Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Data mentioned in this article are adjusted using a model of how they will appear 12 months into the future based on historical trends, to take predicted reporting lags into account. As such, they may differ from earlier published versions of the same data.

Last month, we examined the H1 2021 funding data for Novel Farming Systems – an AgFunder-defined category covering ventures in tech-enabled aquaculture, insect farming, and controlled environment agriculture (CEA) including vertical farming, greenhouses, and other ‘indoor’ setups.

Novel Farming Systems was the eighth most-funded of AgFunder’s 15 categories, and the third highest-funded category explicitly covering upstream technologies — after Innovative Food and Ag Biotech — raising around $911 million worldwide in total during the six-month period.

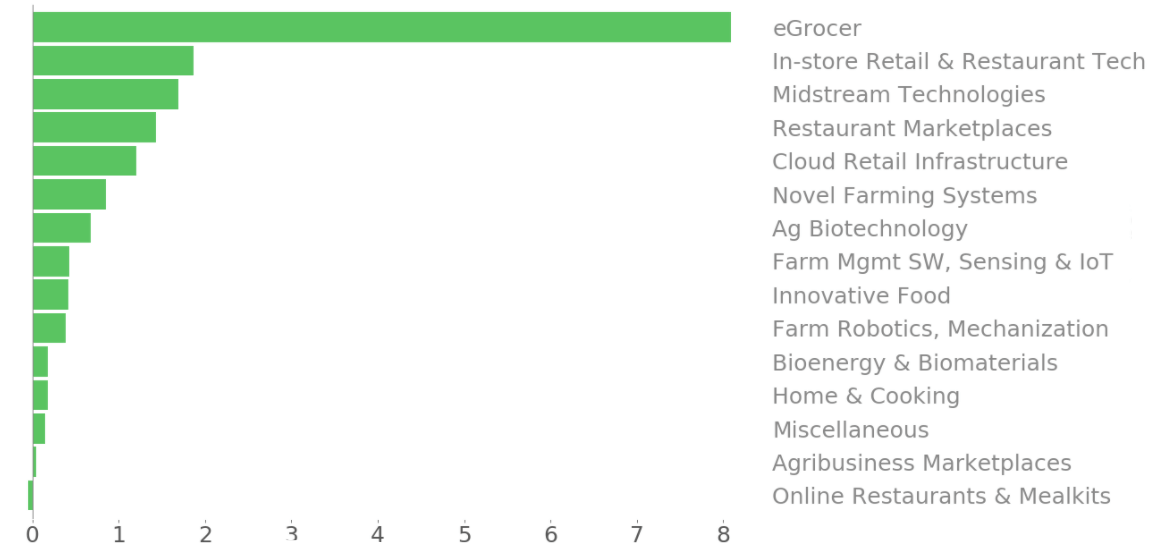

Moreover, it added more investment dollars year-on-year in H1 2021 than any other upstream category (discounting Midstream Technologies), as shown in the chart below:

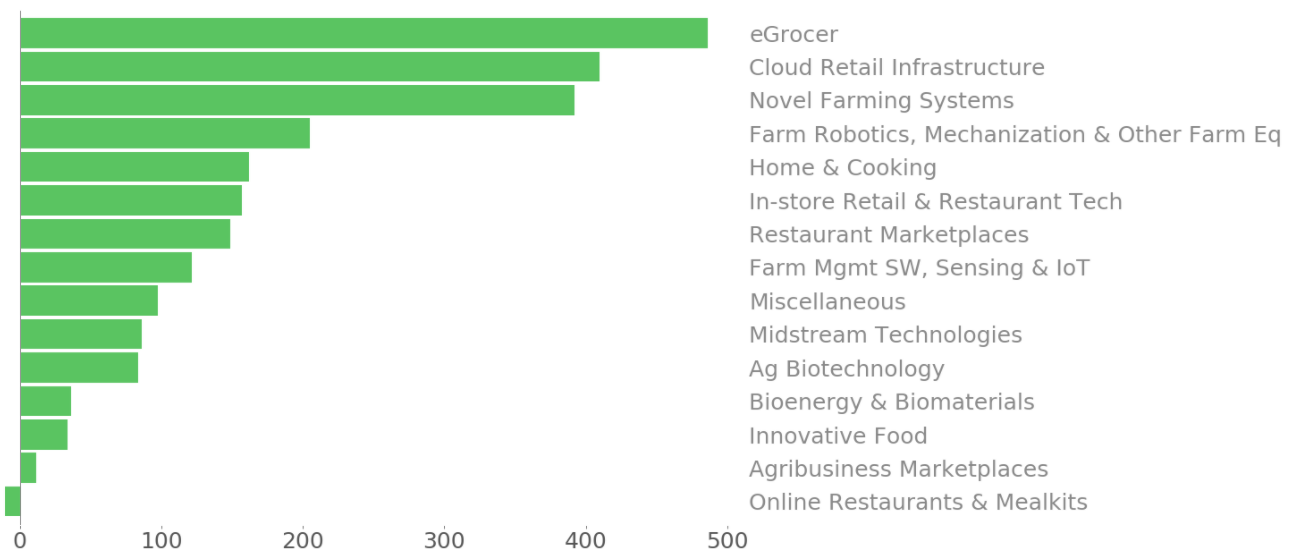

In fact, dollar investment into Novel Farming Systems increased by almost 400% year-on-year – making it the single fastest-growing upstream category by a significant margin:

On the face of it, Novel Farming Systems appears to have been one of the favorite funding categories for agrifoodtech investors in the first half of the year – and particularly for those targeting upstream agtech and food production.

But, as always, dollars don’t tell the whole story…

What’s going on?

Despite an impressive nine-figure haul, ventures in the Novel Farming Systems category closed a total of 44 funding rounds in H1 2021 – the third-lowest deal count of any category except for Agribusiness Marketplaces and Home & Cooking.

Again, that doesn’t necessarily mean much when viewed in the rather two-dimensional context of a single six-month reporting period.

For one thing, this may simply reflect a smaller number of deals with larger-than-average ticket sizes.

Indeed, almost a third of Novel Farming Systems’ $911 million in H1 went to US-based vertical ag company Bowery Farming, which raised $300 million in Series C funding in the half-year’s third-biggest agrifoodtech investment deal overall. Other substantial rounds in the category included a $122 million placement involving US aquaponics specialist Upward Farms (formerly known as Edenworks) and German vertical ag player Infarm‘s $100 million Series C extension.

More telling than this time-static view is the comparison of H1 2021’s data with earlier half-years.

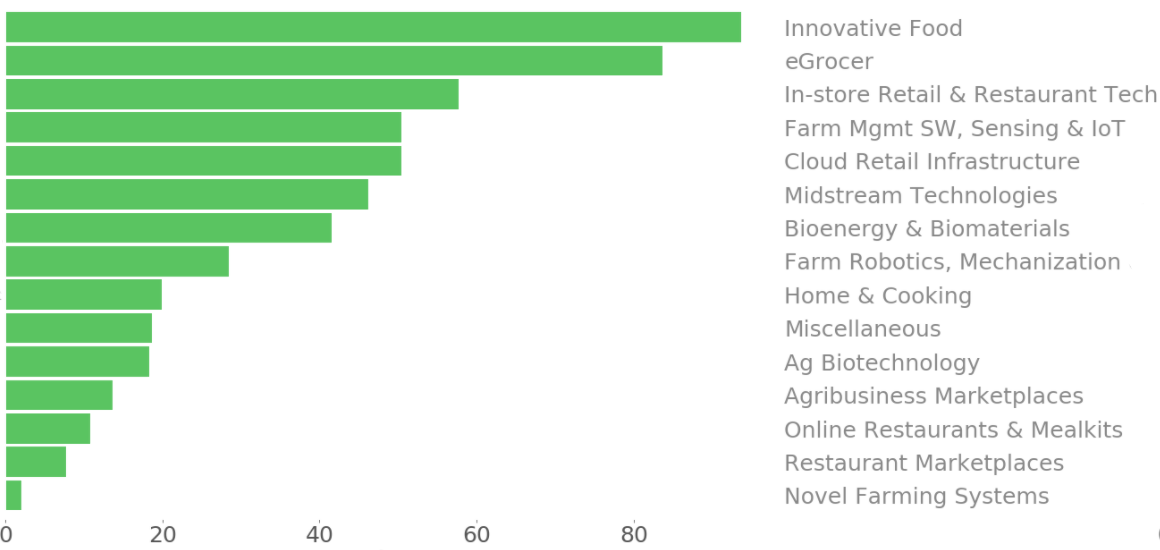

The following chart shows that the number of deals done stayed pretty much flat year-on-year in the Novel Farming Systems category, despite the significant uptick in dollars invested:

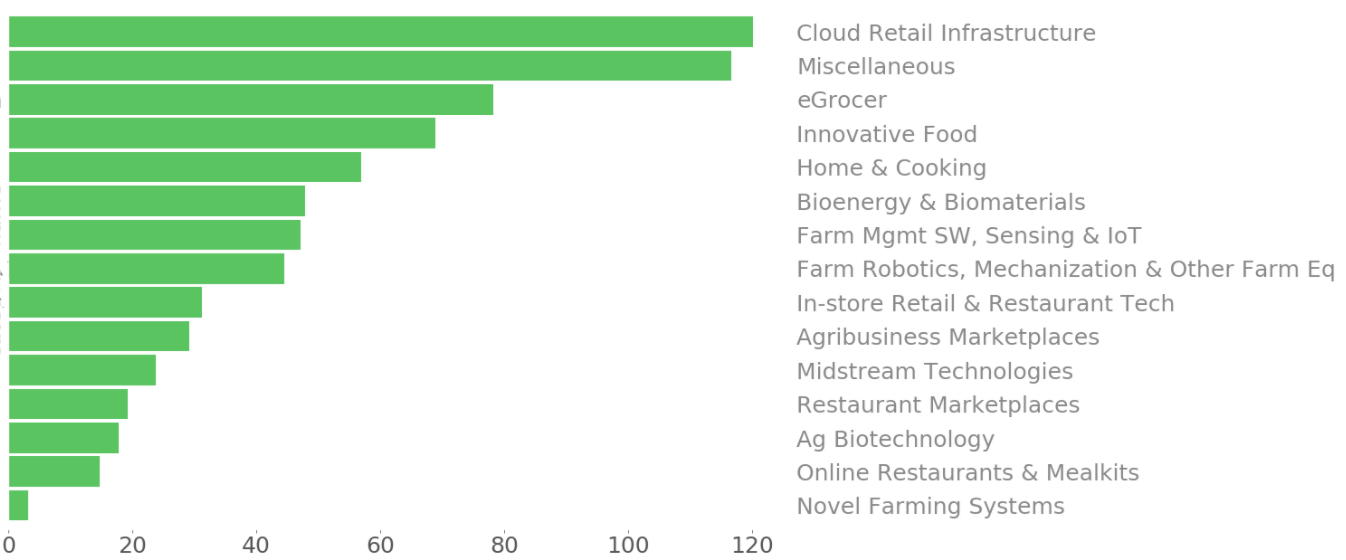

The picture is equally clear when expressed in percentage terms:

What does it mean?

Novel Farming Systems scored some really big dollar sums in H1 2021 — with investment growing almost 4x on H1 2020 — but deal numbers barely changed over the same period.

There are a few ways in which this disparity might be interpreted.

The most likely explanation is that more investment into CEA startups in the first half of this year tended to go to later-stage rounds than previously — later rounds are, generally speaking, larger — while there were far fewer early-stage fundings of smaller ticket sizes being made.

This may mean that investors decided to double-down on their existing bets, making follow-on fundings – as was the case with the major Bowery and Infarm Series C rounds mentioned above.

Does the apparent dropoff in first-time, early-stage deals mean that investors are losing their appetite for CEA businesses? Or could it be that the number of indoor ag startups being founded is decreasing after a hype-filled few years in which a brand-new player seemed to enter the scene every week?

It may well be that investors and entrepreneurs alike have exited the ‘peak of inflated expectations’ and entered the ‘trough of disillusionment’ in the Gartner hype cycle when it comes to indoor ag companies.

The business model has increasingly been questioned, with many observers arguing that the attempt to successfully combine a tech company and a working farm under one roof is doomed to failure; startups focusing on one or the other have begun to emerge, with tech providers like Intelligent Growth Solutions (IGS) supplying equipment and expertise to growing operations like Jungle and Eden Towers [disclosure: AFN‘s parent company AgFunder is an investor in IGS.]

For evidence of this ‘disillusionment’ we can perhaps look to the public markets, where a number of CEA businesses have gone public — or attempted to do so — via mergers with special purpose acquisition companies (SPACs).

Greenhouse operator AppHarvest, which merged with Nasdaq-listed Novus Capital in February, saw its share price nosedive -29% in August after slashing revenue targets it had set at the time of its SPAC deal [disclosure: AFN‘s parent company AgFunder is an investor in Root AI, which was acquired by AppHarvest.]

Newark-based vertical farm operator AeroFarms and SPAC Spring Valley terminated their $1.2 billion merger last month, with the former’s co-founder and CEO David Rosenberg saying both sides agreed that “proceeding with this transaction is not in the best interests of our shareholders.”