AgFunder’s sixth annual investment report — rather flirtatiously described by the research team as “our love letter to the industry” — is now officially published; it can be downloaded right here, right now.

There’s more maths behind this romantic agrifoodtech gesture than quills by moonlight: “Utilizing new advanced machine-learning algorithms and artificial intelligence to help identify and categorize agrifoodtech startups, our knowledge base has grown to over 29,939 companies, with new startups and historical data being added each day,” the AgFunder research team writes, describing a “painstaking” process of data curation where investments are tracked and verified over the course of months. The means the dataset “represents the most comprehensive and curated knowledge base of agrifoodtech companies globally.”

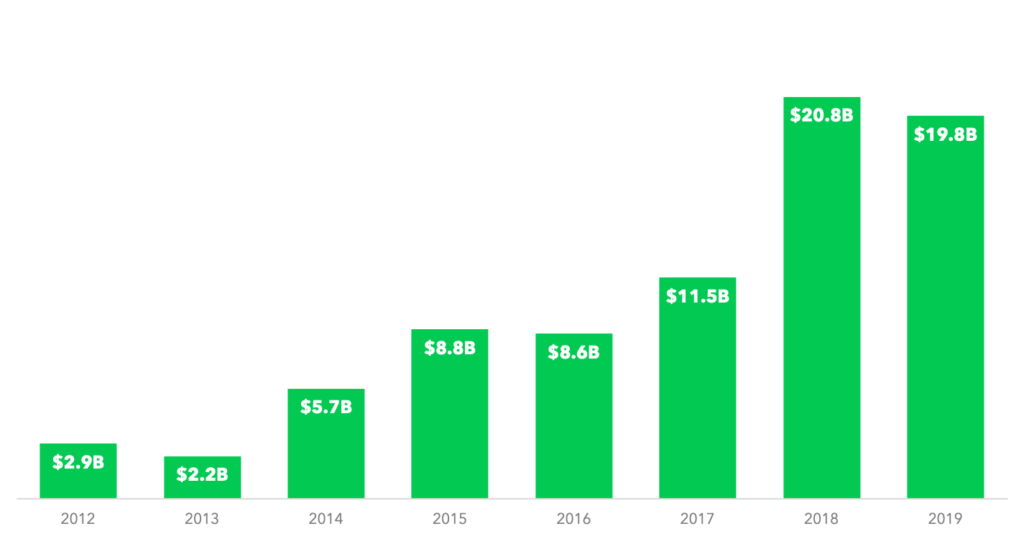

Hey, big spenders! $19.8 billion raised in 2019

For anyone delaying reading the full report till a Bill Gates-inspired “think week” or something, AFN can share a few choice morsels to whet your appetites. First off, the world’s agri-foodtech startups raised a total of $19.8 billion in 2019, across 1858 deals and 2344 unique investors.

As the graph above illustrates, there are a few ways to interpret this $19.8 billion figure. Though it signals a 4.8% drop in funding and 15% decline in deal activity year-over-year, it also represents a staggering 250% growth in five years, and proves that the huge scale of investments in 2018 was no freak outlier. In some respects, as AgFunder’s research head Louisa Burwood-Taylor notes in the report, a meeker 2019 also chimes with a wider pullback seen across the VC space, as highlighted by recent KPMG research in the VenturePulse report.

“Venture capital investment across all sectors dropped 16% in 2019 against a backdrop of global uncertainty related to the US-China trade war, Brexit, and a weakening Chinese economy,” writes Burwood-Taylor. “It was the same for agri-foodtech, particularly affecting the US and China, but not to quite the same extent.”

