Editor’s Note: Amit Sridharan is director of Investments at Mahindra Partners US, the corporate venture capital arm of India-headquartered conglomerate Mahindra Group. His investment focus is around digital-physical intersections, autonomous driving, mobility, robotics, IoT, AI, and agtech. He has a Masters in Management degree from Stanford Graduate School of Business, where he graduated as the Robert Joss Scholar.

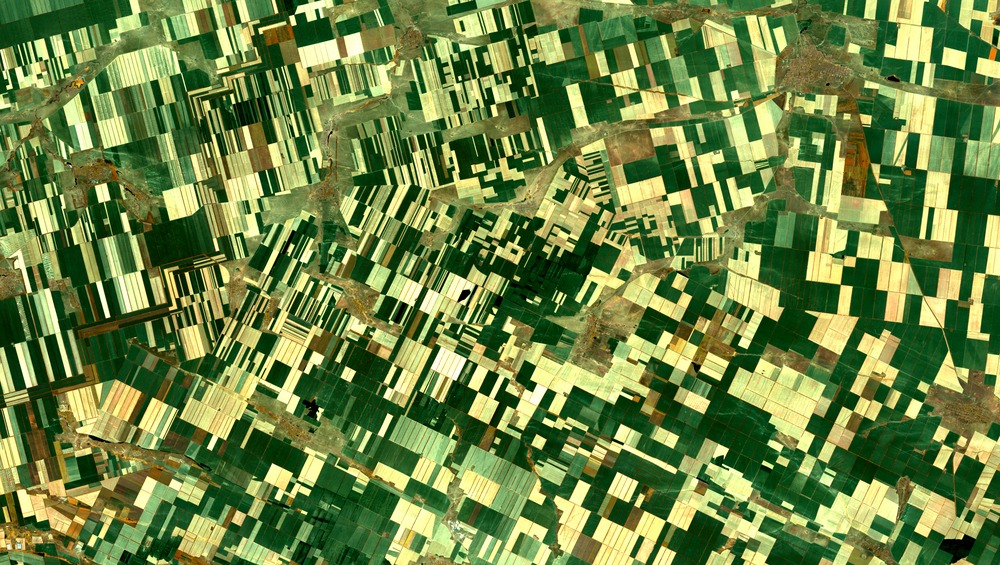

Agriculture is often referred to as the last bastion of digitization.

Creating step change in a 10,000-year-old industry is obviously hard. Technology deployed on farms must be easy to implement, resilient and affordable to overcome the refined art of “The Farmer.” Existing growers refrain from taking risky bets on emerging technologies that cannot demonstrate an obvious value proposition.

Truthfully, the first mover advantage at the farm level is seldom convincing. That said, the potential for technological intervention in agriculture is too large to be ignored. In 2016, Goldman Sachs came up with a report showing technology interventions in agriculture could increase value at the farm by over $240 billion. That’s a massive untapped opportunity to investors, but the industry carries legacy technologies and manual operations serving as roadblocks to making this quantum leap. So, how can a startup bring technology to drive value in agriculture?

The full stack approach augurs well for the startup when digging into the food system. Innovation in traditional agriculture requires understanding across the multiple players in the value chain. Over the last 100 years, the food system has migrated from the farmer whose advantage was using the fertility provided by his animals and his best seeds in a good location to a disparate community of big agricultural suppliers.

The ‘Big Ag’ companies have focused on the efficiency of one task, then grown it and consequently found fewer technology solutions to plug into their broader but shallower system. Full stack startups offering service models have the potential to break in and adapt with the parts of the system driving strategic value for the end customers. Companies like Blue River Technologies and Farmwise addressed the challenges farmers were seeing with weeds. These startups identified the obvious pain for farmers of the high cost and availability of manual labor. Using computer vision and robotics, they brought solutions creating efficiency against obvious challenges.

By interpreting the challenges of roundup resistance first, and bringing the right solution, they could provide this as a service to farmers at the cost of manual labor. Understanding the challenges of the system presented a $50 billion market opportunity in the US alone. More broadly, full stack thinking can be applied to startups looking at breaking the barriers in traditional agriculture. Indigo and Farmers Business Network are also full stack solutions in the sense that they can cater to the farmers’ needs end-to-end.

The world is seeing advancements in technology and falling cost curves that fit right in with Moore’s laws. Hardware has become exciting with sensors and new capabilities like computer vision capturing edge data that we did not previously understand the value of. The cloud has democratized data storage, computing power, and access. 5G and edge solutions are driving down latency while computer power itself is growing exponentially. AI and machine learning have led to breakthrough insights. And advancements in robotics are leading autonomy not previously possible. It is no wonder investors have found full stack solution startups that are combining data acquisition, insights from machine learning, and autonomous actions attractive.

Another result of this thought is indoor farming at scale. No longer viewed as the system to grow contraband in your college closet, growers are leveraging the falling cost of LED lighting (hardware), optimizing variables for plant growth using machine learning (software) and building a fully automated plant factory (robotics). And indoor ag startups are building stacked systems that deliver food at a cost close to traditional agriculture but more local and at the desired timing. It is also interesting that many startups, who are not full stack solutions themselves, are building solutions that enable efficiencies in creating a robust full stack play. This further presents a supplementary opportunity in this area.

The brave entrepreneurs bringing their agtech solutions can take inspiration from this vision: full stack solution can deliver big breakthroughs for our food system. Agtech VC funding has been growing and full stack solutions can be pull in funding from the traditional VCs willing to bet big into ag as well as CVCs who are looking to back radical new business models.