Latin America is one of the most biodiverse regions in the world, home to around 60% of global terrestrial life in addition to vast amounts of land and water resources. The livestock sector in Latam accounts for 23% of global beef and buffalo production and just over 20% of the world’s poultry. Important commodities like coffee, soy, and cacao are also critical parts of the region’s agrifood economy.

At the same time, Latam struggles with vast inequalities and rising food insecurity and hunger intensified by economic recessions, climate-related disasters, and humanitarian conflict. Annual damages from climate change alone are predicted to reach $100 billion by 2050 for the region, including a net loss of agricultural exports of between $30 billion and $52 billion. Meanwhile, 22.5% of the population can’t access a healthy diet.

Against this bleak backdrop, agrifoodtech innovators are working with startups, agribusinesses and farmers to improve the region’s food system from farm to fork, bolstering smallholder incomes and planetary health in the process.

Apply to GLOCAL’s 2023 program to help advance Latin American agrifoodtech

Farmers: Latam’s ‘agents of change’

As in other parts of the world, the Covid-19 pandemic sparked an explosion of consumer-facing startups in Latam for restaurant and grocery delivery in 2020 and 2021, with the latter being an outlier year that saw billions of dollars pumped into these downstream companies.

In 2022 and 2023, a more sober macro-environment has all but dried up funding in many of these areas. As AgFunder’s 2023 Global AgriFoodTech Investment Report found, investors are now sending what money they’re willing to part with to upstream categories like farm management software, novel farming systems and ag biotechnologies. While Latin American investors may not have copied those trends in 2022 — keep your eyes open for AgFunder’s inaugural Latin America agrifoodtech investment report coming soon — it will no doubt follow suit soon.

That spells good news for a region like Latin America where 14 million smallholder farmers are responsible for 50% of total production, according to a recent report from J.P. Morgan Private Bank. These smallholders typically struggle to access technologies that would allow them to increase food production and access the supply chain. Ensuring these farmers aren’t left behind is now the goal of many Latam startups.

“Farmers are the agents of change in this opportunity in Latin America,” Tomás Peña, managing director for The Yield Lab Latam, tells AFN. “I think that we will see more money in the previous [upstream] stages of the value chain that would provide more solutions to the farmers enabling them to access better logistics and financial instruments securing traceability.”

“Distributed innovation and farmer-centric networks could allow Latam talent to give a more systemic solution on a global scale,” he adds.

“There are few really scalable companies [in Latam], and I think this is because, for a very long time, growers were focused on technologies related to core operations — seeds, machinery, etc.,” Seedz co-founder and CEO Matheus Ganem tells AFN. “They weren’t really involved with things that may look secondary, but can be really important, especially if we’re thinking about increasing efficiency, increasing sustainability.”

For example, 90% of smallholder farms in Brazil don’t use any kind of management software to handle farm finances, says Ganem.

“They’re using a lot of paperwork. They are so focused on machinery, fertilizer, etc. but they could achieve better results by simply managing the cash flow of the business better.”

More agrifoodtech startups with broader offerings could solve some of this, according to Ganem.

“Most agtechs [in Latam] address a very specific market and this is really hard to grow. On the other hand, most farms need financial services, whether they’re corn, soybeans, livestock.” To that end, several of the top-funded Latam startups in the last year are marketplaces and fintech tools that offer things like farmer financing, supply chain logistics, and more direct access to customers.

Sofia Ramirez, venture capital at AgFunder, AFN’s parent company, blames the general lack of connectivity across the region for a lack of digitization, but that’s changing as mobile operators expand their networks in rural areas, according to a recent IICA report, which details a 12% improvement in significant rural connectivity in Latin America from 2020 to 2022.

This expansion can be attributed to coverage commitments outlined in spectrum auctions, regulatory incentives, or simply due to the demands of the agriculture sector

“One of the main reasons for the extensive use of paperwork in the agricultural sector is the lack of connectivity, which is crucial for technological advancements. Consequently, recent announcements and developments in this area are providing strong support for the adoption of agtech,” she tells AFN.

In the meantime, here’s how a few startups are addressing the future of Latam’s food and ag system.

The following companies are a small sampling of Latam agrifoodtech companies, more of which will be showcased in AgFunder’s forthcoming and inaugural Latin America AgriFoodTech Investment Report in partnership with SP Ventures and Alianza Team. Sign up for our newsletter to be one of the first to receive it next month.

7 Latin American agrifoodtech startups

Frubana

- Founded in 2018

- Headquarters: Bogotá, Colombia

- Founder: Fabián Gómez

Frubana is an online wholesale marketplace that enables restaurants and food retailers to buy food directly from farmers.

