Denver is considered by some to be the epicenter of cannabis cultivation and innovation, so why did 80% of dispensaries recently tested by the Denver Department of Public Health and Environment fail mold testing? The random inspections were part of an effort to learn more about shelf life and packaging issues that may exist among the hundreds of cannabis retailers in Denver. The random inspections were announced in August. Dispensaries with failed product samples received their supply from wholesale providers.

“It’s not just an issue in Denver; it’s a countrywide issue,” Jill Ellsworth, CEO and founder of cannabis safety technology provider Willow Industries tells AFN. “All of the state agencies are now looking at microbials because there is an issue when you inhale mold and yeast. The spores go into the delicate lung tissue. For immune-compromised patients, this is particularly concerning. It’s not like consuming moldy food that goes into the digestive tract where it can be broken down.”

Just how big of a problem is it?

The cannabis industry received a massive shockwave in 2016 when a cancer patient in California died after using medical marijuana and inhaling cannabis contaminated with bacteria and fungi including Klebsiella, E.coli, Pseudomonas, and Acinetobacter — serious threats to anyone with a compromised immune system like cancer patients.

As this list compiled by cannabis e-commerce startup Leafly shows, states are taking testing seriously and imposing a variety of testing requirements.

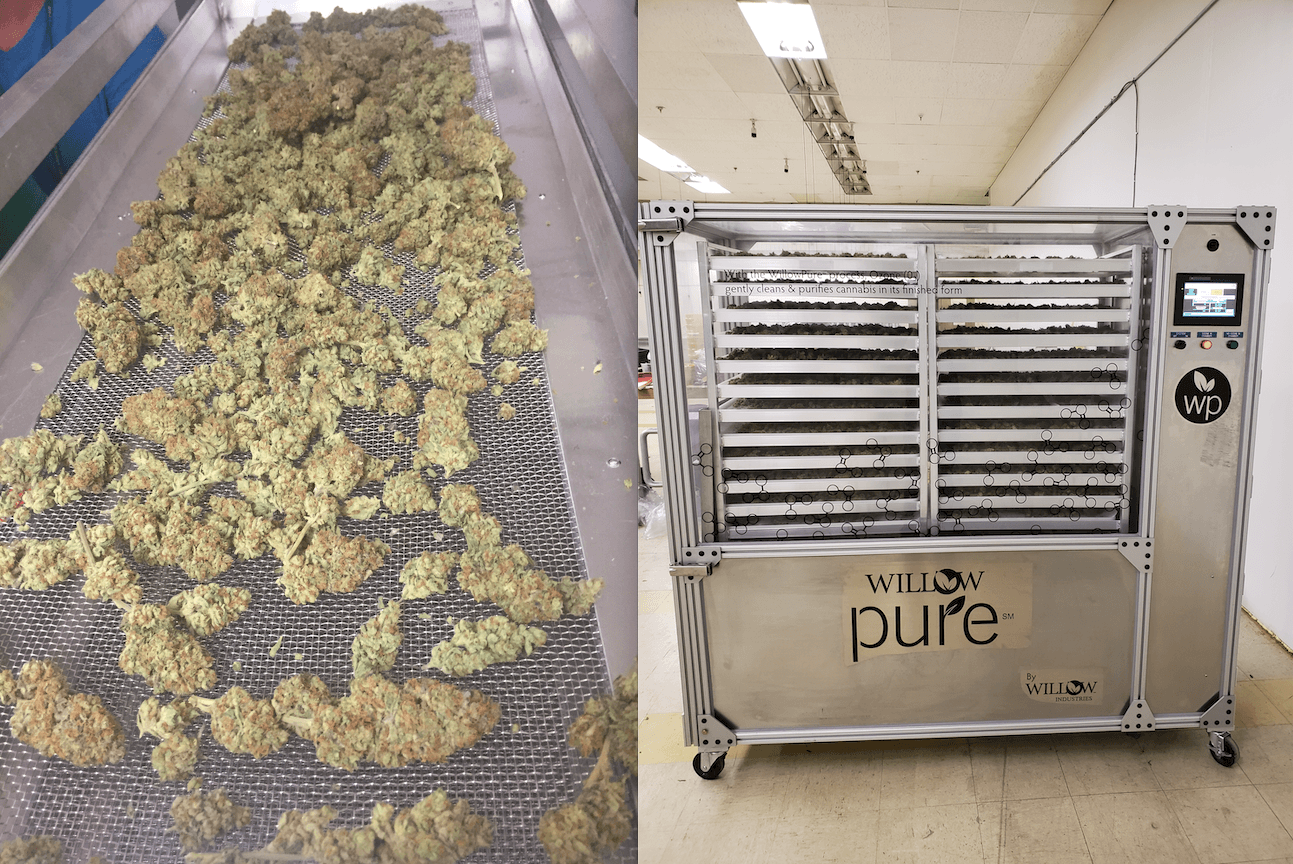

Willow Industries is the creator of WillowPure, an ozone-based technology that provides a post-harvest cannabis microbial decontamination kill-step to remove things like mold, e-coli, and other contaminants from cannabis flower.