Delivery overload

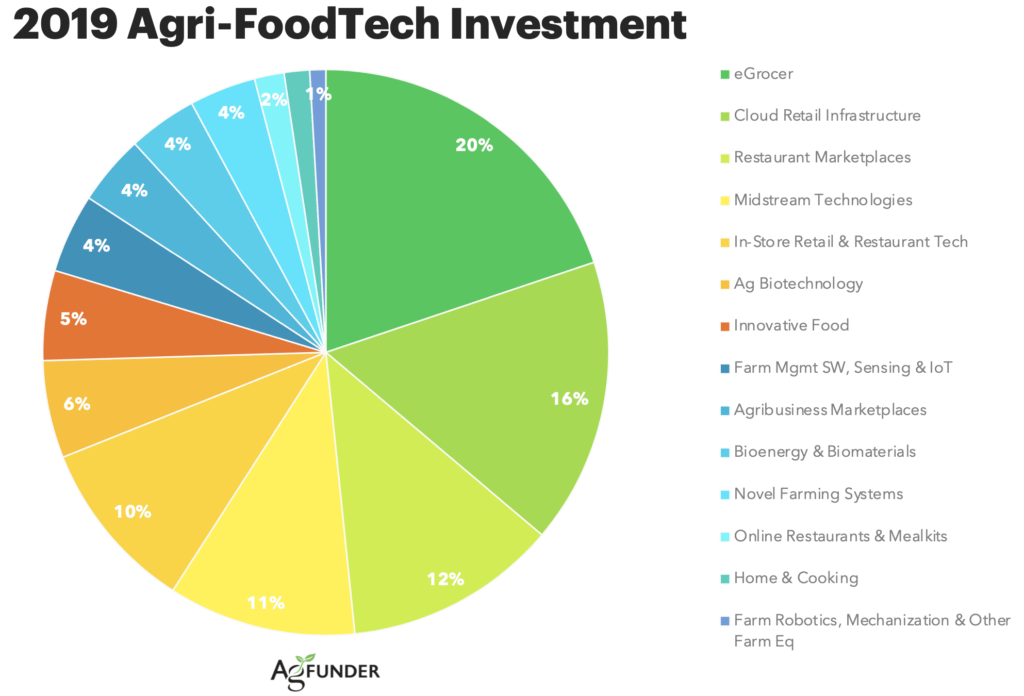

The report shows how much of the pullback in agrifoodtech funding came from the increasingly competitive area of innovation downstream in the food supply chain. “The drop in funding overall was largely a result of a 56% decrease in investment to consumer food delivery apps as the more mature players extended their dominance in an over-saturated marketplace with ever-larger fundraisings.” (Meanwhile, investment grew in enabling, white-label technologies for retailers to create their own delivery options.)

Another downstream category, eGrocery, also suffered a 7% decrease in funding across fewer deals, the report reveals, as the economics of delivery services cause challenges and sentiment sours. Walmart, for instance, reported a $1 billion loss on its e-commerce offering, dampening investor expectations. Even so, eGrocery innovation remained active in China — in 2020, the ongoing coronavirus threat could make these services increasingly important for consumer access to food. China’s MissFresh, one of the leaders, raised one of the year’s largest rounds.

To call it a lean year for food delivery services, eGrocery and their ilk, is to get carried away. In fact, the largest agri-foodtech deal of the year turned out to be a massive SoftBank-led $1 billion Series E round for Rappi, Latin America’s biggest on-demand delivery startup. Total funding for companies like Rappi in a category the AgFunder research team now calls Cloud Retail Infrastructure — still reached 16% of total agri-foodtech funding in 2019, as seen in this pie chart below.

Plant-based profusions

Upstream startups — early stage companies providing farm-facing and supply chain innovations — reached new heights in 2019. Upstream startups posted their strongest H2 on record with funding overall reaching $7.6 billion, a 1.3% year-over-year increase. Alternative proteins and vertical farming drove much of the upstream uptick. Investment in the “Innovative Food” category, which is mostly alt protein plays, doubled year-over-year to $1 billion, bolstered by Impossible Foods’ $300 million bridge round and a 17% increase in the number of deals; no doubt a sizzling IPO by Beyond Meat helped whet investor appetites.

With vertical farming, two huge deals landed on the doors of two contrasting approaches with Germany’s Infarm and New Jersey’s Aerofarms both each securing over $100 million in their respective rounds. Their success, alongside the robotic insect farm Ynsect, drove a 38% increase in the Novel Farming Systems category, despite 16% fewer deals.

