Editor’s note: Nadav Berger is a co-founder and managing partner at PeakBridge Partners, an investment fund specializing in high-impact FoodTech; Elliot Hool is a co-founder at 2Scots. Here they write about the opportunities that persist in food technology investment. Of course, as a foodtech VC they have an agenda here, but they include some salient points and interesting data points that we thought worth sharing. (It also helps that we agree with them!)

Sweeping through the industrial world like an Australian bushfire, the Covid-19 virus has devastated communities in its wake. Stock markets have crumbled like Arctic glaciers in July. Millions are out of work; more than half the world sits at home.

The coronavirus pandemic is the single most disruptive global event since World War Two. The world we thought we knew before the millennium turned twenty is set to look and behave very differently as it heads into a new decade.

As investors seek diversity in order to weather the storms ahead, now, more than ever, FoodTech stands out for its value, its strength, its opportunities and the benefits it brings. Of course, we’d say that; we’re a FoodTech VC, but below we’ve laid out some unique ways FoodTech can weather this storm.

Rewiring supply chains

The pandemic is waking up governments and companies to the fundamental value of food. And that has not been a pleasant wakeup call. The resilience of food supply chains have been sorely tested as entire models shift from restaurants to retail and home delivery. Many retail companies, including the biggest brands, were in bad need of innovation before the crisis. Now they need it more than ever, yet budgets are being diverted from R&D to other more immediate challenges.

That all opens up yawning opportunities for cooler-headed fast movers. Heightened sanitary needs and social distancing are going to be requirements for processing plants and warehouses. That’s going to happen no matter what, and it will either slow things down, or technologies will have to be adopted that allow for doing more from a distance. Entrenched legacy systems have kept many of those new ideas out for too long, but conservatism here is now untenable.

Supply chain digitisation and automation will be borne of necessity, and the technology is rapidly improving to meet the challenge. Computer vision can play its part in remote quality control, providing real-time monitoring and analysis. New refrigeration techniques are coming into view, as are better bio-packaging solutions or drone deliveries.

Consumers in the ‘new normal’

Supply chain elasticity has also been tested by radically changing consumers too. Much has been written about surging sales of plant-based protein companies during the crisis, an acceleration of a pre-existing trend toward flexetarianism or veganism. But there is also growing demand for food to be healthier. From data we’ve been sent from Tastewise, a Peakbridge portfolio company that gleans food insights from social media activity and other sources, a new normal is already emerging among consumers. Interest in “immune system” is up by 66% since February, the firm’s data analysis shows. Interest in ‘stress relief’ as a functional benefit for food, meanwhile, is up 12% this year and is likely to increase over the coming months. For example, rosemary, commonly perceived to reduce stress, is up 114% in conversations about stress relief over the last year.

Looking over some of the other insights tucked into the Tastewise data, senior industry executive Dr Ellen De Brabander sees a growing appetite for traceability. It has become clear, she reckons, that both regulators and consumers will demand enhanced traceability of products and ingredients. These can only be enabled by the rapid adoption of digital technologies, whether that’s QR codes, RFID, satellite imagery, or blockchain.

It is of course worth reflecting on whether some of these Tastewise trends are going to be a long-term new normal, or something temporary that will disappear at the end of lockdown. No one can predict whether certain trends that have started now, like having breakfast at home, will be gone in a year; but somehow you’ll need to be able to react quickly, you can’t just hope that you’ve chosen the right scenarios. That ability to quickly react to changing situations: that will be more important than ever, and companies capable of doing that will hit the big time.

Sugar reduction, healthier living

Food markets will also need to react to the specter of the virus itself as it spreads round the world. With science reportedly as much as 18 months away from a vaccine, a lot of focus is turning to the many ways of fending off the virus by being in a stronger metabolic state. According to leading endocrinologist and Director of the Glandt Center for Diabetes Care, Dr Mariela Glandt, the Coronavirus survival rate will have a lot to do with what and how we eat. Over 70% of US citizens suffer from some form of insulin resistance that is hampering the body’s ability to fight the infection. The Metabolic Syndrome, where, due to insulin resistance, the body simply can’t handle its nutrition, causing vital white cells to lose their potency, leaves the body predisposed to infection and illness and exposed to the deadly Coronavirus.