Ellsworth was inspired in part by the food safety and health protocols that impact the entire food and beverage industry. As the industry transitions from a burgeoning gold rush to a more solidified and well-defined space, stakeholders are confronted with a serious question: should the ingestible and inhalable products it produces be treated any differently than other food and beverage items? Health advocates in the industry err on the side of wanting strict testing protocols, but for some producers in the industry, it may be perceived as unnecessary overregulation that mainly cuts in on their margins.

“It’s become a huge issue now because we are seeing a proliferation of cultivators over a five-year span growing in the same warehouses for multiple years. You will see pathogenic growth through that,” she explains. “It’s also become a national issue now in terms of all states moving towards legalization. More consumers are buying regulated cannabis and the crackdown to make sure that it is a safe product just like the FDA does for food and beverage is starting to happen.”

Problems, of course, are the fuel that keeps entrepreneurs’ engines running. As states continue to enact mandatory testing requirements, tech companies are finding new footholds in an industry that has become saturated with competition and me-too companies. This is a boon to innovators and investors, but some cannabis cultivators are not keen on more expenses.

Willow raised a $2 million venture round earlier this year and has plans to seek a Series A round early next year. Other startups offering testing compliance-related services include PathogenDx, which raised a $7.5 million Series B earlier this year for its rapid-result genotype-based testing service. Competitor Cannalysis, which offers an automated service for cannabis compliance that aims to reduce the impact of human error in data entry, raised a $22.6 million Series A.

FrontRange Biosciences offers a clean stock nursery program to help growers get a jump on avoiding pathogens from day one with its guaranteed squeaky clean stock. It also raised $8.5 million earlier this year.

Ellsworth’s product pitch was actually met with quite a bit of opposition at first, she says, with many growers opting for the “if it ain’t broke, don’t fix it” approach to evaluating whether they needed to add a microbial kill-step to their production lines.

But as the random audits in Colorado suggest, perhaps something is already broken in the cannabis supply chain.

“I think we are already at the point where the conversation has changed. I would say it happened over summer when Michigan came online with strict testing rules. There are still a lot of states coming on and adopting recreational use with strict testing rules and cultivators are realizing, ‘I don’t have the capacity or the bandwidth to fail a microbial test once.’”

It varies by state, but if a batch of flower fails a test, the cultivator usually has the option of fixing the problem by using a remediation step like what Willow offers and testing again. If it fails a second test, the product can still be put through an extractive process or it must be destroyed. Unsurprisingly, most producers opt for remediation or extraction over destruction.

To help hesitant producers dip their toe in the kill-step waters, Willow offers a variety of methods for accessing its technology. Producers can lease the equipment or contract with Willow to have its employees come to the producers’ facilities to perform the cleaning process as a white-glove service. The company has opened a processing facility in California where producers can also send flower for cleaning. Indoor and greenhouse growers tend to opt for the leasing option due to their year-round needs, Ellsworth explains.

For Mary Dimou, director of the investment team at cannabis-focused VC Canopy Rivers, shortcuts to compliance are not worth the potential fallout.

“As an industry, we need to focus on quality and consistency of consumer products and pharmaceuticals — this means no short cuts regardless of demand. Leading investors and producers are being diligent about understanding the plant,” Dimou wrote to AFN in an email. “There is so much opportunity to invest, develop, and build companies that focus on agronomic traits including disease prevention or novel treatments. We’ve invested in a New Zealand-based academic spin-out, Biolumic, to mitigate the risks of disease and increase yield for our producers.”

An unfortunate unintended consequence of some of the strict cannabis regulations has been a boost in the black market where some cultivators might see a reprieve from the red tape and compliance costs. The black market is alive and well by Ellsworth’s estimate, but few people in the industry are surprised. As the legal market for cannabis grows, cultivators, regulators, retailers, and other stakeholders will likely become interested in finding ways to snuff out the black market competition and the attractive margins it may offer to some willing to assume the risk of criminal prosecution.

Whether the existing momentum behind cannabis decriminalization will be enough to one day produce the black market out of existence remains to be seen. For now, the industry is focusing on arguably more essential pain points like helping consumers find the right strain of cannabis to suit their needs, revolutionizing cannabis plant science as barriers to research continue to crumble, and creating microbial inputs to enhance yield and quality.

“This is unfortunately not the first issue the cannabis sector has had with mold in products,” said Dimou. “It really demonstrates the immense need for the industry to adopt more agri-technology during production and processing.”