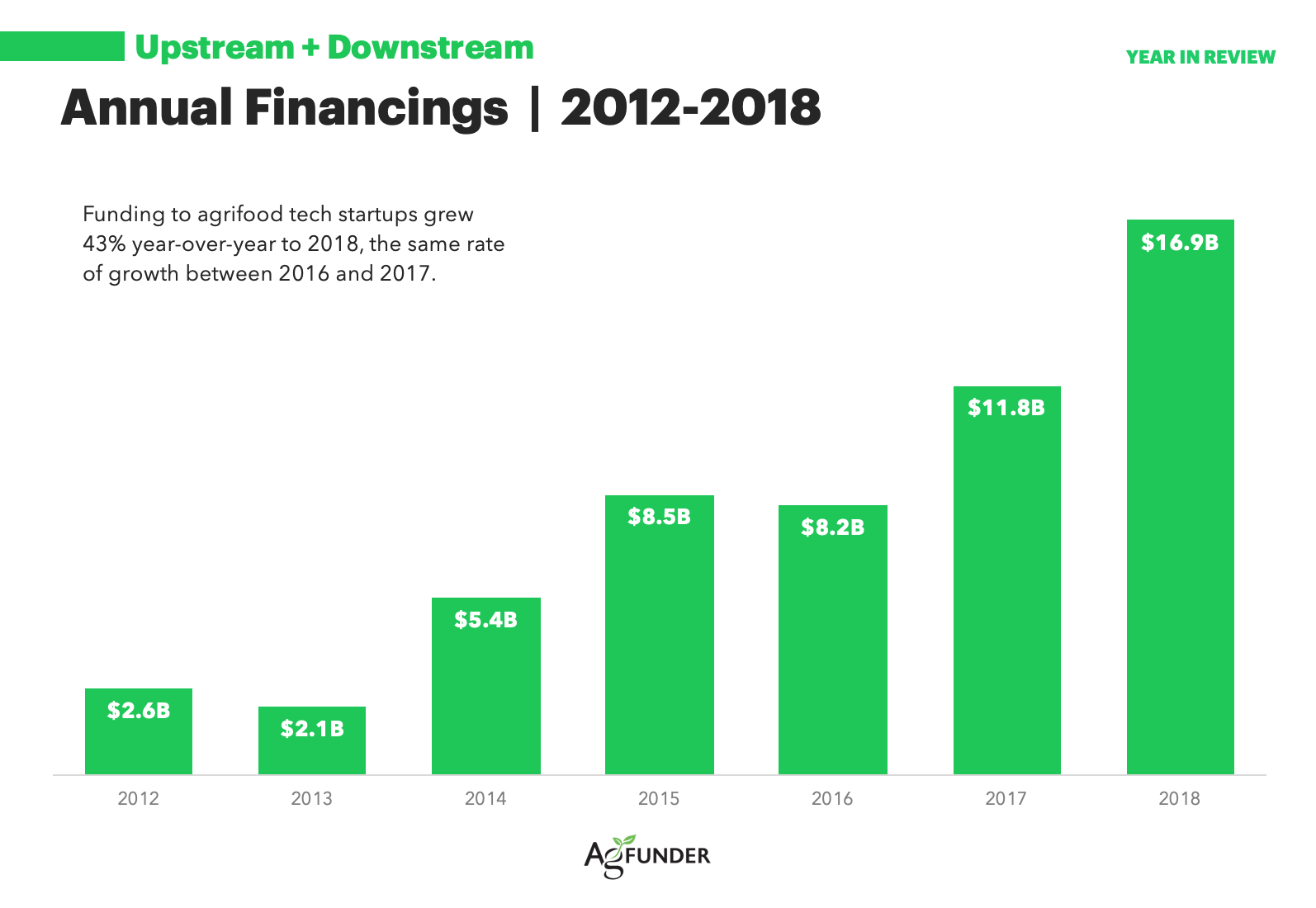

AgriFood Tech startups — those innovating all along the food and ag supply chain — raised $16.9 billion in 2018, a 43% increase year-over-year growth, according to AgFunder’s latest investing report.

Deal activity also increased, by 11%, bucking the trend across venture capital industries where it dropped off considerably, according to VenturePulse.

There were several drivers at play contributing to the increase, not least the continuing maturation of agrifood tech as a venture capital asset class. In 2018, deal sizes grew significantly at the later stages, with the median size at Series D reaching $73m, far ahead of other VC industries where it was $50m, according to VenturePulse.

It wasn’t just startups developing technologies at the consumer end of the supply chain that drove those median increases — Indian restaurant marketplace Swiggy closed a massive $1 billion round — but agtech startups building solutions for farmers and for the supply chain also raised jumbo rounds, including Zymergen’s $400m Series C, Indigo’s $250m Series E, and a $300m round for an undisclosed Farm Management Software & Sensing startup.

That agrifood tech startups can raise such large rounds highlights the presence of an increasingly diverse range of investors, including larger, institutional investors that are starting to find investment opportunities in the sector. It also highlights the strength of the proposition of disrupting, or improving, the world’s broken food systems with technology; an industry worth almost $8 trillion that employs well over 40% of the global population.

An Established Asset Class

With $17 billion of investment in one year, it is probably fair to say that agrifood tech has confirmed its position as an established venture capital sector. Over the past 6 years, investment in agrifood tech startups has increased 550%.