In Europe and Asia, the Coronavirus mortality rate has in general affected an elderly generation. By contrast, Dr Glandt expects a younger cohort to be affected in the US, where so many suffer from Metabolic Syndrome. “Put plainly, we have become sick through the food we eat.” she tells us. “Refined sugar, refined oils, fat, preservatives have made us predisposed to strokes, cancer and cardiovascular diseases and have brought about so many of the life-threatening underlying diseases that are now making Coronavirus patients so critically ill.” Dr Glandt is a founder of EatSane, a Tel Aviv-based startup that specializes in low carb alternatives that reduce the risk of Metabolic Syndrome. She believes the coronavirus is an alarm bell for the world’s population to reset and not just treat the diabetes that is behind so many underlying health issues, but rather treat its root causes: “Going cold turkey on carbs is hard to sustain, but reducing your carb intake gradually is the effective way for people to reduce their levels of insulin and susceptibility to Metabolic Syndrome.”

We are seeing more FoodTech companies like this. Each exploring in their own way how we can still enjoy our food, but still stay healthy. As the effects of the worst pandemic to hit the modern world become clear, sugar-reducing innovations, such as low carb bread and low carb chocolate are solutions that the world badly needs as it looks to face up to the Coronavirus in the strongest metabolic state of health. And these technologies are welcome allies of the wasteline for those stuck at home.

Still, companies like these could have their hopes dashed in a bearish funding environment. The current apocalyptic investment climate reminds veteran entrepreneur and PeakBridger Rick Borenstein of the 2008 crash and its aftermath. “The most obvious similarity is the difficult fund-raising environment venture-funded companies are facing,” he tells us. “Capital conservation was the name of the game in 2008 and is the same today. I started a seed fund in March 2009 and was immediately impressed by what a target rich environment it was at that time. Every company, no matter how exciting, needed money. I turned those circumstances to my advantage. My money, little as it was at the time, was welcomed into the best deals.”

Borenstein believes that although the economic impact of the virus could last some time, some sectors are fundamentally sound and will bounce back. He suspects the Coronavirus will lead people to be more aware of the potentially positive roles their investments are playing in a world set to undergo a restart: “I expect investors to take more of an interest in the social impact of what they are investing in, this could lead to a big boost for the FoodTech and Agtech sectors.”

Glorious food not going anywhere

Food, of course, is one of the least cyclical industries. Unlike the heavily hit tourism and entertainment sectors, in times of depressions, downturns and even pandemics, people still need to put food on the table — and lots of it.

That’s why it is one of the essential industries that has to press on in the face of an oncoming virus. And as unemployment soars, the food sector is on a major hiring spree. PepsiCo announced last month that they were hiring 6000 new workers to help cope with the overwhelming demand brought on by this crisis. Similar news has come from Papa John’s, Mondelez, Dominos, Kelloggs and other food industry giants — all have announced creating thousands of new jobs as they struggle to feed an anxious, hungry, stockpiling customer base. General Mills recently said it has raised its 2020 forecast as customers stockpile its cereals and snack bars. Not only has demand for food not subsided; it has multiplied.

