Data Snapshot is a regular AgFunderNews feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

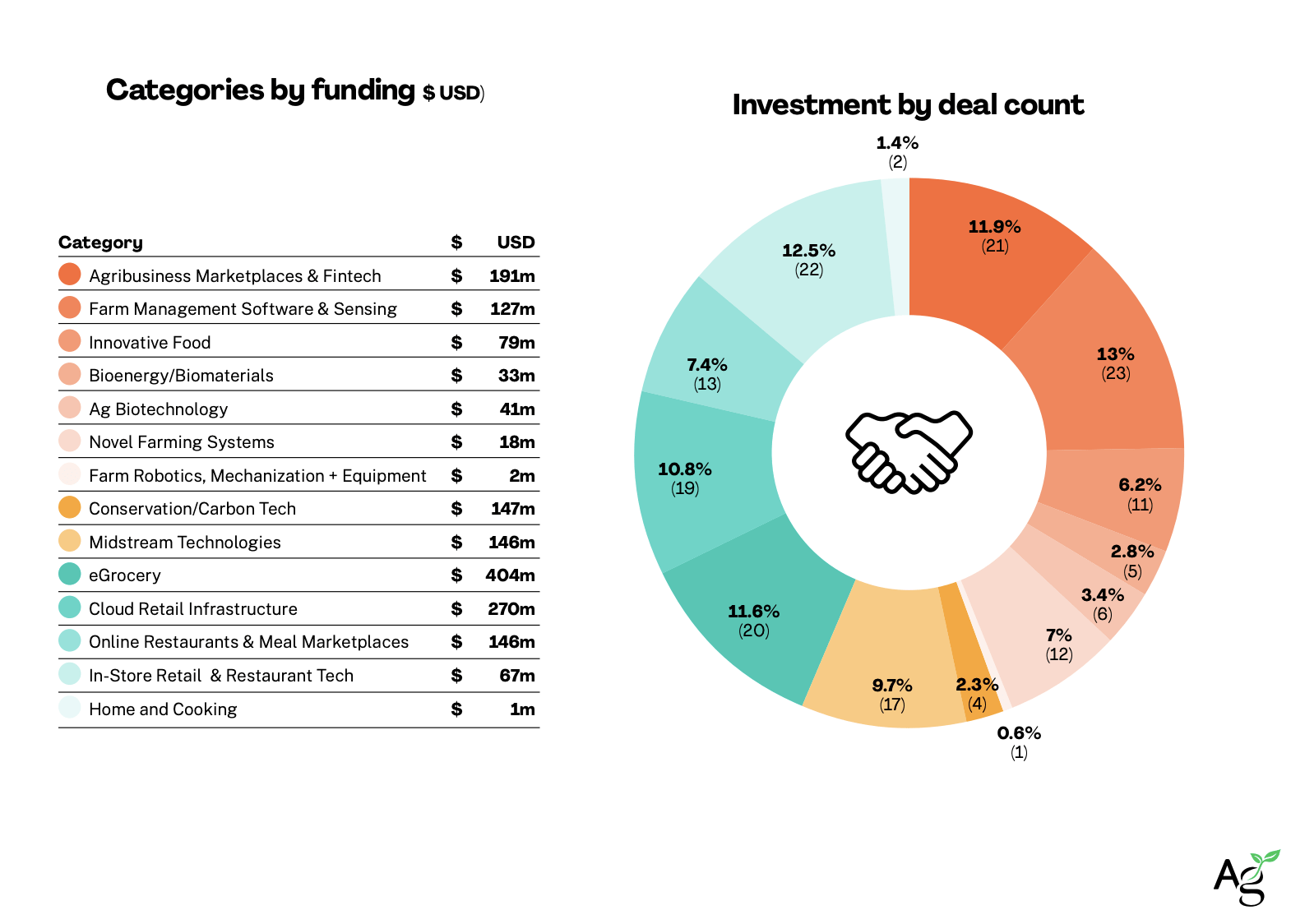

Agribusiness Marketplaces & Fintech was the most-funded upstream category in Latin America in 2022, according to AgFunder‘s inaugural Latin America AgriFoodTech Investment report produced in partnership with SP Ventures, Alianza Team, BASF and Cibersons. Startups in the category raised $191 million in 2022, 73% more than 2021 ($110 million), albeit over fewer deals.

The AgFunder-defined category is the term for online marketplace platforms providing farmers with everything from inputs and equipment to offtake and marketing in addition to credit and financial advice.

The idea fueling most startups in the category is to bring more efficiency and transparency to the agrifood supply chain.

Ag Marketplaces & Fintech is a strength for the Latin American region, where 14 million smallholder farmers produce 50% of the region’s food supply.

