Oatly has slashed its full year forecast and revised its strategy in Asia after a weak performance in China and slower than expected progress in the US in the second quarter.

Oatly, which started trading on Nasdaq in May 2021 at $22 per share with prices peaking at almost $29 in June 2021, has had a bumpy ride over the past couple of years dogged by supply chain issues. Yesterday, it closed at $1.65 per share after slashing its full year (2023) outlook for constant currency sales growth from 23-28% to 7-12%.

The Swedish oatmilk maker, which posted a net loss of $86.7 million on revenues up 10.1% to $196 million in the second quarter, said revenues rose 19.4% in the Americas and 17.6% in EMEA. However, they fell 14.9% in Asia thanks to “a slower-than-expected post-COVID-19 recovery in China.”

Asia: ‘We cannot continue to distract ourselves’

Oatly had expected “a large post-pandemic tailwind across foodservice, retail, and e-commerce,” as China lifted COVID restrictions, COO Daniel Ordonez told investors on the earnings call yesterday. But he added: “This expected tailwind has not materialized as we expected.”

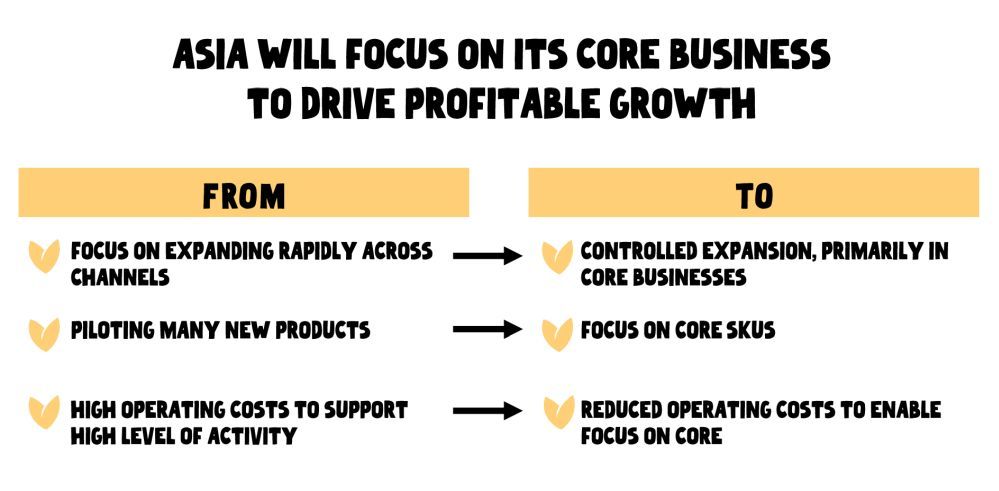

As a result, he said: “We cannot continue to distract ourselves and we cannot continue to justify significant investments with uncertain payoffs. We will be therefore slowing down on SKU expansion and eliminating many unnecessary SKUs… and migrating to a more simplified cost structure.”

New CEO Jean-Christophe Flatin explained: “We are refocusing on our core business, which means foodservice and very few key retail partners only on key cities.”

The Americas: ‘Our strategy is working but at a slightly slower pace than we originally expected’

In the Americas, with the supply chain now “stable,” fill rates up, and with additional advertising, Oatly has started to regain distribution, but at a slightly slower rate than it had forecast, said Ordonez.

“Our strategy is working but at a slightly slower pace than we originally expected. Of course, what you’re seeing is a more muted performance for plant-based in general. But let’s face it. Our oat milk continues to outperform all other crops.”

Outlook slashed for FY 2023, but gross margins on an upward trajectory

Despite the weaker outlook, Oatly remains on track to achieve “positive adjusted EBITDA in 2024,” said the firm, which recently raised $125 million via a guaranteed term loan B credit agreement and $300 million from selling convertible notes. Since then, it has also struck a deal with an affiliate of Hillhouse Investment Management Ltd. to raise an additional $35 million through the sale of convertible notes to provide liquidity as it approaches “financial self-sufficiency.”

According to Flatin, gross margins are now moving steadily upwards: “In full-year 2022, we were at just 11% gross margin. This quarter, we are at 19% and we believe we can reach our long-term target of 35-40%.”

Oatly is looking to cut SG&A costs by $85 million this year, he added: “This will come primarily from non-people cost expenses such as fewer project-related expenses and reducing our reliance on outside consultants as well as unfortunately some eliminated jobs, including roles we have not yet hired for.”

CFO Christian Hanke clarified: “We have identified $85 million of annualized SG&A expense savings, of which the Americas and the corporate segment is already behind us, that is $45 million out of the $85 million, with Asia happening in the second half of this year.”

The company has not confirmed how many people have already been laid off as part of the cost-cutting drive.

Plant-based milk by numbers, US retail

- Plant-based milk is a $2.83bn category in US retail, according to SPINS data shared with AgFunderNews for the 52 weeks to March 26, 2023.

- Dollar sales were up +9.3% while units were down -3.7%, with a +5.4% increase in unit sales of shelf-stable products offset by a -4.9% drop in unit sales of refrigerated products.

- Over the 52-week period, all of the growth in volume came from refrigerated oat milk ($+24.2%, units +8.1%), shelf-stable oat milk ($+44.8%, units +31.7%), and shelf-stable coconut milk ($ sales +53.2%, units +39.9%).

- Dollar sales of almond milk, the largest segment of the category, were up +3.8% (refrigerated), and 4.7% (shelf-stable); while units were down -8.2% (refrigerated) and -6.4% (shelf stable).

*Source: SPINS natural enhanced and conventional (IRI multi-outlet) channels, 52 weeks to March 26, 2023, excludes Whole Foods, Trader Joe’s, and convenience stores.