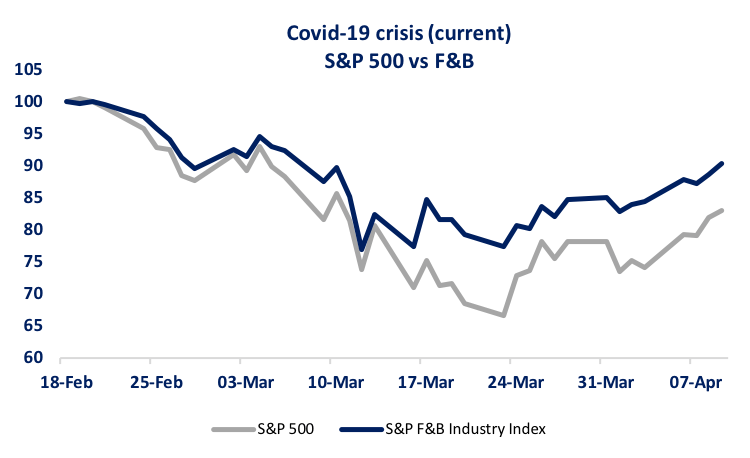

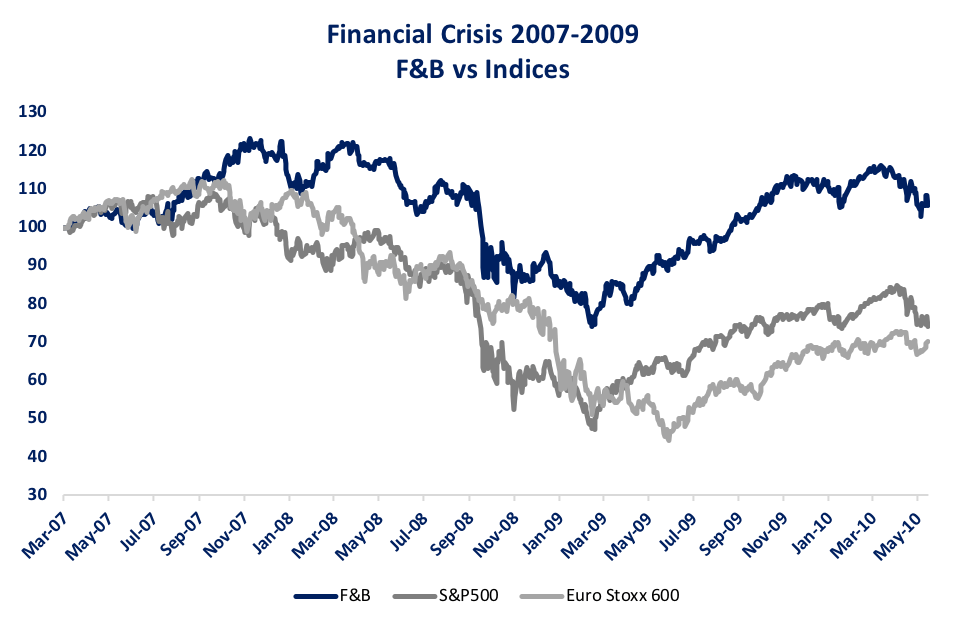

The Food and Beverage sector has significantly outperformed the S&P 500 since mid-February (see Figure C), as it did in the US and Europe in the months following the 2008 crisis (see Figure D).

Environmental reawakening

The Coronavirus has stopped the world in its tracks in a way other existential threats could only have dreamed of. And on reflection, this is a moment to think bigger than hygiene and personal health. This is a moment to think about the environmental impact our species is having. As humans cower in the face of the nature they believed they were insulated against, thoughts are beginning to drift toward a reboot, to creating a greener, cleaner, fairer earth beyond our bubbles. This is a challenge that the FoodTech industry can lead.

When we raised this issue with a long-serving chief agricultural officer at Mars — our fellow Peakbridger Dr Howard-Yana Shapiro — he emphasised how much of an environmental warning this really is. “How many times can you tear the fabric of ecology and things won’t escape? Take Ebola, the virus had been around 80 years, people knew about it, but we tore enough of the fabric of the ecology in a certain region that it was allowed to escape. What we’re seeing now with Coronavirus is the same. We’ve upset the ecology to a point that it has no ability to recover. We’ve lost our buffers.”

For all that, Shapiro believes we are living in unique and opportune times for food and agriculture: “For the first time in history we have a unified view on food and agriculture: We now understand what food is made of at a molecular level, and what role it plays in our body and why each particular food ingredient is important to our health, well-being or growth. This awareness isn’t happening in isolation, but simultaneously across the field. We are starting to understand how to do things.”

Shapiro notes that since the markets crashed, all he hears about on his business news channel is the outstanding value of Apple and Google stock. But he thinks the real value lies elsewhere: Companies that understand what food really is, and have the scientific tools to do something special. “What if you gave Machine Learning the rules for food, what type of tomato would it come up with?”, he speculates excitedly. “Fast pivoting food businesses that understand science will have the opportunity to change the paradigm of what food is all about over the coming decade.

So after contacting some of the thinkers in our ecosystem, it is time for some homely reflections. As thoughts turn to the day after, we will consider future investments as follows:

- Their relevance to the issues and ‘pains’ we now face

- The security of the industry

- Their groundbreaking innovation

- The positive role they will play in reshaping our world

- Their value in the market

FoodTech in 2020 ticks many, if not all, of these boxes. FoodTech investment is an opportunity for significant returns and a chance to play a positive part in a world that is shifting on its axis. This is how we will be spending our time at home.