While much of the increase has come from startups offering technologically-backed products to consumers such as food e-commerce, investment in upstream startups is catching up, increasing 44% year-over-year to reach $7 billion in 2018, in its fastest growth rate on record.

Ag Biotech startups represented a significant portion of that upstream growth, closing $1.5 billion of funding. There was a strong presence of startups using gene editing tools to breed new varieties of food crops for improved nutritional value as well as enhanced performance in the field.

Startups improving efficiencies between the farm and retail — so called Midstream Technologies — also contributed to the growth in upstream funding, raising $1.3 billion. This varied category included an increasing number of robotics startups aiming to improve efficiencies in transport – Nuro, Starship Tech, and Kodiak – while others work on food processing and packing — RightHand Robotics and Soft Robotics.

The rapid development of robotic technologies across industries was noticeable across the food supply chain as investment into Farm Robotics & Equipment increased 56% year-over-year across 83 deals. Serious challenges around labor shortages on the farm and the increasing cost of labor in developed markets are driving many of the entrepreneurs in this category.

A Global Asset Class

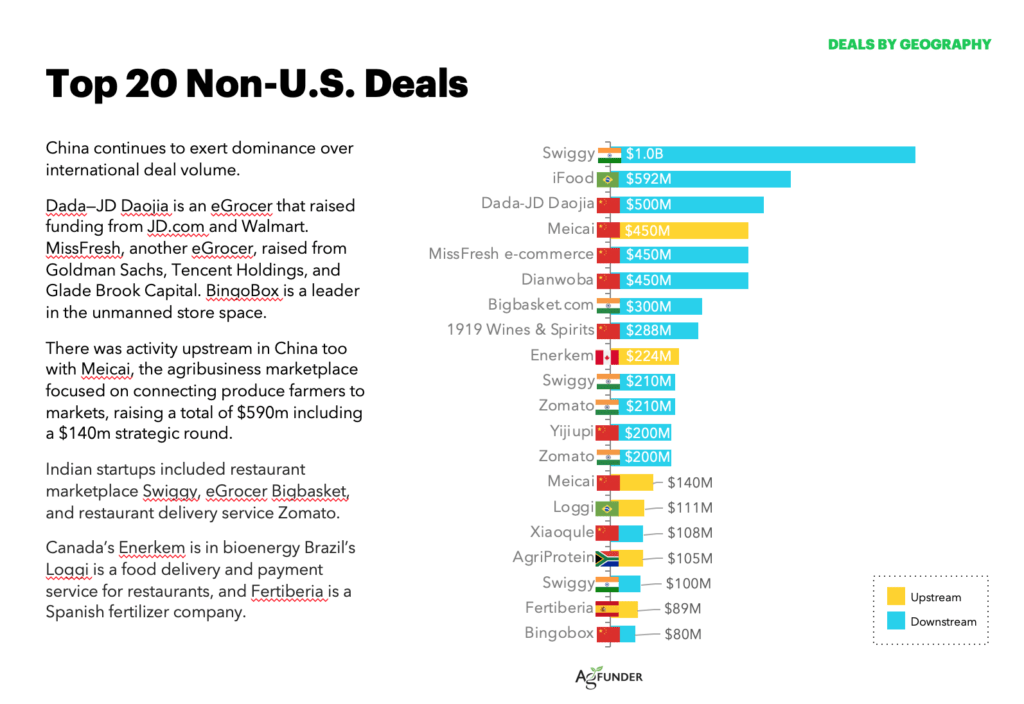

While the US still dominates the industry representing 46% of total funding and 40% of deal count, there were significant deals in other parts of the globe, particularly China and India. The majority of this investment occurred downstream in the form of food delivery platforms– from eGrocers to Restaurant Marketplaces to Online Restaurants & Meal Kits — as entrepreneurs take advantage of the growing middle classes in these regions and increasing demand for more convenience and choice. Logistically, access to clean, safe food is also a challenge in these countries — the infamous Mumbai traffic makes eating out a particular challenge!

And while we’d like to see more innovation upstream, closer to farmers who are facing acute challenges such as access to inputs and markets for their produce, some startups are trying to meet those challenges such as Meicai, an online agribusiness marketplace that raised $590m over the course of the year from some major Chinese investors. In India, Stellapps is improving the supply chain for dairy farmers and raised a more conservative $14 million Series B.

And while we’d like to see more innovation upstream, closer to farmers who are facing acute challenges such as access to inputs and markets for their produce, some startups are trying to meet those challenges such as Meicai, an online agribusiness marketplace that raised $590m over the course of the year from some major Chinese investors. In India, Stellapps is improving the supply chain for dairy farmers and raised a more conservative $14 million Series B.

A Developing M&A — and Exit — Market

Over 60% of M&A for farm tech startups during 2018 resulted in an exit for venture capital, private equity, and other investors. The sector’s largest exit on record also occurred during the year when private equity group BC Partners sold digital animal health business Antelliq to German pharmaceutical company Merck for $2.4 billion.

Find a list of farmtech M&A, category deep-dives, the most active agrifood tech investors and more in the 60-page AgriFood Tech Investing report here.

Download here

Special thanks to our data partners Crunchbase, BitsxBites, Omnivore, SP Ventures, Start-Up Nation Central and Verdant Partners. And to Singapore Management University MBA students Elijah Tan, Ervin Wee, Barry Seah, Ke Jinghao for their help curating the data and co-authoring the report.

Feedback always welcome! And if we’re missing your data, email [email protected], or submit it to Crunchbase!