AgFunder and AFN recently released the latest edition of our annual report on global agrifoodtech funding [disclosure: AgFunder is AFN’s parent company].

In past editions, we’ve regularly separated out US data, given that the country has been far and away the dominant market for agrifoodtech investing to date. But this was the first time we parsed out data for another country: China.

Here’s why.

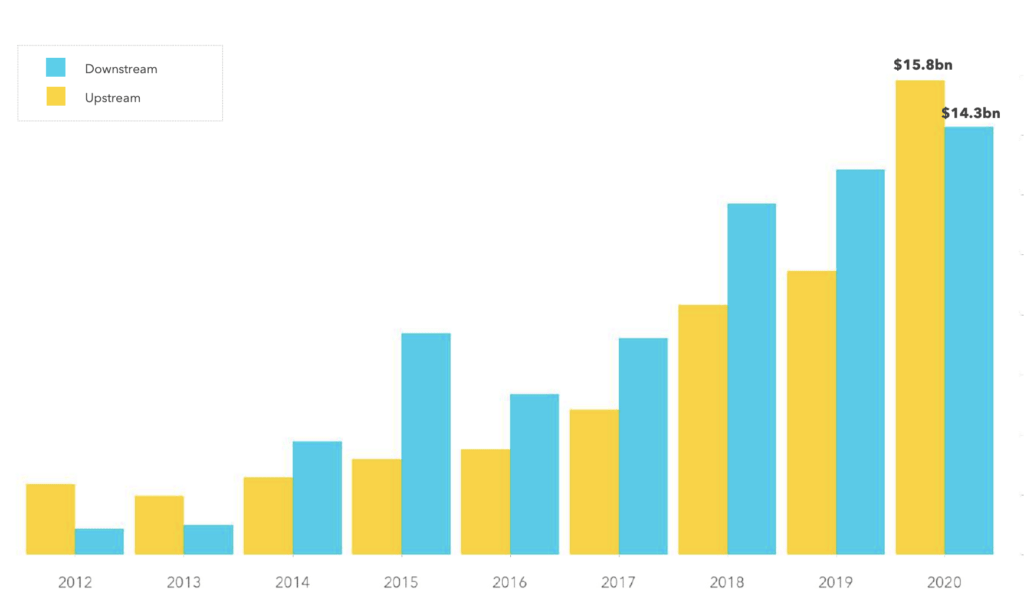

As we previously noted, one of the overarching themes in 2020 was that total funding for upstream technologies (ie, those closer to the farm) overtook downstream (ie, consumer-facing) tech for the first time in years.

Nevertheless, downstream investment continued its trend of annual growth, banking a total of $14.3 billion on 2019’s $12 billion. The continued attraction of downstream categories such as eGrocery, Restaurant Marketplaces, Online Restaurants & Mealkits, and Home & Cooking has been widely ascribed to the Covid-19 pandemic, which forced millions of consumers to stay at home and turn to meal and grocery delivery services.

At least, that’s the story indicated at first glance. But we’ve found that when one country’s data is taken out of the equation, the global picture of downstream investment changes quite significantly.

Here’s our projected worldwide funding total for 2020 and the preceding eight years, which appeared in the 2021 Agrifoodtech Investment Report:

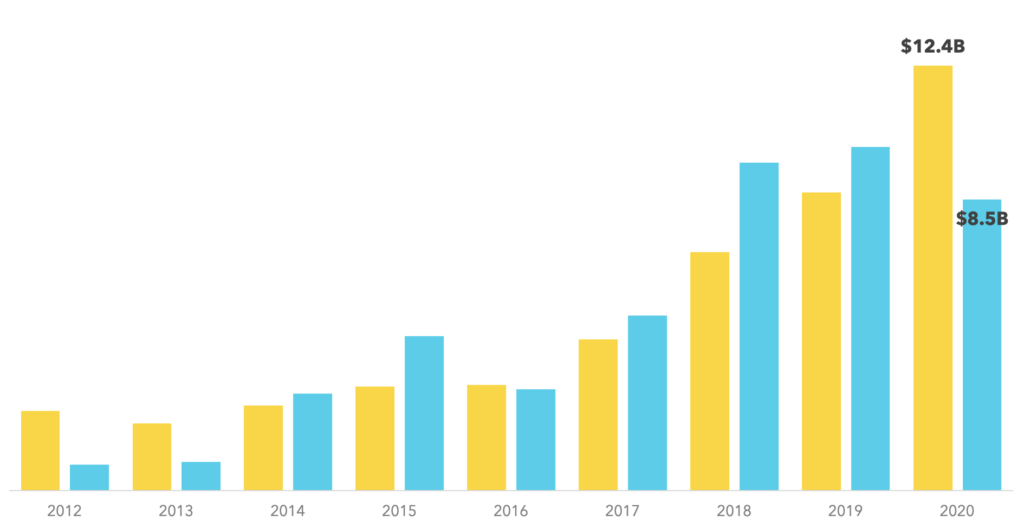

And here’s the same data, but charted with all China deals removed:

And here’s the same data, but charted with all China deals removed:

The revised data show that it isn’t simply that upstream investment overtook downstream in 2020; but downstream funding volume actually dropped in real terms on a worldwide basis when Chinese deals are discounted.

China still trails the US in terms of total dollars invested, securing $4.8 billion compared to the States’ $13.2 billion last year (though it has opened up a substantial gap on third-placed India, which clocked $1.8 billion in total funding.)

In fact, when it comes to the number of deals done, Chinese funding activity actually declined year-on-year. But a handful of massive tickets in the eGrocery category served to skew the dollar figure upwards.

Six of the top 10 ex-US deals in 2020 involved downstream Chinese companies. The largest of these — and the second-biggest deal globally, including the US — was Furong Xingsheng‘s $700 million injection from e-commerce behemoth JD.

Other oversize fundings went to several of Xingsheng’s fellow community-buying platforms, which allow consumers to form groups to purchase produce and other goods in bulk from farmers, agribusinesses, and food companies.

These include Nice Tuan, which netted close to $450 million in Series C funding across several tranches last year from investors including tech giant Alibaba; and Tongcheng Life, which raised $200 million in a June Series C round co-led by livestreaming platform Joyy.

It’s worth underlining again that the total funding figures published in the 2021 Agrifoodtech Investment Report are projections based on current data; we expect these numbers to grow and shift as more 2020 data becomes available over time.

The 2021 edition of our annual China Agrifood Investing Report is due to hit inboxes later in H1 2021 – that’s sure to provide an even more accurate picture of what went down in China’s booming agrifoodtech scene last year.

Comment? News tip? Story idea? Email me at [email protected] or find me on LinkedIn and Twitter