The company runs a “vertically integrated” supply chain for produce, with the goal of minimizing the complex chain of middlemen normally involved in procurement.

Currently, products travel through several middlemen, with little transparency or consistency, in order to reach restaurants.

By contrast, Frubana purchases produce directly from the farmers and manages distribution in regional hubs in Colombia, Mexico and Brazil. It fulfills deliveries to customers using an intelligent routing system.

Frubana raised a $75 million Series C at the end of 2022, bringing its total current funding to $271 million.

NotCo

- Founded: 2015

- Headquarters: Santiago, Chile

- Founders: Karim Pichara, Matias Muchnick and Pablo Zamora

NotCo bills itself as a kind of AI for alt-protein. In addition to developing its own range of plant-based meat and milk products, the company is also known for Giuseppe, its AI platform that models novel combinations of plant-based ingredients.

Giuseppe can identify which combinations most accurately mirror the taste and texture of animal-based meats and milks — factors that remain elusive to most alt-protein companies out there.

NotCo bagged $70 million in 2022 from Princeville Capital and others, and also recently launched a partnership with Kraft Heinz to develop plant-based versions of some of the company’s most known products, starting with a vegan version of Kraft Singles.

NotCo’s own products, meanwhile, include burgers, milk, mayonnaise and ice cream, all of which are available in Chile, Brazil, Argentina and Colombia. Some products are also available in the US.

Solinftec

- Founded: 2007

- Headquarters: São Paulo, Brazil

- Founder: Britaldo Hernandez

[Disclosure: AFN’s parent company, AgFunder, is an investor in Solinftec.]

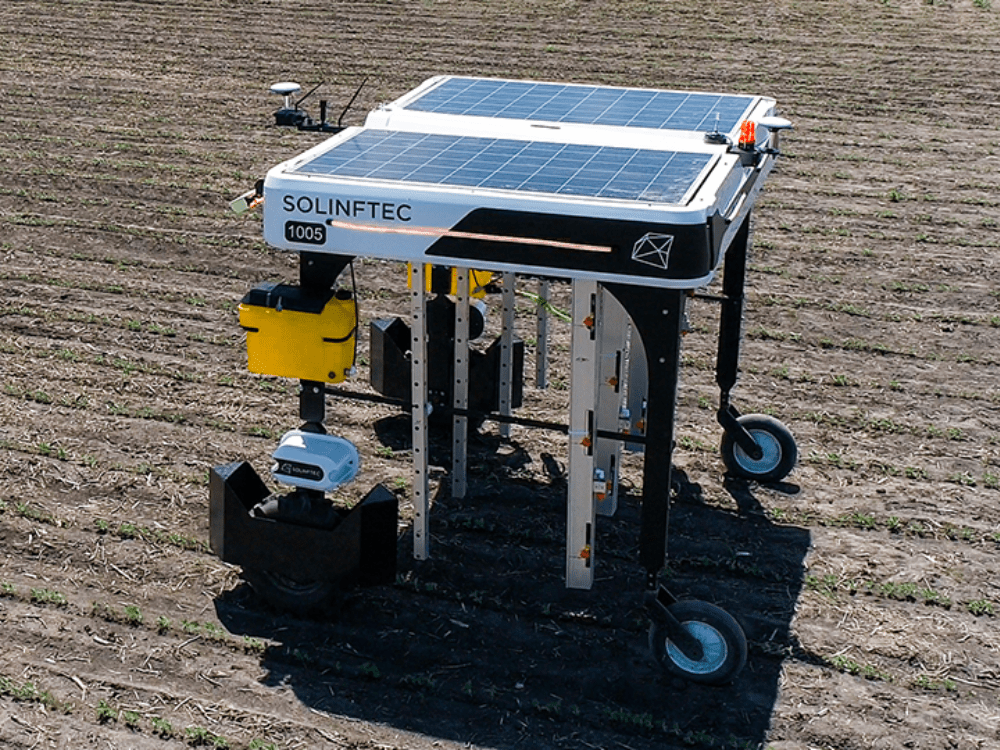

Solinftec’s IoT-based farm management system aims to provide growers with better information that can inform decision-making around planting, harvesting, spraying and tendering. The digital platform links to a farm’s machinery and is powered by an AI system dubbed ALICE.AI. ALICE connects with sensors, computers and displays to provide growers with real-time, in-field crop data, information about inputs, and weather conditions.

Solinftec says its system manages more than 27 million acres in the US, Brazil and other parts of Latin America. Right now, the company’s main focus is on sugarcane, soy, corn and cotton, as well as coffee, timber, and citrus.