“It is heartening to see Upstream investment levels grow faster than the more consumer facing downstream sectors for the first time in years,” AgFunder’s Michael Dean told AFN. “In a year where political instability impacted on the established investment players in the US and China, the extraordinary performance of new and emerging markets for agri-foodtech investment was welcome and not a little surprising in its intensity.”

The advent of the generalists

The investor leader board for 2019 shows signs of new and emerging markets coming to the fore. Asian investor powerhouses, Temasek and SoftBank, are notable entrants to the leader board this year, both investing across borders in a range of agri-foodtech startups. Other big generalist Silicon Valley lead investors like Sequoia are also vaulting into the lead on big rounds, with fewer agri-foodtech specialists, though the most active investor last year was the multi-stage food and agriculture venture firm S2G Ventures.

“Adoption, financing and syndicate are the three biggest risks we manage as a fund,” says Sanjeev Krishnan of S2G, reflecting on his company’s activism. “If you are going to invest in the sector, you need a “tough tech”, marathon mindset to company building and exits. I think the consumer, innovation and new business model design can help mitigate the challenges to the sector. We continue to be excited about following the consumer change as a way to scale the next generation of food and agriculture companies.”

LatAm sizzles as Europe matures

Looking at the data by stage and geography, the AgFunder research team uncovered a breakout year for Latin American agri-foodtech as the region raised $1.4 billion, up 32% year-over-year; that’s more than the whole VC industry of the region raised in 2017. Europe’s VC industry, the report finds, “continued to mature, and it was noticeable in agri-foodtech as investment increased 94% year-over-year to $3.3 billion. The UK was the leader in the region and the fourth biggest globally with $1.1 billion raised across 112 deals, although it did experience a small dip in the number of deals closed. While food delivery is still the strongest category in the UK and Europe, the region is diversifying across categories, with leading startups in other areas like Novel Farming Systems, alternative proteins, fintech for ag, and Agribusiness Marketplaces.”

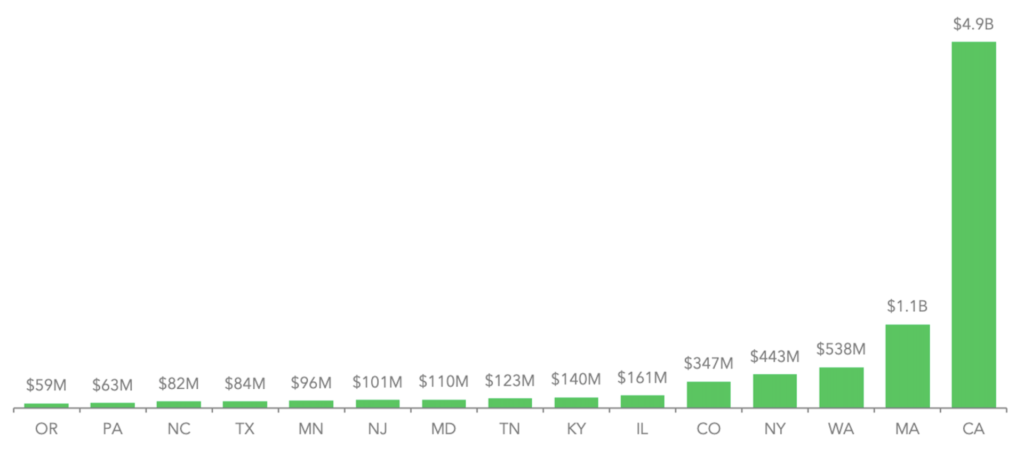

Many startups with operations across Africa are headquartered in the UK, however those based on the continent doubled their funding in 2019, aided by a large deal for fintech startup Opay out of Nigeria that enables consumers to transfer money, pay bills and order groceries. In the US context, Silicon Valley still held its own as a fundraising hotspot, despite many of its investors taking more active positions on global newcomers. As this infographic suggests, California-based startups ended up raising more than all other US states combined.

What insights did you draw from this report? What do you expect is coming next in 2020? Let us know. Drop a note to [email protected]