Agrolend ‘ready to face any storm’

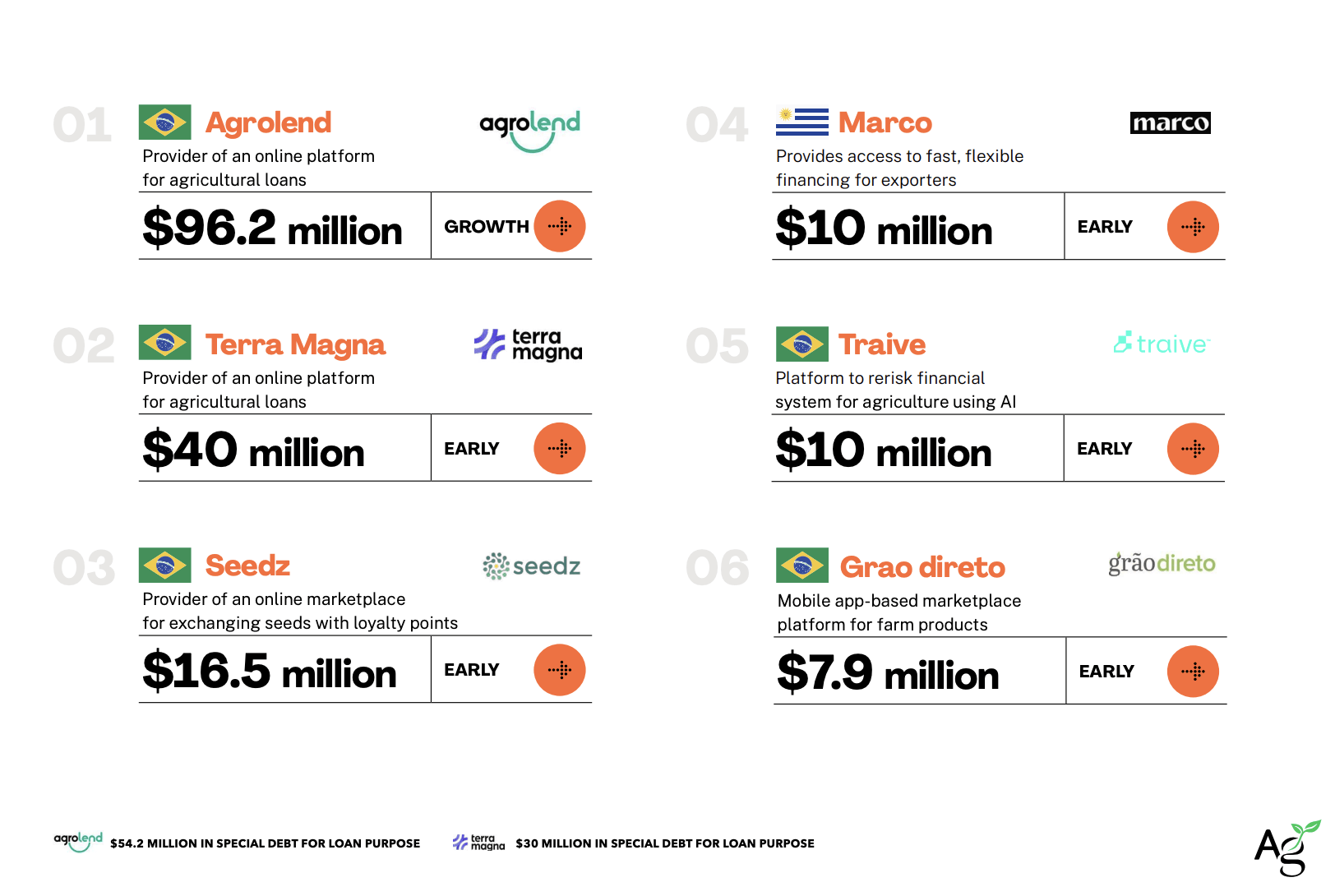

Brazil-based Agrolend had the top deal in 2022 for Ag Marketplaces & Fintech. The startup, which provides working capital loans to small- and medium-sized farmers, raised nearly $100 million in 2022.

“We promote the development and growth of GDP in rural areas of Brazil, supporting family agriculture evolution,” the company noted in AgFunder’s report, adding that Agrolend capital “promotes the adoption of higher quality agriculture inputs, such as biological fertilizers and crop protection products.”

Agrolend said in the report that lack of financial resources for farmers will get worse as the world shifts to a higher interest rate environment.

“We are in a cyclical industry and stormy markets happens from time to time. We work around the clock to build a solid company that’s ready to face any storm when crisis strikes.”

Other top deals in 2022

Fintech-focused startups made up a huge portion of the Ag Marketplaces & Fintech categories’ top deals. Terra Magna, Marco and Traive provide agricultural loans, flexible financing for exporters and risk assessment, respectively.

Seedz is an online marketplace where farmers can purchase inputs in exchange for loyalty points; Grão Direto is a mobile app-based marketplace platform for farm products.

Brazil has the most startups in this category, which is no surprise given that it’s home to 4.4 million smallholder farmers that account for 85% of all agriculture in the country. It’s also the world’s fourth-largest food producer, exporting to many countries around the globe including China, where demand for Brazilian exports is surging.

In 2022, Brazil had $75 billion of working capital credit lines available to farms, all of which were used.

Sponsored

Farmers ‘ready and willing to try’ biological crop solutions. Only ‘strong business models’ need apply