The company raised $60 million in May 2022. Prior to that, it struck a partnership with US-based ag cooperative Growmark to develop a weed-killing robot that aims to reduce farmers’ dependence on chemical-based inputs. The Solix Spray robot can also provide reports to farmers on crops, identify weeds, diseases, and pests, and offer other data such as analysis on inputs saved.

Seedz

- Founded: 2017

- Headquarters: Belo Horizonte, Brazil

- Founders: Daniel Rosa, Matheus Ganem

Seedz operates an online marketplace that connects rural producers with agribusiness distributors, resellers and cooperatives.

The Seedz platform generates data and intelligence for large agribusiness companies about their customers and helps them create relevant engagement strategies.

Farmers and producers can transact with dealers through the Seedz platform, gaining loyalty points and rewards in the form of “SDZ,” the platform’s digital currency. Seedz co-founder Matheus Ganem has said one of the biggest benefits of the platform is its ability to help transition many of these smallholder producers online, giving them the chance to try new tools and services in addition to boosting income.

Seedz currently serves Brazil, Paraguay, Argentina and Uruguay. The company just announced a forthcoming expansion to the US, where many of its biggest customers — John Deere, Mosaic Syngenta — are located.

Seedz raised a $16.5 million Series A in 2022.

Agrolend

- Founded: 2020

- Headquarters: São Paulo, Brazil

- Founders: Alan Glezer, Andre Glezer, Leopoldo Vettor, Valeria Bonadio

Agrolend connects small- and medium-sized farmers with something not normally available to them via traditional banks: credit. The company’s digital-native platform allows these producers to bypass many of the bureaucratic barriers that would normally stand in their way when it comes to financing.

Through the Agrolend platform, farmers can get supplies on credit. Agrolend provides credit to traditional ag input resellers like Syngenta and BASF, who in turn make inputs and other supplies available to farmers.

Agrolend says the entire process is online and takes about two days, from requesting the loan to making a final payment.

Speaking to AFN last year, co-founder and chief financial officer Alan Glezer said demand for credit amongst smallholder farmers is expected to increase in the next five years, and a greater need for local currency along with that. The company aims to become “the first digital bank” in the Latin American agribusiness sector.

Agrolend’s latest round was a $28 million Series B in November 2022 led by Lightrock. To date the company has raised $106 million.

Aravita co-founders, Marco Perlman, Aline Azevedo and Bruno Schrappe. Image Credits: Aravita

Aravita

- Founded: 2022

- Headquarters: São Paulo, Brazil

- Founders: Marco Perlman, Aline Azevedo, Bruno Schrappe.

Aravita is focused on developing an AI-powered solution for supermarkets. The technology considers various factors such as climate, seasonality, consumer behavior, and economic conditions to optimize the purchasing of fresh food, particularly fruits and vegetables. By reducing surplus items and minimizing sales loss due to waste, Aravita’s software aims to increase the availability of in-demand items.

Speaking to TechCrunch, Aravita mentioned that the abundant consumer data available at the point of sale in supermarkets makes them an ideal target audience for their solution. This data serves as the foundation for achieving accurate low-demand forecasting predictions.

With a prototype and an ongoing pilot program in collaboration with a supermarket chain near São Paulo, the company has recently secured a $2.5 million investment co-led by Qualcomm Ventures and 17Sigma.

Verqor

Founded: 2019

Headquarters: Mexico

Founders: Hugo Garduno, Valentina Rogacheva

Verqor is an agricultural fintech startup that aims to bring formal processes and data to the agricultural sector in Mexico. The company’s platform connects farmers with credit, buyers, and markets, providing them with access to financial services and enabling them to adopt new agtech tools.

In Mexico and Latin America, where agricultural transactions are predominantly cash-based and informal, Verqor seeks to digitize the industry and facilitate cashless credit. Speaking to AFN, Verqor mentioned that Farmers can join the platform, submit their information, and undergo a productive analysis to determine their credit eligibility. Once approved, farmers receive credit that they can use to purchase inputs such as seeds, fertilizers, and agro-chemicals directly from the Verqor platform. The company also connects farmers with buyers, facilitating the sale of their products through formal transactions.

In terms of funding, Verqor recently raised approximately $2.5 million in a seed funding round led by SP Ventures. The investment will support the company’s expansion, allowing it to strengthen its operations in Mexico and potentially expand to other Latin American countries. Verqor’s long-term vision is to become a leader in agricultural lending and accelerate the adoption of agtech solutions in the region.