Data Snapshot is a regular AFN feature in which we analyze agrifoodtech market investment data provided by our parent company, AgFunder.

Click here for more research from AgFunder and sign up to our newsletters to receive alerts about new research reports.

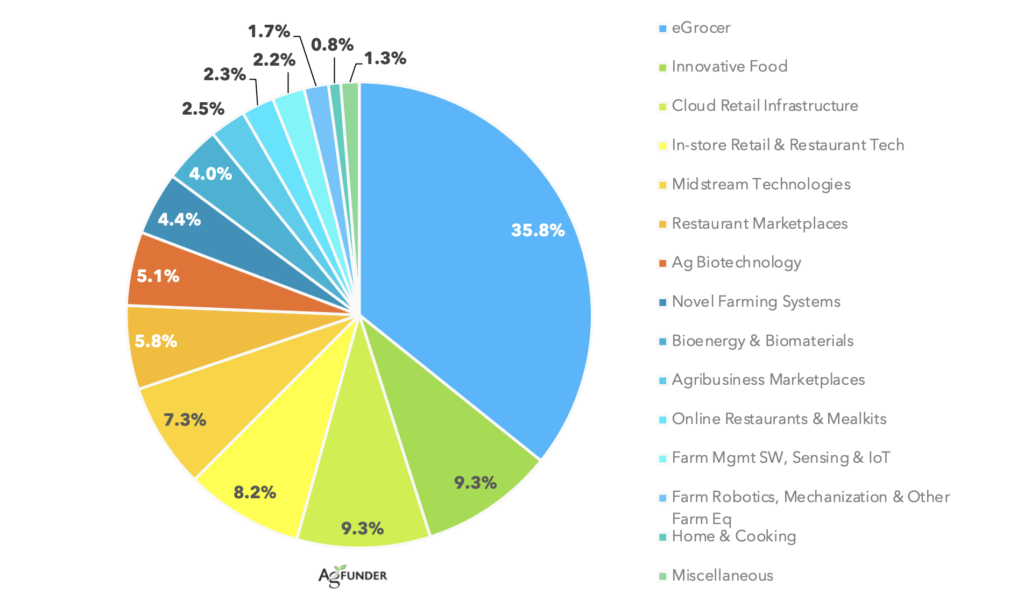

If 2020 was the year agrifoodtech investment took off, 2021 saw the industry explode, raking in $51.7 billion in venture capital deals, according to the just-released 2021 AgFunder Agrifoodtech Investment Report. Nowhere is that growth more evident than in the eGrocery category, which was by far the biggest VC investment category for the year.

In 2021, eGrocery saw $18.5 billion in investments, claiming over 35% of all agrifoodtech investment for the year and growing 188% over 2020. AgFunder defines eGrocery as “online stores and marketplaces for sale and delivery of processed and unprocessed ag products to the consumer.”

Mega-deals by companies raising eight-, nine-, and 10-figure rounds fueled much of this growth worldwide, including Chinese company Furong Xingsheng’s mammoth $3 billion round – the single biggest agrifoodtech venture deal of 2021.

Excluding China, eGrocery still raised $13 billion, which is far higher than any other category in AgFunder’s report.

Share of total agrifoodtech venture funding by category, 2021

Top deals for eGrocery in 2021

Four companies raised more than $1 billion, including the aforementioned Furong Xingsheng. In fact, China’s agrifoodtech funding landscape was “synonymous” with eGrocery in 2021: of the $7.3 billion raised by Chinese agrifoodtech ventures, 75% went to companies in the category.

Outside of China, eGrocery saw massive raises from the up-and-coming “instant grocery” startups such as US-based goPuff, which raised $1.5 billion, and Turkey’s Getir, with a $555 million.

Other notable deals included Germany’s “dueling instant-delivery companies,” Gorillas and Flink.

Furong Xingsheng, Gorillas, and goPuff each had multiple funding rounds above the $200 million mark in 2021.

Rapid growth for instant grocery’s future

Prior to 2020, the eGrocery category was a “nice-to-have” rather than a necessity for most. The Covid-19 pandemic is frequently seen as the main driver for consumers adopting online grocery-buying habits. As AgFunder’s report notes, online grocery shopping is now “so engrained in consumer behavior that new entrants are building their brands around not just ‘convenient’ but near-instant delivery.”

This is evident from the rise of startups such as Gorillas and goPuff promising super-fast delivery (sometimes 10 minutes or less) for staples such as baking flour, ice cream, toilet paper, and in some cases alcohol. Aided by micro-fulfillment centers located in dense urban areas, these services offer an enticing prospect to busy consumers: get last-minute goods without leaving the apartment in the same amount of time it would take to walk up the block to the local market.

Naturally, such massive investments into these startups raise a lot of questions about whether eGrocery, and in particular instant grocery, is a fleeting trend or a sector that’s sustainable for the long haul. Instant grocery is such a new model that it’s too soon to tell whether the economics are feasible over the long term. For now, at least, investors seem to be betting on it.