Disclosure: AFN’s parent company is AgFunder.

“I don’t even remember 2021!” AgFunder partner Manual Gonzalez declared from the stage this week at the AgFunder 2023 Global Report special briefing in San Francisco.

Gonzalez, along with Winnie Leung of agrifoodtech VC Bits x Bites and Magi Richani, founder of AgFunder portfolio company Nobell Foods, were discussing the 2023 AgFunder Global AgriFoodTech Investment Report, which provides data and insights on the state of agrifoodtech VC investment. The report was launched in collaboration with AgFunder’s global ecosystem partner Temasek.

The report’s most obvious takeaway was the 44% year-over-year (YoY) drop in funding to agrifoodtech companies between 2021 and 2022, with the second half of 2022 being especially terrible. Hindered by supply chain issues, war, record oil prices and other macro pressures, funding for agrifoodtech startups reached $29.6 billion last year, “lifetimes away” from 2021’s record-breaking $51.7 billion, as Gonzalez put it.

But that’s only part of the story. The following chart from the report is particularly telling about the state of agrifoodtech investment in 2023:

Innovative Foods still unoriginal

It’s no secret that plant-based proteins — a critical part of the Innovative Foods category — fell out of favor with many investors in 2022 as “me too” products flooded the market, companies failed to differentiate, and sales plateaued.

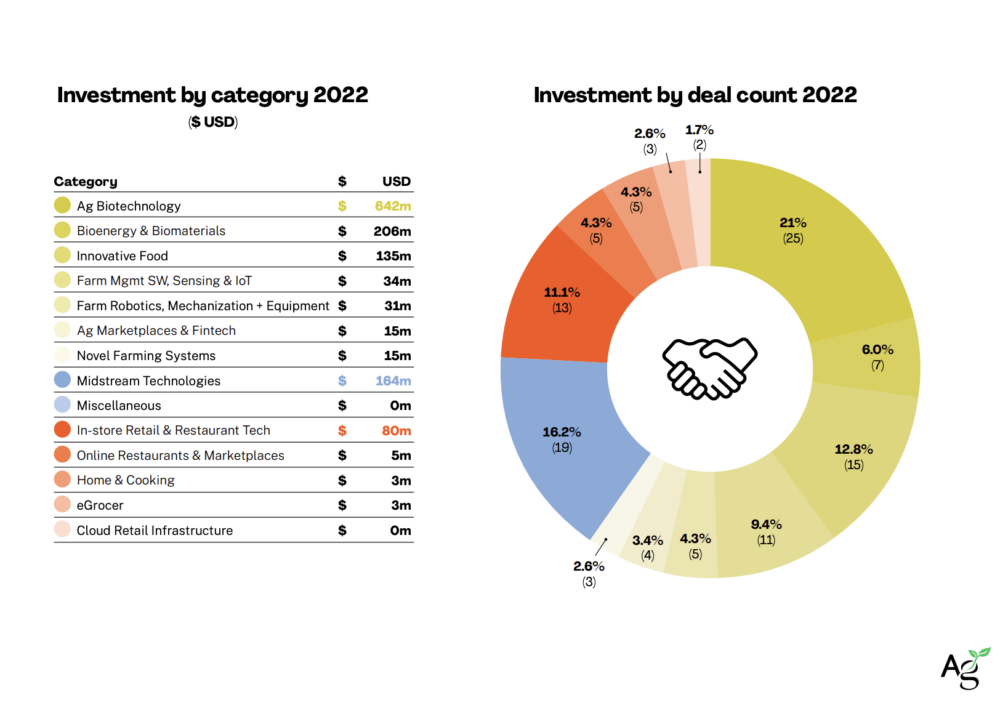

As the above chart shows, funding for Innovative Foods, along with food delivery technologies, fell sharply in 2022. Funding declined more than 35% for Innovative Food and Midstream Technologies; eGrocery funding dropped 73% and Cloud Retail Infrastructure and Online Restaurants & Meal Marketplaces dropped over 70% each year-over-year.

Panelists dissected this decline at the event.

Richani spoke to the opportunities — and challenges — of “nailing down the flavor” of alternative protein products, saying “there are incredible products out there, but they’re clearly not good enough to really displace or have a meaningful change in how consumers are buying. There’s a lot of more innovation and work that needs to be done on that front.”

The next year (at least) will be “challenging for fundraising,” the panelists agreed.

“We’re putting things back in place,” said Gonzalez. “The reality is that there are not many food companies worth multi-billion dollars. It takes a long time to build a food company that’s worth that much money.”

“If you want to raise the money you really need to hit your milestones, and make something different. You need to show progress,” he added.

Climate tech investment bucks the decline

Another not-so-subtle point from the global report: investment for upstream, climate-focused technologies saw more investment in 2022 versus 2021.

Four categories related to climate and efficiency experienced an increase in funding in 2022, including Ag Biotech, Farm Management Software, Sensing & IoT, Bioenergy & Biomaterials and Novel Farming Systems.

“The more you focus on solving big problems, the more defensive you are,” said Gonzalez in reference to a question of where investors will channel their agrifoodtech dollars this year.

China swims upstream, too

China, of course, was one of the largest players in the eGrocery space in 2021, bucked my mega rounds for some companies reaching as much as $3 billion.

But investment in China agrifoodtech dropped over 80% to $1.3 billion in 2022 from nearly $7 billion in 2021.

On a brighter note, Chinese investors turned their attention towards upstream agrifoodech investments. Leung argued that this speaks to the growing pool of agrifood entrepreneurs responding to the country’s top-down priorities for food security and carbon neutrality goals.

“Animal protein technology is going to surpass alternative protein technology in China,” she said. “There are just so many challenges in animal agriculture: reducing the carbon footprint of how we produce animal dairy and addressing some of the disease threats.”

Alternative protein in China has a lot of work to do in order to win consumers, she suggested, particularly around taste.

“Biotechnology-enabled products” will be another important area for the country, though the path to regulatory approval for products might be slower than in other parts of the world.

“China is a very conservative place when it comes to food safety,” said Leung. “But honestly, from a China government standpoint, the focus is really around food security, making sure there’s enough food for everyone. Whether or not it comes from plant or from meat, I don’t think that that’s so much the issue as self-sufficiency.”