passed with flying colors,” says Francisco Jardim, founding partner of SP Ventures, an agtech investor based out of São Paulo, Brazil that collaborated on the map.

For him, Brazil not only has a huge agricultural market, but it is expanding its competitive advantage with technological differentials that can solve local problems.

“Brazil is globally competitive and a serious contender in the majority of major agricultural commodities. Besides a growth opportunity, agrifoodtech has proven itself a defensive asset class as well; since the market performs well, even when the region is doing poorly,” Jardim says.

Below, Marcella Falcão, an associate at SP Ventures, details the launch of the map and offers details about what’s included. The views expressed in this guest commentary are the author’s own and do not necessarily reflect those of AFN.

During the F&A Next 2022 conference in Wageningen, the Netherlands last month, the English version of the Radar Agtech Brasil 2020-2021 report was launched. Radar Agtech Brasil is a study carried out in a three-way partnership between Embrapa (the Brazilian Agricultural Research Corporation), Homo Ludens Research & Consulting, and SP Ventures.

The report’s translation and the conference’s Brazilian delegation received full support from the Brazilian Embassy in The Hague and ApexBrasil, the Brazilian government’s international trade promotion agency.

Climate tech will become the next big VC thesis for Latin America – read more here

Radar Agtech Brasil provides an extensive map of startups operating in the agrifoodtech value chain. This includes those positioned before, during, and after the farm, with diverse production chains and their links. The report serves as a tool for determining research, establishing public policies, and supporting decision-making in various parts of the ecosystem. It also connects new investors, corporates, and entrepreneurs, and promotes the adoption of technologies.

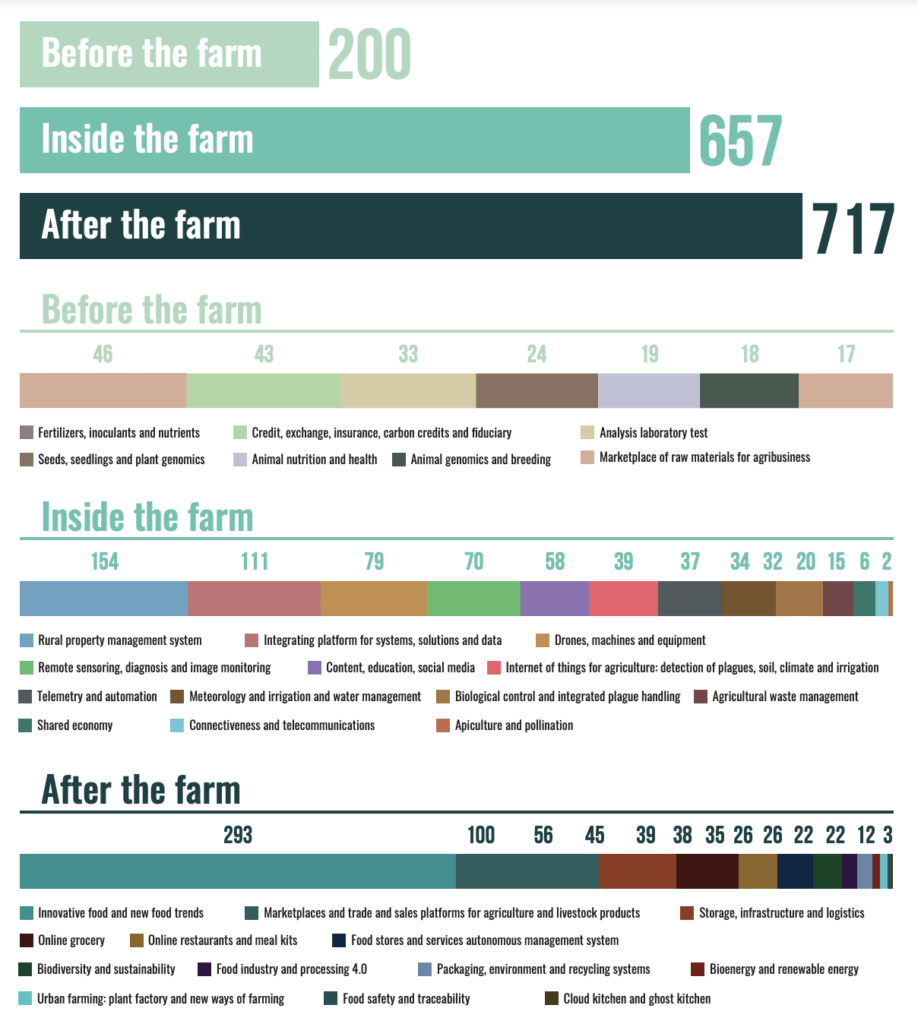

In its report, Radar Agtech Brasil mapped 1,574 agtech companies in 33 categories and three field segments, as follows:

- Before the farm: includes areas such as fertilizers, credit, insurance, seeds, laboratory analysis, animal nutrition, genomics, animal reproduction

- Inside the farm: includes property management, data, drones, remote sensing, IoT, meteorology, irrigation, pest management

- After the farm: includes innovative foods, platforms for agricultural products, storage and logistics, biodiversity, sustainability, packaging

The study also provides a breakdown of Brazil’s agrifoodtech startups by focus area:

- Innovative foods and new food trends: 293 startups (18.6% of total startups)

- Rural property management: 154 (9.8%)

- Systems, solutions, and data integration: 111 (7.1%)

- Marketplaces and platforms for trading and selling agricultural products: 100 (6.4%)

- Drones, machines, and equipment: 79 (5.0%)

- Remote sensing, diagnostics, and image monitoring: 70 (4.4%)

- Content, education, and social media: 58 (3.7%)

- Storage, infrastructure, and logistics: 57 (3.6%)

- Fertilizers, inoculants, and plant nutrition: 46 (2.9%)

- Online grocery stores: 45 (2.9%)